Share price of Tejas Networks Ltd. fell over 14% in trade on Monday after the company swung to loss in the quarter ended March 31, 2025.

The telecom equipment company reported a net consolidated loss of Rs 71.8 crore for the quarter, as compared to a profit of Rs 147 crore in the previous fiscal.

The company's topline grew nearly 44% to Rs 1,907 crore in the quarter under question. On the operating side, the company reported a fall of 60% in earnings before interest, taxes, amortisation and depreciation, while margin fell 1,700 basis points to 6.3% from 23.3% in the corresponding quarter of the previous fiscal.

Tejas Networks Q4 Highlights (Consolidated, YoY)

Revenue up 43.7% to Rs 1,907 crore versus Rs 1,327 crore.

Ebitda down 60.8% to Rs 121 crore versus Rs 309 crore.

Margin to 6.3% versus 23.3%.

Net loss of Rs 71.8 crore versus profit of Rs 147 crore.

The company, in a press release, reported inventory of Rs 2,367 crore during the quarter ended March, which will be converted to finished goods and shipped in upcoming months. Trade receivables for the quarter stood at Rs 4,884 crore, with the increase mainly due to higher shipments.

Working capital decreased by Rs 214 crore for the quarter, with the cash position at the end of the quarter at Rs 827 crore. Borrowings stood at Rs 3,269 crore at the end of Q4, mainly for working capital purposes.

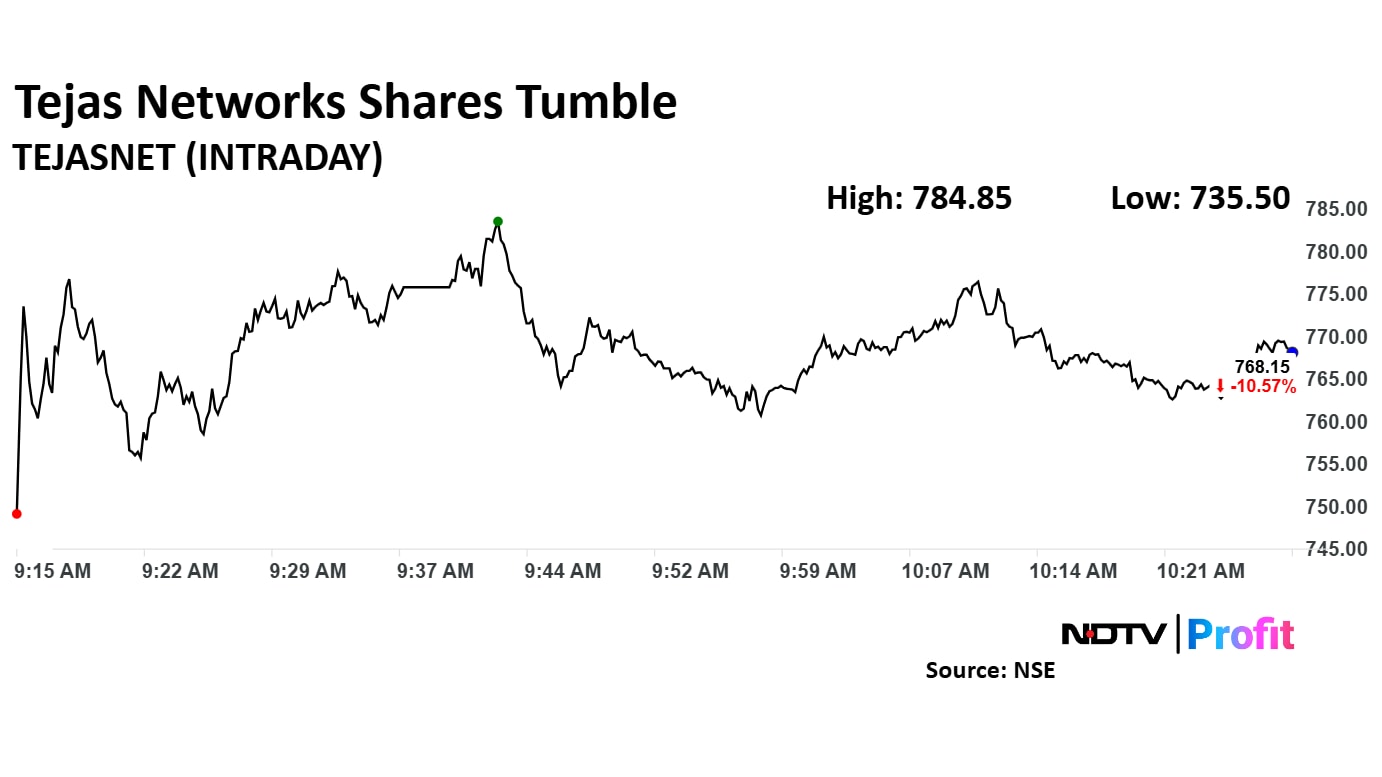

Tejas Networks Share Price Today

The scrip fell as much as 14.37% to Rs 735.50 apiece, the lowest level since April 7. It pared losses to trade 10.58% lower at Rs 768.05 apiece, as of 10:35 a.m. This compares to a 0.86% advance in the NSE Nifty 50.

It has fallen 35.07% on a year-to-date basis, and 25.16% in the last 12 months. Total traded volume so far in the day stood at 1.47 times its 30-day average. The relative strength index was at 65.64.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.