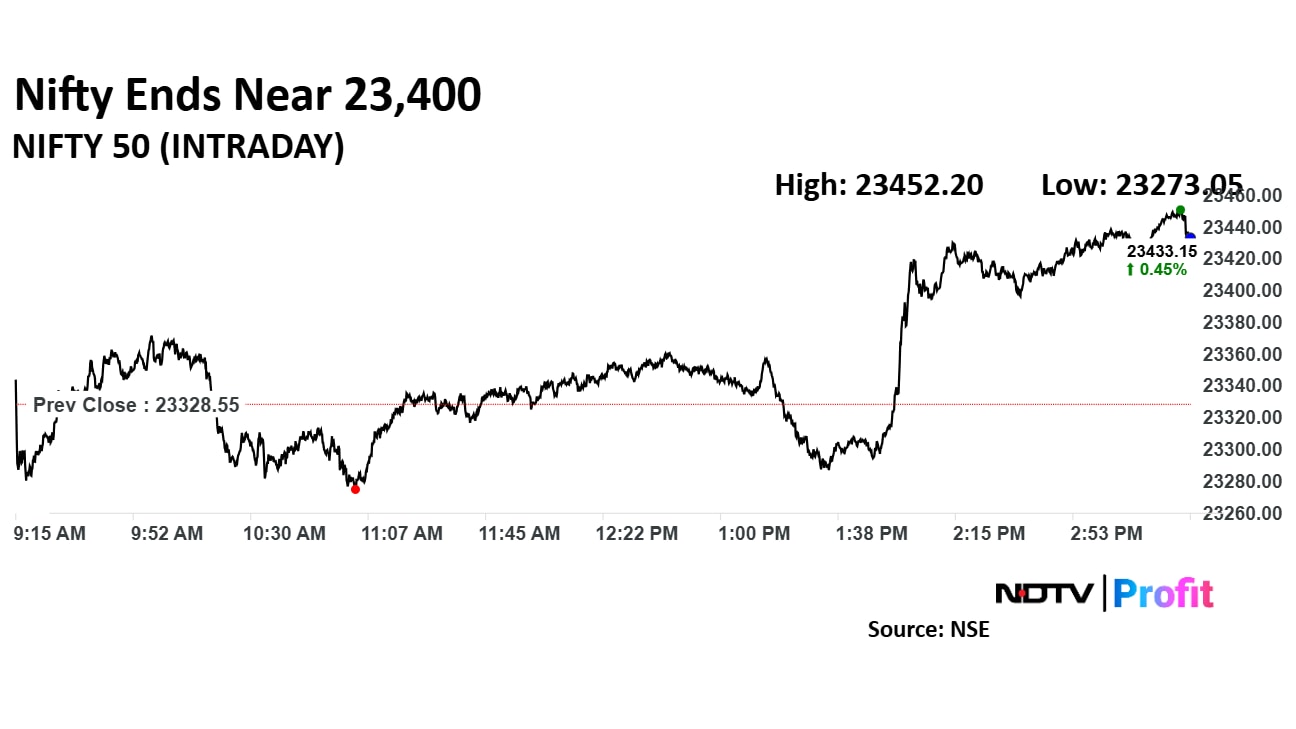

The NSE Nifty 50, which rose nearly 0.5% on Wednesday, could face resistance at around the 23,450 to 23,500 range, according to analysts.

"The index has formed a positive candle, but it is approaching a key resistance zone of 23,450 to 23,500, and is showing a marginal overbought condition," according to Aditya Gaggar, director of Progressive Shares.

If Nifty 50 manages to cross and stay above these levels, the next significant resistance will be at 23,800, noted Gaggar, with the support potentially holding at 23,275 on the downside.

"From a technical standpoint, support is now placed at 23,200, and as long as the index sustains above this level, the sentiment is expected to remain bullish," according to Mandar Bhojane, research analyst at Choice Broking.

A decisive breakout above 23,450 could open the door for a rally towards the 23,800 zone. On the downside, 23,200 and 23,000 will act as strong support levels in the near term, he added.

"Bank Nifty is expected to maintain a positive bias and head towards 53,700 to 53,900 levels in the coming weeks being the previous major highs and price parity with its previous up move," according to Bajaj Broking Research.

Market Recap

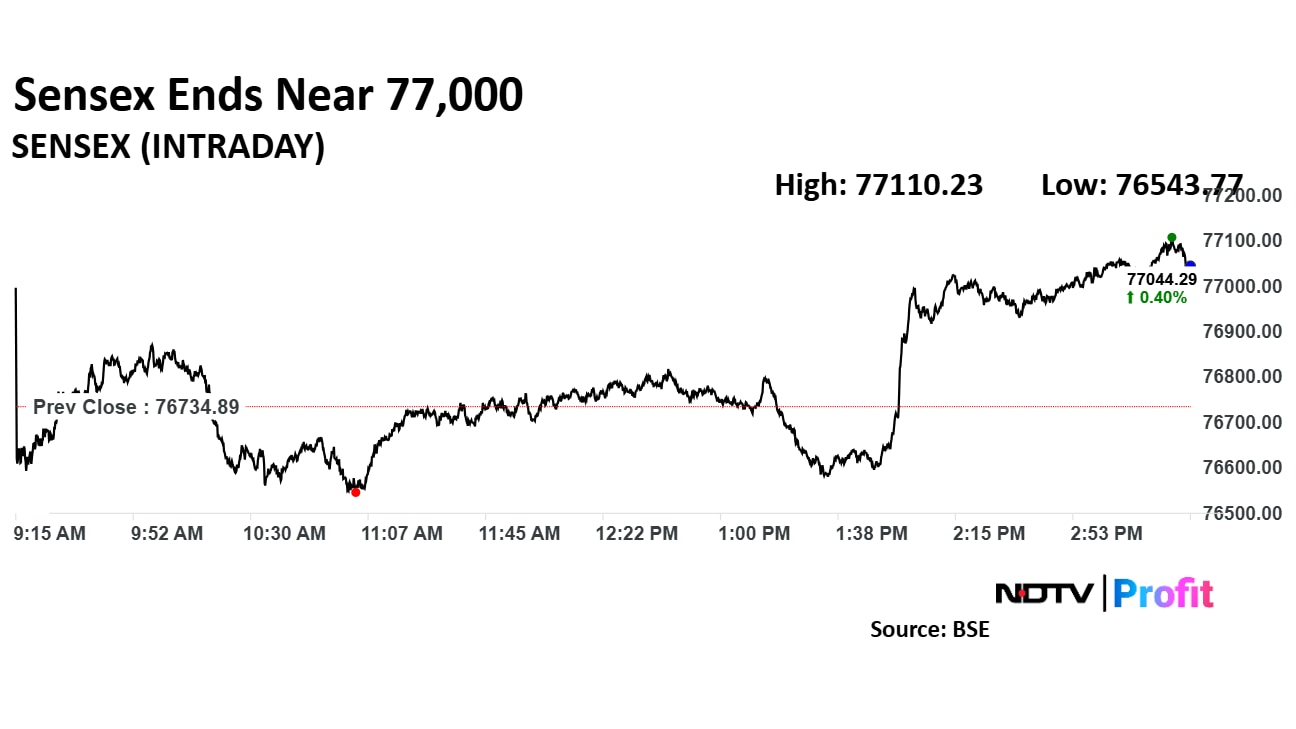

Indian benchmark indices continued their upward trajectory to close higher for the third consecutive trading session on Wednesday.

Nifty 50 closed 0.47%, or 108.65 points higher at 23,437. While, the BSE Sensex closed 0.40% or 309.40 points higher at 77,044.

Money Market

The Indian rupee appreciated by nine paise at market close on Wednesday, with easing inflation, a sliding dollar index and lower oil prices lending support.

The local unit closed at 85.68 against the US dollar, extending its slip below the psychological level of 86 for the second session. The rupee had opened at 85.61.

Global Cues

Most markets in Asia-Pacific region erased opening losses. The indices fell at open, tracking an overnight sell-off on Wall Street as US Federal Reserve Chair Jerome Powell's speech implied a potential persistent inflation because of tariff.

The Nikkei 225 and KOSPI were trading 0.46% and 0.52% higher as of 6:42 a.m. The S&P ASX 200 was 0.31% higher.

Powell said in a speech at the Economic Club of Chicago that the central bank must ensure that tariffs do not result into persistent inflation. Fed is on wait and watch mode as far as the tariff impact is concerned.

On Wednesday, the Dow Jones Industrial Average and S&P 500 ended 1.73% and 2.24% down, respectively. The Nasdaq Composite ended 3.07% down.

The dollar index was trading 0.23% higher at 99.1. Brent crude was trading 0.47% higher at $66.16 a barrel. The Bloomberg spot gold was trading 0.36% higher at $3,355.21 an ounce.

The GIFT Nifty was trading 0.26% higher at 23,433.50 as of 6:50 a.m.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.