Titan Company Ltd. shares rose nearly 7% in early trade on Tuesday after the jewellery-to-eyewear maker posted a 25% year-on-year revenue growth in its March quarter update, driven by broad-based gains across segments. The update was released post-market hours on Monday.

The company's jewellery business — its largest revenue contributor — also rose 25%, buoyed by a sharp rise in gold prices. However, buyer growth was in single digits as elevated prices dented demand at entry price points. Average ticket sizes grew in the high double digits, helping offset the drag.

Watches and wearables rose 22% year-on-year, while the eyecare division grew 19%. The fragrances and accessories business rose 26%, while ethnic wear label Taneira saw a 4% decline.

Brokerages broadly saw the update as positive, citing healthy growth in the core jewellery business. Macquarie and Morgan Stanley both flagged stronger-than-expected headline performance, though they noted the muted buyer growth and mixed trends in the product mix. Citi was more cautious, pointing to a lower share of studded jewellery and calling margins a key monitorable.

Titan is scheduled to report its fourth-quarter earnings in May.

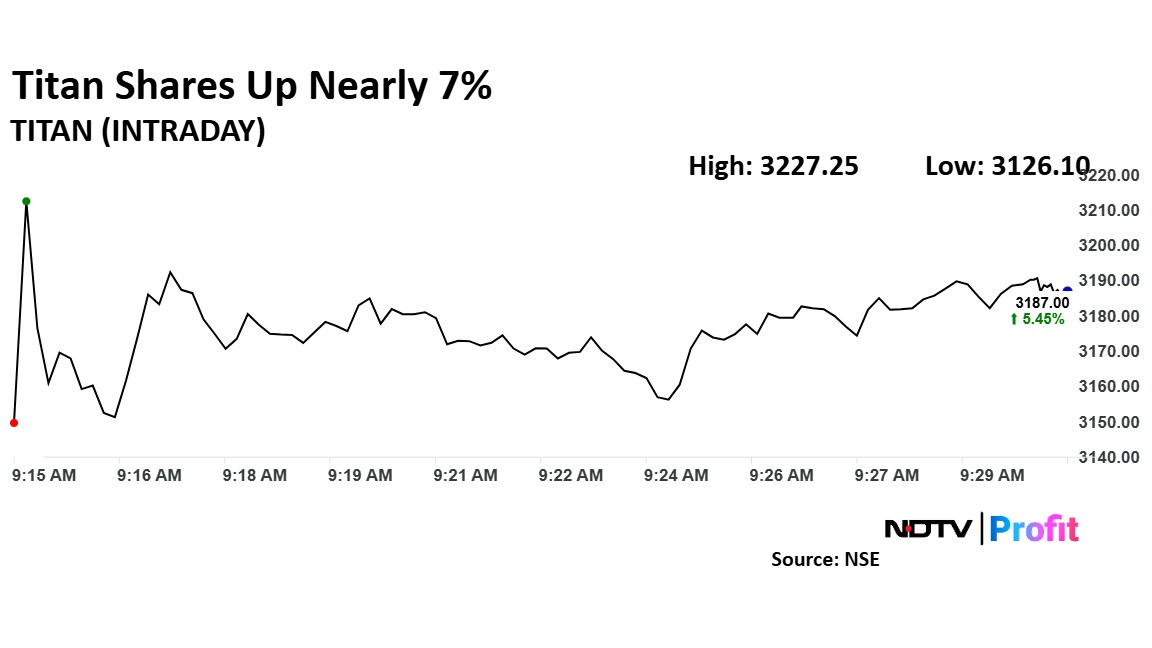

Titan Share Price Today

Titan stock rose as much as 6.78% during the day to Rs 3,227.25 apiece on the NSE. It was trading 5.4% higher at Rs 3,185.4 apiece, compared to a 1.75% advance in the benchmark Nifty 50 as of 9:29 a.m.

It has fallen 15.42% in the last 12 months and 2.07% on a year-to-date basis. The total traded volume so far in the day stood at 10 times its 30-day average. The relative strength index was at 54.81.

Twenty-one out of the 35 analysts tracking the watchmaker have a 'buy' rating on the stock, ten recommend a 'hold' and four suggest a 'sell', according to Bloomberg data. The 12-month analysts' consensus target price on the stock is Rs 3,733.91, implying an upside of 18.5%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.