- KFin Technologies CTO Venkatagiri Vonkayala resigned to pursue a new opportunity

- Vonkayala led major AI and cloud projects, cutting costs and boosting efficiency

- KFin Tech’s Q3FY26 revenue rose 27.9% YoY to Rs 370.87 crore with steady profits

KFin Technologies' Chief Technology Officer Venkatagiri Vonkayala has resigned from his role with immediate effect. He has been in this leadership position since June 2022, previously serving as the Chief Data Officer for the company. The resignation letter stated that the decision to step down was driven by the pursuit of a better professional opportunity.

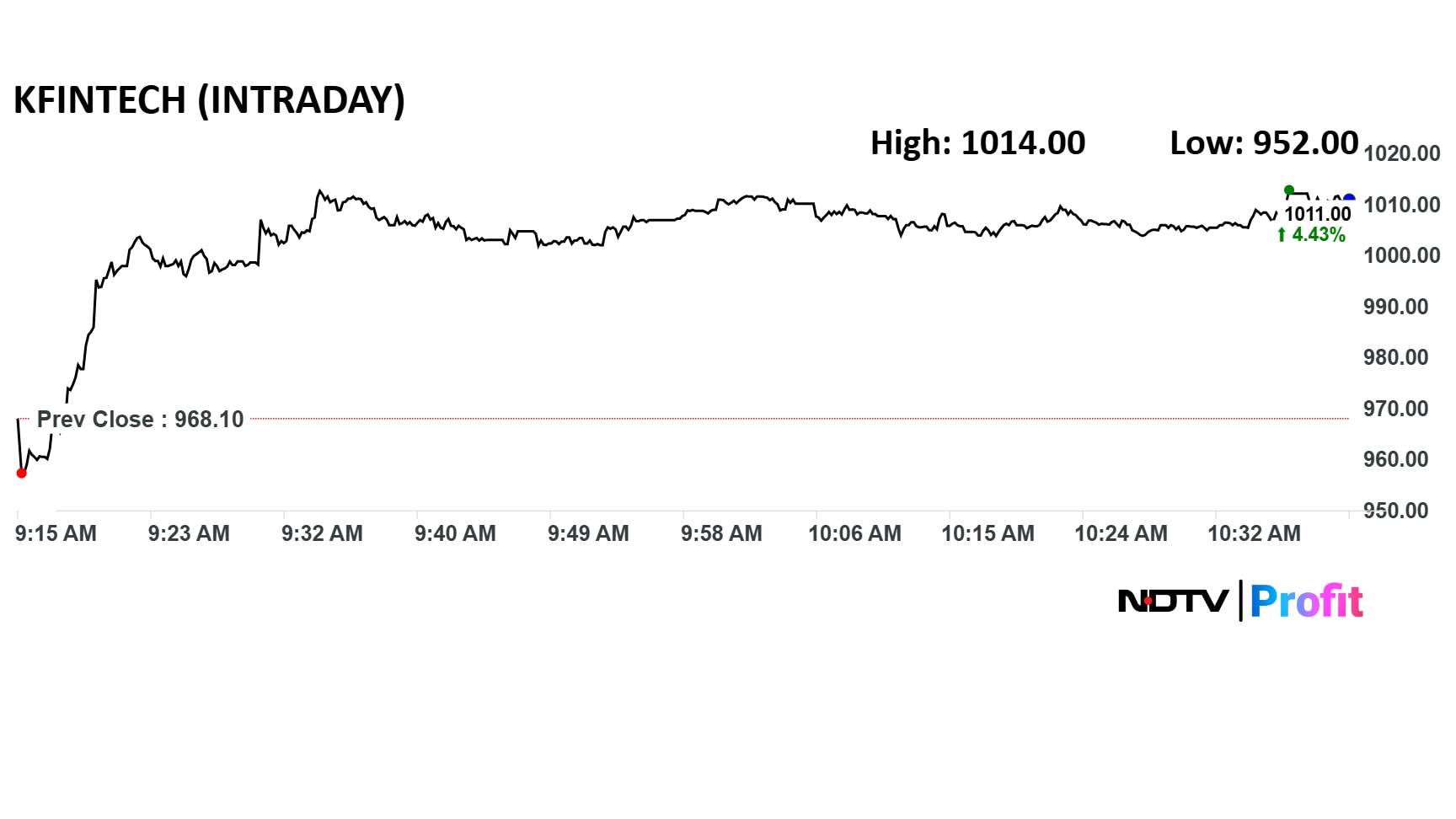

The solutions provider's share price is currently up over 4.4%, trading at Rs 1,011 apiece.

Recognised for his work in AI-led engineering, cloud migration, and data lakes, Vonkayala led a major data transformation project at Nippon Life India Asset Management last year. This project reduced processing time by 70% and infrastructure costs by 50%. He also spearheaded the use of AWS serverless architecture for managing IPOs.

KFin Tech also reported a strong set of numbers for the quarter ended December 31, 2025, delivering healthy revenue growth and steady profitability across its diversified business verticals. Consolidated revenue from operations — including contributions from Ascent Fund Services — stood at Rs 370.87 crore, reflecting a 27.9% year‑on‑year increase. For the nine‑month period of FY26, revenue rose 18.1% YoY to Rs 954.16 crore, underscoring broad‑based operational momentum.

The company posted an EBITDA of Rs 151.62 crore for Q3FY26, marking a 16.1% YoY rise. EBITDA margin came in at 40.9%, compared with 45.0% in the same quarter last year, reflecting continued investments across key business lines.

Core Profit After Tax for the quarter stood at Rs 98.39 crore, translating into a 9.1% YoY increase, while the Core PAT margin was reported at 26.5%.

The International and Other Investor Solutions segment remained the standout performer this quarter, with core revenue surging 176.5% year‑on‑year. Even after excluding the impact of GBS, the business delivered a strong 30.7% YoY growth. The international franchise expanded meaningfully, with the total client count rising to 428, of which 328 came from Ascent.

A key milestone during the quarter was a major multinational bank selecting Ascent's compliance platform, OneConstellation, for global investor onboarding — a validation of the company's expanding footprint in technology‑led fund services.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.