.jpg?downsize=773:435)

- Earnings today: ACC, HDFC Standard Life Insurance Company, Mastek, Mindtree.

- Fortis Healthcare receives non-binding expression of interest from Fosun.

- Lupin receives tentative USFDA approval for generic AndroGel.

- Vedanta's resolution plan for Electrosteel Steels approved by NCLT.

- Indian Hume Pipe Company Ltd receives order worth Rs 108.19 crore.

Asian equities pushed higher at the start on Wednesday as an encouraging U.S. earnings season underscored resilient growth.

Stock benchmarks climbed in Japan, Hong Kong and Australia. The Singapore-traded SGX Nifty, an early indicator of NSE Nifty 50 Index's performance in India, rose 0.5 percent to 10,610 as of 7:05 a.m.

Here Are The Stocks To Watch Out For In Wednesday's Trade

- Lupin received tentative U.S. FDA approval for generic AndroGel.

- Indian Hume Pipe Company Ltd received order of Rs. 108.19 crore.

- Shalby Signs memorandum of understanding with Sen Sok International University Hospital, Cambodia.

- Ducon received final NCLT order approving ongoing merger process.

- Jayaswal Neco Industries said Supreme Court directed parties involved in debt restructuring of company to maintain status quo.

- AstraZeneca to invest $90 million over the next five years in India.

- Vedanta's resolution plan for Electrosteel Steels approved by NCLT. Vedanta will hold 90 percent stake while existing shareholders and creditors to get the remaining 10 percent.

- KS Oils said corporate insolvency resolution process expired on April 16. The committee of creditors has not approved resolutions plans.

- Andhra Bank said that the exposure to SSK Trading of Rs 30 crore is non performing asset. (Bloomberg)

- HAL enhanced jet production capacity. (Bloomberg)

- Jagran Prakashan to consider share buyback on April 27.

- Uttam Galva says lenders yet to accept offer to settle debt.

- Future Consumer hiked stake in Integrated Food Park Pvt. Ltd. to 99.93 percent.

F&O Setup

- Nifty April futures closed trading at 10,551 with a premium of 2.5 points versus 14.6 points

- April series: Nifty open interest up 2 percent, Bank Nifty open interest up 5 percent

- India VIX ended at 14.04, down 1.5 percent

- Max open interest for April series at 10,700 (open interest at 46.3 lakh, up 5 percent)

- Max open interest for April series at 10,400 (open interest at 52.6 lakh, down 2 percent)

F&O Ban

- In ban: IRB Infra, JP Associates, TV18 Broadcast, Reliance Communications.

- Out of ban: Balrampur Chini.

Only intraday positions can be taken in stocks which are in F&O ban. There is a penalty in case of a rollover of these intraday positions.

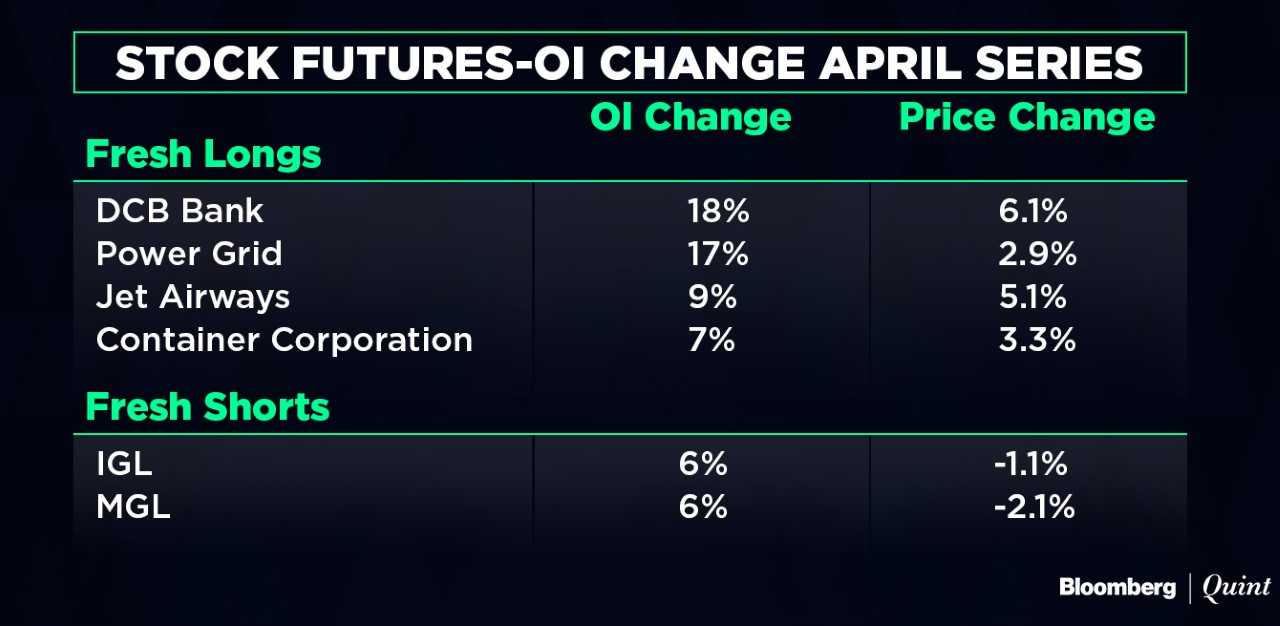

Active Stock Futures

Bulk Deals

- Karda Constructions: Capstone Capital Partners sold 87,360 shares or 0.7 percent equity at Rs 185.94 each.

- Kwality: UA Enterprises Pvt Ltd sold 12 lakh shares or 0.5 percent equity at Rs 59.06 each.

- Talwalkar Fitness: Tata MF sold 4.09 lakh shares or 1.3 percent equity at Rs 88.41 each.

- Ajmera Realty: Promoter Rajnikant Ajmera sold 5 lakh shares or 1.4 percent equity at Rs 282.6 each.

- Idea Cellular: First State Investments ICVC- Stewart Investors Asia Pacific Leaders Fund sold 3.92 crore shares or 0.9 percent equity at Rs 71.5 each.

- Moldtek: AKG Finvest sold 1.5 lakh shares or 0.5 percent equity at Rs 50 each.

Earnings To Watch:

- ACC

- HDFC Standard Life Insurance Company

- Mastek

- Mindtree

Earnings Reactions To Watch

Tata Sponge Iron (Q4, YoY)

- Revenue up 46 percent at Rs 243.5 crore.

- Net profit at Rs 47 crore versus Rs 21 crore.

- Ebitda at Rs 61.5 crore versus Rs 25.5 crore.

- Margin at 25.3 percent versus 15.3 percent.

Orchid Pharma (Q4, YoY)

- Revenue down 20 percent at Rs 144 crore.

- Net loss of Rs 77 crore versus net loss of Rs 65 crore.

- Ebitda down 31 percent at Rs 13.5 crore.

- Margin at 9.4 percent versus 10.8 percent.

5Paisa Capital (Q4, YoY)

- Revenue at Rs 8 crore versus Rs 5 crore.

- Net loss of Rs 7 crore versus net loss of Rs 3 crore.

Fortis receives fourth offer in a month.https://t.co/HSKmWjQeeJ pic.twitter.com/6ws582sLTY

Brokerage Radar

Edelweiss on Future Supply Chain

- Initiated ‘Buy' with a price target of Rs 862.

- Expect demand boom for third party logistics services.

- Rapidly expanding anchor client to ensure growth.

- Asset-light model to ensure strong free cash flow.

- Improving working capital cycle to spur return ratios.

- Expect revenue, operating income and earnings per share to compound at 36 percent, 33 percent and 36 percent over the fiscal 2018-2020.

- Future Supply well placed to capture opportunity.

Motilal Oswal on Room Air Conditioners

- 2018 to be another year of strong industry growth.

- AC penetration to inch up from current low levels.

- Expect 15 percent compounded growth rate in room AC industry over the fiscal 2018-2020.

- Inverters' share in industry volumes to rise to 50 percent by March 2020.

- Prefer Blue Star over Voltas.

Haitong on ICICI Lombard

- Maintained ‘Buy' with a price target of Rs 1,000.

- Star Health acquisition could significantly increase ICICI Lombard's retail health book.

- Retail health has been a profitable segment for insurers.

- Potential acquisition of Star Health could be positive.

Macquarie on Phoenix Mills

- Maintained ‘Outperform' with a price target of Rs 732.

- Phoenix Mills-CPPIB inked an agreement to purchase 16 acres of land in Hebbal - media reports.

- Catchment area for the mall is good.

- Visibility of growth increasing.

- Phoenix Mills is one of our top picks in the Indian real estate space.

CLSA on Vedanta

- Maintained ‘Buy' with a price target of Rs 410; implying a potential upside of 42 percent from the last regular trade.

- Acquired Electrosteel Steels at attractive valuations.

- Acquisition price implies an EV/tonne of $562.

- If capacity expanded to 2.5 MTPA, then EV/tonne down to $409.

- Acquisition marginally EPS/Value accretive at full utilisation and EBITDA/tonne of $120.

CLSA on FMCG

- Dabur: Upgraded to ‘Buy' from ‘Outperform'; raised price target to Rs 415 from Rs 400.

- Rural growth outlook improving.

- Pressures from Patanjali Ayurved seem to be behind.

- IMD forecast and expected increase in MSP is positive.

- Emami, Dabur, HUL and Colgate have highest rural exposure.

- Top consumer picks: Emami, Dabur, ITC, Varun Beverages and Jubilant Foods.

HSBC on India Non-Ferrous

- Ongoing disruptions have led to a surge in alumina and aluminium prices.

- Integrated producers to benefit more.

- Q4 earnings to be lacklustre on the back of rising input cost.

- Hindalco: Maintained ‘Buy'; raised price target to Rs 305 from Rs 284.

- Hindustan Zinc: Maintained ‘Buy'; raised price target to Rs 370 from Rs 365.

- Vedanta: Maintained ‘Buy'; cut price target to Rs 405 from Rs 435.

- Supply cuts due to ongoing disruptions pose further upside.

CLSA on India Power

- Government's 24x7 plan has better chances of being implemented

- Expect 30 percent rise in demand.

- Lays foundation for next bull market for power stocks.

- Expect utilities to report profit growth of 5-15 percent in the current quarter

- Buy: NTPC, Power Grid, CESC, Tata Power.

- Sell: Adani Transmission, Adani Power and JSW Energy.

Legal hurdles in RCom's asset sale to Reliance Jio. @arpanc_ reports.https://t.co/sL7GSrkMPB pic.twitter.com/goxxkbXNjx

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.