Shares of Tega Industries Ltd. listed at a premium on market debut after investors piled into its Rs 619-crore initial public offering.

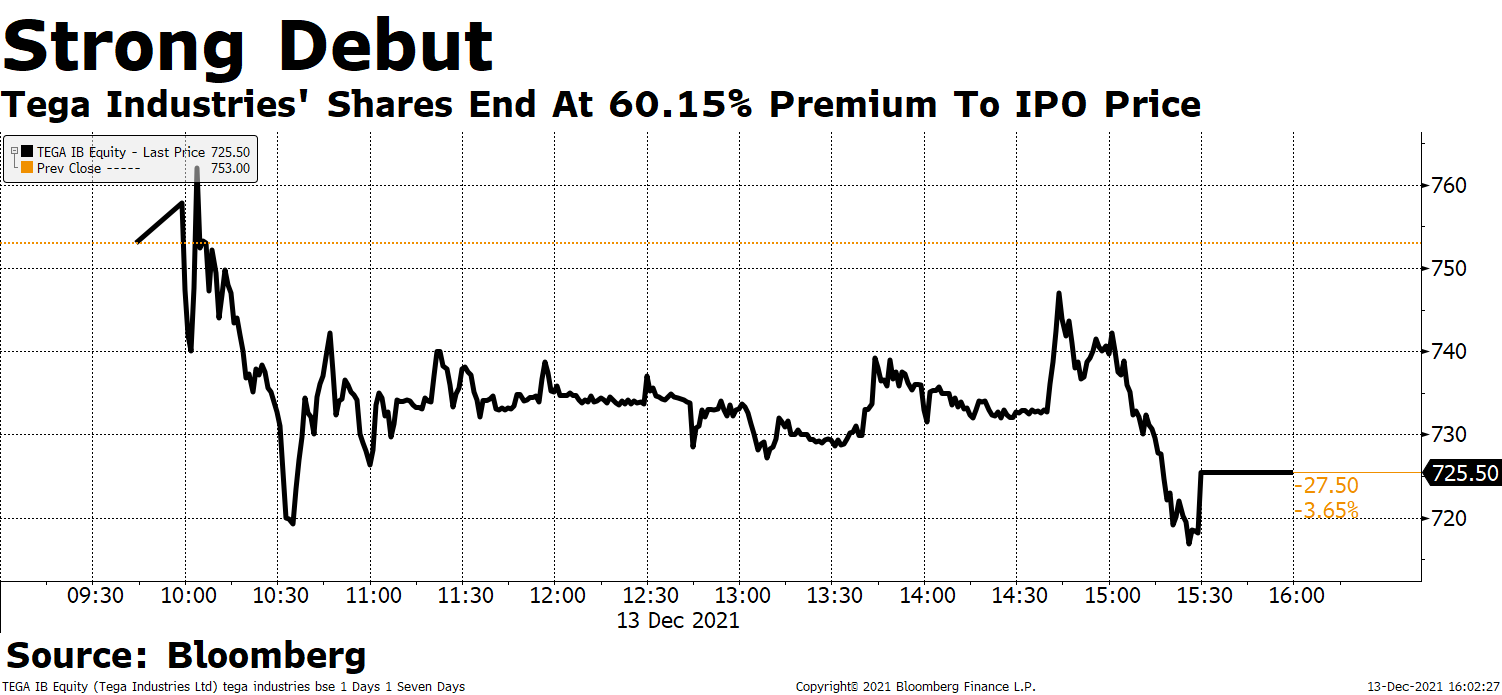

The stock listed at Rs 763 apiece, a 68.43% premium over the issue price of Rs 453 apiece, on the BSE. The stock hit an intraday high of Rs 767.17 apiece, and ended its first trading day at Rs 725.50 apiece, a 60.15% premium to IPO price.

Tega Industries' IPO—a pure offer for sale by promoters and existing arm of private equity firm TA Associates—was subscribed more than 219 times, the third-best so far this year.

What It Does

The company offers solutions in mineral beneficiation, mining and bulk solids handling industry with global footprints in over 70 countries. Its products include a range of abrasion and wear-resistant rubber, polyurethane, steel and ceramic-based lining products used for mining, among others.

The company claims it's net cash positive in the balance sheet and does not need any fund requirement for growth. All future capital expenditure will be funded out of internal accruals.

Watch The Interaction With Company's Management

Research Reports On Tega Industries

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.