Shares of Suzlon Energy surged nearly 4% after CRISIL Ratings upgraded the renewable energy company's credit rating to 'CRISIL A' with a positive outlook, highlighting the company's robust performance and improved profitability.

In an exchange filing on Tuesday, the renewable energy solutions provider, announced that this marks the second rating upgrade by CRISIL in 2024, reflecting Suzlon's strong operational efficiencies, disciplined financial management, and consistent quarter-on-quarter growth.

Earlier this year, CRISIL had assigned Suzlon a rating of ‘CRISIL A-', which has now been further upgraded in recognition of the company's improved financial metrics and growing opportunities in the renewable energy sector. The positive outlook reflects the potential for Suzlon's wind turbine generator business to outperform on higher execution volumes.

"This milestone reinforces our focus on creating value through efficient capital management and sustainable business practices, strengthening our position as a trusted leader in the renewable energy sector," said Himanshu Mody, Chief Financial Officer, Suzlon Group in the statement.

Additionally, CRISIL also upgraded the ratings of SE Forge Limited, a wholly owned subsidiary of Suzlon, to 'CRISIL BBB+' with positive outlook from ‘CRISIL BBB-' with a stable outlook.

In November, Morgan Stanley upgraded Suzlon Energy's stock rating to 'Overweight' but lowered the target price to Rs 71 per share from Rs 78. The brokerage expects Suzlon's market share to rise to 35–40% by the financial year 2027 from the current 25%. Key strengths identified include Suzlon's strong business moat and a 5.1 gigawatt order backlog, while risks include potential delays in capacity addition, high operating expenses, and increased competition.

Suzlon Energy Share Price Today

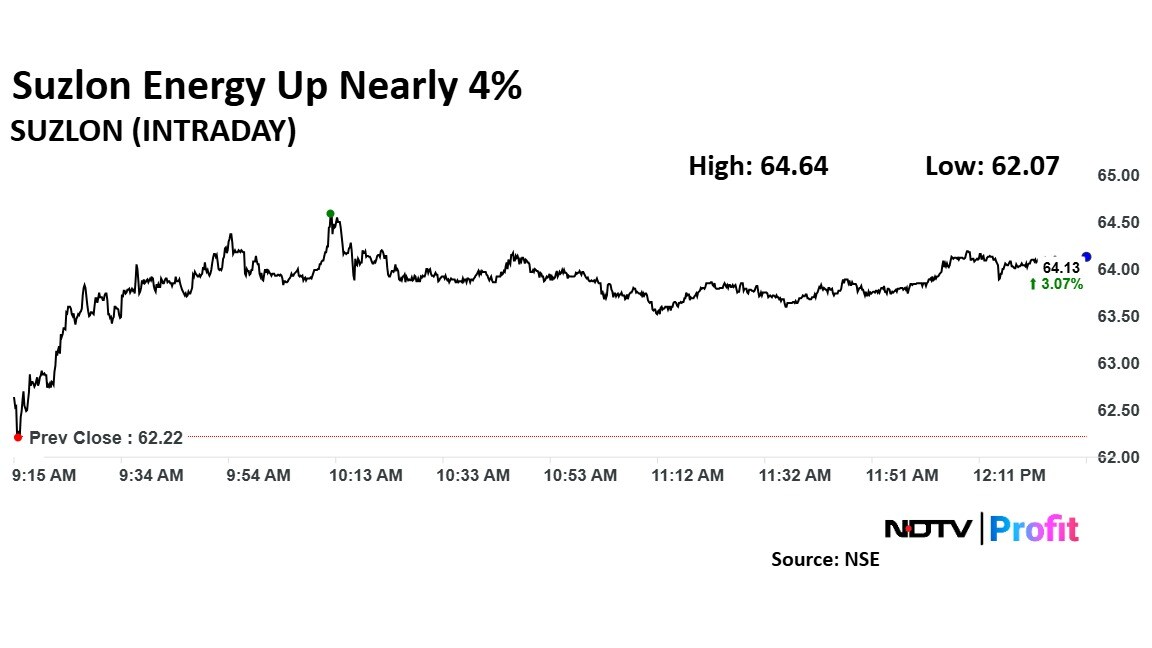

Suzlon Energy stock rose as much as 3.89% during the day to Rs 64.6 apiece on the NSE. It was trading 2.99% higher at Rs 64.08 apiece, compared to a 0.43% advance in the benchmark Nifty 50 as of 12:29 p.m.

It has risen 22% in the last 12 months. The total traded volume so far in the day stood at 0.6 times its 30-day average. The relative strength index was at 45.

Three out of the five analysts tracking the company have a 'buy' rating on the stock and two recommended a 'hold', according to Bloomberg data. The 12-month analysts' consensus target price on the stock implies an upside of 19%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.