Good afternoon readers. The NSE Nifty 50 and BSE Sensex opened higher on Thursday snapping its three day fall. The Nifty 50 opened 0.74% higher at 25,344.15 and Sensex opened 0.67% up at 82,459.66. The markets are expected to close in the green, with Nifty near 25,300 and Sensex up nearly 400 points.

That's all for today folks. Before you leave for the day here are a few stories to read:

Air India Braces For Record $1.6 Billion Loss After Deadly Crash

Silver Slumps, ETFs Crash Up To 24% As Geopolitical Risk Premium Fades

PhonePe Files DRHP For IPO; Walmart To Cut 9% Stake, Microsoft Exits — Check OFS Details

See you tomorrow.

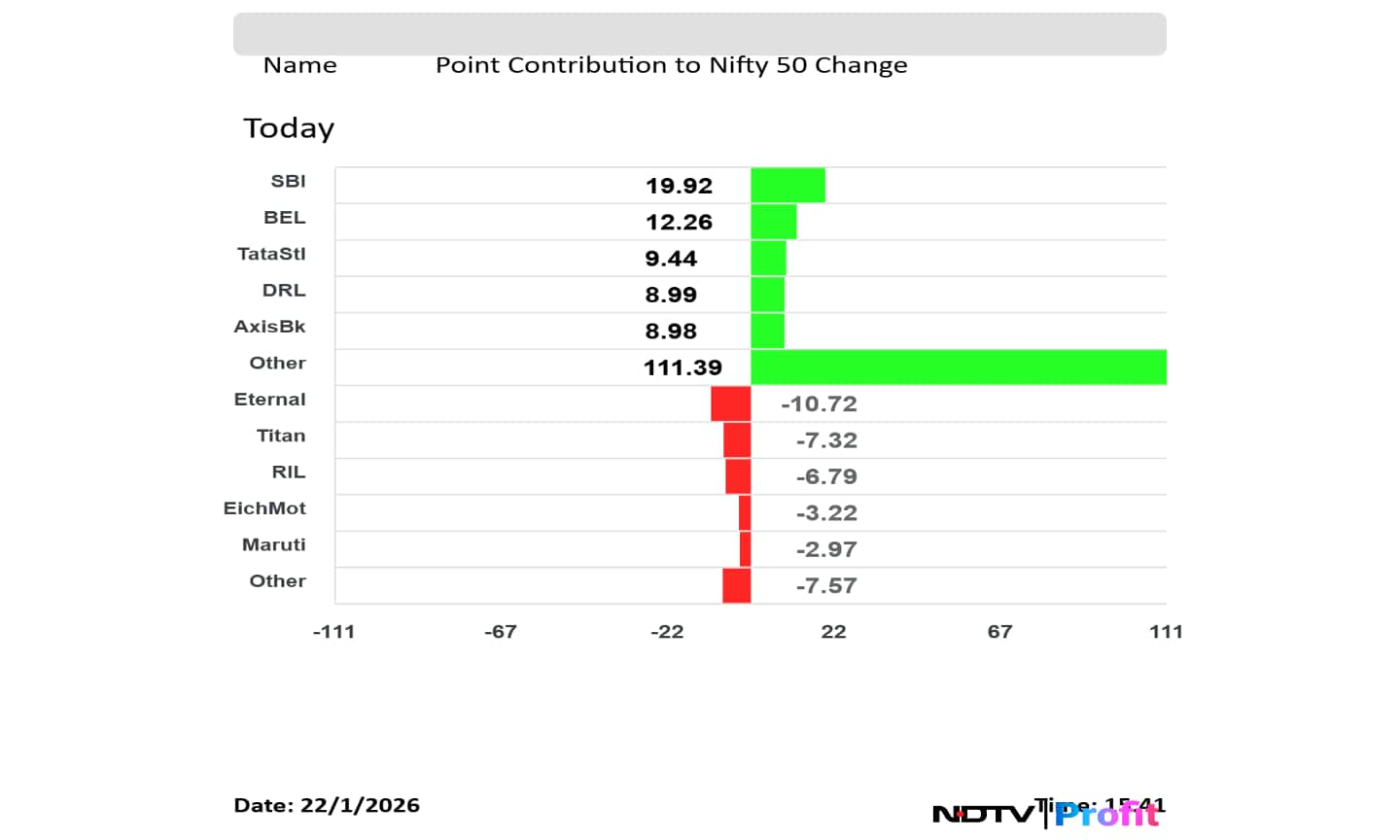

SBI, BEL, Tata Steel, Br. Reddy's and Axis Bank emerged as the top gainers for the day.

On the other hand, Eternal, Titan, RIL, Eicher Motors and Maruti Suzuki were the worst performers of the Nifty 50 index.

Broader indices on the other hand ended in the negative. Nifty Midcap 150 ended 2.49% lower and Nifty Smallcap 250 closed 2.68% lower.

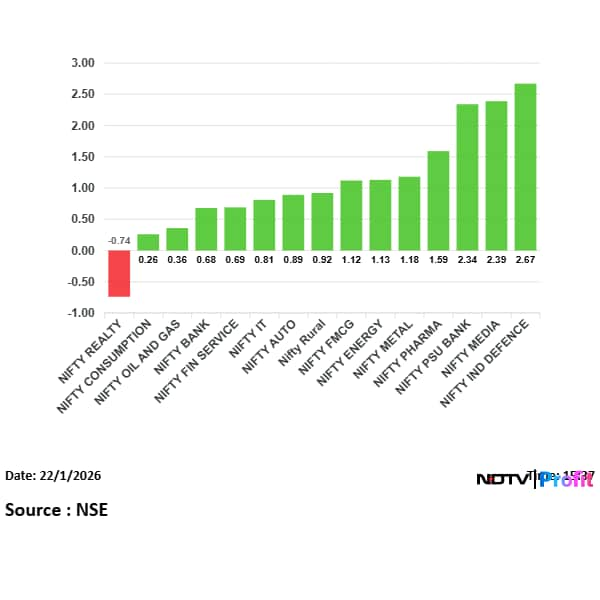

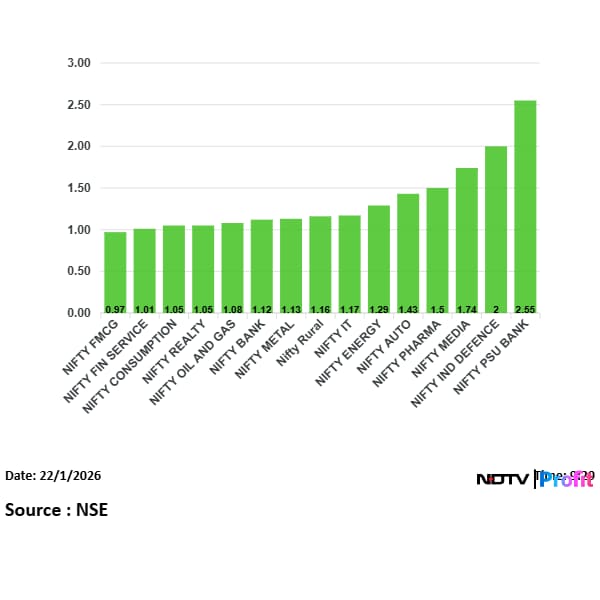

Most sectoral indices rose with Nifty Defence and Nifty Media leading the advance, Nifty Realty was the only sector in red.

The market breadth was skewed in the favour of sellers, as 1,268 stocks declined, 2,962 advanced and 162 remained unchanged on the BSE.

Indian equities end volatile session in green, snapping its three-day losing streak. Nifty had risen above the 25,400 levels but closed near 25,300.

Intraday, both Nifty and Sensex rose nearly 1%.

Nifty ends 25,289.90 points or 0.53% higher at 25,289.90.

Sensex ends 397.74 points or 0.49% higher at 82,307.37.

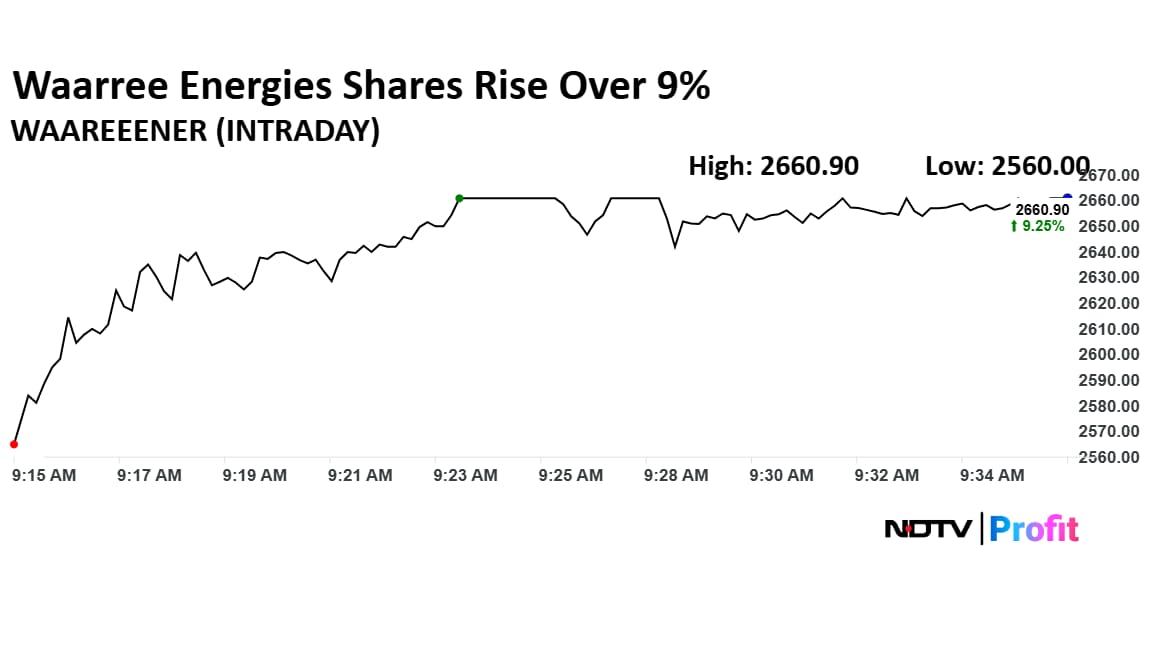

Waaree Energies Ltd. is planning to deploy its Rs 25,000 crore capital expenditure outlay over a strict two-year timeline, which is expected to support the company's Rs 60,000 order book, according to Group Head of Finance, Abhishek Pareek.

Speaking to NDTV Profit, Pareek provided a detailed roadmap for Waaree Energies' execution following a stellar third-quarter. The company reported a 118% year-on-year jump in consolidated net profit to Rs 1,106.79 crore, with revenue also more than doubling to Rs 7,565 crore.

"Our total capital expenditure, which is announced, is around 25,000 crore, to be done over the next two years of time," Pareek told NDTV Profit. "Every quarter, there are new capacities which are going live—like last quarter, we have done around 3 gigawatt worth of new capacity live in solar panels."

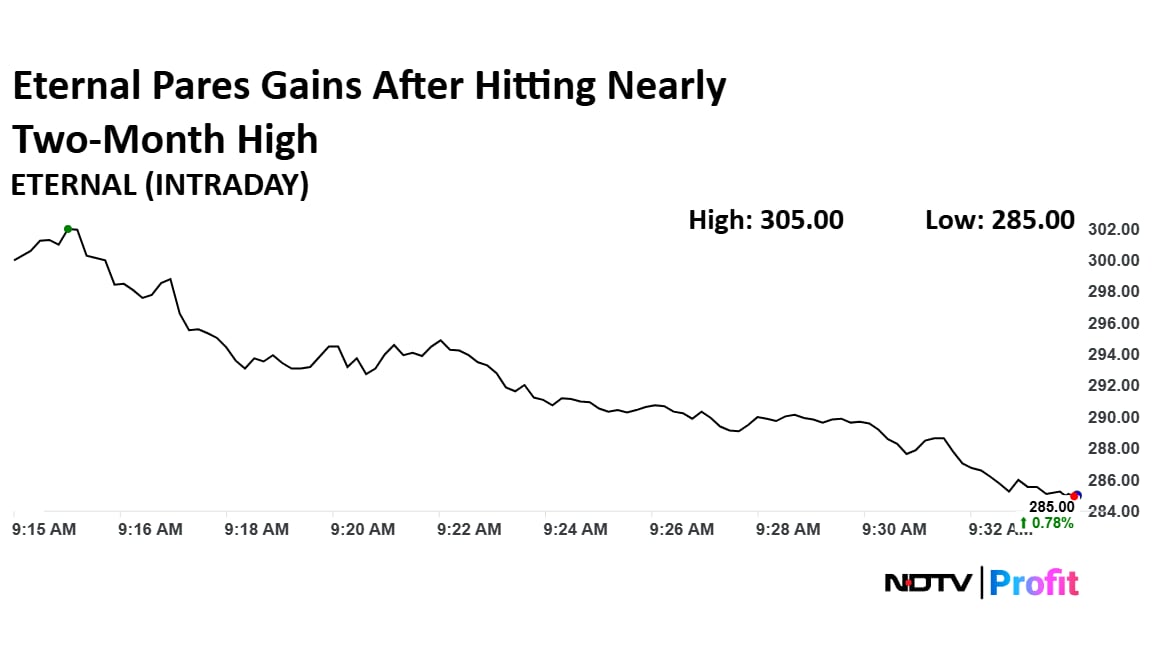

Amid the latest changes in management, Deven Choksey, Managing Director at DRChoksey Investment, has raised concerns over Zomato parent Eternal's steep market capitalisation, questioning whether the company's current earnings profile justifies a valuation of nearly Rs 3 lakh crore, even as competition in quick commerce intensifies with the rise of JioMart.

Choksey in an interview with NDTV Profit pointed out that Eternal's reported profit of around Rs 100 crore offers little support for such a large market value. According to him, the existing profit base does not signal enough visibility to justify current valuations, and investors will need to wait and watch how the company's new revenue models eventually shape up.

"At this point, a ₹100 crore profit does not suggest anything meaningful to support a ₹3 lakh crore market cap,” he told NDTV Profit.

Tata Silver ETF plunged nearly 24% to Rs 25.56, while Edelweiss Silver ETF and Mirae Asset Silver ETF dropped 22% each. 360 ONE Silver ETF declined 21%, and Nippon India Silver ETF fell 20% on the NSE. The sharp fall in ETFs reflects the broader pullback in precious metals, which had seen a strong rally earlier.

Shares of CAMS rose over 4% on Thursday after the company posted its third quarter results. In addition the board of directors also announced interim dividend today.

Source: KEI Industries On Earnings Call

InterGlobe Aviation Ltd., which operates IndiGo, is expected to report a soft performance in the December quarter, with profitability coming under pressure despite modest revenue growth. The third quarter is typically the strongest period for airlines, but was impacted by flight cancellations, weaker yields and currency headwinds.

On a year-on-year basis, consolidated revenue is seen rising 2.5% to Rs 22,674 crore compared with Rs 22,111 crore a year ago. This would mark the slowest revenue growth for IndiGo in the last 19 quarters, highlighting the impact of operational disruptions during the peak travel season.

Read more here: IndiGo Q3 Preview: Weak Yields, Cancellations To Drag Profit To Four-Year Low

Over 1.09 million shares of Eternal were traded via another block deal on Thursday. The share of Eternal fell as much as 0.64% to Rs 281 apiece.

Why Bank Of India Is Betting On Q4, Rajneesh Karnatak, MD & CEO Explains

While we give you live market updates. I am sure you are also interested in the upcoming Union Budget, especially what are the current expectations.

Here is what leather goods manufacturers expect from the budget 2026: Mr. Amol Goel, Founder & CEO, Louis Stitch has his own expectations from the point of view of the Indian footwear and leather goods industry. He expects a shift in focus "from volume to value, design, and brand-led manufacturing. We believe the upcoming Budget should prioritise rationalisation of GST on premium footwear and leather accessories, as the current inverted duty structure continues to impact margins and consumer pricing. A more uniform tax regime across materials, components, and finished products will significantly improve supply-chain efficiency and compliance. From a manufacturing standpoint, targeted incentives for modernisation of leather processing, automation in cutting, stitching and finishing, and adoption of Industry 4.0 technologies can help Indian manufacturers improve consistency, reduce wastage, and meet global quality benchmarks."

You can track more here: Budget 2026 Expectations Live: Focus On Clean Energy, Power Infrastructure Push, And More

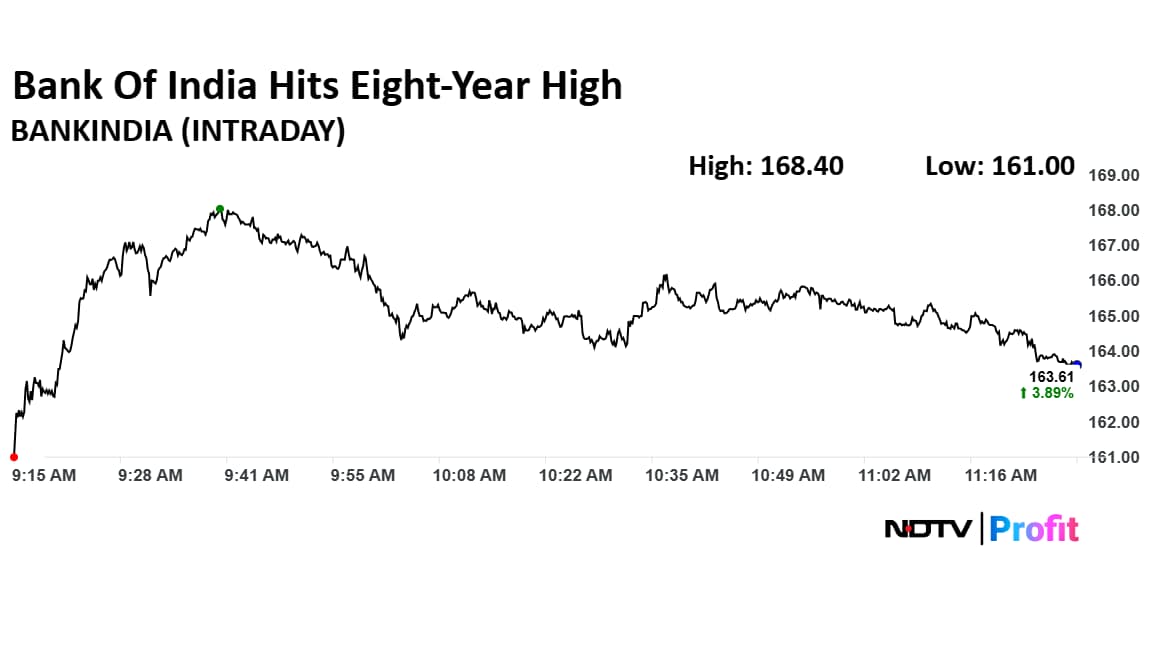

The shares of Bank of India hit eight-year high on Thursday. The scrip rose as much as 6.93% to Rs 168.40 apiece on Thursday, highest level since Jan. 29, 2018. It pared gains to trade 4.49% higher at Rs 164.55 apiece, as of 11:27 a.m. This compares to a 0.40% advance in the NSE Nifty 50 Index.

It has risen 65.38% in the last 12 months and 13.82% year-to-date. Total traded volume so far in the day stood at 2.42 times its 30-day average. The relative strength index was at 55.23.

Over 1 million shares of HDFC Bank were traded via another block deal on Thursday. The share of HDFC Bank rose as much as 0.79% to Rs 928.30 apiece.

Over 1.85 million shares of Power Grid were traded via another block deal on Thursday. The share of Power Grid rose as much as 1.27% to Rs 259 apiece

Over 2.74 million shares of NTPC were traded via another block deal on Thursday. The share of NTPC rose as much as 1.26% to Rs 342.75 apiece.

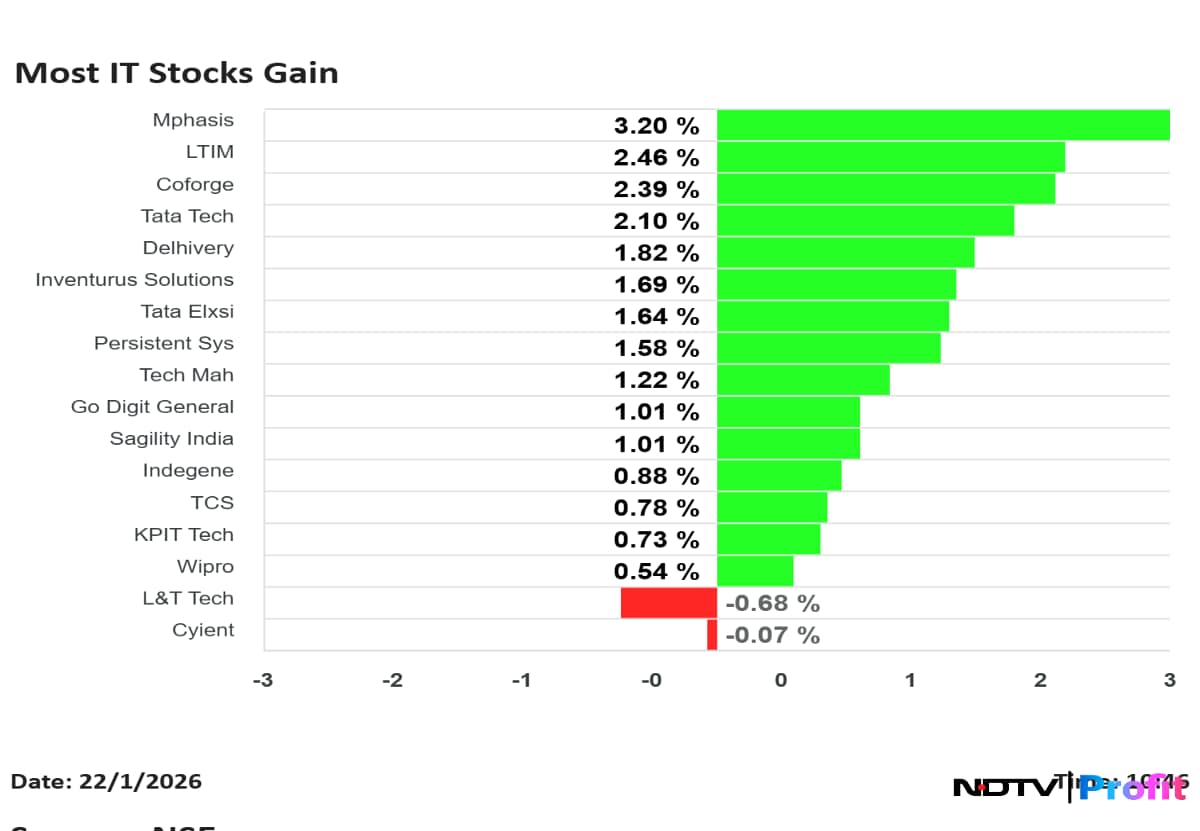

As the markets snap three day losing streak to rise over 1% on Thursday, most IT stocks rise. The Nity IT index was trading 0.89% higher as of 10:47 a.m.

Photo Credit: NDTV Profit

Nifty and Sensex pared the early gains to trade 0.44% higher at 25,268, while Sensex was up 0.38% at 82,218.93.

South Korea's stock benchmark advanced to cross the 5,000 target set by President Lee Jae Myung, fueled by AI‑driven demand in the tech‑heavy market.

The Kospi Index climbed as much as 2.2% to 5,019.54, lifted by gains in Samsung Electronics Co., and SK Hynix Inc. The gauge has gained over 95% in the past 12 months, making it the world's best-performing index.

Over 1.05 million shares of Dabur were traded via another block deal on Thursday. The share of Dabur rose as much as 2.09% to Rs 528.75 apiece.

Shares of Bajaj Consumer Care were in focus on Thursday after the company reported a strong set of December-quarter results, with sharp growth across profit, revenue and operating margins. The stock gained over 7% intraday, rebounding from recent weakness, even as broader FMCG peers continue to grapple with uneven demand and margin pressures.

Bajaj Consumer Care is trading over 7% near Rs 267, after touching an intraday high of Rs 274, compared with its previous close of Rs 248.80.

Shares of Waaree Energies Ltd. surged in trade on Thursday after the company reported a strong set of numbers during the third quarter of the ongoing financial year. The stock is trading at Rs 2,660, accounting for gains of more than 9% compared to Wednesday's closing price of Rs 2,435.

This comes on the back of a stellar quarter that saw revenue and profit double while margins expanded by over 400 basis points.

Shares of Eternal hit nearly two-month high on Thursday after its third quarter results. The company also confirmed Deepinder Goyal will step down as Group CEO and will be replaced by BlinkIt's top boss, Albinder Dhindsa.

In addition, over 3.34 million shares of Eternal were traded in pre-market trading on Thursday.

On NSE, all 15 sectors were in the green. Nifty PSU Bank and Nifty Defence lead the advance.

Broader markets were trading higher, with the NSE Midcap 150 trading 1.64% higher and NSE Smallcap was trading 1.48% higher.

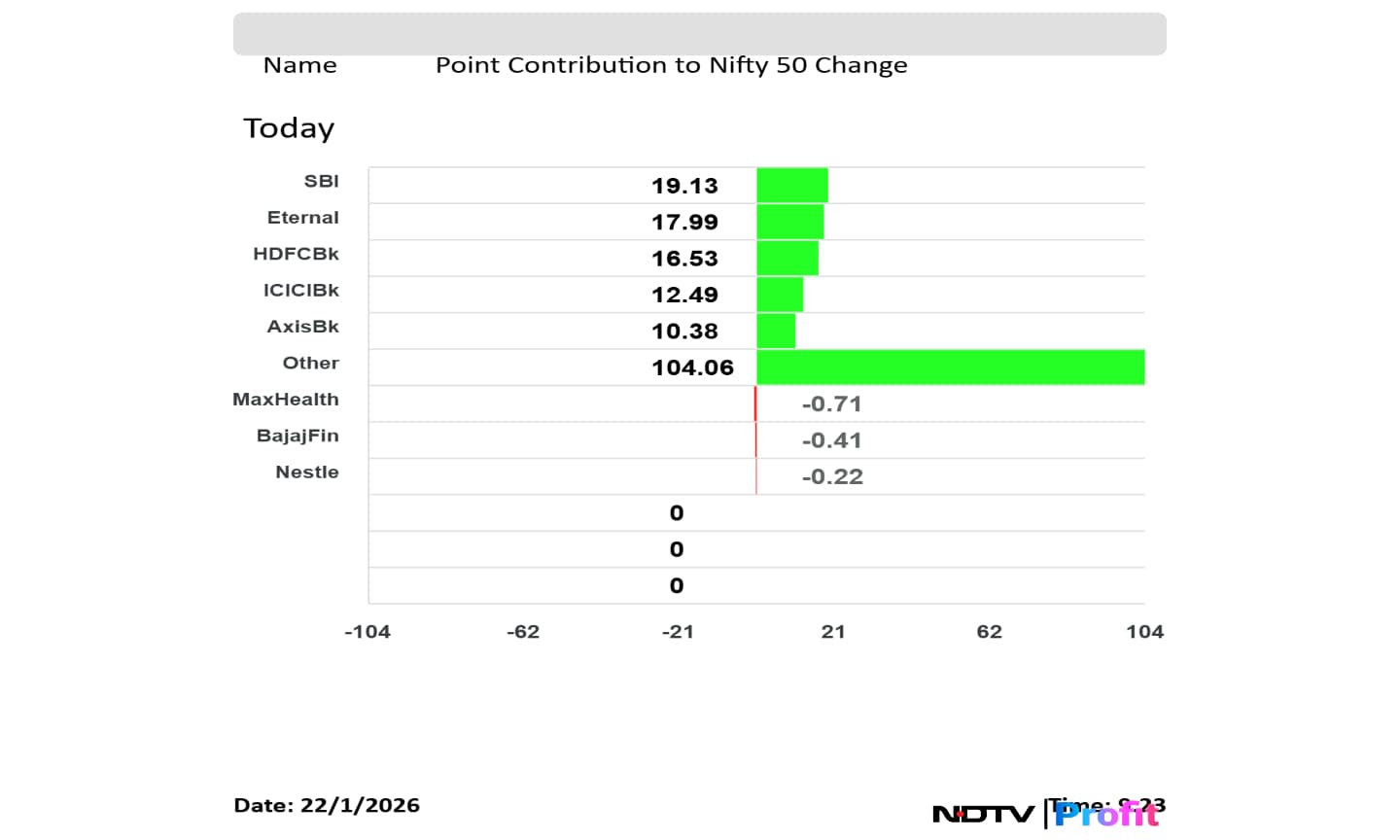

Max Health, Bajaj Finance and Nestle weighed on the Nifty 50 index.

SBI, Eternal, HDFC Bank, ICICI Bank and Axis Bank added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened higher on Thursday snapping its three-day fall. The Nifty 50 opened 0.74% higher at 25,344.15 and Sensex opened 0.67% up at 82,459.66. However, minutes after open the Nifty was trading 0.60% higher and Sensex was also trading over 507 points higher.

Over 3.34 million shares of Eternal were traded in pre-market trading on Thursday.

At pre-open, the NSE Nifty 50 was trading 186.65 points or 0.74% higher at 25,344. The BSE Sensex was up 550.52 points at 82,460.15.

Morgan Stanley on Dr Reddy's

Maintain Equal-weight; Cut TP to Rs 1285 from Rs 1389

Resilient quarter

Strong ex-US growth led by India, EU and EMs

Solid cash flows; stable EBITDA margins

Muted earnings growth keeps rating unchanged

Key monitorables: gRevlimid phase-out, GLP-1 ramp-up, abatacept progress

Jefferies on Dr Reddy's

Maintain Underperform; Cut TP to Rs 1040 from Rs 1100

Broadly in-line quarter

India and EMs/Europe strong, aided by forex

One-off expenses lifted SG&A; adjusted EBITDA beat

Mgmt expects gOzempic launch in Canada by May-26 and abatacept US approval by Dec-26

Timelines seen as aggressive; delays remain key downside

BofA on Dr Reddy's

Maintain Buy; Cut TP to Rs 1480 from Rs 1560

Q3 strengthens confidence in base business

EBITDA beat driven by ex-Revlimid base

Semaglutide launch next key catalyst

More legs to ex-US growth

Cost trajectory key for margins

PhonePe, a Walmart-backed fintech company, has filed confidential draft papers for its Initial Public Offering. The public offer will only include offer-for-sale up to 5.06 crore shares by promoter and investor selling shareholders.

The equity shares are proposed to be listed on the National Stock Exchange of India Ltd and BSE Ltd.

WM Digital Commerce Holdings Pte Ltd., owned by Wal-Mart International Holdings Inc is the promoter of the company offloading shares in the offer for sale. The promoter is offloading 4.59 crore shares which represents 9.06% of the total paid-up equity. Tiger Global PIP 9-1 Ltd. and Microsoft Global Finance Unlimited Company, an Irish subsidy of Microsoft Corporation are the investors offloading stake.

Read more: PhonePe Files DRHP For IPO; Walmart To Cut 9% Stake As Microsoft Exits — Check OFS Details

Citi on Ashok Leyland

Maintain Buy; Hike TP to Rs 205 from Rs 165

MHCVs doing the heavy lifting; LCVs chipping in

MHCV volumes driven by replacement demand and improving sentiment

Sharp improvement in LCV demand surprised positively

Market share steady overall

Higher LCV contribution and commodity costs factored in

Operating leverage lifts EBITDA and earnings estimates

Citi on Dalmia Bharat

Maintain Buy with TP of Rs 2600

Q3 EBITDA below estimates

Industry demand trends improving; room for further cost savings

Uncertainty around strategy and capacity utilisation remains

Medium-term pricing pressure in South/East likely limited

Rs 50/t cost savings achieved out of Rs 150–200/t target

HSBC on Dalmia Bharat

Maintain Buy with TP of Rs 2740

Q3 marginal earnings miss; Q4 expected to improve

EBITDA slightly below estimates, but strong YoY volume growth

Recovery in cement prices in South and East

Valuation and regional exposure key positives

Macquarie on Dalmia Bharat

Maintain Outperform with TP of Rs 2462

In-line quarter

Remain constructive on improving fundamentals

Growth projects remain on track

The US Dollar index is down 0.01% at 98.570.

Euro was up 0.03% at 1.1690.

Pound was up 0.01% at 1.3432.

Yen was up 0.04% at 158.34.

Asian stocks followed Wall Street higher after US President Donald Trump dropped his tariff threat against European partners, easing trade-war concerns.

The MSCI Asia Pacific Index rose 0.9% — putting it in line to break a three-day losing streak — with most of the sub-sectors gaining. South Korean shares climbed to a new record. S&P 500 futures rose 0.2%, suggesting momentum could carry the benchmark beyond a rally that delivered its biggest advance since November.

Source: Bloomberg

Good morning readers.

The GIFT Nifty was trading near 25,400 early on Thursday. The futures contract based on the benchmark Nifty 50 rose 0.84% at 25,363 as of 6:57 a.m. indicating a positive start for the Indian markets. This comes after the Wall Street rally on Wednesday.

In the previous session on Wednesday, the benchmark ended in red extending fall for the third day. The NSE Nifty 50 ended 75 points or 0.30% lower at 25,157.50, while the BSE Sensex closed 270.84 points or 0.33% lower at 81,909.63.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.