Indian equities end volatile session in red, extending the fall for the second day. Nifty had fallen below the 25,200 levels but closed above it. Intraday, both Nifty and Sensex fell nearly 1.50%, worst intraday fall since 7th April 2025. While, Nifty ends 353 points or 1.38% lower at 25,232.50, Sensex was down 1,065.71 points or 1.28% lower at 82,180.47.

That's all for today folks. Before we part for the day here are a few stories for you to catch up on:

IndiGo Faces Rs 2,000 Crore Hit From December Flight Disruptions

Davos 2026: Why Swiggy Isn't Rushing Back to Markets Despite Quick Commerce Heat

From Rupee Weakening To FII Outflows: Five Reasons Why Markets Are Down Today

Nifty declines 1,200 points from recent all-time high.

Nifty Index is trading near its lowest level since October 2025. The 300 points decline is the biggest fall since June 2025.

Nifty fell 1.24% to 25,267.15, while Sensex was down 1.14% to 82,297.49. Nifty Index is trading near its lowest level in two months. It has fallen 2.7% year-to-date making it the worst year-to-date performance in a decade.

Infosys on Tuesday announced that it has been recognised by Brand Finance, a brand valuation firm, as one of the world's top 3 most valuable IT services brands.

In the Brand Finance Global 500 2026 report, Infosys was recognised as the fastest-growing brand with 15% CAGR over the last six years and a brand value of US$ 16.4 billion in 2026.

Infosys also achieved a Brand Strength Index (BSI) score of 86.8 out of 100, ranking #80 within the Global 500 2026, an improvement of 16 places over the 2025 ranking.

After a slight upmove on Monday, markets have fallen sharply on Tuesday, with the benchmark Nifty 50 trading with cuts of more than 200 points or 0.82%. The Sensex has also fallen more than 600 points and is trading in the range of 82,600, with cuts of around 0.73%.

Here at NDTV Profit, we will take a look at five reasons why the markets are under pressure in trade on Tuesday.

As Davos 2026 enters its day 2 top seven business leaders will join group of 146 in meeting with US President Trump, source told NDTV Profit. The meeting is set to happen on Wednesday between 5 p.m. to 6 p.m. The seven industrialists include N. Chandrasekaran, Tata Sons, Chairman (Non-Independent, Non-Executive) TCS, Srini Pallia, Chief Executive Officer and Managing Director, Wipro, Sunil Bharti Mittal, Founder and Chairman, Bharti Enterprises and Dr Anish Shah, Group CEO and MD, Mahindra Group. Sanjiv Bajaj, Chairman and MD, Bajaj Finserv, Hari S Bhartia, Founder and Co-Chairman, Jubilant Bhartia Group and Salil Parekh, CEO and MD, Infosys will also be art of this meeting.

Check live Q3 Results here: Q3 Results LIVE: Canara Robeco AMC, AU SFB, ITC Hotels In Focus

Nifty fell 0.84% to 25,371.10, while Sensex was down 0.73% to 82,638.35. Nifty Index is trading near its lowest level in two months. It has fallen 2.7% year-to-date making it the worst year-to-date performance in a decade.

The IT sector has been a subject of much discussion in Indian markets, especially after major firms reported their third-quarter earnings for the financial year ending March 2026. With the year just kicking off, Pankaj Murarka, CIO of Renaissance Investment Managers, believes the IT sector is set to outperform markets in 2026.

Speaking to NDTV Profit, Murarka explained that a shift in client sentiment and the maturation of artificial intelligence could pave the way for the IT sector to realise better growth prospects in this calendar year.

"All of them are seeing that the environment is improving gradually," Murarka said, referring to the top five IT firms. "They're seeing many more deals, client conversations, and engagements are improving."

India's corporate presence is unusually visible at the World Economic Forum annual meeting in Davos this year, with founders and CEOs fielding questions on growth, capital and competitiveness. Among them is Swiggy, coming off a Rs 10,000-crore fundraise and navigating intensifying competition in quick commerce. In his conversation with NDTV Profit's Tamanna Inamdar from Davos, Rohit Kapoor, CEO of Swiggy's Food Marketplace, pushed back against speculation that the company may need to tap markets again soon.

"We've been very clear in our prospectus on what the funds are for," Kapoor said. "Food delivery is already profitable and throwing cash. This capital gives us strength to be competitive — not runway. There is no discussion around another fundraise at all."

He said questions around fresh capital are largely a by-product of rising competition rather than any internal funding stress.

Nifty 50 fell 2.7% on year-to-date basis making it the worst year-to-date start since 2016.

Havells shares have hit over 23-month low. Here's why the shares have fallen:

Rupee touched its all-time low on Tuesday. Here's why

Over 1.97 million shares of Eternal were traded via another block deal on Tuesday. The share of Eternal fell as much as 3.68% to Rs 271 apiece.

India's largest airline, IndiGo, was rocked by a series of flight disruptions in early December 2025, with over three lakh passengers getting impacted. This led to serious financial ramifications for IndiGo, which has totalled to Rs 2,000 crore, sources have exclusively told NDTV Profit.

IndiGo cancelled over 4,500 flights through Dec. 12. As a result of these untimely cancellations, IndiGo had to bear the cost of passenger refunds, hotel accommodations, and serve a Rs 22.20 crore penalty imposed by the Directorate General of Civil Aviation. The regulator also ordered the carrier to submit a Rs 50 crore bank guarantee.

The airline is also grappling with significant operational recovery costs. According to the Civil Aviation Requirements (CAR), the carrier is liable for Rs 10,000 in compensation for specific delays.

Read full details: IndiGo Faces Rs 2,000 Crore Hit From December Flight Disruptions

#NDTVProfitExclusive | #IndiGo hit by December disruptions

— NDTV Profit (@NDTVProfitIndia) January 20, 2026

Flight disruptions costs IndiGo over Rs 2,000 crore, including DGCA penalties. Over 4,500 flights were cancelled, impacting 3 lakh passengers.@Daanish_Anand explains the cost heads comprising the refunds ⬇️ pic.twitter.com/smOEGEuvCt

Flight disruptions costed IndiGo over Rs 2000 crore, sources told NDTV Profit. This also includes fine imposed by DGCA.

Among the main costs is the Rs 10,000 compensation the company had to pay for compensations in addition to the refunds. This was as per the Civil Aviation Requirements. Among other expenses was hotel bookings, transport, meals, courier for returning baggages. IndiGo also announced flight vouchers worth Rs 10,000.

Coal India on Tuesday gets license for grant of mineral concession. The state government will execute the mining lease deed it added in an exchange filing. The company also got mineral concession for Kawalapur Block.

Gold and silver prices have increased across major Indian cities on Tuesday, Jan. 20, 2026. Today's surge is primarily driven by a "trust shock" in global markets.

Prices reached record highs after US President Donald Trump threatened 10% to 25% tariffs on several European allies, including Germany, France, and the UK, linked to a diplomatic dispute over the purchase of Greenland. Today, gold is trading at Rs 1,48,500 while silver is at Rs 3,16,990 according to Bullions' website.

Metropolitan Stock Exchange of India Ltd. on Tuesday announced that it will be open for trade on Feb. 1, Sunday on account of presentation of the Union Budget.

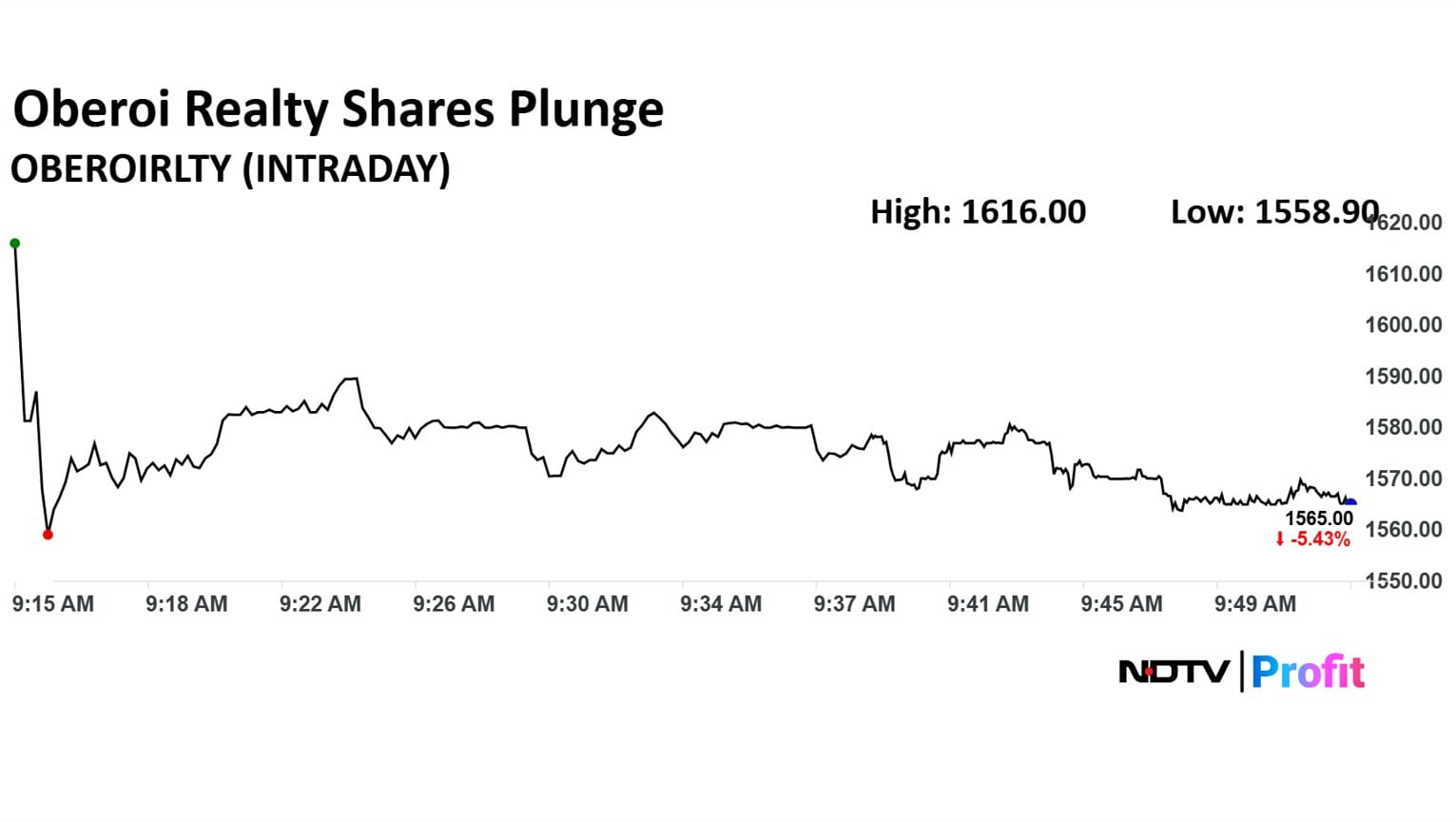

Shares of Mumbai-based real estate developer Oberoi Realty Ltd. on Tuesday plunged 5.80% with the stock trading at Rs 1574.10 apiece after the firm reported its Q3 earnings ending December.

The scrip fell as much as 5.50% to Rs 1574.10 apiece on Tuesday. This compares to a 0.48% decline in the NSE Nifty 50 Index.

Total traded volume so far in the day stood at 0.38 times its 30-day average. The relative strength index was at 54.20

Out of 27 analysts tracking the company, 14 maintain a 'buy' rating, seven recommend a 'hold,' and six suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target of Rs 1930.33 implies a downside of 21.7%.

Photo Credit: (Photo: NDTV Profit)

Over 2 million shares of HDFC Bank were traded via another block deal on Tuesday. The share of HDFC Bank rose as much as 0.84% to Rs 134.49 apiece.

Shares of LTIMindtree are under immense pressure in trade on Tuesday after the company reported its third-quarter earnings for the ongoing financial year. The stock is currently trading at Rs 6,010, which accounts for a correction of over 6%, compared to Monday's closing price of Rs. 6,407.

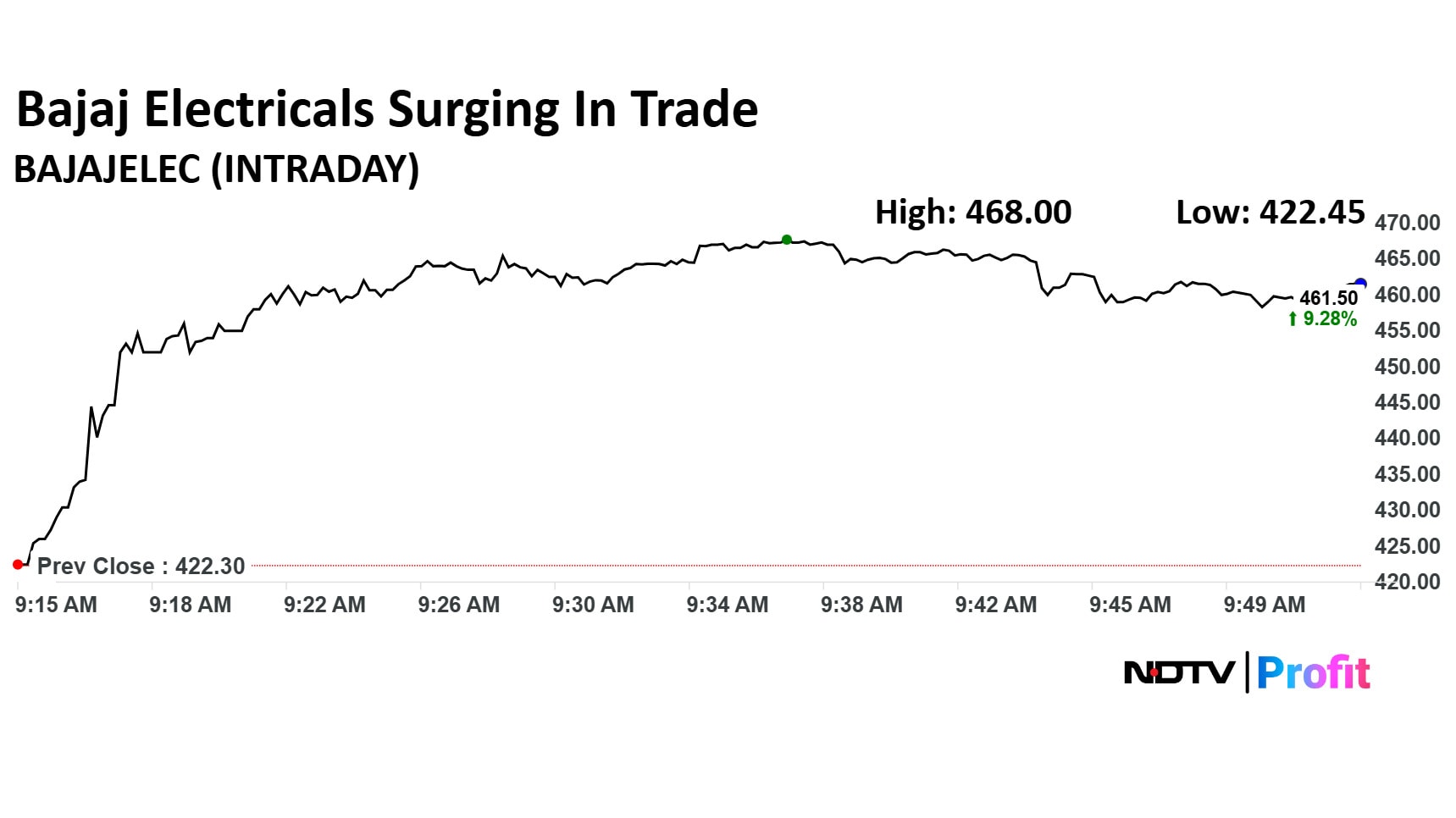

The stock zoomed 11% higher and is currently trading around 9.3% higher at Rs 461.50 apiece. Over the past one month, performance reflected a decline of 4.07%. The downward trend extended over longer durations, with the stock dropping 31.82% in the last six months, 34.65% over the past year, and 30.86% across a five‑year period.

Of the 17 analysts, tracked by Bloomberg, who have coverage on this stock, seven have a 'buy' call, another seven have a 'hold' view, and three have a 'sell' rating.

Rupee was near record low on Tuesday as it weakens past 91 per dollar for the first time since Dec. 17, 2025

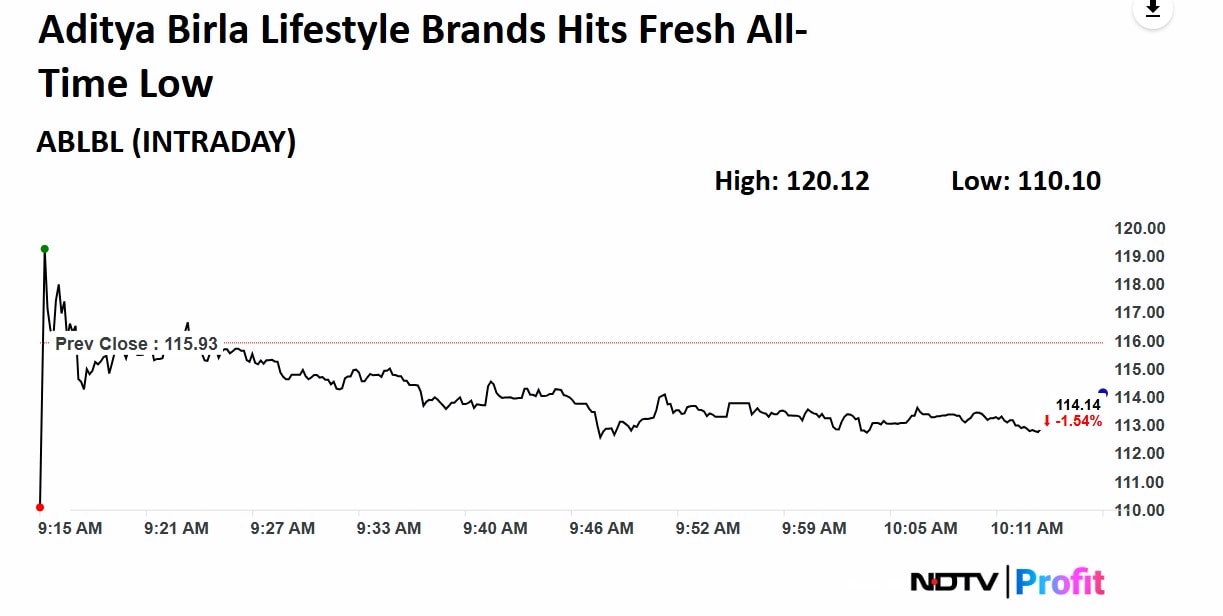

The shares of Aditya Birla Lifestyle Brands fell as much as 5.03% hitting a fresh all-time low on Tuesday after block deal. It pared gains to trade 2.33% lower at Rs 113.23 apiece, as of 10:16 a.m. This compares to a 0.48% decline in the NSE Nifty 50 Index.

It has fallen 76.42% in the last 12 months and 11.26% year-to-date. Total traded volume so far in the day stood at 0.96 times its 30-day average. The relative strength index was at 65.62.

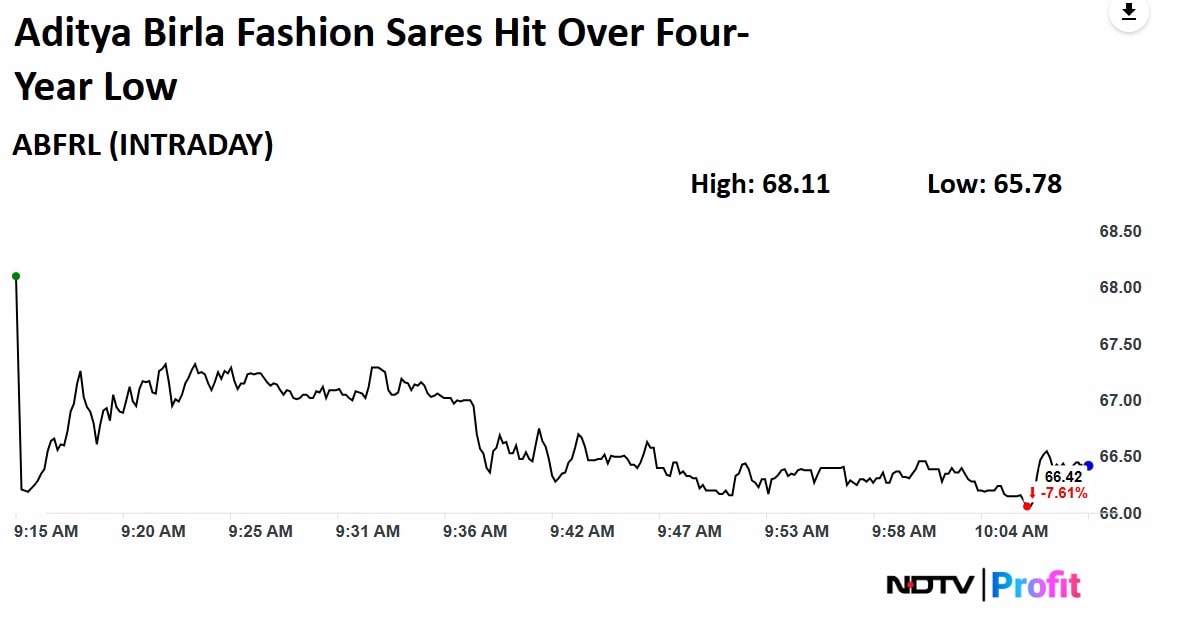

The shares of Aditya Birla Fashion fell as much as 8.50% on Tuesday after block deal, lowest level since May 5, 2021. It pared gains to trade 8.50% lower at Rs 65.78 apiece, as of 10:10 a.m. This compares to a 0.40% decline in the NSE Nifty 50 Index.

It has fallen 76.42% in the last 12 months and 13.21% year-to-date. Total traded volume so far in the day stood at 15.38 times its 30-day average. The relative strength index was at 51.73.

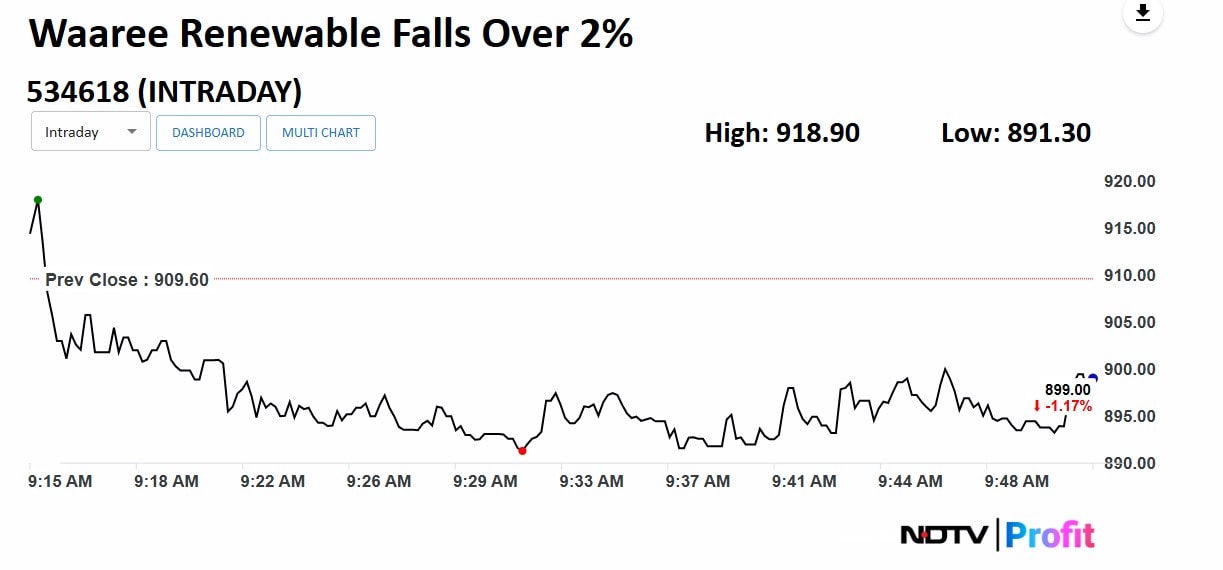

The shares of Waaree Renewable fell as much as 2.01% on Tuesday. This comes despite the company won an order worth Rs 38 crore. The scrip fell as much as 2.01% to Rs 891.30 apiece on Tuesday, lowest level since Jan. 9. It pared gains to trade 1.28% lower at Rs 898 apiece, as of 9:50 a.m. This compares to a 0.49% decline in the NSE Nifty 50 Index.

It has fallen 16.16% in the last 12 months and 7.56% year-to-date. Total traded volume so far in the day stood at 0.34 times its 30-day average. The relative strength index was at 44.34.

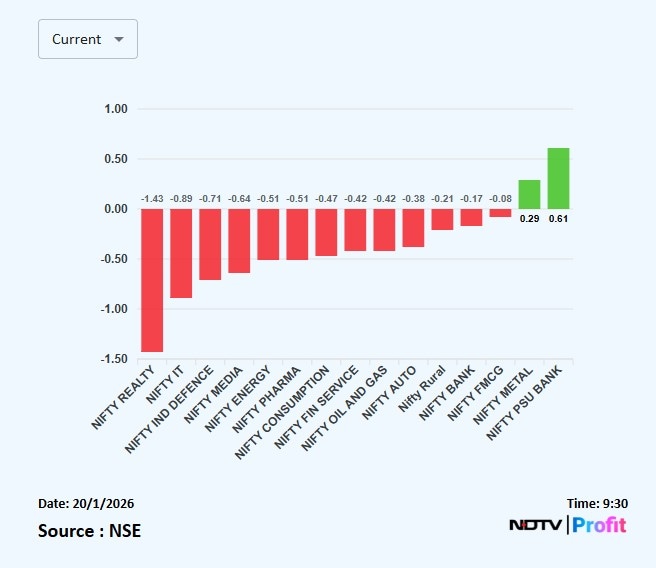

On NSE, 13 of the 15 sectors were in the red. Nifty Realty and Nifty IT lead the decline, while Nifty Metal and Nifty PSU Bank were the only sectors in green.

Broader markets were trading lower, with the NSE Midcap 150 trading 0.80% lower and NSE Smallcap was trading 0.82% higher.

HDFC Bank, Bajaj Finance, ICICI Bank, Eternal and Bharti Airtel weighed on the Nifty 50 index.

SBI, Hindalco, Tata Steel, UltraTech and HUL added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened lower on Tuesday extending decline for the second day. The Nifty 50 opened 0.02% lower at 25,580.30 and Sensex opened 0.05% down at 83,207.38. However, minutes after open the Nifty was trading 0.,22% lower and Sensex was also trading over 100 points lower.

At pre-open, the NSE Nifty 50 was trading 5.20 points or 0.02% lower at 25,580.30. The BSE Sensex was down 45.68 points at 83,200.50.

Hindustan Zinc Ltd. delivered a strong third quarter performance, driven by higher silver prices, better volumes and tighter cost control, prompting most brokerages to raise earnings estimates and target prices. However, views diverge on how much of the commodity upside is already priced into the stock.

Read more: Hindustan Zinc Q3 Review: Silver Rally Lifts Earnings, Brokerages Split on Valuation Comfort

Shares of Angel One Ltd. and ICICI Prudential Asset Management Company Ltd. will be of interest on Tuesday, as the day marks the last session for investors to buy shares to qualify for receiving the dividend before the stock goes ex/record-date.

The record date determines the eligible shareholders who will receive the dividend payment. The ex-dividend date, which mostly coincides with the record date, marks when the share price adjusts to reflect the upcoming payout.

Read more: Angel One, ICICI Prudential AMC Dividends: Last Day To Buy Shares To Qualify — Details Here

Citi

Maintain Neutral; TP Rs 1,600.

Growth beat, but margins disappointed.

Lower-than-expected margins in Cables & Wires weighed on EBITDA and PAT.

ECD saw volume growth across categories, excluding fans.

C&W growth is accelerating due to capacity additions.

Margin improvement is critical for re-rating.

UBS

Maintain Buy; TP Rs 1,765.

Strong Q3 earnings led by Cables & Wires.

Consumer demand remains sluggish but recovery expected.

GST and income tax cuts, plus easing inflation to aid demand.

Margins are seen improving from cyclical lows.

Macquarie

Maintain Outperform; TP Rs 1,710.

Revenue surprise offset by margin miss.

Cables & Wires drove both growth and margin disappointment.

Commodity price stability remains key.

Macquarie

Maintain Outperform; TP Rs 6,930.

Revenue beat with broad-based growth.

Best-in-class QoQ constant currency growth at 2.4%.

All verticals grew except BFSI.

Sees over 9% YoY USD revenue growth in Q4 FY26E.

Morgan Stanley

Maintain Equal-weight; Hike TP to Rs 6,300 from Rs 5,700.

Top hi-tech client grew in Q3; top BFSI client saw bottoming out in Q4.

Portfolio transition progressing better than peers.

Near-term margins could be a drag.

Balanced risk-reward at current valuations.

New management has established execution credibility.

Citi

Maintain Sell; Cut TP to Rs 5,415 from Rs 5,480.

Headline EBIT slightly ahead; revenues aided by seasonal passthrough.

Exit guidance closer to double-digit growth.

Wage hike impact of ~100 bps each in Q4 and Q1.

Valuation at 31x FY27E is seen as rich versus large-cap peers.

Citi on PNB

Maintain Sell; Hike TP to Rs 115 from Rs 108.

NIM contracted 7 bps QoQ; FY26 NIM guidance trimmed.

Slippages contained below 0.7%; floating provisions created towards ECL.

Management confident of 1% FY26 RoA, aided by recoveries, modest credit cost and flat NIMs.

Kotak Securities on PNB

Maintain Add; Hike TP to Rs 140 from Rs 125.

Margins saw a blip, but overall profitability remains steady.

Earnings growth and RoE are healthy despite ~10 bps QoQ NIM decline.

Slippages low at 70 bps; credit cost elevated due to one-off.

Jefferies on PNB

Maintain Buy; Hike TP to Rs 150 from Rs 145.

Weak margins and ECL provisioning weighed on earnings.

Profit beat estimates on higher other income and lower taxes.

Slippages stable; core credit costs remain benign.

ECL transition impact estimated at 0.8% of loans over five years.

Nifty Jan futures is down 0.69% to 25,574.0 at a discount of 11 points.

Nifty Options 20th Jan Expiry: Maximum Call open interest at 25800 and Maximum Put open interest at 25500.

Securities in ban period: SAIL, SAMMAANCAP

The US Dollar index is down 0.01% at 98.860.

Euro was down 0.02% at 1.1644.

Pound was up 0.05% at 1.3422.

Yen was down 0.03% at 158.04.

Global markets retreated while gold surged to a fresh record as trade tensions between the US and Europe intensified, sparked by President Donald Trump's renewed push to take control of Greenland.

Asian stocks slid around 0.5%, while S&P 500 futures dropped 1.1%. In Europe, equities posted their sharpest decline since November in the previous session.

US equity futures slid sharply, with S&P 500 futures down nearly 0.9% and Nasdaq 100 futures off 1.1%. In Europe, the Stoxx 600 was on track for its worst session in two months, led lower by losses in luxury and automobile stocks. Gold climbed to a record above $4,670 an ounce, while the dollar weakened about 0.3% as the Swiss franc outperformed. US cash markets were closed for a public holiday, reports Bloomberg.

Good morning readers.

The GIFT Nifty was trading near 25,600 early on Tuesday. The futures contract based on the benchmark Nifty 50 rose 0.16% at 25,608 as of 7:07 a.m. indicating a positive start for the Indian markets. This comes as Asian shares post small gains.

In the previous session on Monday, the benchmark ended in red. The NSE Nifty 50 ended 108.85 points or 0.42% lower at 25,585.50, while the BSE Sensex closed 324.17 points or 0.39% lower at 83,246.18.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.