Overseas investors in Indian equities remained net buyers for the tenth day in a row on Wednesday.

Foreign portfolio investors mopped up equities worth Rs 1,833.13 crore, according to data from the National Stock Exchange.

Domestic institutional investors turned sellers, and sold stocks worth Rs 789.67 crore, snapping a two-day buying streak, the NSE data showed.

Foreign institutions have remained net sellers and have offloaded Rs 33,418.99 crore worth of stocks so far in 2023.

The yield on 10-year bond closed flat at 7.04% on Wednesday.

Source: Bloomberg

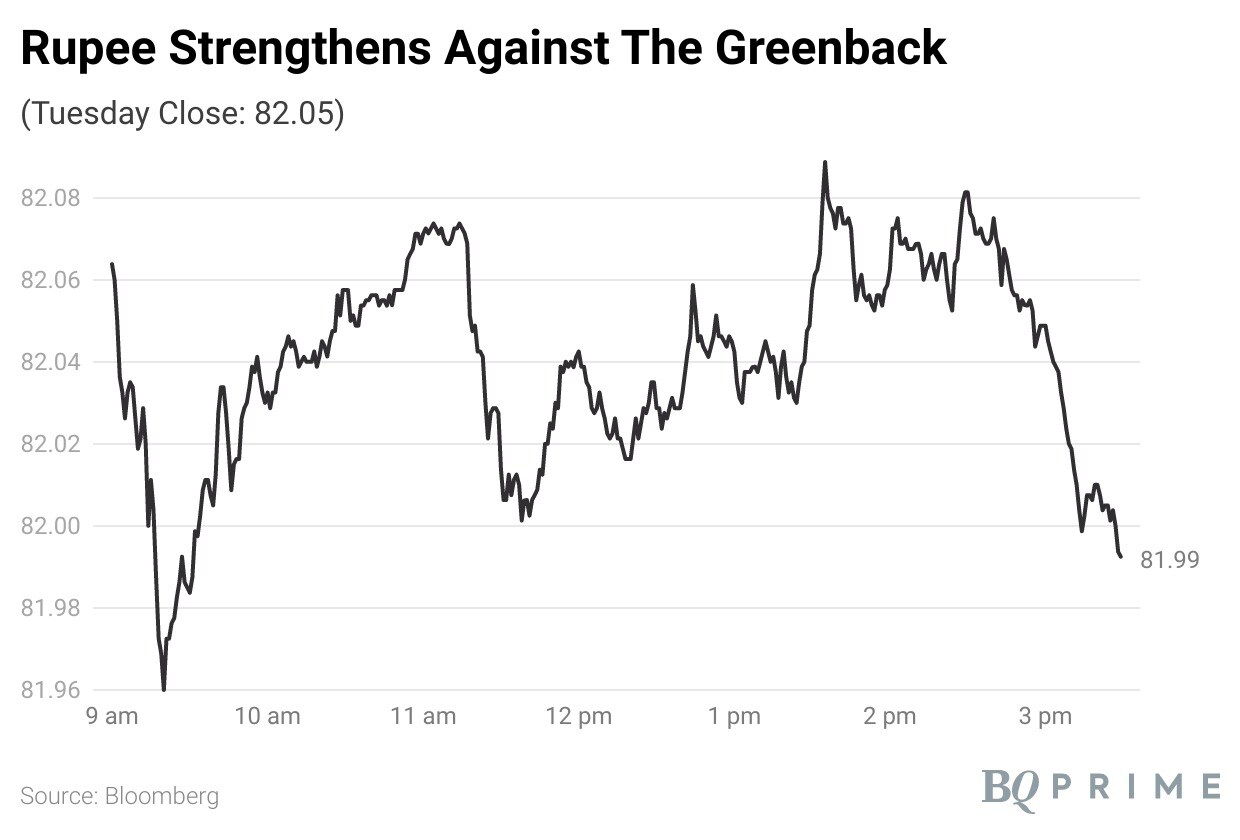

The local currency appreciated by 5 paise to close at 81.99 against the greenback on Wednesday.

The local currency closed at 82.05 on Tuesday.

Source: Bloomberg

The local currency appreciated by 5 paise to close at 81.99 against the greenback on Wednesday.

The local currency closed at 82.05 on Tuesday.

Source: Bloomberg

Indian equity benchmarks swung between gains and losses through Wednesday to pick up in the late minutes of trading. While media, auto and realty sectors gained, PSU banks and metals declined. The S&P BSE Sensex Index was closed above 61,900-level, whereas NSE Nifty 50 Index was ended upwards of the 18,300-mark.

European stocks and U.S. equity futures edged lower as cautious investors awaited a U.S. inflation report for insights on the path of Federal Reserve rate hikes. Retail and consumer shares were the biggest drag on European stocks, outweighing positive earnings news from some companies.

Contracts for the S&P 500 and the Nasdaq 100 retreated, with Airbnb Inc. sliding 13% in premarket trading after the vacation home-rental company gave a cautious forecast for revenue in the second quarter. Asian stocks declined as a regional stocks gauge headed for the biggest loss in two weeks.

The U.S. CPI to come later on Wednesday is expected to rise by 5% in April on a year-on-year basis, as per Bloomberg, indicating that price pressures are still uncomfortably high for the Fed.

The S&P BSE Sensex Index closed up 179 points or 0.29% at 61,940.20 while the NSE Nifty 50 Index was higher by 49 points or 0.27% at 18,315.10.

Reliance Industries Ltd., HDFC Bank Ltd., Bajaj Finance Ltd., IndusInd Bank Ltd., and Power Grid Corp of India Ltd., and were positively adding to the change.

Whereas, Infosys Ltd., Larsen and Toubro Ltd., Dr. Reddy's Laboratories Ltd., UPL Ltd., and Hindalco Industries Ltd. were negatively contributing to the change in the Nifty 50 Index.

The broader market indices were ended higher; the S&P BSE MidCap Index was up by 0.34%, whereas S&P BSE SmallCap Index was higher by 0.33%.

Fourteen out of the 19 sectors compiled by BSE advanced, while five declined in trade.

The market breadth was spit bewteen the buyers and the sellers. About 1,833 stocks rose 1,658 declined, and 146 remained unchanged on the BSE.

Sanofi India will demerge its consumer healthcare business from the demerged company into a new subsidiary, Sanofi Consumer Healthcare.

The demerged unit will include brands like Allegra®, Combiflam®, DePURA ®, Avil®, etc.

The shareholders of the demerged company, will be issued equity in the ratio of 1:1.

Source: Exchange filing

Shares of Aarti Industries Ltd. advanced 9.25% to Rs 505.6 apiece, as of 2:55 p.m., in trade on Wednesday compared to 0.07% advance in the benchmark, NSE Nifty 50 Index.

The stock fell as much as 9.99% intraday, the most in over 18 months since Oct. 20, 2021. Total traded volume stood at 12.6 times its 30-day average. The relative strength index was at 33.6.

Out of the 26 analysts tracking the company, 13 maintain a 'buy' rating, five recommend a 'hold' and eight suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential upside of 20.6%.

Source: Bloomberg, Exchange filing

The company acquired land at Wagholi and NIBM Road, Pune with an estimated saleable area of 1.9 million square feet.

While the five acres of land parcel at Wagholi is a direct purchase, The company entered into a JV for the project at NIBM Road.

Source: Exchange filing

Shares of PSU banking companies were trading lower on Wednesday as the NSE Nifty PSU Bank Index fell 1.48%, as compared to a 0.06% advance in the NSE Nifty 50.

All the 12 constituents compiled by the gauge declined.

Punjab National Bank, Indian Bank, Union Bank of India, Bank of India, Central Bank of India, Indian Overseas Bank, Canara Bank, Bank of India, Bank of Maharashtra, UCO Bank, Bank of Baroda, State Bank of India, and Punjab & Sind Bank declined in trade.

Source: NSE

Indian equity benchmarks swung between gains and losses through midday on Wednesday. While PSU banking sector was the top loser, FMCG and private banks advanced. The S&P BSE Sensex Index was trading above 61,800-level, whereas NSE Nifty 50 Index was trading upwards of the 18,200-mark.

U.S. equity futures, treasuries and the dollar traded in narrow ranges as investors awaited a key inflation report. Contracts for the S&P 500 and Nasdaq 100 were little changed in Asia after the indexes fell 0.5% and 0.7%, respectively, on Tuesday.

Asian markets retreated about 0.6%, putting it on course for the biggest loss in more than two weeks. Stocks in Shanghai saw some of the biggest falls amid selling of state-owned enterprises after recent gains. Toyota Motor Corp. rose in Tokyo, helping trim some of the declines in Japan after the carmaker announced a share buyback.

The U.S. CPI to come later on Wednesday is expected to rise by 5% in April on a year-on-year basis, indicating that price pressures are still uncomfortably high for the Fed.

As of 12:08 p.m., the S&P BSE Sensex Index was up 21 points or 0.03% at 61,782.35 while the NSE Nifty 50 Index was higher by 5 points or 0.03% at 18,271.15.

Reliance Industries Ltd., Bajaj Finance Ltd., IndusInd Bank Ltd., Hindustan Unilever Ltd., and HDFC Bank Ltd., and were positively adding to the change.

Whereas, Infosys Ltd., Larsen and Toubro Ltd., State Bank of India, Bharti Airtel Ltd., and HDFC Ltd. were negatively contributing to the change in the Nifty 50 Index.

The broader market indices were trading higher; S&P BSE MidCap Index was up by 0.06%, whereas S&P BSE SmallCap Index was higher by 0.18%.

Out of the 19 sectors compiled by BSE, 11 advanced, while eight declined in trade.

The market breadth was spit bewteen the buyers and the sellers. About 1,658 stocks rose 1,637 declined, and 142remained unchanged on the BSE.

Shares of Krishna Defence and Allied Industries Ltd. hit an all-time high after it secured a Rs 63.48 crore order from the Ministry of Defence.

The company bagged an order from Ministry of Defence for the supply of Special Heating Equipment to be used by armed forces at sub-zero temperatures. The order worth Rs 63.48 crore is expected to be executed over the next 12 months.

The company's management addressed the order win as a "significant milestone" in an exchange filing. "This order showcases our strength as a Company with experienced team of engineers who work closely with customers to design and develop products that meet their unique requirements," the statement said.

Shares of Krishna Defence and Allied Industries Ltd. advanced 7.20% to Rs 186 apiece, as of 11:43 a.m., in trade on Wednesday compared to 0.05% advance in the benchmark, NSE Nifty 50 Index.

The stock gained as much as 11.33% intraday, to hit an all-time high at Rs 193.13 apiece. Total traded volume stood at 8.7 times its 30-day average. The relative strength index was at 69.8.

Source: Bloomberg, Exchange filing

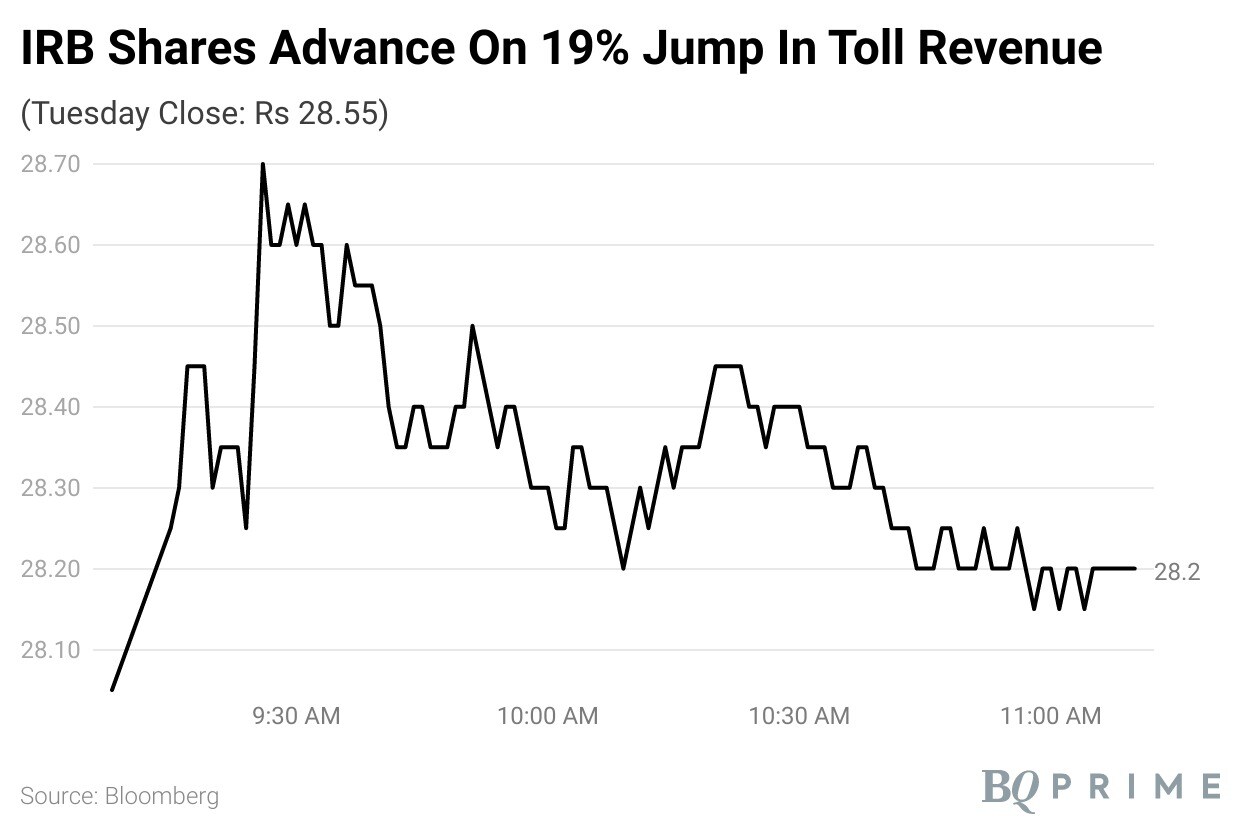

Shares of IRB Infrastructure Developers Ltd. gained on Wednesday after the announcement of April toll revenue.

The company's toll revenue rose 19% year-on-year to Rs 388 crore in April 2023, according to an exchange filing. The toll collection in FY23 was Rs 4,180 crore, compared to Rs 2,986 crore in FY22.

Shares of the company rose 2.72% to Rs 28.35 apiece as of 10.30 a.m., compared to a 0.08% decline in the benchmark NSE Nifty 50. However, the stock is down 2.18% year-to-date compared to a decline of 0.17% in the S&P BSE Sensex index.

The total traded volume so far in the day stood at 3.8 times its 30-day average.

Out of the nine analysts tracking the company, seven maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.9%.

Shares of IRB Infrastructure Developers Ltd. gained on Wednesday after the announcement of April toll revenue.

The company's toll revenue rose 19% year-on-year to Rs 388 crore in April 2023, according to an exchange filing. The toll collection in FY23 was Rs 4,180 crore, compared to Rs 2,986 crore in FY22.

Shares of the company rose 2.72% to Rs 28.35 apiece as of 10.30 a.m., compared to a 0.08% decline in the benchmark NSE Nifty 50. However, the stock is down 2.18% year-to-date compared to a decline of 0.17% in the S&P BSE Sensex index.

The total traded volume so far in the day stood at 3.8 times its 30-day average.

Out of the nine analysts tracking the company, seven maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 3.9%.

Shares of Apollo Tyres Ltd. declined the most in over 14 weeks despite company's fourth-quarter earnings beating analyst estimates.

The company approved fixation of tenure of Onkar Kanwar as chairman for five years, effective from Feb. 1, 2023 to Jan. 31, 2028. It also approved the reappointment of Neeraj Kanwar as managing director and Satish Sharma as whole-time director for five years from April 1, 2024 to March 31, 2029.

Apollo Tyres Ltd.'s profit rose by over 276.73% year-on-year to Rs 427.4 crore in the quarter ended March, beating analyst estimates pegged at Rs 315.96 crore. This compares with the net profit of the period in the previous fiscal, which stands at Rs 113.5 crore, according to its exchange filing.

Company's March quarter revenue was up 11.99% to Rs 6,247.33 crore compared with Rs 5,578.3 crore, in the same period a year back. The consensus of analyst estimates, pooled by Bloomberg expected revenue at Rs 6,227.97 crore.

Apollo Tyres Q4 FY23 (Consolidated, YoY)

Revenue up 11.99% at Rs 6,247.33 crore vs Rs 5,578.3 crore (Bloomberg estimate: Rs 6,227.97 crore)

Ebitda up 59.4% at Rs 998.45 crore vs Rs 503.3 crore (Bloomberg estimate: Rs 919.30 crore)

Ebitda margin at 15.98% vs 11.23% (Bloomberg estimate: 14.8%)

Net profit up 276.73% at Rs 427.4 crore vs Rs 113.5 crore (Bloomberg estimate: Rs 315.96 crore)

The board recommended a final dividend of Rs 4 per share and special dividend of Rs 0.50 per share, aggregating to Rs 4.50 per share and a total outgo of Rs 285.80 crore.

Shares of Apollo Tyres Ltd. declined 4.06% to Rs 366.1 apiece, as of 10:48 a.m., in trade on Wednesday compared to 0.10% declined in the benchmark, NSE Nifty 50 Index.

The stock declined as much as 4.47% intraday, the most in over 14 weeks since Jan. 27, 2023. Total traded volume stood at 8.2 times its 30-day average. The relative strength index was at 67.2.

Out of the 32 analysts tracking the company, 23 maintain a 'buy' rating, two recommend a 'hold' and seven suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential upside of 3%.

Source: Bloomberg, Exchange filing

Shares of Eveready Industries India Ltd. gained during trade on Wednesday. The company reported an increase in revenue by 18.63% at Rs 286.17 crore, in the fourth quarter of FY23. It reported a net loss of Rs 14.39 crore.

Eveready Industries Q4 FY23 Highlights (Consolidated, YoY)

Revenue up 18.63% at Rs 286.17 crore.

Ebitda profit of Rs 1.03 crore vs Ebitda loss of Rs 35.64 crore.

Ebitda margin at 0.36%.

Net loss was 62.53% at Rs 14.39 crore.

Shares of Eveready Industries rose 5.32%, the most in a day since March 31. It was trading 4.06% higher at Rs 311.2 apiece, compared to a 0.11% fall in the benchmark NSE Nifty 50 as of 10:21 a.m.

The average traded volume so far in the day was 12.6 times its monthly average.

Shares of Godrej Agrovet Ltd. declined the most in over a year after the company's fourth-quarter earnings missed analyst estimates.

The company's profit narrowed by over 80% year-on-year to Rs 23.47 crore in the quarter ended March, missing analyst estimates pegged at Rs 56 crore. This compares with the net profit of the period in the previous fiscal, which stands at Rs 139.81 crore, according to its exchange filing.

As per the company's investor presentation, the decline in profitability was aided by high level of channel inventories, pricing pressures, government's interventions in input and output prices and lower salience of plant-growth regulator products. Godrej Agrovet Ltd. also flagged limited transmission of cost inflation to the customers as the reason for the fall in the net profit.

Company's March quarter revenue was up 0.68% to Rs 2,094.99 crore compared with Rs 2,080.75 crore, in the same period a year back. The consensus of analyst estimates, pooled by Bloomberg expected revenue at Rs 2,202.36 crore.

Godrej Agrovet Q4 FY23 (Consolidated, YoY)

Revenue up 0.68% at Rs 2,094.99 crore vs Rs 2,080.75 crore (Bloomberg estimate: Rs 2,202.36 crore)

Ebitda down 55.91% at Rs 74.62 crore vs Rs 169.24 crore (Bloomberg estimate: Rs 126.60 crore)

Ebitda margin at 3.56% vs 8.13% (Bloomberg estimate: 5.7%)

Net profit down 83% at Rs 23.47 crore vs Rs 139.81 crore (Bloomberg estimate: Rs 56 crore)

The company declared a final dividend of Rs 9.50 crore for the fiscal 2023.

Shares of Godrej Agrovet Ltd. declined 4.01% to Rs 421.05 apiece, as of 10:17 a.m., in trade on Wednesday compared to 0.17% declined in the benchmark, NSE Nifty 50 Index.

The stock gained as much as 4.90% intraday, the most in over a year since May 4, 2022. Total traded volume stood at 13.3 times its 30-day average. The relative strength index was at 39.

Out of the 10 analysts tracking the company, seven maintain a 'buy' rating, one recommends a 'hold' and two suggest to 'sell' the stock, as per the Bloomberg data.

The average calculated from the 12-month price target given by analysts implies a potential upside of 23.4%.

Source: Bloomberg, Exchange filing

JSW Steel Ltd.'s standalone crude steel production rose 7% year-on-year to 17.77 lakh tonnes in April.

It recorded a 16% YoY growth in production of flat rolled products and 9% YoY decline in long rolled products.

Production of rolled long products was lower due to planned capital shutdowns taken at Salem and Vijayanagar plant in April.

Source: Exchange filing

The broader market indices opened higher; S&P BSE MidCap Index was up by 0.27%, whereas S&P BSE SmallCap Index was higher by 0.39%.

The 19 sectors compiled by BSE advanced, with S&P BSE Capirtal Goods and S&P BSE Information Technology being the top gainers.

The market breadth was skewed in the favour of the buyers. About 1,738 stocks rose 675 declined, and 107 remained unchanged on the BSE.

Source: BSE

ICICI Bank Ltd., Reliance Industries Ltd., TCS Ltd., Power Grid Corp of India Ltd., and IndusInd Bank Ltd. were positively adding to the change.

Whereas, State Bank of India, HDFC Ltd., UPL Ltd., Grasim Industries Ltd., and HDFC Bank Ltd. were negatively contributing to the change in the Nifty 50 Index.

Indian equity benchmarks opened higher on Wednesday after closing with little change on Tuesday.

Asian stocks dropped as traders were taking risk positions off the table ahead of a U.S. inflation report that will feed into the Federal Reserve’s policy decisions.

Shares of Chinese state firms extended a decline after a recent rally, with an index of central government-owned companies down more than 1%. Contracts for the S&P 500 and Nasdaq 100 were fractionally higher in Asia after the indexes fell 0.5% and 0.7%, respectively, on Tuesday. Benchmark gauges slipped from Japan to Australia.

U.S. gauges have been stuck in narrow trading ranges as investors weigh the potential end of the Federal Reserve’s interest rate hikes against the possibility of an economic slowdown.

Real estate shares led the decline in Europe, with Swedish landlord SBB falling to the lowest in nearly five years. Futures contracts on the S&P 500 and the Nasdaq 100 retreated by about 0.2%. A gauge of Asian equities fell slightly. Saudi Aramco shares rallied as much as 7.2% in Riyadh after the oil giant reported soaring free cashflow and announced an additional dividend.

At pre-open, the S&P BSE Sensex Index was up 81 points or 0.13% at 61,842.02 while the NSE Nifty 50 Index was higher by 48 points or 0.26% at 18,313.60.

At pre-open, the S&P BSE Sensex Index was up 81 points or 0.13% at 61,842.02 while the NSE Nifty 50 Index was higher by 48 points or 0.26% at 18,313.60.

Source: Bloomberg

The yield on the 10-year bond opened flat at 7.05% on Wednesday.

Source: Bloomberg

The local currency weakened about 2 paise to open at 82.07 against the greenback on Wednesday.

The local currency closed at 82.05 on Tuesday.

Source: Bloomberg

Voting is underway for all 224 Assembly seats in Karnataka on Wednesday after days of high voltage campaigning by political bigwigs. More than 5.31 crore voters will cast their votes to elect their representatives for the state assembly out of 2,615 candidates contesting the polls.

Catch the Karnataka Elections 2023 Live Updates on the following link;

U.S. Dollar Index at 101.6

U.S. 10-year bond yield at 3.51%

Brent crude down 0.39% to $77.14 per barrel

Nymex crude down 0.42% at $73.40 per barrel

SGX Nifty up 0.17% at 18,342.5 as of 8:10 a.m.

Bitcoin up 0.26% at $27,730.75

Rajnish Wellness: Promoter Rajnish Kumar Singh bought 2 lakh shares on May 8.

Ex-Date Interim Dividend: Coforge, Laurus Labs

Ex-Date Income Distribution: Mindspace Business Parks REIT

Ex-Date Buy Back of Shares: Welspun India

Record Date Interim Dividend: Coforge, Laurus Labs

Record Date Income Distribution: Mindspace Business Parks REIT

Record Date Buy Back of Shares: Welspun India

Price Band Revised From 20% To 10%:

Move Into Short-Term ASM Framework: Patel Engineering

Move Into Short-Term ASM Framework: AGI Greenpac, Kirloskar Electric Company

IndoStar Capital Finance: Rosy Blue India bought 6.43 lakh shares (0.52%) at Rs 130.59 per share.

Krsnaa Diagnostics: ACM Global Fund VCC bought 6.91 lakh shares (2.2%), Somerset Indus Healthcare Fund I sold 8.91 lakh shares (2.84%) at Rs 495.27 apiece.

IRB Infrastructure Developers: The company reported an 18.76% year-on-year increase in toll collection during April 2023 at Rs 388.42 crore. Toll collection by wholly owned subsidiaries increased 16.5% year-on-year to Rs 194.52 crore, while that by joint venture entities under the IRB Infrastructure Trust grew 4.3% to Rs 193.90 crore.

Raymond: The company will raise Rs 2,200 crore by issuing non-convertible debentures to Raymond Consumer Care for the repayment of external debt.

Greaves Cotton: The company completed the first stage of the acquisition of a 60% shareholding in Excel Controlinkage.

Nazara Technologies: The company will invest Rs 15 crore in subsidiary Next Wave Multimedia by acquiring a 19.5% stake from promoters.

Hindustan Petroleum Corporation/Life Insurance Corporation of India: The insurance major increased its shareholding in the state-run refiner to 5.013% from 4.901%.

Larsen & Toubro, Dr Reddy's Laboratories, Gujarat Gas, Godrej Consumer Products, Prism Johnson, Procter & Gamble Hygiene & Health Care, Relaxo Footwears, Sanofi India, Sagar Cements, Cera Sanitaryware, BASF India, Bosch, Escorts Kubota, Gokul Agro Resources, HG Infra Engineering, JBM Auto, Kabra Extrusiontechnik, MAS Financial Services, Novartis India, Orchid Pharma, Pricol, Ratnamani Metals & Tubes, Venky's (India)

Apollo Tyres Q4 FY23 (Consolidated, YoY)

Revenue up 11.99% at Rs 6,247.33 crore (Bloomberg estimate: Rs 6,227.97 crore)

Ebitda up 59.4% at Rs 998.45 crore (Bloomberg estimate: Rs 919.30 crore)

Ebitda margin at 15.98% vs 11.23% (Bloomberg estimate: 14.8%)

Net profit up 276.73% at Rs 427.4 crore (Bloomberg estimate: Rs 315.96 crore)

The board recommended a final dividend of Rs 4 per share and special dividend of Rs 0.50 per share, aggregating to Rs 4.50 per share and a total outgo of Rs 285.80 crore. It also approved fixation of tenure of Onkar Kanwar as chairman for five years, effective from Feb. 1, 2023 to Jan. 31, 2028. It also approved the reappointment of Neeraj Kanwar as managing director and Satish Sharma as whole-time director for five years from April 1, 2024 to March 31, 2029.

Lupin Q4 FY23 (Consolidated, YoY)

Revenue up 14.09% at Rs 4,430.08 crore (Bloomberg estimate: Rs 4432.85 crore)

Ebitda up 165.38% at Rs 604.05 crore (Bloomberg estimate: Rs 491.15 crore)

Ebitda margin at 13.64 % vs 5.86% (Bloomberg estimate: 11.1%)

Net profit of Rs 235.96 crore vs net loss of Rs 517.98 crore (Bloomberg estimate: Rs 307.15 crore)

The company announced a dividend of Rs 4 per share.

Nuvoco Vistas Corporation Q4 FY23 (Consolidated, YoY)

Revenue down 0.06% at Rs 2,928.5 crore (Bloomberg estimate: Rs 3,091.54 crore)

Ebitda down 11.48% at Rs 380.44 crore (Bloomberg estimate: Rs 407.26 crore)

Ebitda margin at 13% vs 14.67% (Bloomberg estimate: 13.2%)

Net profit up 590.69% at Rs 201.06 crore (Bloomberg estimate: Rs 44.54 crore)

Birla Corporation Q4 FY23 (Consolidated, YoY)

Revenues up 8.76% at Rs 2,462.57 crore (Bloomberg estimate: Rs 2,397.17 crore)

Ebitda down 0.86% at Rs 274.33 crore (Bloomberg estimate: Rs 269.51 crore)

Ebitda margin at 11.14% vs 12.22% (Bloomberg estimate: 11.2%)

Net profit down 23.52% at Rs 84.95 crore (Bloomberg estimate: Rs 54.08 crore)

The board recommended a dividend of Rs 2.50 per share for the fiscal ended March 2023. It also approved raising Rs 200 crore via non-convertible debentures on private placement basis.

Godrej Agrovet Q4 FY23 (Consolidated, YoY)

Revenue up 0.68% at Rs 2,094.99 crore (Bloomberg estimate: Rs 2,202.36 crore)

Ebitda down 55.91% at Rs 74.62 crore (Bloomberg estimate: Rs 126.60 crore)

Ebitda margin at 3.56% vs 8.13% (Bloomberg estimate: 5.7%)

Net profit down 74.63% at Rs 31.02 crore (Bloomberg estimate: Rs 56 crore)

The company declared a final dividend of Rs 9.50 crore for the fiscal 2023.

Castrol India Q4 FY23 (Consolidated, YoY)

Revenue up 4.71% at Rs 1,293.89 crore (Bloomberg estimate: Rs 1,384.10 crore)

Ebitda down 6.99% at Rs 295.03 crore (Bloomberg estimate: Rs 328.95 crore)

Ebitda margin at 22.8% vs 25.67% (Bloomberg estimate: 23.80%)

Net profit down 11.34% at Rs 202.5 crore (Bloomberg estimate: Rs 247.90 crore)

Poly Medicure Q4 FY23 (Consolidated, YoY)

Revenue up 19% at Rs 307 crore (Bloomberg estimate: Rs 305 crore)

Ebitda up 36% to Rs 86 crore (Bloomberg estimate: Rs 75 crore)

Ebitda margin at 27.9% vs 24.5% (Bloomberg estimate: 24.6%)

Net profit up 63% at Rs 59 crore (Bloomberg estimate: Rs 50 crore)

The company announced a dividend of Rs 3 per share for the fiscal 2023.

Nazara Technologies Q4 FY23 (Consolidated, QoQ)

Revenue down 8.1% at Rs 289.30 crore (Bloomberg estimate: Rs 296.15 crore)

Ebit down 25.83% at Rs 11.20 crore

Ebit margin at 3.87% vs 4.8%

Net profit up 92% at Rs 9.4 crore (Bloomberg estimate: Rs 16.23 crore)

Eveready Industries Q4 FY23 (Consolidated, YoY)

Revenue up 18.63% at Rs 286.17 crore

Ebitda profit of Rs 1.03 crore vs Ebitda loss of Rs 35.64 crore

Ebitda margin at 0.36%

Net loss narrows 62.53% to Rs 14.39 crore

Asian equities opened slightly lower on Wednesday ahead of a critical inflation report.

Benchmark indices fell in Japan, South Korea, and Australia, while futures for Hong Kong stocks indicated a slight gain. Contracts for the S&P 500 and Nasdaq 100 were fractionally higher in Asia after the indexes fell 0.5% and 0.7%, respectively, on Tuesday.

U.S. gauges have been stuck in narrow trading ranges as investors weigh the potential end of the Federal Reserve’s interest rate hikes against the possibility of an economic slowdown. It’s a similar story for global stocks, which have largely moved sideways for more than a month, as measured by the MSCI World Index.

The yield on the 10-year Treasury note in the U.S. was trading at 3.51%. Crude oil prices traded around the $77 mark, while Bitcoin declined below the $28,000 level.

At 8:10 a.m., the Singapore-traded SGX Nifty, an early indicator of the Nifty 50 Index’s performance in India, was up 0.17% at 18,342.5.

Domestic benchmarks—BSE Sensex and NSE Nifty 50—closed mostly unchanged, with decline in PSU banks and realty stocks countering the advance in IT, auto and pharma stocks.

The Indian rupee closed lower against the U.S. dollar amid a stronger greenback and tepid domestic equities.

Foreign investors were net buyers for the ninth day in a row and bought equities worth Rs 1,942.19 crore. On the other hand, domestic institutional investors turned buyers after a day and bought stocks worth Rs 404.70 crore, the NSE data showed.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.