Shares of Tata Consumer Products rose over 5% on Friday to hit three-month high after the company reported mixed third-quarter results. The Tata Tea maker's profit was flat at Rs 278.88 crore in the quarter ended December.

TCPL posted a 23% growth in its India business, driven by a 10% increase in India packaged beverages, with tea volumes growing 7%. The company also strengthened its salt market share by 110 basis points, with the salt segment delivering 7% value growth and 1% volume growth following a price increase.

However, tea market share dipped by 20 basis points due to cost pressures. The e-commerce channel grew 59%, while modern trade recorded a 14% growth, reflecting a shift in consumer purchasing behaviour.

On the other hand, brokerages have cut target prices of Tata Consumer Products. While Morgan Stanley maintained an 'Overweight' rating on Tata Consumer, it cut the target price to Rs 1,235 from Rs 1,273.

Jefferies kept a 'Buy' rating but reduced the target price to Rs 1,100 from Rs 1,130. While Tata Consumer showed growth, margins were impacted by rising tea prices in the third quarter. Acquisitions have stabilised, and the focus is now on growth. Jefferies has lowered EPS forecasts by 4-8%, and the stock is expected to trade weak due to the margin miss.

Goldman Sachs maintained a 'Neutral' rating with a target price of Rs 1,040. The tea business showed strong volumes, and acquired brands have stabilised, it said. Goldman Sachs cut EPS estimates by 3-11%.

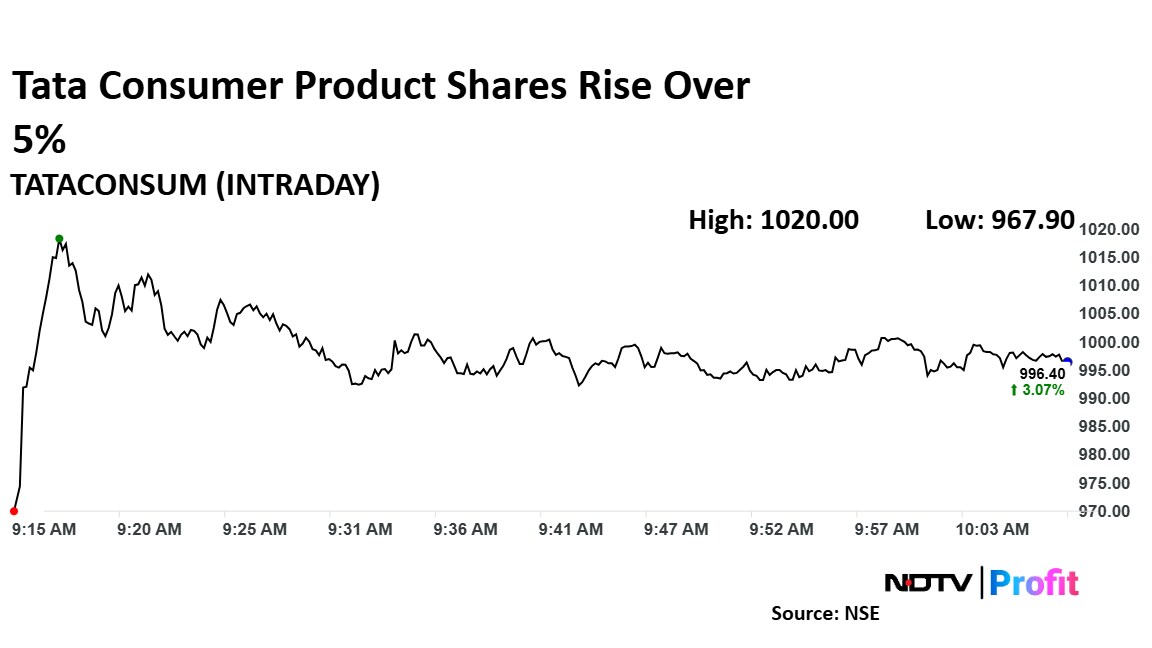

Tata Consumer Products Shares Rise

The shares of Tata Consumer rose as much as 5.51% to Rs 1,020 apiece, the highest level since Oct. 31. The stock pared gains to trade 3.20% higher at Rs 997.35 apiece, as of 10:07 a.m. This compares to a 0.45% advance in the NSE Nifty 50 index.

It has fallen 9.04% in the last 12 months. Total traded volume so far in the day stood at 0.08 times its 30-day average. The relative strength index was at 46.

Out of 49 analysts tracking the company, 34 maintain a 'buy' rating, nine recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 9.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.