Sun Pharmaceutical Industries Ltd.'s share price declined nearly 5% following the announcement of its fourth-quarter FY25 results. The pharmaceutical giant reported notable growth in revenue and Ebitda, although net profit saw a decline.

For the quarter ended March 31, Sun Pharma's consolidated revenue increased by 8% to Rs 12,959 crore, compared to Rs 11,983 crore in the same period last year. This figure, however, fell short of Bloomberg's estimate of Rs 13,254 crore. The revenue growth underscores Sun Pharma's strong market presence and ability to drive sales amidst challenging conditions.

The company's earnings before interest, taxes, depreciation, and amortisation rose significantly by 22.4%, reaching Rs 3,716 crore versus Rs 3,035 crore year-on-year. This improvement in Ebitda exceeded Bloomberg's estimate of Rs 3,650 crore, highlighting Sun Pharma's operational efficiency and effective cost management strategies. The Ebitda margin also expanded to 28.7% from 25.3%, surpassing the estimated 27.5%.

However, Sun Pharma's net profit declined by 19% to Rs 2,154 crore, compared to Rs 2,659 crore in the corresponding quarter of the previous fiscal year. This figure was below Bloomberg's estimate of Rs 2,794 crore. The decline in net profit was partly due to an exceptional loss of Rs 362 crore, significantly higher than the Rs 102 crore loss reported in the same period last year.

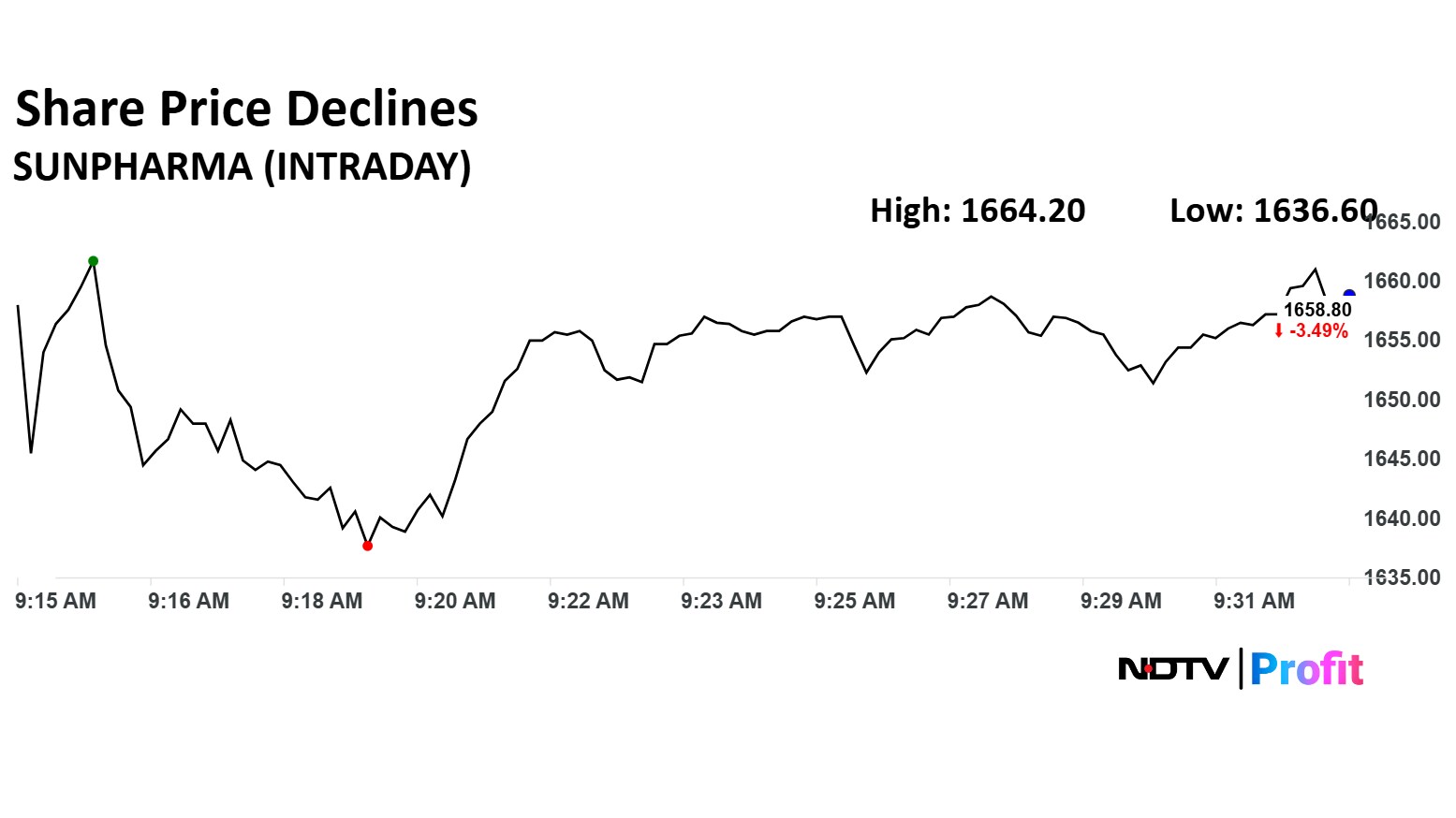

Sun Pharma Share Price Today

The scrip fell as much as 4.78% to Rs 1,636.60 apiece. It pared losses to trade 3.19% lower at Rs 1,663.90 apiece, as of 09:35 a.m. This compares to a 0.54% advance in the NSE Nifty 50 Index.

It has risen 11.29% in the last 12 months. Total traded volume so far in the day stood at 3.9 times its 30-day average. The relative strength index was at 37.

Out of 42 analysts tracking the company, 34 maintain a 'buy' rating, five recommend a 'hold' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 20.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.