- Swiggy's board approved a slump sale of Instamart to a wholly-owned subsidiary

- Swiggy will divest its Rapido stake to Prosus and WestBridge for Rs 2,400 crore

- Prosus will acquire Rapido shares for Rs 1,968 crore, WestBridge for Rs 431.5 crore

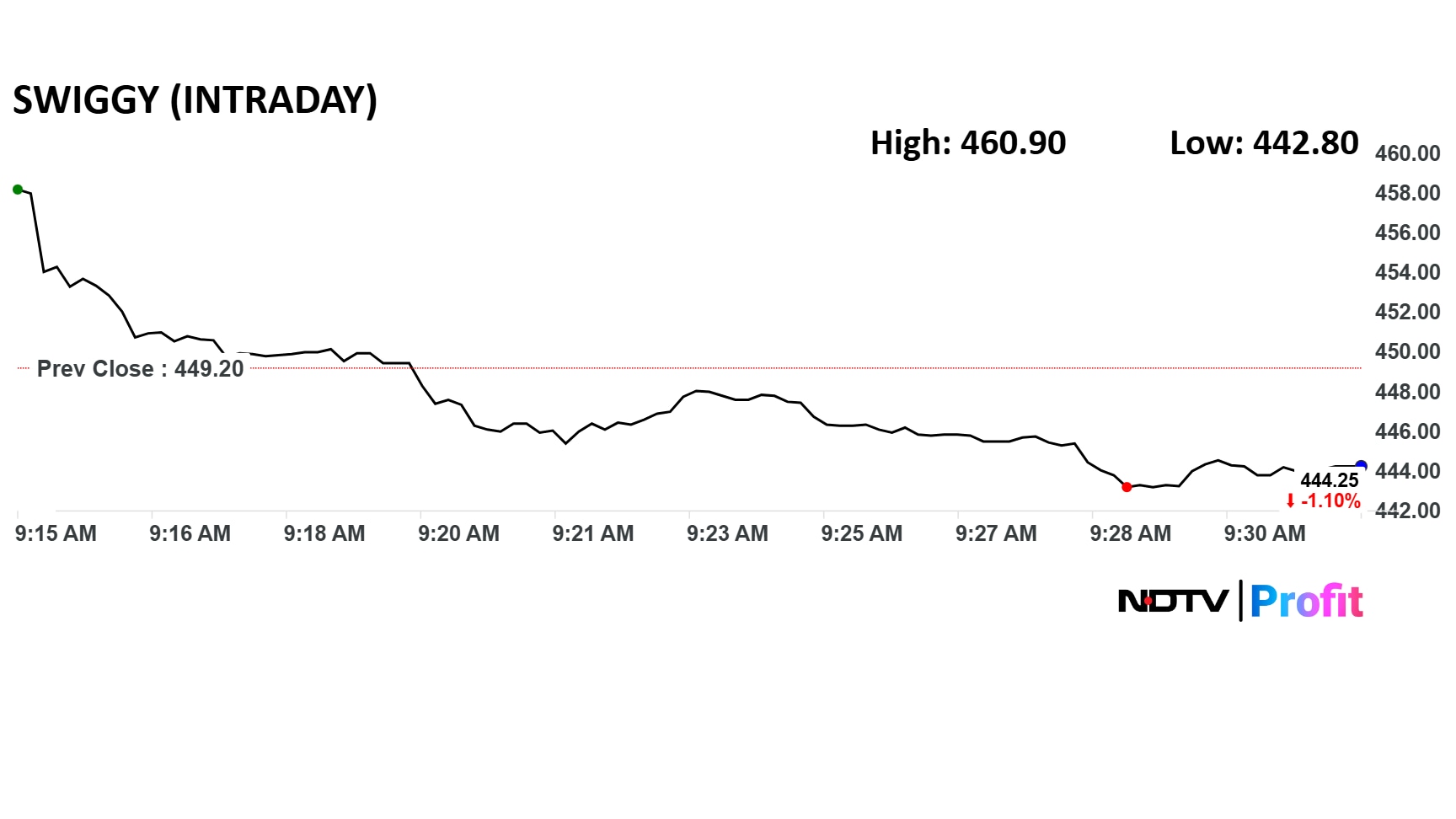

Shares of Swiggy rose during early trade on Wednesday after the board approved to separate quick commerce business 'Instamart' through a slump sale and the fully divest its stake in Rapido to Prosus and WestBridge for a total consideration of Rs 2,400 crore.

The stock rose as much as 2.6% to 460.9 apiece on the NSE, before slipping into red. The benchmark Nifty 50 was down 0.35%. The relative strength index was 56 and the total traded turnover was Rs 214 crore.

The board approved the slump sale of the Instamart on Sept. 23 to Swiggy Instamart, an indirect step-down wholly-owned subsidiary of the company.

The approval includes authority to directors and officers of the company to enter into a business transfer agreement and other related documents to give effect to the transaction, according to a stock exchange filing. All assets, liabilities, permits and licenses, records, intellectual property, employees and contracts will be transferred.

The completion of the sale is expected after the expiry of the third quarter of financial year 2026, as may be determined by the Board.

Instamart has a negative book value of Rs 297 crore as on March 2025.

Swiggy said the transfer is aimed at "developing a focused, efficient, and strategically aligned corporate entity for the long-term development and performance of the Instamart business along with enhanced flexibility in deployment of resources".

Rapido Exit

Swiggy will sell its stake in Rapido to Prosus and WestBridge for a total consideration of Rs 2,400 crore. Both Prosus and WestBridge are existing investors at the ride-hailing startup.

While Tencent-backer Prosus NV will buy Rapido shares for Rs 1,968 crore, Westbridge will pick the remaining for Rs 431.5 crore. This comes after Swiggy, following its first quarter earnings for fiscal 2026, said that the company would reconsider its Rapido stake as the cab aggregator entered the food delivery space.

As per the latest data, the Tencent-backer currently holds around 2.7% in Rapido, and around 23.3% in Swiggy. Sriharsha Majety's firm, meanwhile, holds its 12% in Rapido since 2022, which it bought for around Rs 950 crore.

"As a strategic decision, the transaction will help to realise the investments of the company, for the benefit of company and its shareholders," Swiggy wrote in an exchange notification.

The stake sale will imply a return of over 2.5 times over the course Swiggy's three-plus years of staying invested in Rapido. The amount will add on to its cash balance upon completion, even as competition heats up in the incredibly crowded quick commerce space.

Swiggy, as of June-end, held cash and equivalents of Rs 5,354 crore.

The transactions also value Rapido at over Rs 20,000 crore, marking around a two-fold increase from its last valuation of $1.1 billion, which it achieved in a 2024 fundraise.

Catch all the live markets here for real-time updates, stock movements, and broader market trends throughout the day.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.