Titan Co. shares fell over 5% during early trade on Tuesday, to their lowest in three weeks, after the first-quarter revenue growth came below market expectations.

The stock was the top loser on the benchmark Nifty 50 index. Its market capitalisation lost over Rs 17,000 crore.

The consumer businesses registered a growth of 20% year-on-year in the June quarter. Its jewellery division, which contributes over three-fourths of its revenue, reported an 18% growth.

"The revenue growth was impacted by gold price volatility, with customers favouring lightweight and lower karatage jewellery," Titan said in a regulatory filing to the stock exchanges on Monday.

Analysts at JPMorgan said that the moderation in the Tata Group company's revenue growth was 'worse than feared'.

Moderation in like-to-like growth to early double digits and being lower than peers, such as Kalyan Jewellers and Senco Gold were disappointing. The next catalyst for Titan could be the earnings print.

Besides, Citi noted the continued decline in the studded mix and said operating margin will now be key to sustain current valuations.

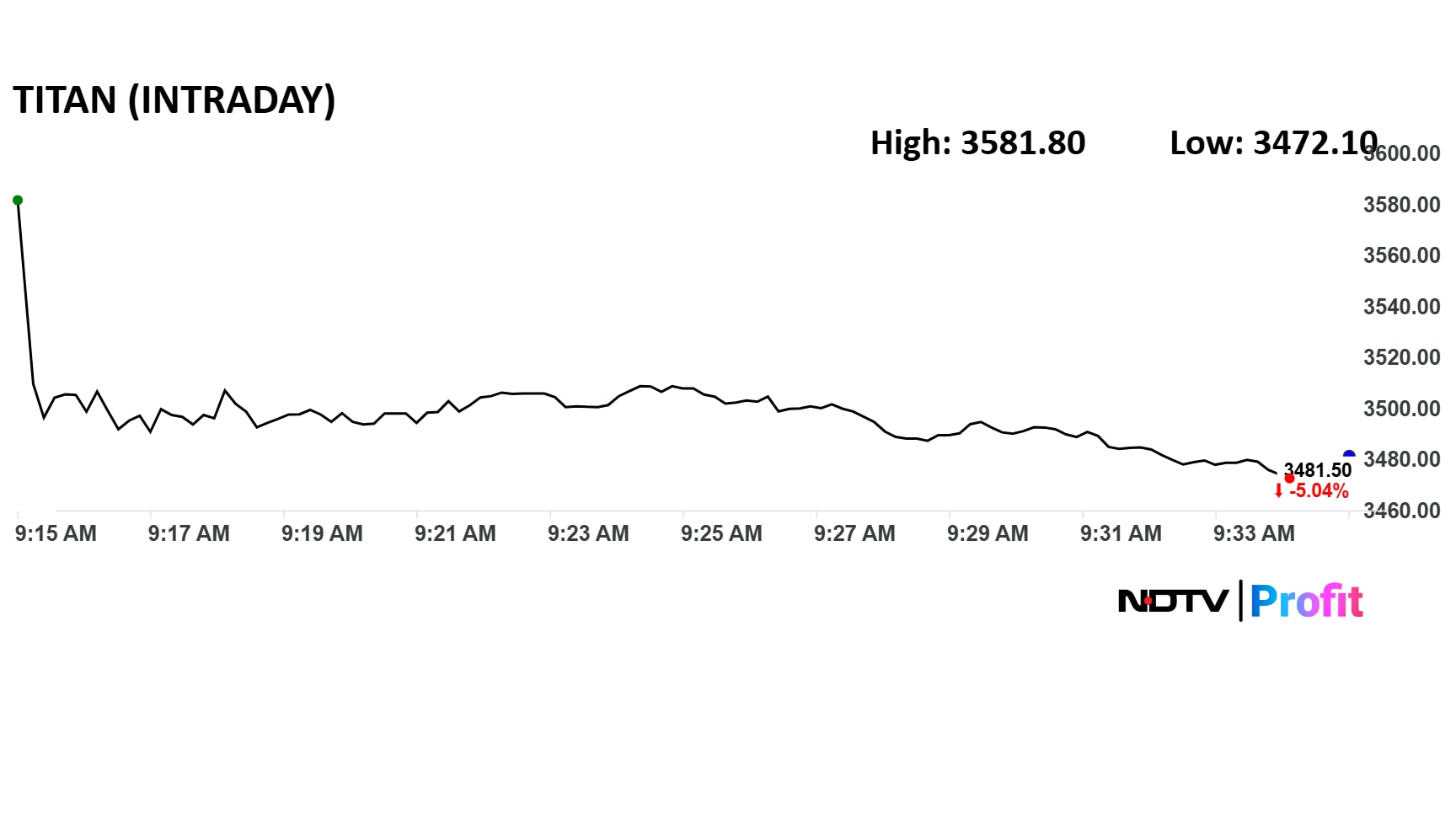

Titan Share Price Movement

Titan share price fell 5.3% to Rs 3,472.1 apiece and traded close to that level at 9:35 a.m.

Titan share price fell 5.3% to Rs 3,472.1 apiece and traded close to that level at 9:35 a.m. The benchmark NSE Nifty 50 was flat.

The total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 60.

Notably, Titan is also trading ex-date for its dividend of Rs 11 per share.

Out of 35 analysts tracking the company, 23 have a 'buy' rating on the stock, seven recommend a 'hold' and five suggest a 'sell', according to Bloomberg data. The average of 12-month analysts' price target implies a potential upside of 9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.