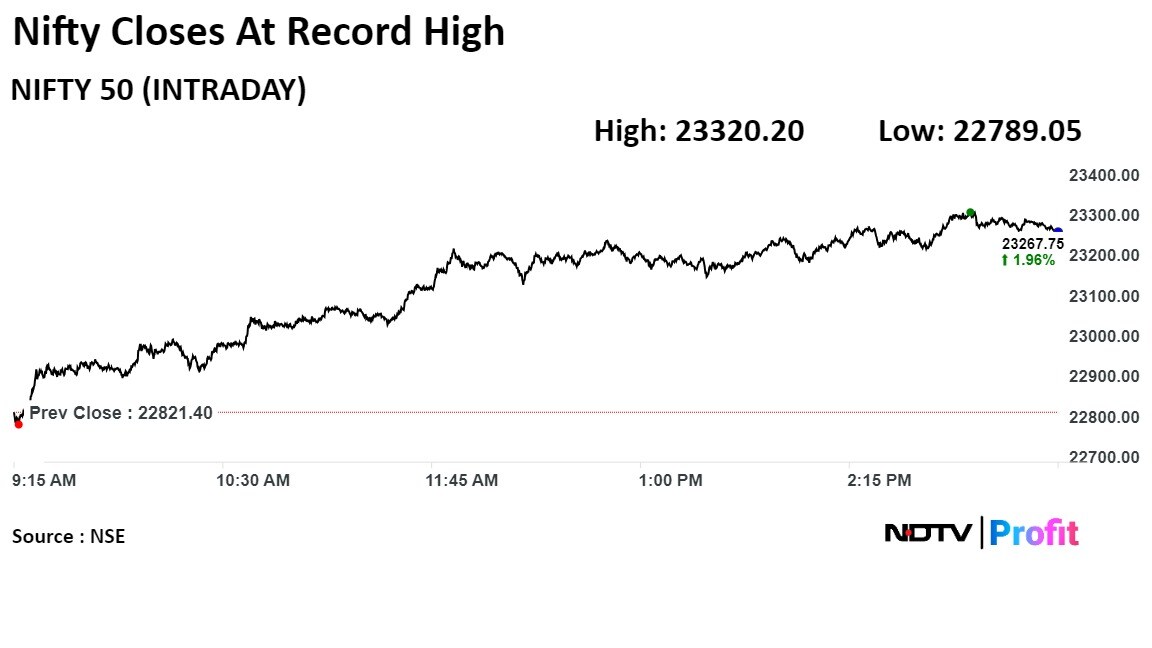

Analysts anticipate Nifty's range-bound activity amid temporary market overbought conditions.

The markets could see range-bound activities at higher levels due to temporary overbought conditions, Kotak Securities' Vice President of Technical Research, Amol Athawale said, adding that buying on dips and sell on rallies would be the ideal strategy for the short-term traders.

On the lower side, 23,000-22,800 would be the key supports zone while 23500-23700 could act as key resistance areas for the bulls, Athawale said.

SAMCO Securities said in a research note that the Nifty is holding its position above the previous resistance zone of 23,000 which is now acting as a crucial support level. "Any minor pullback towards 23,100 could present a buying opportunity," SAMCO Securities' Derivatives & Technical Analyst Ashwin Ramani said in a note, adding, "If the upward momentum continues, the index might move towards 23,500-23,550 levels."

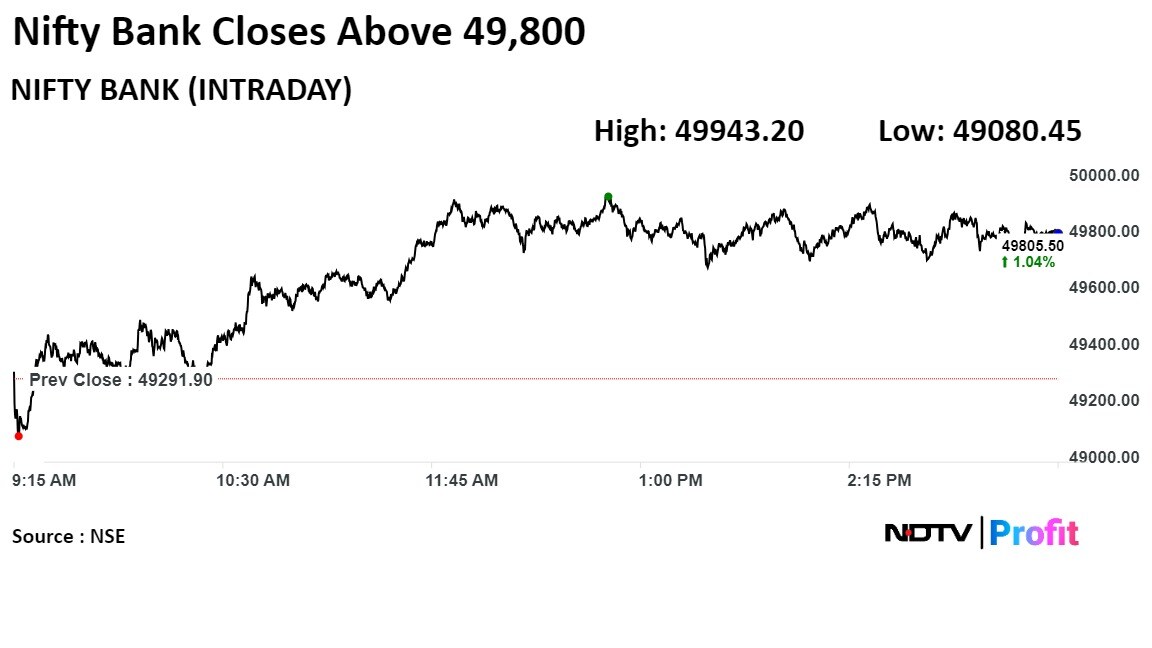

Commenting on the Nifty Bank, Ramani said that the index is firmly holding the 20-Day moving average and has displayed a positive bias with higher highs and higher lows on the hourly chart on Friday.

F&O Action

Nifty June futures saw a 1.9% increase to 23,325.15, trading at a premium of 35 points, while the open interest decreased by 2.5%.

Nifty Bank June futures rose by 1.01% to 49,908, with a premium of 105 points, and the open interest increased by 0.34%.

In the options market, for Nifty options' June 13 expiry, the maximum call open interest was observed at 24,000, and the maximum put open interest stood at 23,000. For Bank Nifty options' June 12 expiry, the maximum call open interest reached 53,000, with the maximum put open interest at 47,000.

FII/DII Activity

On Friday, overseas investors became net buyers of Indian equities after three consecutive sessions of selling. According to provisional data from the National Stock Exchange, foreign portfolio investors acquired stocks worth Rs 4,391 crore. In the last three sessions, FPIs had sold over Rs 24,960.2 crore.

The uncertainty surrounding government formation concluded with Narendra Modi scheduled to take oath as Prime Minister for the third time. Consequently, FPIs transitioned into net buyers.

Markets Recap

The Indian benchmark equity indices recovered from their losses on counting day and recorded their highest close on Friday as heavyweights led the rally. The NSE Nifty 50 closed 468.75 points or 2.05%, up at 23,290.15, while the S&P BSE Sensex closed 1,618.85 points or 2.16%, higher at 76,693.36.

.jpeg)

Major Stocks In News

Suzlon Energy: Marc Desaedeleer resigned from the post of Independent Director.

Adani Ports and SEZ: Company recorded a 7% growth on-year in cargo handled to cross the one-million-tonne mark last fiscal.

Wardwizard Innovations And Mobility: The company received an order worth $1.29 billion from Beulah International for EVs.

Gland Pharma: The company appointed Srinivas Sadu as Executive Chairman and CEO of the company.

Rail Vikas Nigam: The company JV with KRDCL received a project worth Rs 156 crore from Southern Railway for “Provision of Automatic Signalling on Ernakulam Thiruvananthapuram Division in Southern Railway.

Dr Reddy's Laboratories: The US FDA has completed a GMP inspection at the API manufacturing facility in Andhra Pradesh and issued Form 483 with four observations.

IDBI Bank: The company received income tax order determining Rs 2,701.6 crore refund for AY 2016-17. The company is in the process of evaluating the implications of tax order on financial statements.

Inox Wind: The company incorporated four wholly owned subsidiaries.

Global Cues

Most Asian markets saw an early rise on Monday, prompted by news of Japan's economy contracting less than anticipated in the first quarter.

As of 06:46 a.m., the Nikkei 225 climbed by 186.92 points or 0.48% to 38,870.85, while the KOSPI dipped by 26.21 points or 0.96% to 2,696.46.

Traders in the world's largest bond market faced significant losses due to a robust US jobs report, leading them to reassess their expectations of Federal Reserve rate cuts.

By Friday, the S&P 500 Index and Nasdaq Composite had increased by 0.11% and 0.23% respectively, while the Dow Jones Industrial Average had fallen by 0.96%.

Meanwhile, Brent crude was trading slightly higher at $79.64 a barrel, with gold rising by 0.07% to $2,295.42 an ounce.

U.S. Dollar Index at 105.1

U.S. 10-year bond yield at 4.44%

Brent crude down 0.03% at $79.60 per barrel

Nymex crude down 0.03% at $75.51 per barrel

Bitcoin was down 0.20% at $69,546.75

Money Market Update

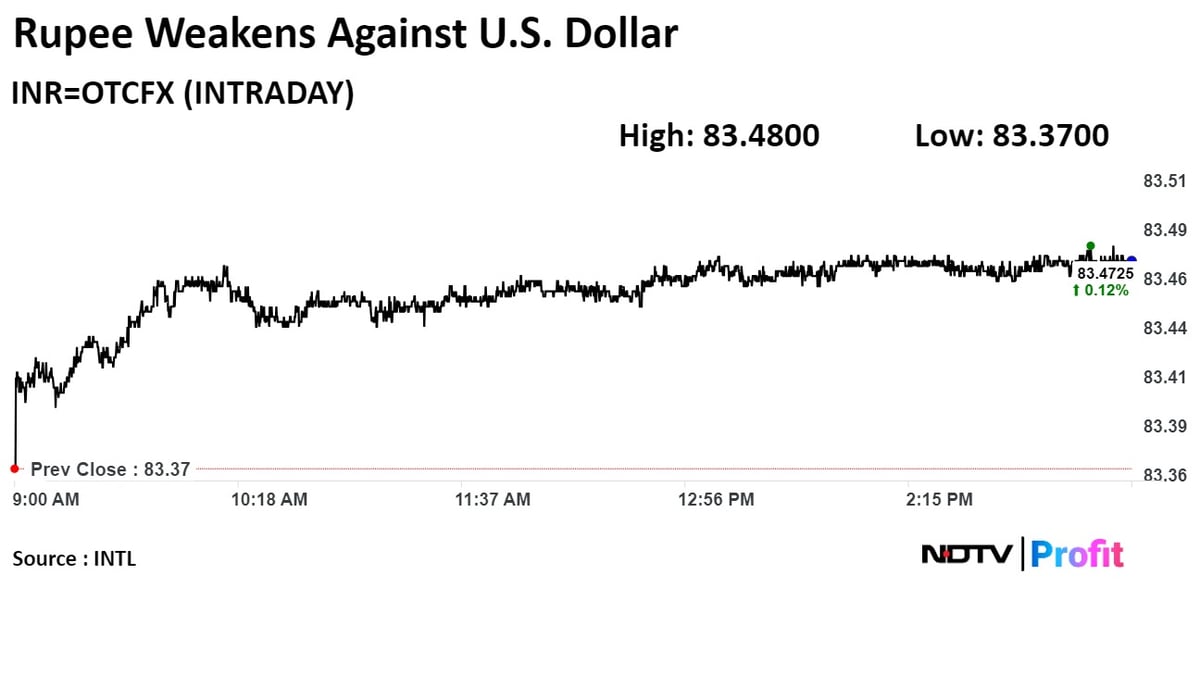

The Indian rupee strengthened against the US dollar on Friday as the RBI kept the repo rate unchanged. Market participants also await the release of US non-farm payroll data later in the day.

The Reserve Bank of India announced its monetary policy decision and kept the benchmark repo rate unchanged for the eighth straight meet.

The local currency strengthened by 10 paise to Rs 83.37 against the greenback on Friday. It had strengthened to Rs 83.45 after the RBI policy was announced, according to Bloomberg. The currency closed at Rs 83.47 on Thursday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.