- Swiggy plans to raise up to 100 billion rupees from institutional investors soon

- Citigroup, JPMorgan, and Kotak Mahindra shortlisted to manage Swiggy's share sale

- Fundraising follows Swiggy's $1.3 billion IPO and amid fierce instant-commerce competition

Indian food deliverer Swiggy Ltd. is preparing to raise as much as 100 billion rupees ($1.1 billion) from institutional investors as early as next week, according to people familiar with the matter.

The company has shortlisted three banks to manage the share sale — the Indian units of Citigroup Inc. and JPMorgan Chase & Co., as well as Kotak Mahindra Capital Co. — the people said, asking not to be identified because the information is private.

Swiggy's board approved plans on Nov. 7 to raise up to 100 billion rupees through a qualified institutional placement, subject to shareholder and regulatory approval. The timing and size of the deal could still change, the people said.

The company's fundraising plans come as India's instant-commerce sector is rapidly expanding amid surging demand and intensifying competition. Startups are competing with Amazon.com Inc. and Walmart Inc.-backed Flipkart to cover cities with networks of neighborhood warehouses and fleets to quickly deliver everything from groceries and electronics.

Swiggy, Citigroup, JPMorgan, and Kotak Mahindra didn't immediately respond to requests for comment.

Swiggy launched a $1.3 billion initial public offering in November last year. The offering, which was one of the few $1 billion-plus listings in India in 2024, was more than three times subscribed.

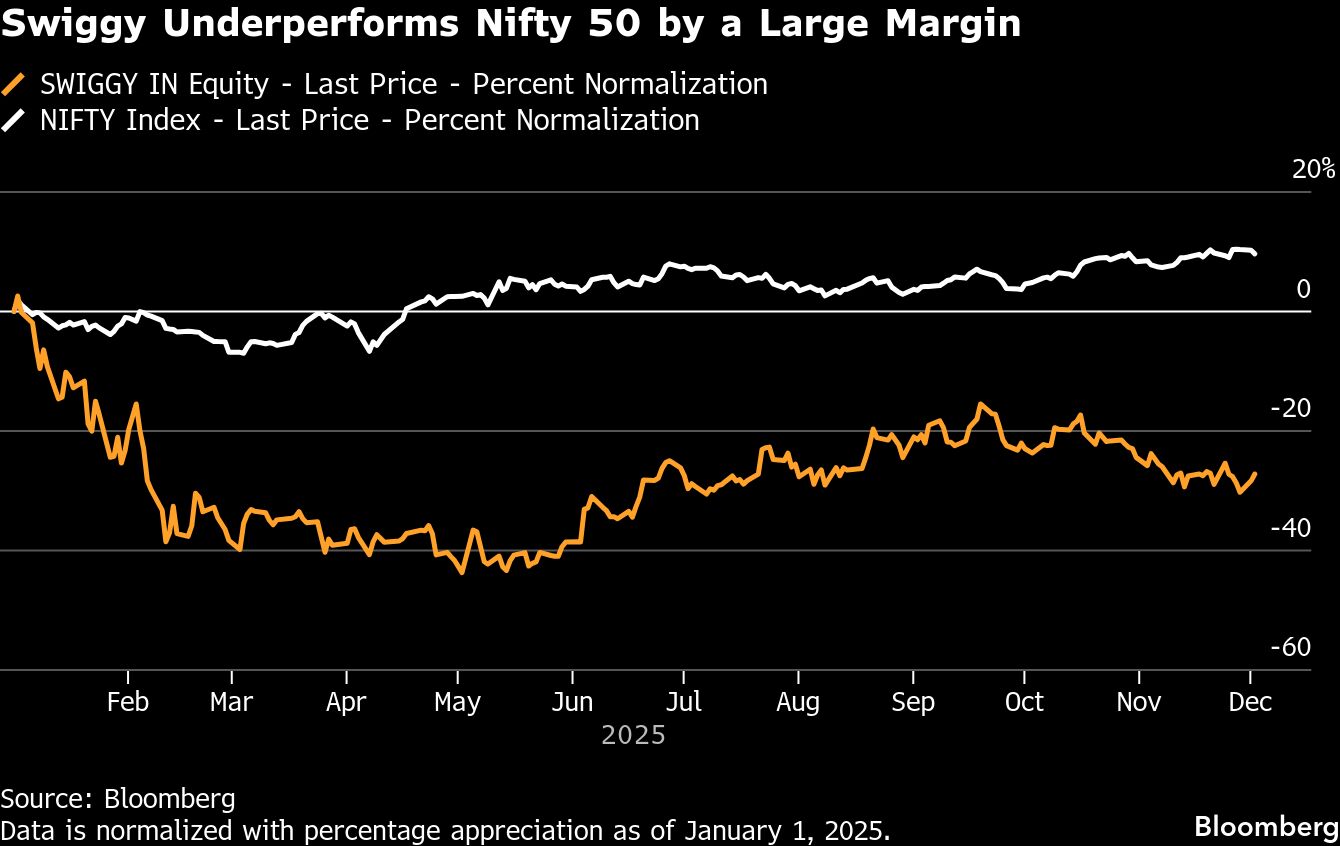

Its shares have fallen about 30% so far this year, as a price war drives aggressive discounting. The development echoes the battle playing out in China, where Meituan, JD.com Inc. and Alibaba Group Holding Ltd. are racing to offer deep discounts.

Eternal Ltd., a Swiggy rival formerly known as Zomato, also raised 85 billion rupees last year through a qualified institutional placement.

Meanwhile, Zepto is preparing for an initial public offering, reviving plans shelved earlier this year, local media outlet Economic Times reported last month. It's seeking to list between July and September next year, targeting to raise $450 million to $500 million in fresh equity, the report said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.