And it's a wrap on NDTV Profit's live market coverage. Thank you for joining us today!

You may track NDTV Profit's Q2 Earnings Live Blog for latest releases.

Nifty Ends In Green, Above 25,550 Mark

Sensex Closes In Green, Above 84,400 Mark

Top Nifty Gainer Nestle & Tata Consumer Product

Small cap 250 Ends In Green, Major Rise Led By Bls International & Tv18 Broadcast

Nifty Midcap150 Ends In Green, Major Rise Led By Oberoi Realty & Gujarat Fluorochemicals

All Sectors End In Green Except Nifty PSU Bank

Nifty FMCG Is The Top Sectoral Gainer, Gains Led By Nestle & Varun Beverages

Nifty PSU Bank Emerges As Top Sectorial Loser, Fall Led By Bank Of Maharashtra & Indian Overseas Bank

Nifty Oil & Gas, Realty, Energy, Auto, Pharma Metal Gain For Second Consecutive Day

Nifty IT Gains For Second Day In A Row, On The Back Of Positive Result Momentum

Nifty Media Snaps Its 2 Day Losing Streak

Nifty Ends In Green, Above 25,550 Mark

Sensex Closes In Green, Above 84,400 Mark

Top Nifty Gainer Nestle & Tata Consumer Product

Small cap 250 Ends In Green, Major Rise Led By Bls International & Tv18 Broadcast

Nifty Midcap150 Ends In Green, Major Rise Led By Oberoi Realty & Gujarat Fluorochemicals

All Sectors End In Green Except Nifty PSU Bank

Nifty FMCG Is The Top Sectoral Gainer, Gains Led By Nestle & Varun Beverages

Nifty PSU Bank Emerges As Top Sectorial Loser, Fall Led By Bank Of Maharashtra & Indian Overseas Bank

Nifty Oil & Gas, Realty, Energy, Auto, Pharma Metal Gain For Second Consecutive Day

Nifty IT Gains For Second Day In A Row, On The Back Of Positive Result Momentum

Nifty Media Snaps Its 2 Day Losing Streak

Rupee closed 24 paise stronger at 87.83 against US dollar

It closed at 88.07 a dollar on Wednesday

Source: Bloomberg

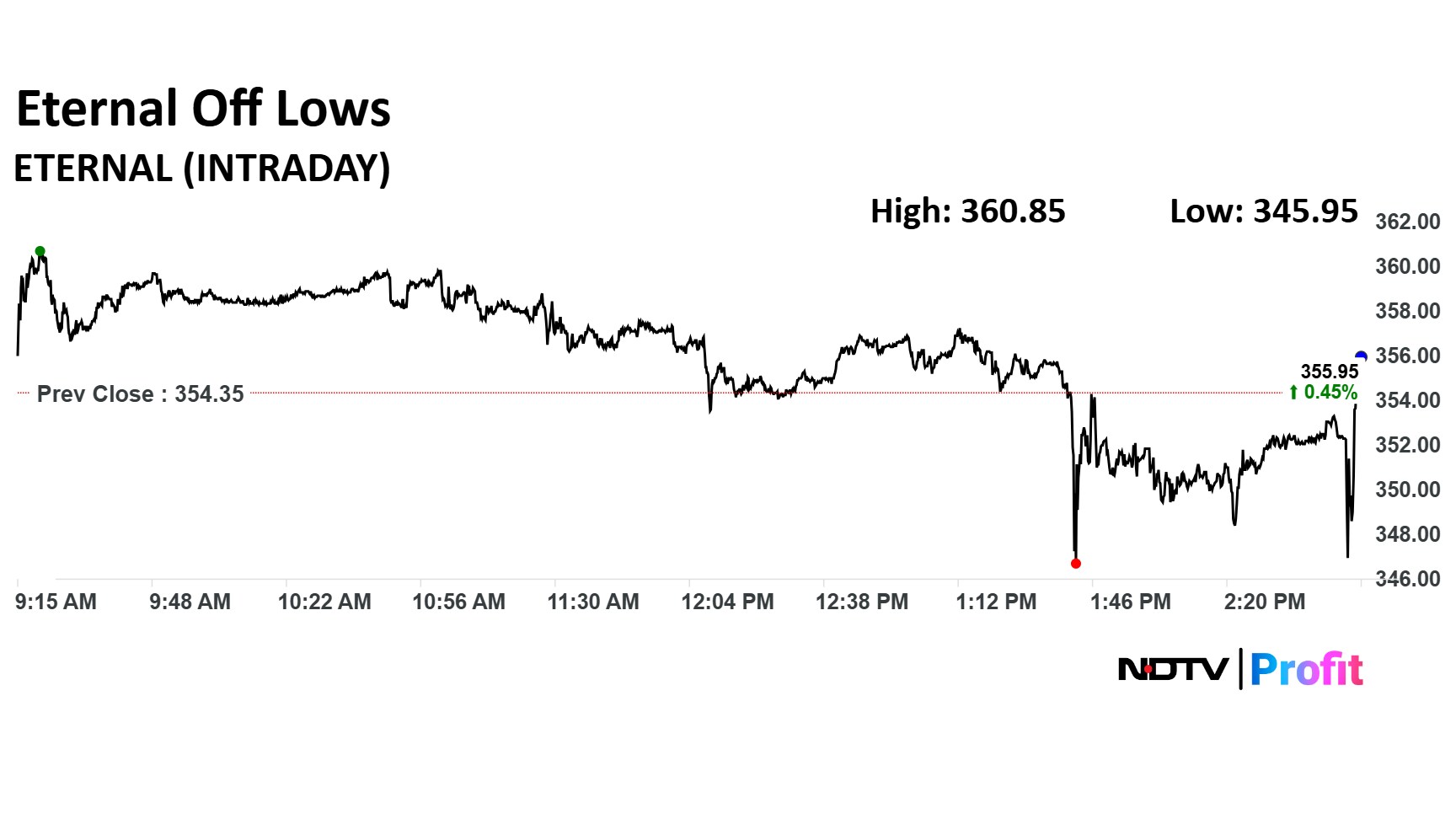

Eternal Q2FY26 (Consolidated, YoY)

Revenue at Rs 13,590 crore versus Rs 4,799 crore (Bloomberg estimate: Rs 8,665 crore)

EBITDA up 5.8% at Rs 239 crore versus Rs 226 crore (Estimate: Rs 236 crore)

Margin at 1.8% versus 4.7% (Estimate: 2.7%)

Profit down 63% at Rs 65 crore versus Rs 176 crore (Estimate: Rs 108 crore)

Eternal Q2FY26 (Consolidated, YoY)

Revenue at Rs 13,590 crore versus Rs 4,799 crore (Bloomberg estimate: Rs 8,665 crore)

EBITDA up 5.8% at Rs 239 crore versus Rs 226 crore (Estimate: Rs 236 crore)

Margin at 1.8% versus 4.7% (Estimate: 2.7%)

Profit down 63% at Rs 65 crore versus Rs 176 crore (Estimate: Rs 108 crore)

PNC Infratech received order worth Rs 297 crore from Airtport Authority of India to develop Lal Bahadur Shastri International Airport, Varanasi.

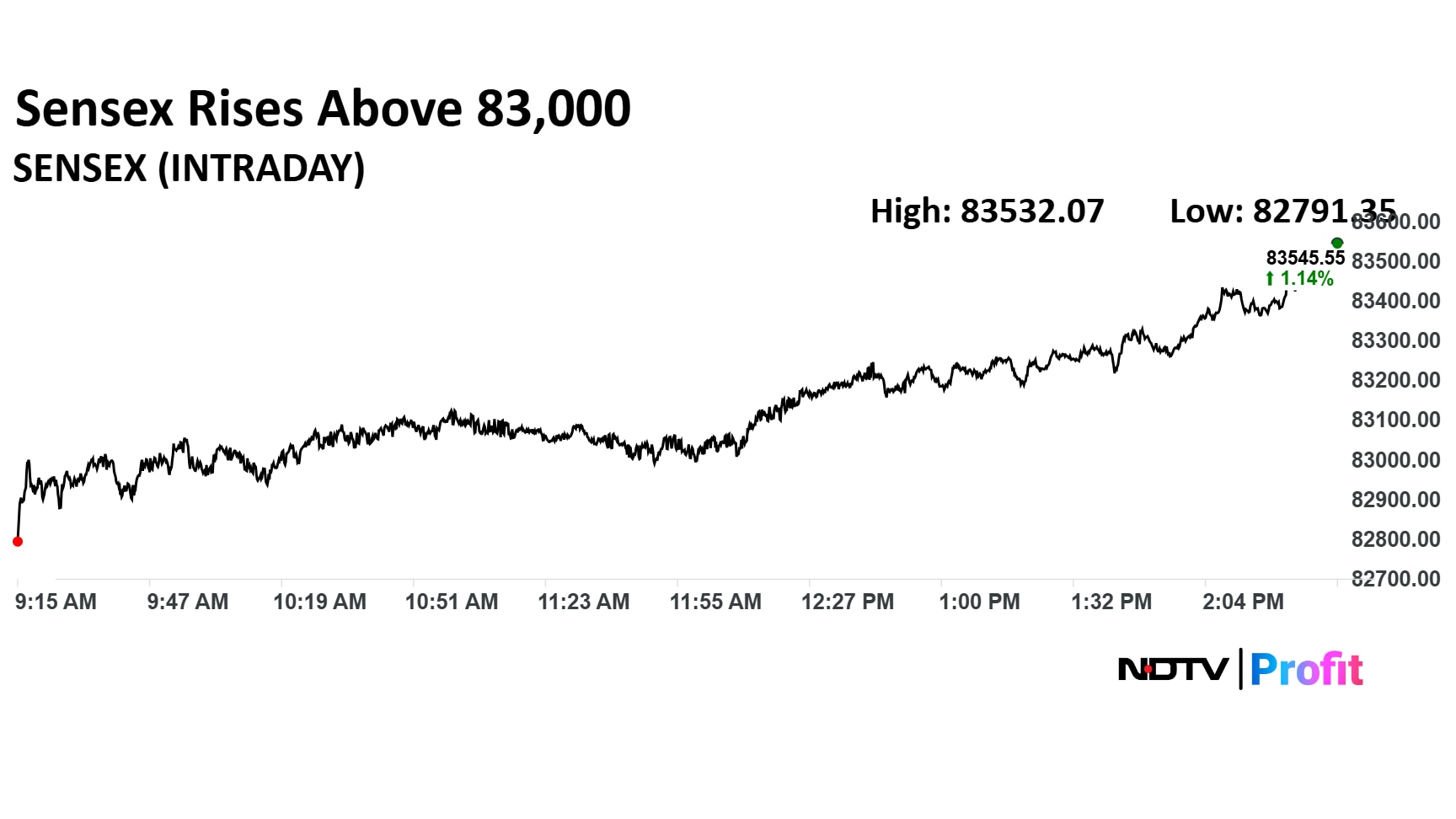

The BSE Sensex rose above 83,000 level for first time since July 10.

The BSE Sensex rose above 83,000 level for first time since July 10.

EMS received letter of award worth Rs 184 crore from UP Jal Nigam for sewage treatment scheme, the company said in the exchange filing.

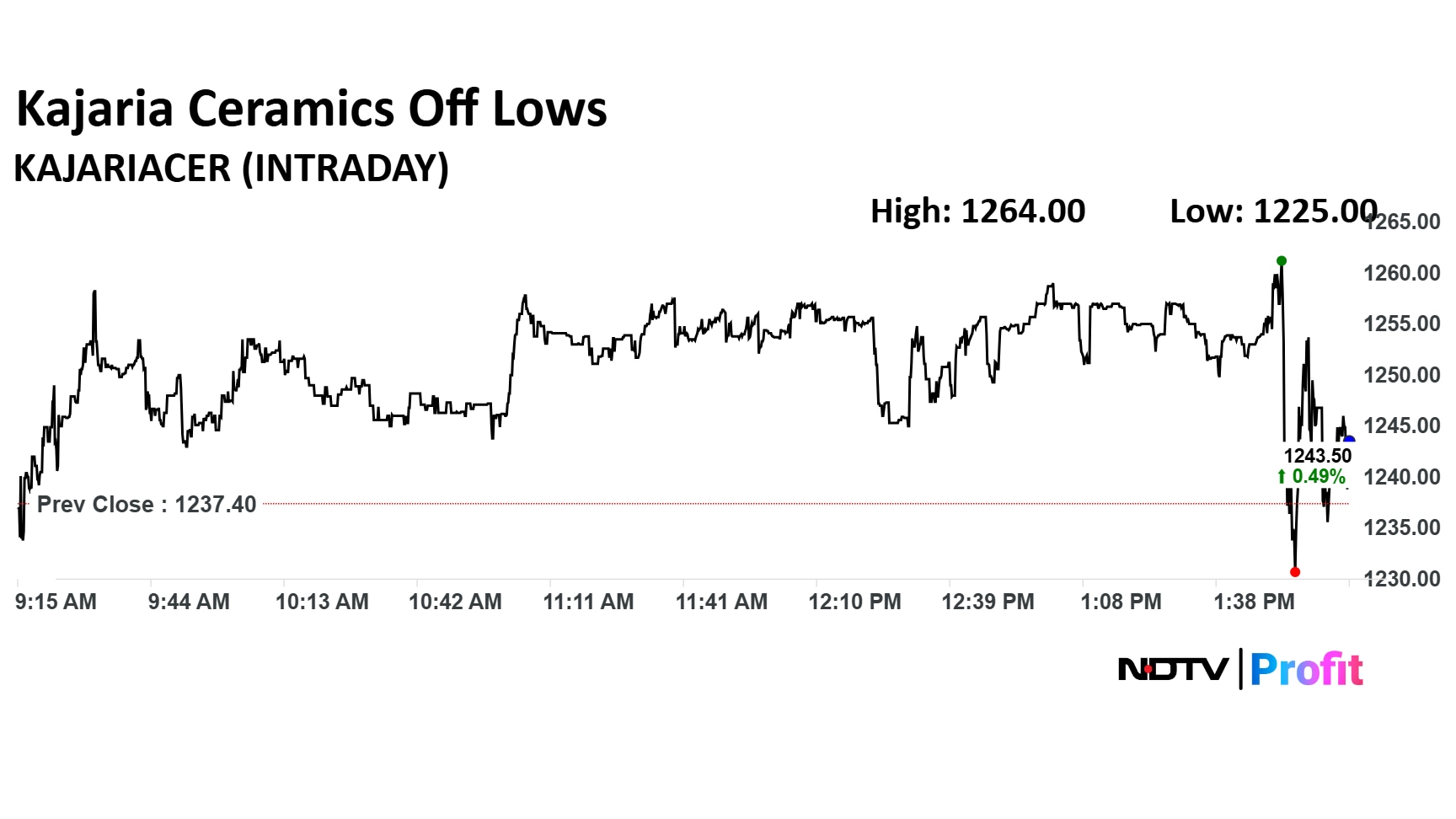

Kajaria Ceramics Q2FY26 (Consolidated, YoY)

Revenue up 2.1% at Rs 1,186 crore versus Rs 1,162 crore

EBITDA up 30.5% at Rs 214 crore versus Rs 164 crore

Margin at 18% versus 14.1%

Net Profit up 56.7% at Rs 134 crore versus Rs 85.5 crore

Track faster live update on Q2 earnings here

Kajaria Ceramics Q2FY26 (Consolidated, YoY)

Revenue up 2.1% at Rs 1,186 crore versus Rs 1,162 crore

EBITDA up 30.5% at Rs 214 crore versus Rs 164 crore

Margin at 18% versus 14.1%

Net Profit up 56.7% at Rs 134 crore versus Rs 85.5 crore

Track faster live update on Q2 earnings here

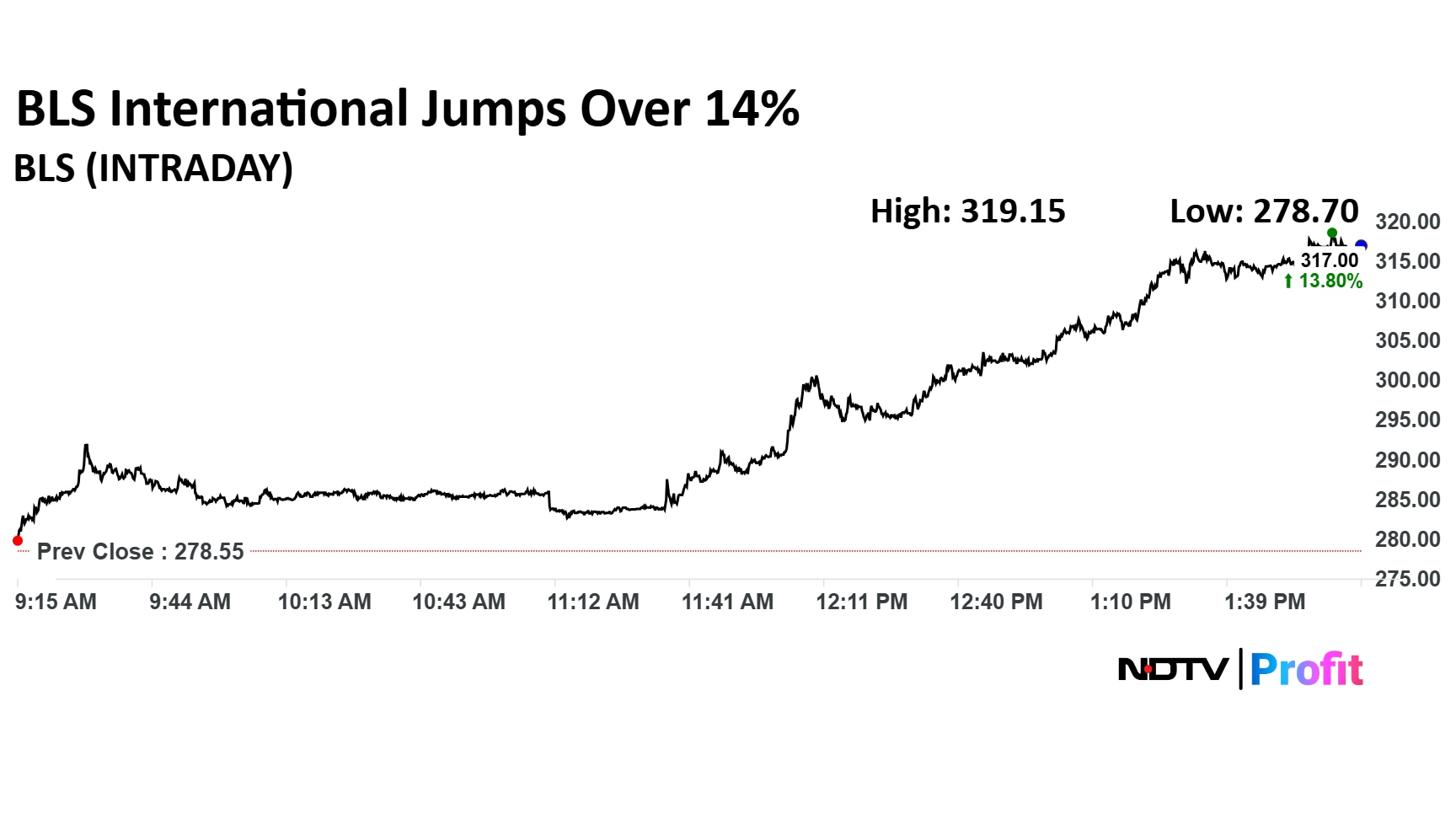

BLS International Services share price jumped 14.58% to Rs 319.15 apiece. It was trading 13.75% higher at Rs 317.95 apiece as of 2:13 p.m.

BLS International Services share price jumped 14.58% to Rs 319.15 apiece. It was trading 13.75% higher at Rs 317.95 apiece as of 2:13 p.m.

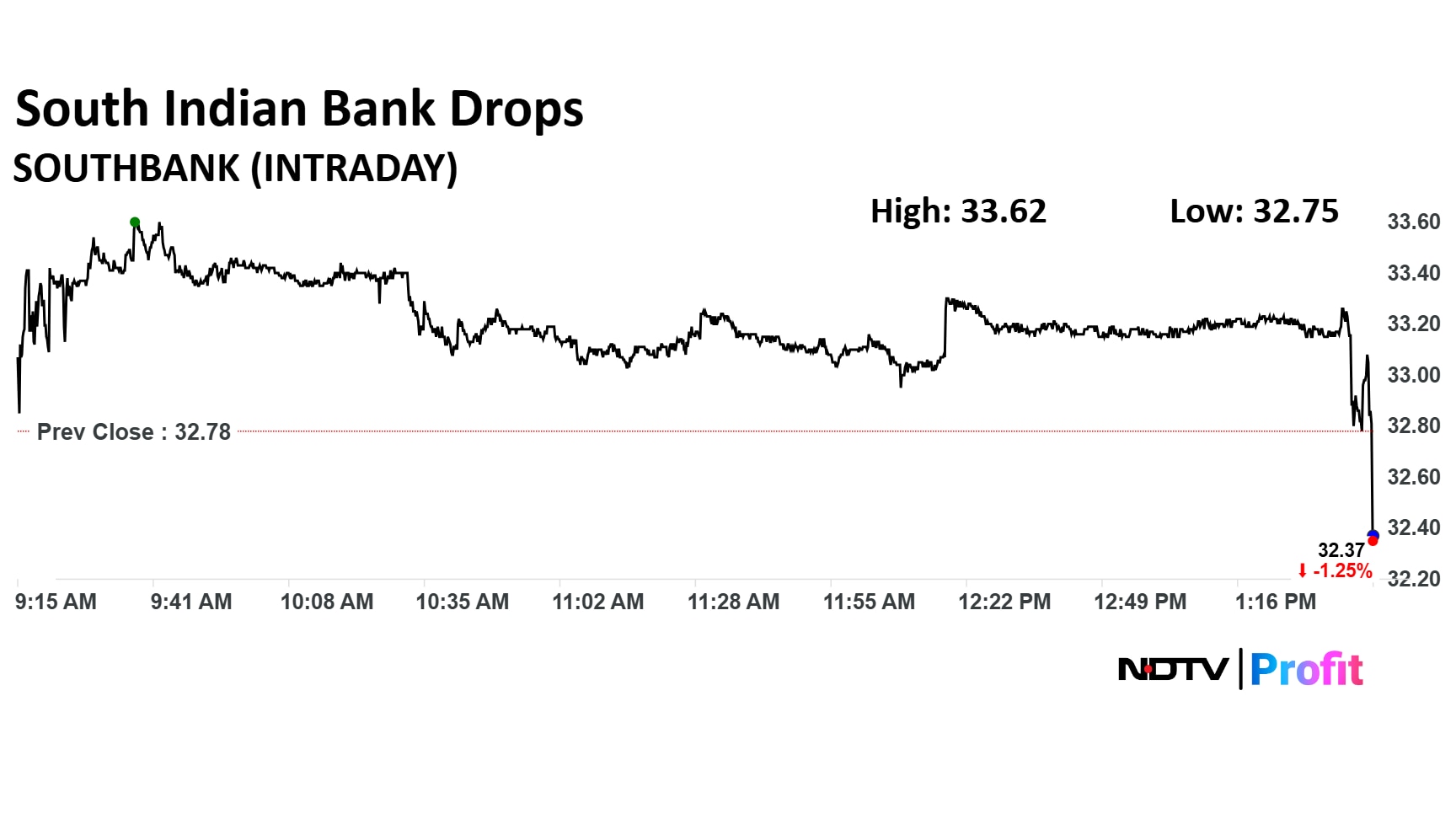

South Indian Bank share price declined 3.36% to Rs 32.75 apiece, the lowest level since Oct 10. It reported that its net interest income declined 8.3% on the year to Rs 809 crore versus Rs 882 crore.

South Indian Bank share price declined 3.36% to Rs 32.75 apiece, the lowest level since Oct 10. It reported that its net interest income declined 8.3% on the year to Rs 809 crore versus Rs 882 crore.

Swaraj Engines' Rajesh Jejurikar resigned from the post of chairman and director, the company said in the exchange filing.

IT major Tata Consultancy Services (TCS) on Thursday concluded the first edition of the tcsAI Hackathon 2025 globally. The competition had massive participation from the company’s workforce, with over 2.81 lakh employees joining in from 58 countries, the company said.

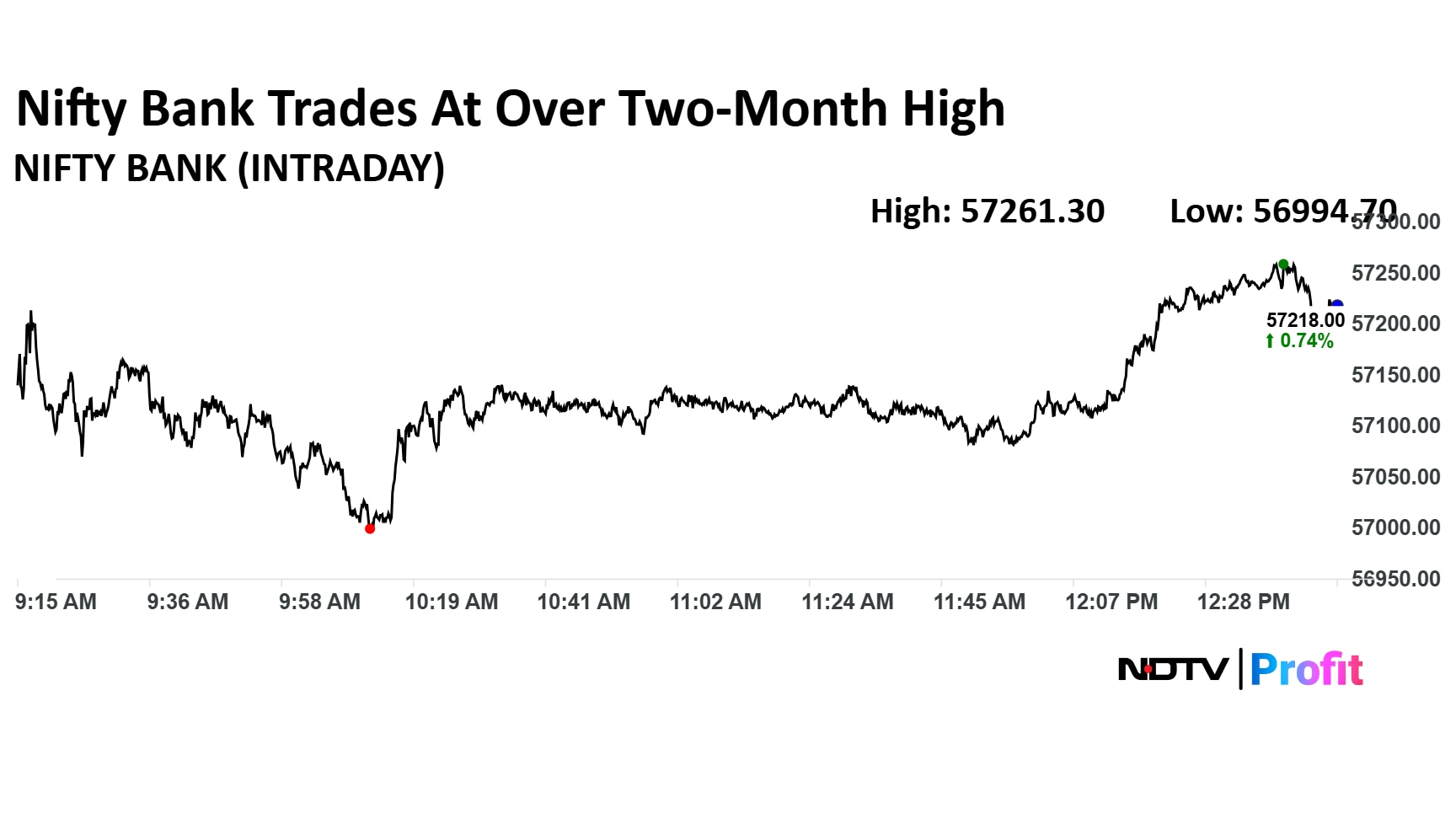

The NSE Nifty Bank rose 0.81% to Rs 57,261.30, the highest level since July 24. ICICI Bank Ltd., HDFC Bank Ltd., and Axis Bank Ltd. shares supported gains

The NSE Nifty Bank rose 0.81% to Rs 57,261.30, the highest level since July 24. ICICI Bank Ltd., HDFC Bank Ltd., and Axis Bank Ltd. shares supported gains

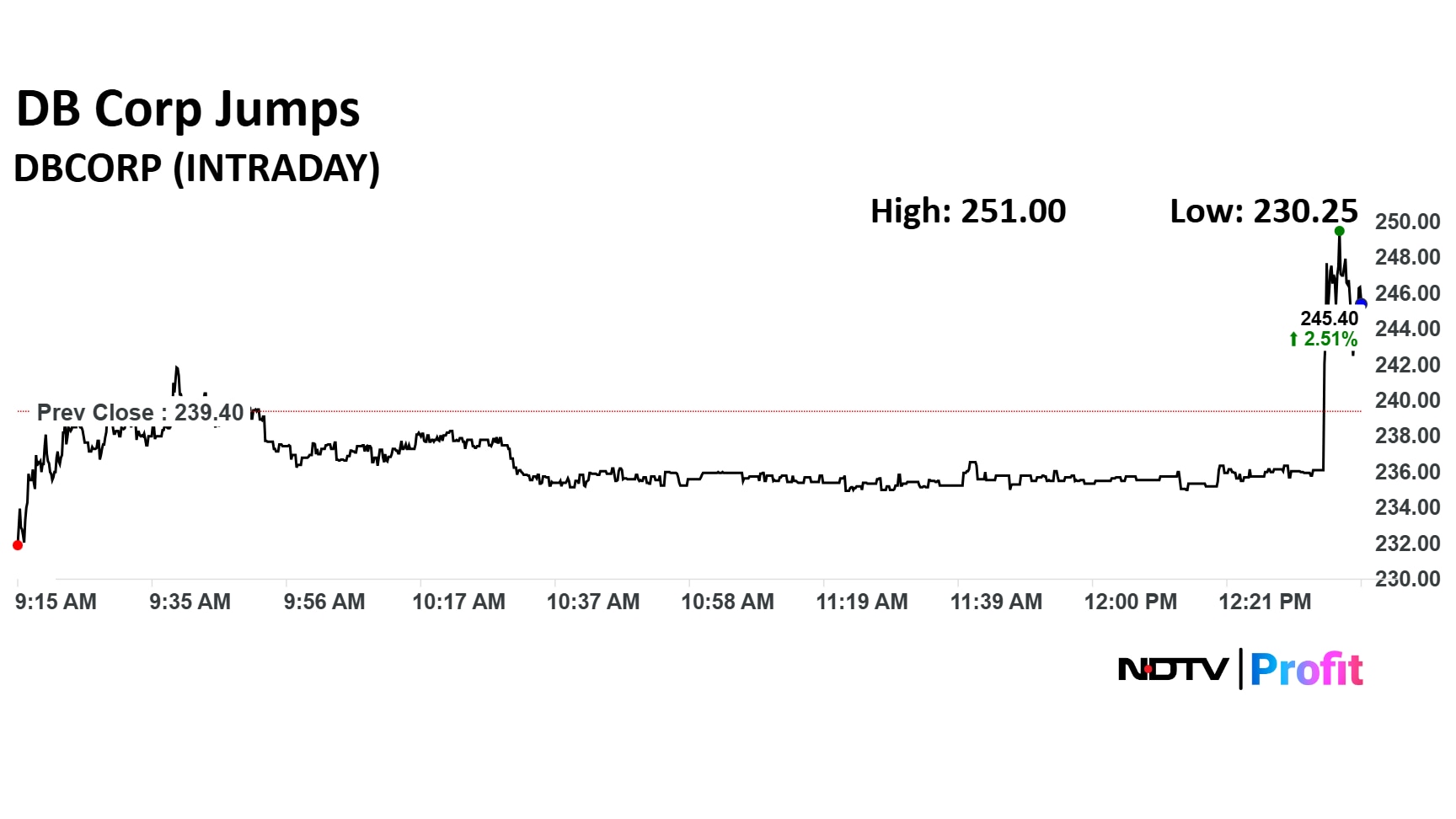

DB Corp share price rose 4.85% to Rs 251 after the company reported an increase of 13.2% year on year in its consolidated net profit.

DB Corp share price rose 4.85% to Rs 251 after the company reported an increase of 13.2% year on year in its consolidated net profit.

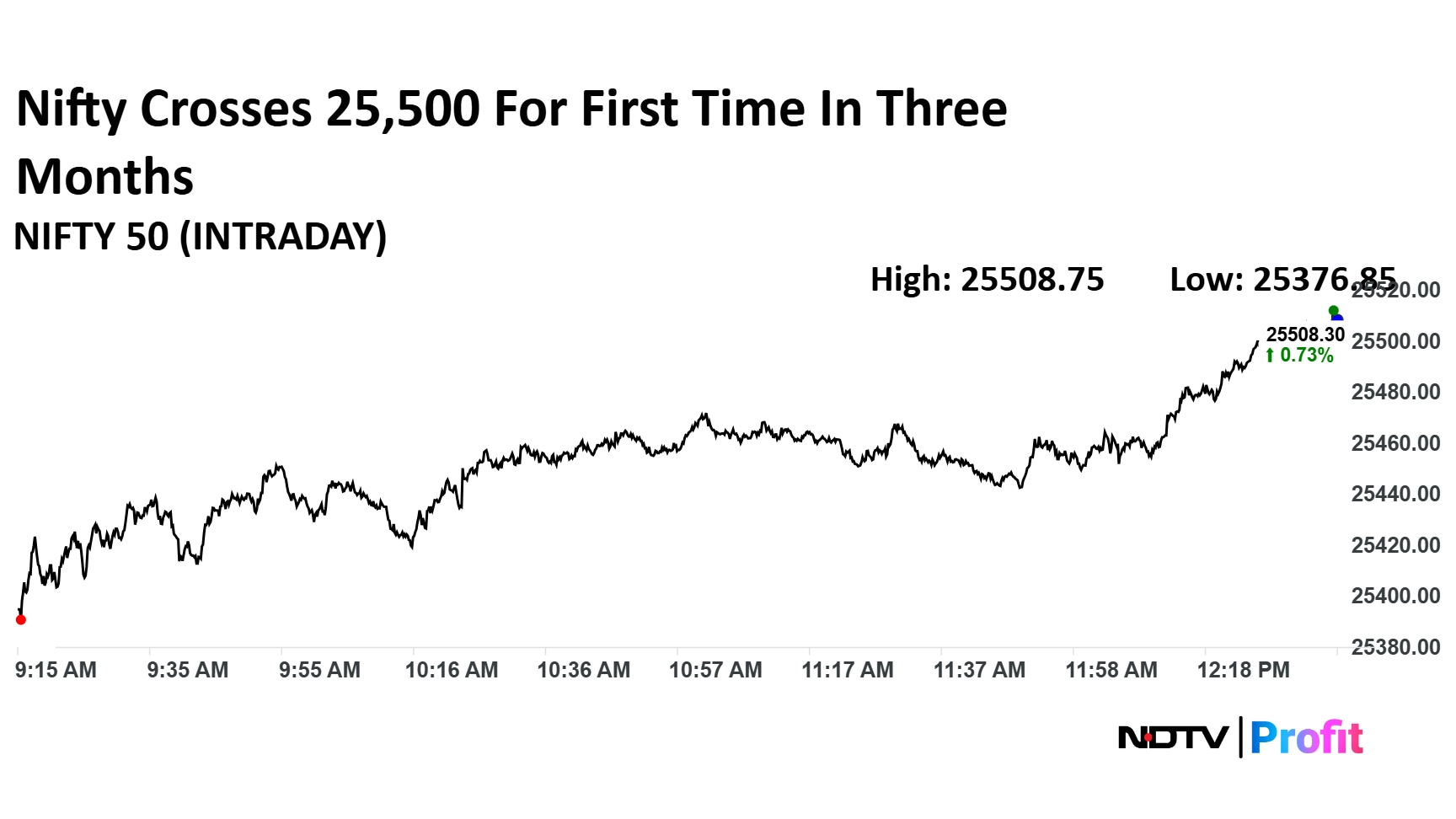

The NSE Nifty 50 breached the day's resistance level to touch a over three-month high. HDFC Bank, ICICI Bank, and Axis Bank shares supported the benchmark index in achieving the level.

The NSE Nifty 50 breached the day's resistance level to touch a over three-month high. HDFC Bank, ICICI Bank, and Axis Bank shares supported the benchmark index in achieving the level.

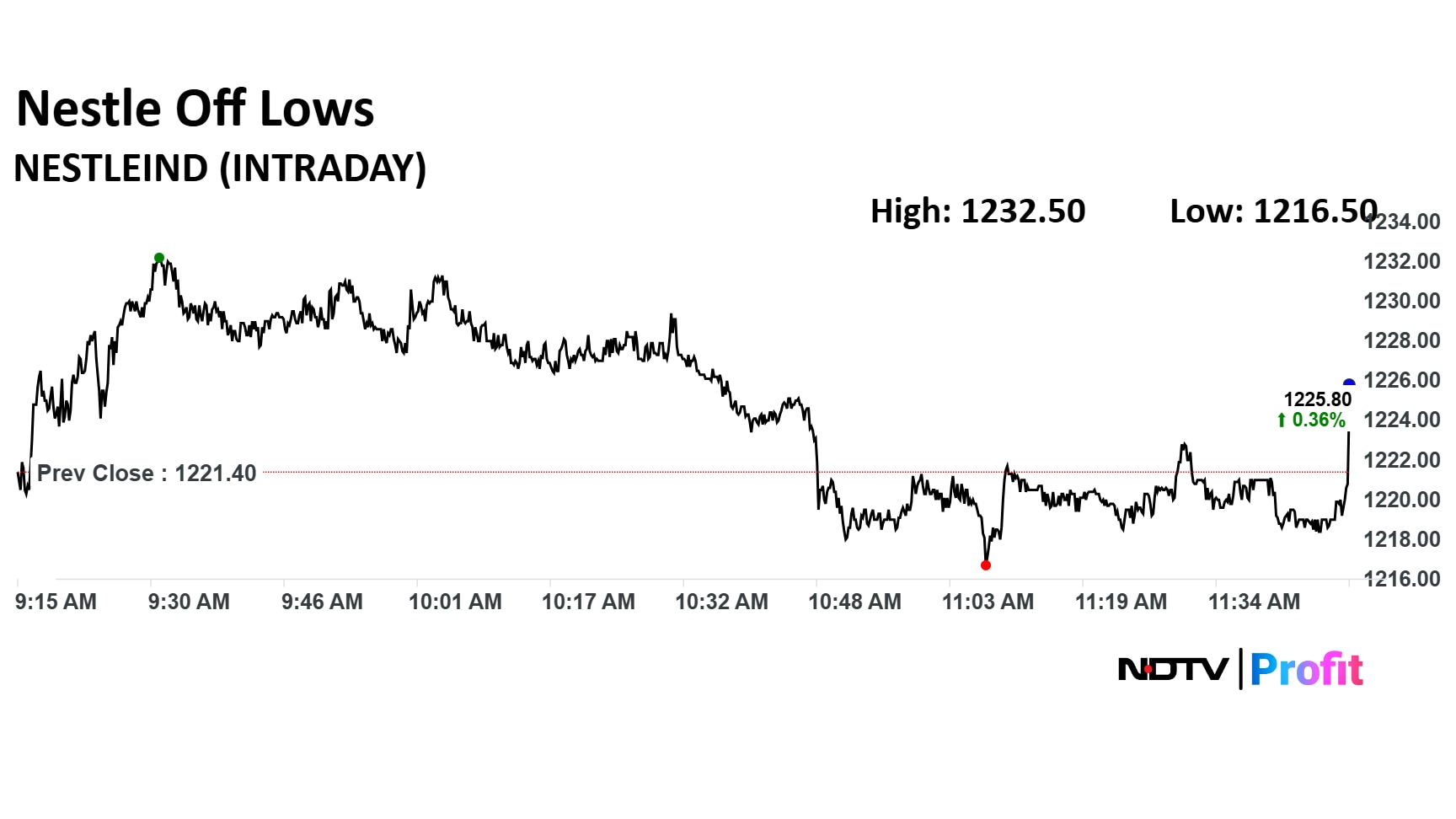

Nestle India Q2FY26 Highlights (Standalone, YoY)

Revenue up 10.5% at Rs 5,643 crore versus Rs 5,104 crore (Bloomberg estimate: Rs 5,350 crore)

Net profit down 23.7% at Rs 753 crore versus Rs 986 crore (Bloomberg estimate: Rs 762 crore)

Ebitda up 6% at Rs 1,237 crore versus Rs 1,168 crore (Bloomberg estimate: Rs 1,191 crore)

Margin at 21.9% versus 22.9% (Bloomberg estimate: 23.4%)

Note: Exceptional gain of Rs 91 crore in Q2 FY25 on slump sale of two businesses.

Track faster live update on Q2 earnings here

Nestle India Q2FY26 Highlights (Standalone, YoY)

Revenue up 10.5% at Rs 5,643 crore versus Rs 5,104 crore (Bloomberg estimate: Rs 5,350 crore)

Net profit down 23.7% at Rs 753 crore versus Rs 986 crore (Bloomberg estimate: Rs 762 crore)

Ebitda up 6% at Rs 1,237 crore versus Rs 1,168 crore (Bloomberg estimate: Rs 1,191 crore)

Margin at 21.9% versus 22.9% (Bloomberg estimate: 23.4%)

Note: Exceptional gain of Rs 91 crore in Q2 FY25 on slump sale of two businesses.

Track faster live update on Q2 earnings here

Ola Electric Mobility launched Battery Ola Shakti, to foray into batter energy storage system market.

It launched the batter in range of 1.5 kilowatt–9.1 kilowatt at introductory price starting at Rs 29,999 apiece.

It leveraged existing 4,680 cell technology via Ola Shakti Launch. India does not face energy shortage. It faces energy storage opportunity, the company said in the exchange filing.

Route Mobile is in pact with Kalaam Tedlecom for customer engagement services across the Middle-East. The company will deliver WhatsApp business services to companies across Middle East.

Godavari Biorefineries received patent related to compounds for inhibition of unregulated cell growth, the company said in the exchange filing.

After receiving an overwhelming response for its initial public offer, Rubicon Research Ltd. listed on the exchanges at nearly 30% premium to its issue price.

Rubicon Research listed on National Stock Exchange at Rs 620, which implied 27.84% premium over its issue price of Rs 485. It listed on BSE at Rs 620.10 apiece, which indicated a premium of 27.86%.

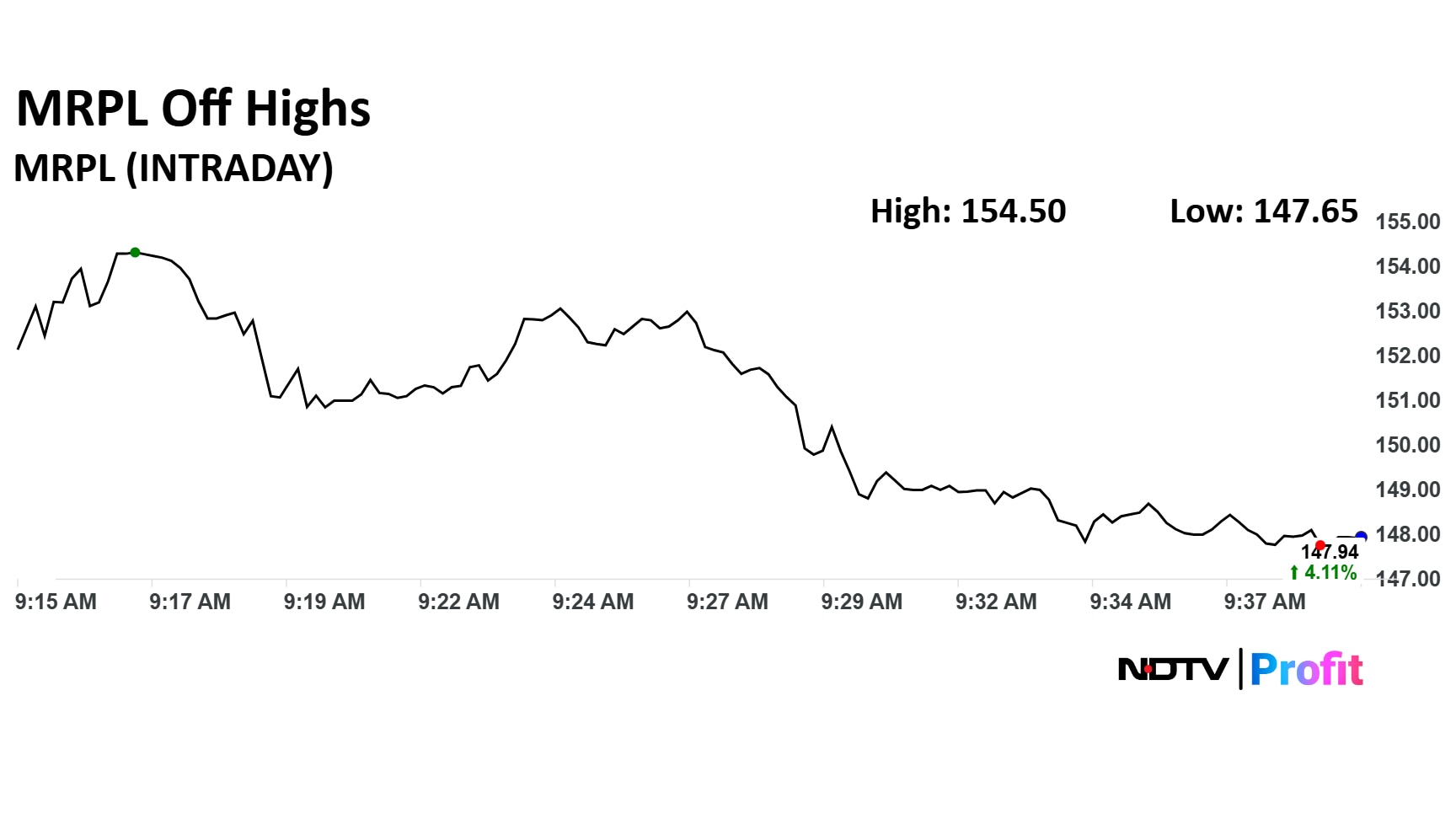

Mangalore Refinery & Petrochemicals Ltd. share price jumped 8.73% to Rs 154.5 apiece, the highest level since July 24.

MRPL Q2 Earnings Key Highlights (Consolidated, QoQ)

Net profit at Rs 627 crore versus loss of Rs 271 crore

Revenue rose 30.5% to Rs 22,649 crore versus Rs 17,356 crore

Ebitda at Rs 1,489 crore versus Rs 180 crore

Margin at 6.6% versus 1%

Mangalore Refinery & Petrochemicals Ltd. share price jumped 8.73% to Rs 154.5 apiece, the highest level since July 24.

MRPL Q2 Earnings Key Highlights (Consolidated, QoQ)

Net profit at Rs 627 crore versus loss of Rs 271 crore

Revenue rose 30.5% to Rs 22,649 crore versus Rs 17,356 crore

Ebitda at Rs 1,489 crore versus Rs 180 crore

Margin at 6.6% versus 1%

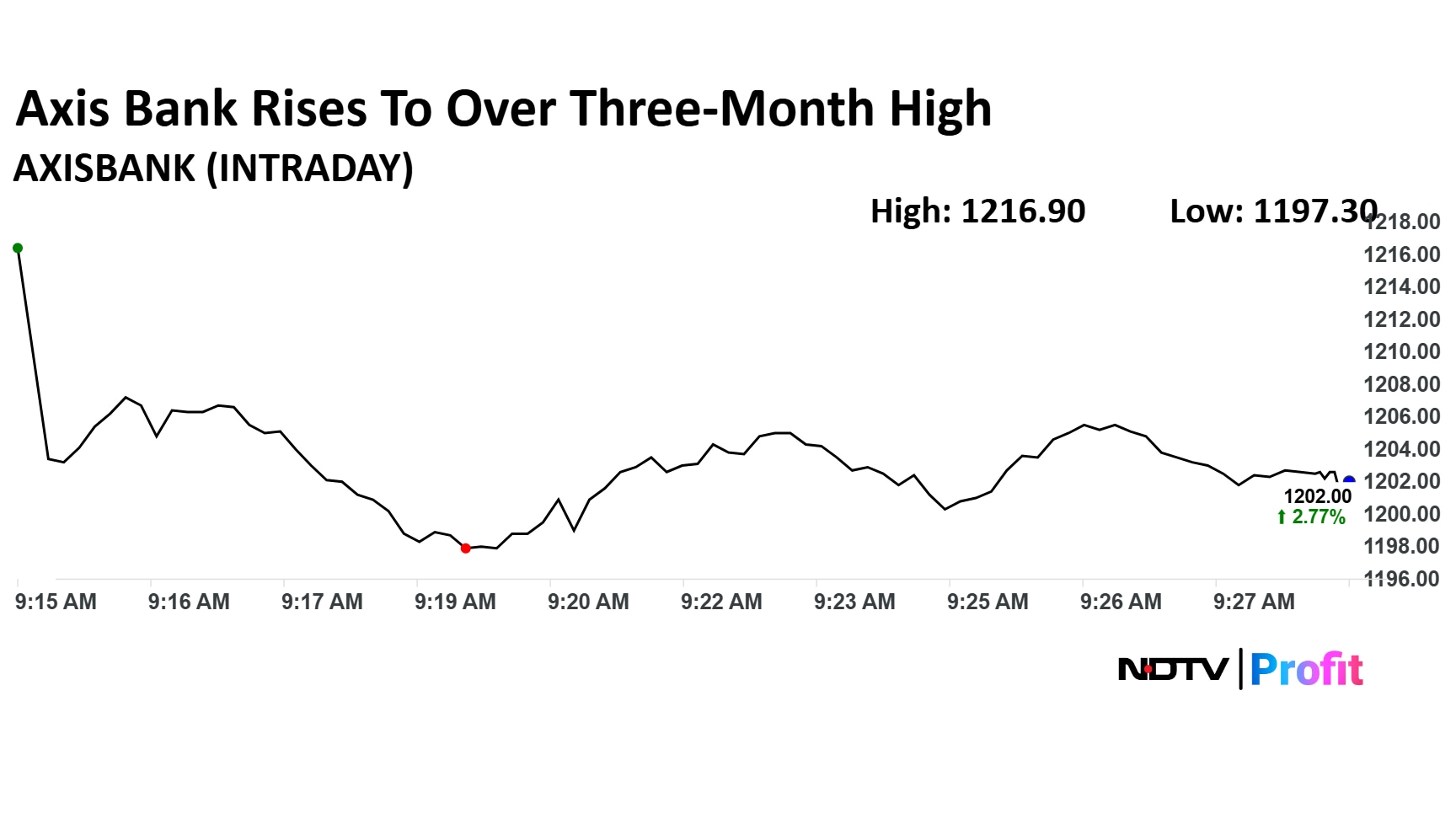

Axis Bank Ltd. share price rose 4.04% to Rs 1,216.90 apiece, the highest level since June 30. It was trading 2.89% higher at Rs 1,203.70 apiece as of 9:31 a.m.

Axis Bank Ltd. share price rose 4.04% to Rs 1,216.90 apiece, the highest level since June 30. It was trading 2.89% higher at Rs 1,203.70 apiece as of 9:31 a.m.

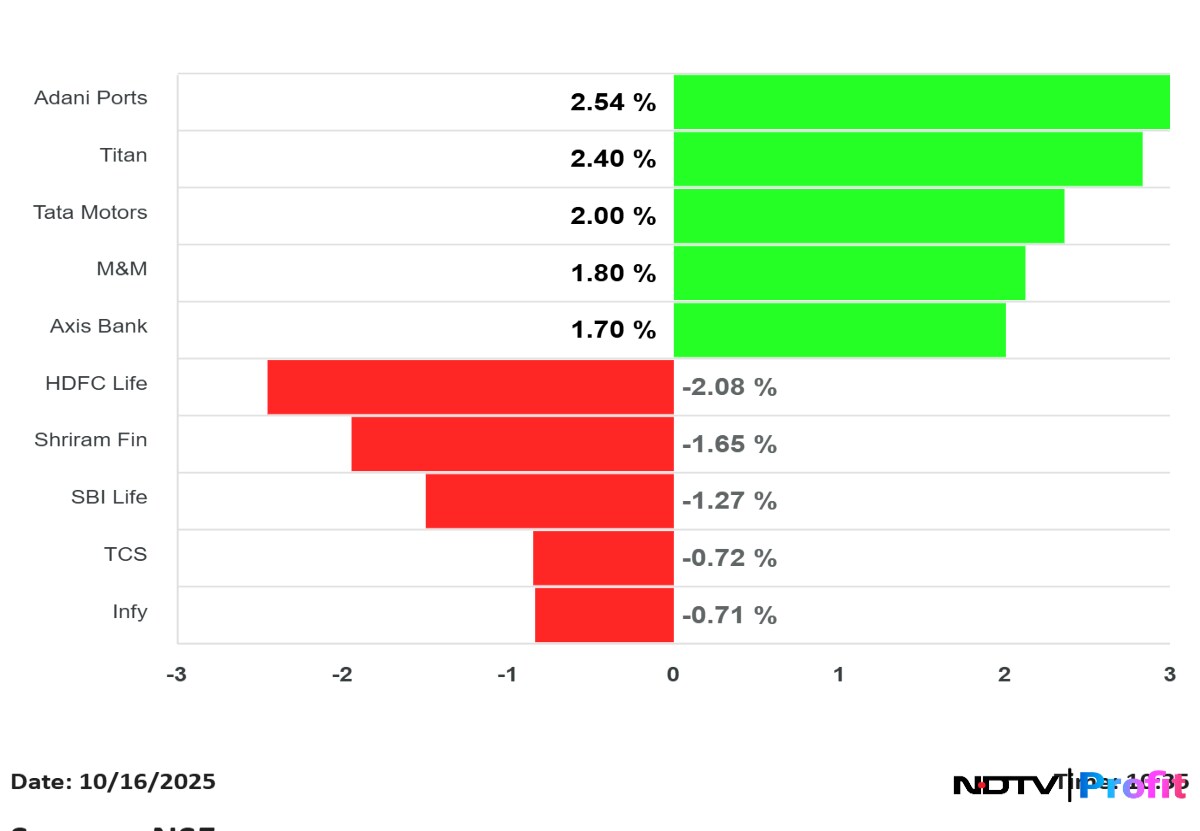

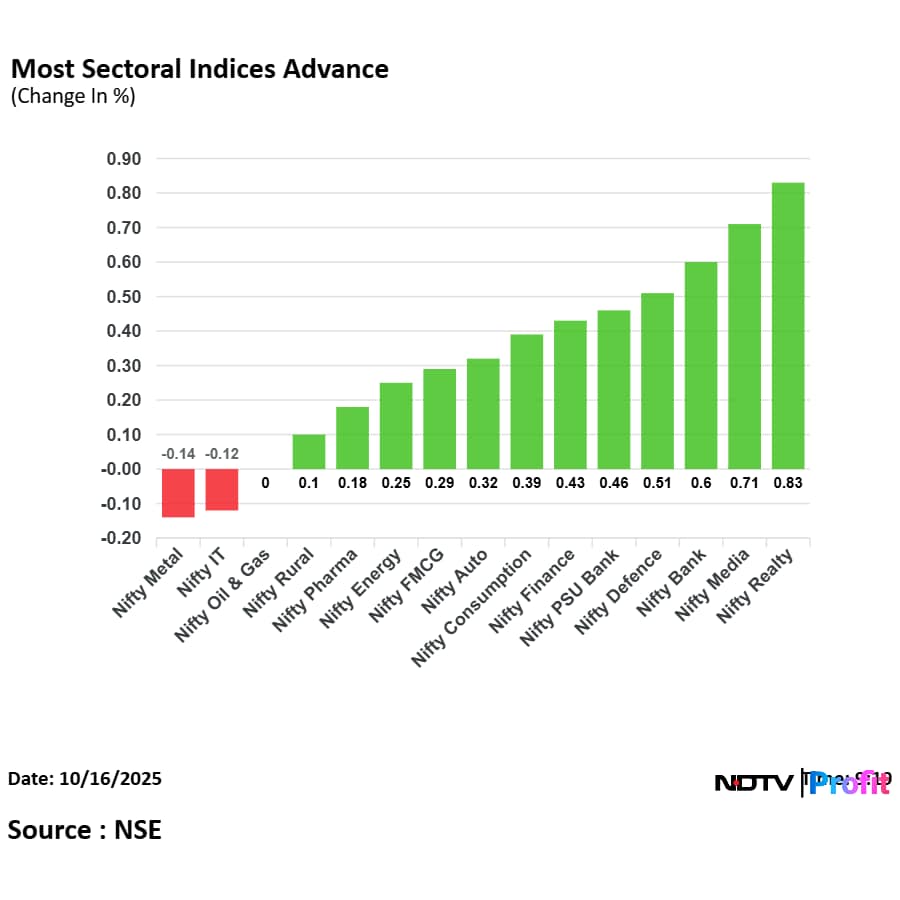

On National Stock Exchange, 12 sectoral indices advanced, one was flat, and two declined out of 15.

On National Stock Exchange, 12 sectoral indices advanced, one was flat, and two declined out of 15.

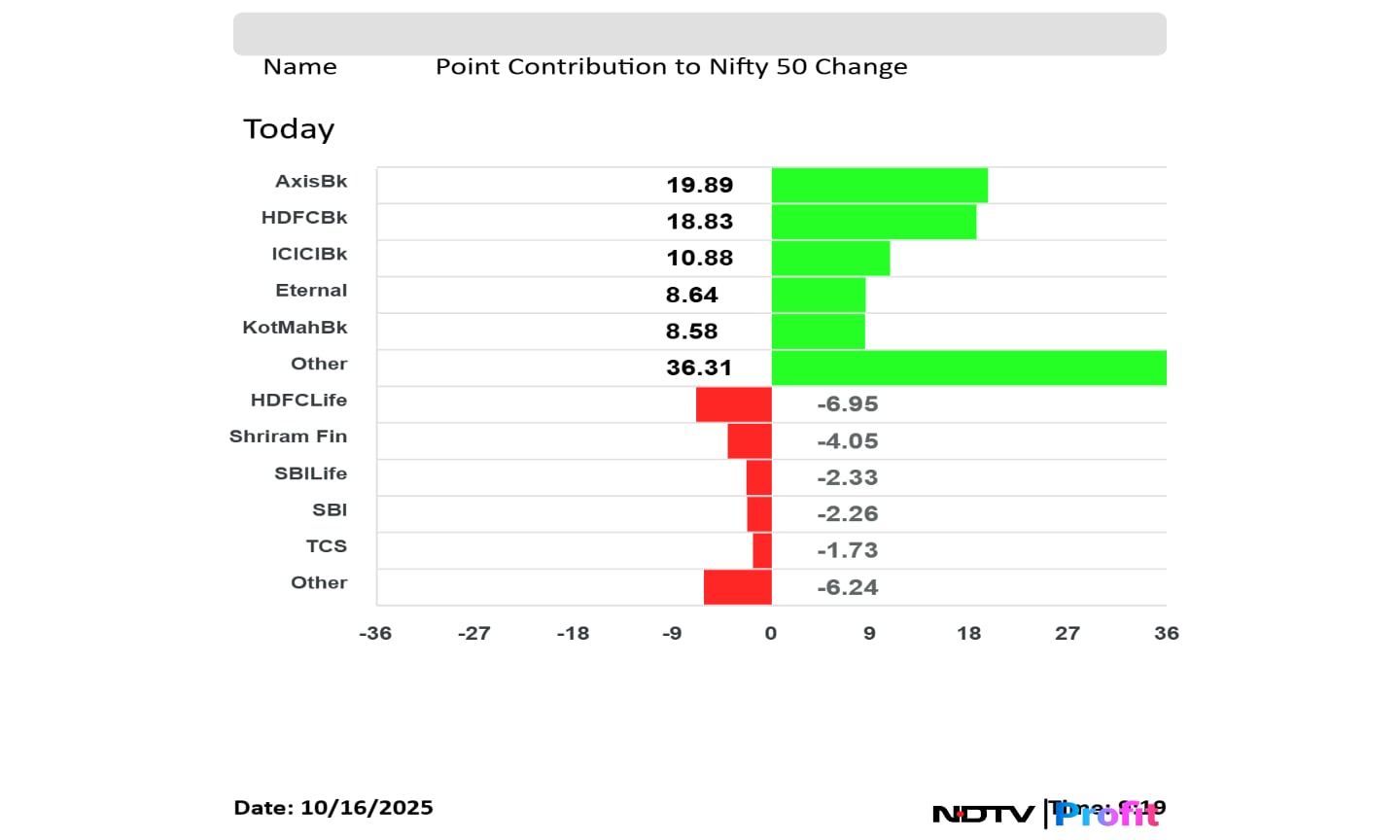

Axis Bank Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Eternal Ltd, and Kotak Mahindra Bank Ltd. added to the NSE Nifty 50 index.

HDFC Life Insurance Co., Shriram Finance Ltd., SBI Life Insurance Co, State Bank of India, and Tata Consultancy Services Ltd. limited gains to the NSE Nifty 50 index.

Axis Bank Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Eternal Ltd, and Kotak Mahindra Bank Ltd. added to the NSE Nifty 50 index.

HDFC Life Insurance Co., Shriram Finance Ltd., SBI Life Insurance Co, State Bank of India, and Tata Consultancy Services Ltd. limited gains to the NSE Nifty 50 index.

The NSE Nifty 50 and BSE Sensex extended gains as Axis Bank Ltd., HDFC Bank Ltd., and Eternal Ltd. shares supported. The indices were trading 0.32% and 0.33% higher, respectively as of 9:21 a.m.

The NSE Nifty 50 and BSE Sensex extended gains as Axis Bank Ltd., HDFC Bank Ltd., and Eternal Ltd. shares supported. The indices were trading 0.32% and 0.33% higher, respectively as of 9:21 a.m.

Apollo Micro Systems approved the transfer of technology of mechatronic Fuze for grenade. It becomes the lowest bidder for orders worth Rs 39.3 crore.

Rupee opened 25 paise stronger at 87.82 against US dollar

It's the highest level since Sept 17

It closed at 88.07 a dollar on Wednesday

Source: Bloomberg

JSW Steel Ltd. is set to announce its financial results for the second quarter of the financial year ending March 2026, with analysts expecting a mixed performance, as weaker realisations are likely to offset gains from robust domestic demand and steady volume growth.

Quarterly Results Calendar: In the ongoing earnings season, many big companies across sectors are scheduled to announce their results for the second quarter of the current financial year on Thursday. As many as 62 companies will declare their quarterly performance results for Q2FY26 on October 16.

Major companies announcing their second-quarter results include Wipro, Infosys, Eternal (formerly Zomato), Jio Financial Services, and Nestle India, among others.

HCLTech Ltd. will be of interest on Thursday, as it marks the last session for investors to buy shares to qualify for receiving the interim dividend before the stock goes ex/record-date.

Gabriel India executed joint venture agreement with SK Enmove Co. on Oct 15, the company said in the exchange filing.

Reiterate Outperform with a Target Price of Rs 2,210

Digital highway star starting to shine

Digital Portfolio were in-line, while Core Connectivity was softer

Overall Core Connectivity revenue growth was soft at 1% YoY

Impact seen from overseas cable cuts

Constructive on the segmental revenue outlook linked to Inda's DC expansion plans

Forecast 11% revenue CAGR (Digital: 17%) alongside a 400bps improvement in EBITDA margin

Axis Bank and L&T are the two major counters under brokerages' lens on Thursday, one on the back of second quarter earnings while the other has been marked as a 'quiet outperformer'.

While analysts have maintained a neutral stance on Axis Bank with an unchanged target price, L&T's target price was hiked by Jefferies as the stock has outperformed Nifty over a period one to five year.

Revenue rose 45.9% to Rs 83.5 crore versus Rs 57.2 crore

Ebit at Rs 5.9 crore versus Ebit loss of Rs 12.7 crore

EBIT margin at 7.1%

Net Profit at Rs 7.9 crore versus loss of Rs 5.5 Crore

Gold prices scaled a new peak for the fourth consecutive session in the international market on Thursday. Heightened US-China trade frictions and bets that the Federal Reserve will cut interest rates through the end of the year have supported demand.

The precious metal jumped 0.5% to $4,227 an ounce in the spot market. Bullion has risen about 5% so far this week amid a breakneck rally underway since mid-August. In October so far, the metal has appreciated by 9.5%.

Maintain Overweight with revised TP 2725 vs 2900 earlier

Strong mid term guidance provided in 1st Investor Day

Looking at 26 New Launch by FY30

Momentum on FY30 Plan on market share gains appears back ended

Est 4% cut in volumes due to delayed new model introduction

1 new launch expected in FY27 vs our expectaton of 2 earlier

Japan's Nikkei 225 and South Korea's KOSPI rose amid renewed tension between China and US. The Nikkei 225 and KOSPI were trading 0.75% and 1.74%, higher, respectively as of 7:09 a.m.

The GIFT Nifty was trading 0.18% or 45 points higher at 25,447.50 as of 6:30 a.m., which implied the benchmark NSE Nifty 50 index may open higher on Thursday.

Traders will monitor Axis Bank Ltd., HDFC Life Insurance Ltd., Oberoi Realty Ltd., and Delta Corp for second-quarter results. Dabur India Ltd., Kaynes Technology Ltd., RBL Bank Ltd., and Hero MotoCopr Ltd. shares will also be in focus because of the overnight news flow.

The NSE Nifty 50 and BSE Sensex snapped a two-day declining streak. The Nifty 50 ended 0.71% or 178 points higher at 25,323. The Sensex settled 0.70% or 575 points higher at 82,605.43.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.