And it's a wrap on live coverage of markets for Wednesday. Thanks for staying with us!

Nifty slips below 26,000 mark.

Nifty falls for the fourth straight trading session

Benchmarks outperformed broader market indices

Max Healthcare and Bharat Electronics fall the most in Nifty

Max Healthcare and Bharat Electronics and Tata Consumer fall over 2% for the day.

Broader Market indices under pressure

Indian Bank and Hudco fall the most in Nifty Midcap 150

SPARC and Easy Trip Planners are the top losers in Nifty smallcap 250

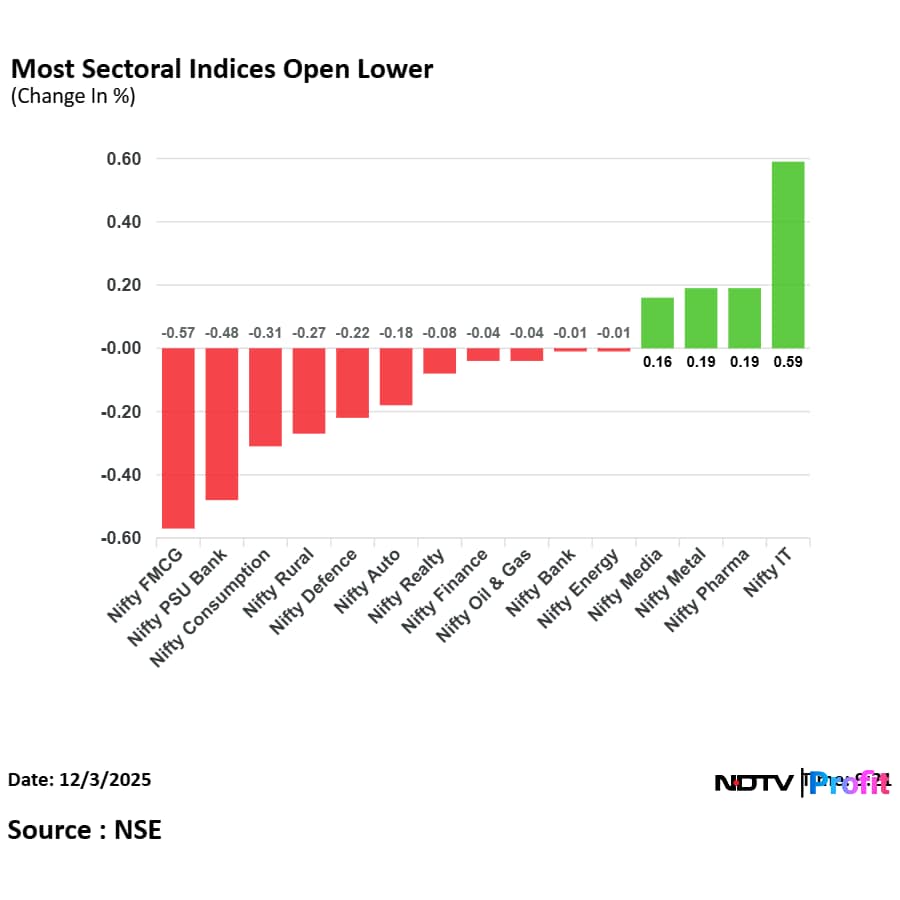

Sectoral Indices close on a mixed note

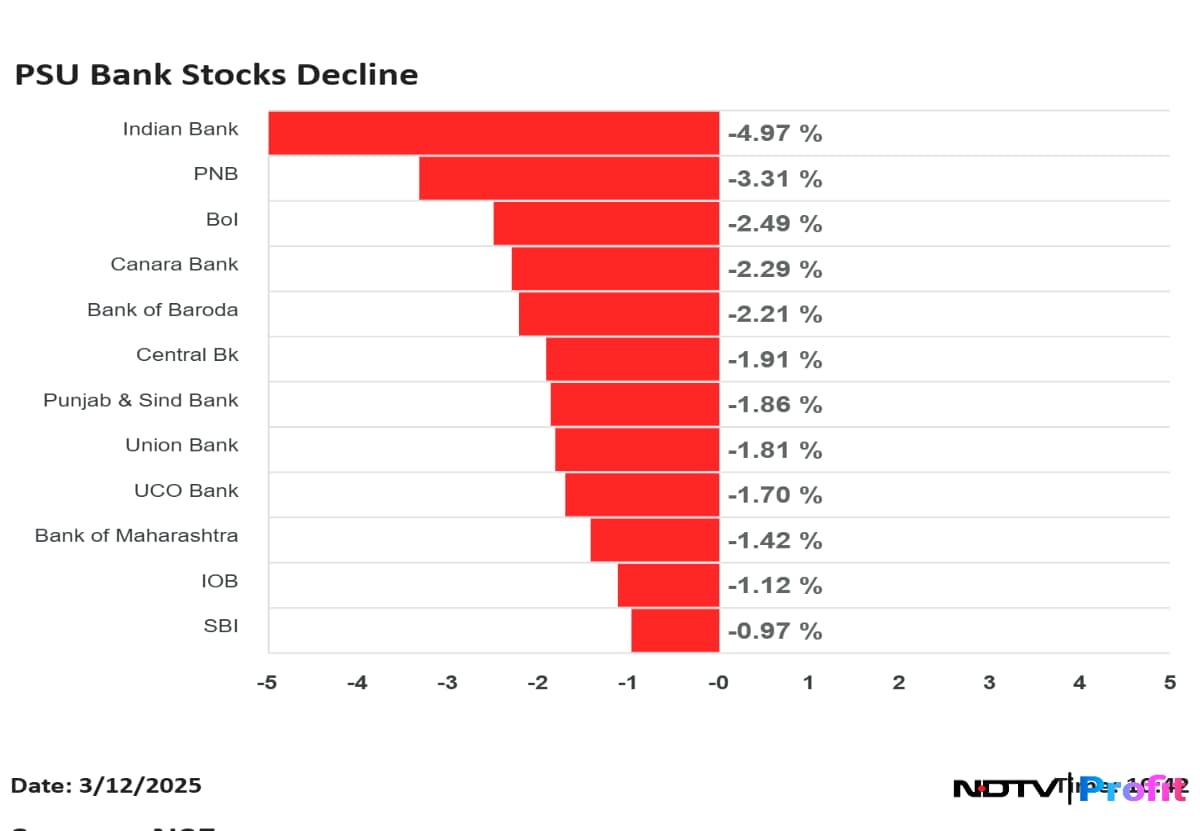

Nifty PSU bank fell over 3% for the day; emerges as the top losing sector for the day.

Indian Bank and Punjab National Bank fell the most in Nifty PSU bank

Nifty IT and Financials gain in the trade

Nifty Oil and Gas, Realty fell for the fifth straight session

Nifty Auto, PSU bank, Metals fell for the 2nd trading session

Nifty Financials services snaps three-day losing streak

Nifty Bank snaps two- day losing streak

Nifty slips below 26,000 mark.

Nifty falls for the fourth straight trading session

Benchmarks outperformed broader market indices

Max Healthcare and Bharat Electronics fall the most in Nifty

Max Healthcare and Bharat Electronics and Tata Consumer fall over 2% for the day.

Broader Market indices under pressure

Indian Bank and Hudco fall the most in Nifty Midcap 150

SPARC and Easy Trip Planners are the top losers in Nifty smallcap 250

Sectoral Indices close on a mixed note

Nifty PSU bank fell over 3% for the day; emerges as the top losing sector for the day.

Indian Bank and Punjab National Bank fell the most in Nifty PSU bank

Nifty IT and Financials gain in the trade

Nifty Oil and Gas, Realty fell for the fifth straight session

Nifty Auto, PSU bank, Metals fell for the 2nd trading session

Nifty Financials services snaps three-day losing streak

Nifty Bank snaps two- day losing streak

Rupee closed 31 paise lower at 90.19 against US Dollar

Itraday, it slumped 42 paise to a record low of 90.30 against US Dollar

It closed at 89.88 a dollar on Tuesday

Source: Bloomberg

IDFC First Bank's Chief Economist Gaura Sengupta expects some relief for the Indian rupee as in the fourth quarter the domestic unit improves. Trade deficits narrows, flows from balance of payments also improve.

Rupee recovered 20 paise to 90.10 a dollar from record low

Intraday, it slumped 42 paise to a record low of 90.30 against US Dollar

It closed at 89.88 a dollar on Tuesday

Source: Bloomberg

BofA initiated coverage on GMR Airports Ltd. with a buy rating and a target price Rs 128 apiece, which implies 21% upside potential from current levels. The Hyderabad and Delhi airports operator has a stellar outlook for earnings growth amid India's rising travel demand.

Not losing sleep over rupee level

Rupee fall not impacting inflation or exports

INR will come back next year

Source: CEA Nageswaran on rupee depreciation

Knowledge Marine & Engineering Works received order worth Rs 10.6 crore from New Mangalore Port Authority for hiring of security patrol boat, the company said in the exchange filing.

BEML Ltd. received additional order worth Rs 414 crore from Bengaluru Metro Rail Corp for trainsets, the company said in the exchange filing.

The company's arm Escorts Heart Institute & Research Centre files writ petition against Rs 6.6 crore tax order. The tax order is regarding charging MRP from IPD patient for medicine & consumables.

Source: Exchange Filing

Manganese ore sales up 3% at 1.4 lakh metric tonnes (YoY)

Manganese ore production up 1% At 1.7 lakh metric tonnes (YoY)

Source: Exchange Filing

Gujarat Pipavav signed a memorandum of understanding with NYK India to enhance RoRo Infra at Pipavav Port. RoRo Infra stands for roll-on/roll-off infrastructure.

NBCC Ltd. received five orders worth Rs 665 crore for construction, redevelopment and renovation of buildings. It also received Rs 643 crore order for redevelopment of Tulsi Niketan in Ghaziabad.

At a time when the global demand for weight-loss drugs has surged significantly, the semaglutide space has emerged as an attractive investment opportunity for many, but not for veteran health investor Aditya Khemka.

Khemka, the Chief Investment Officer at InCred Asset Management, told NDTV Profit that he is avoiding investing in the semaglutide space as the sector currently lacks clarity on future market leaders.

India is expected to invite bids by January for establishing rare earth permanent magnet (REPM) manufacturing facilities under a Rs 7,280-crore incentive scheme, according to a report.

The government will notify the scheme this month and begin pre-bid consultations shortly, they added. “We are hoping to call bids by January-end,” a senior official told the Economic Times. The draft guidelines will be released for stakeholder comments before the final notification, the official said.

Vodafone Idea Ltd.'s stock surged more than 4% on Wednesday amid speculation of possible relief on adjusted gross revenue dues by year-end. The company, however, clarified in an exchange filing that it has already addressed the AGR matter in previous disclosures and will update exchanges only if there are further developments.

The shares of India's state-run lenders fell on Wednesday after the Finance Ministry clarified on increasing the Foreign Direct Investment (FDI) limit within the sector. The decline was led by Indian Bank Ltd. and Punjab National Bank Ltd.

The government has dismissed expectations of a hike in foreign direct investment (FDI) limits for public sector banks (PSBs), confirming that the cap will remain unchanged at 20%. This means no fresh foreign inflows will be enabled for state-owned lenders despite earlier market speculation of an increase to 49%.

The shares of India's state-run lenders fell on Wednesday after the Finance Ministry clarified on increasing the Foreign Direct Investment (FDI) limit within the sector. The decline was led by Indian Bank Ltd. and Punjab National Bank Ltd.

The government has dismissed expectations of a hike in foreign direct investment (FDI) limits for public sector banks (PSBs), confirming that the cap will remain unchanged at 20%. This means no fresh foreign inflows will be enabled for state-owned lenders despite earlier market speculation of an increase to 49%.

Vedanta Ltd. share price snapped a six-day gaining streak after it hit a new high. The share price rose to a fresh high of Rs 541.05 apiece.

Vedanta Ltd. share price snapped a six-day gaining streak after it hit a new high. The share price rose to a fresh high of Rs 541.05 apiece.

The shares of Bank of Maharashtra fell nearly 2% extending its decline for the fifth day as the offer-for-sale opens for the retail investors on Wednesday.

The government aims to sell up to 6% stake in Bank of Maharashtra via an offer-for-sale. While the government will divest 5% equity in the bank it has offered an additional 1% as a green shoe option.

Macquaarie maintained an Outperform rating and hiked a target price to Rs 500 from Rs 480

The brokerage sees 10%+ cigarette EBIT growth in FY27E

Believe concerns on high per-stick taxes shared in draft excise document are misplaced

Such rates represent the cap and not the applicable rates

See potential moderation in discounting post move to GST as % of retail price, and moderation in leaf tobacco costs

Believe re-rating needs clarity that cigarette tax will not increase materially post levy of new cess

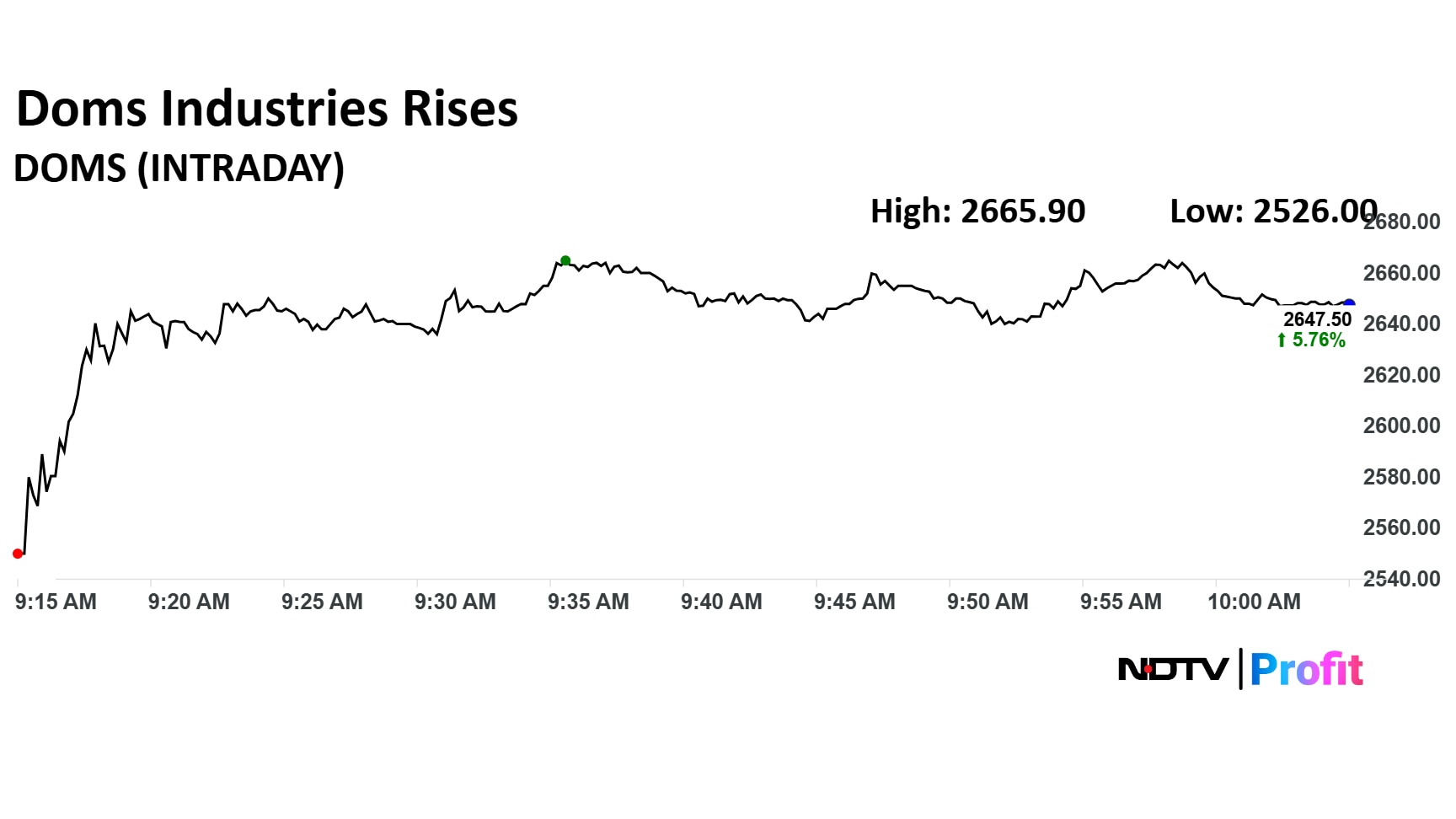

Doms Industries Ltd. share price 6.49% to Rs 2,665.90 apiece, the highest level since Sept 5. It was trading 5.42% higher at Rs 2,640.10 apiece as of 10:07 a.m.

Doms Industries Ltd. share price 6.49% to Rs 2,665.90 apiece, the highest level since Sept 5. It was trading 5.42% higher at Rs 2,640.10 apiece as of 10:07 a.m.

Infrastructure Leasing and Financial Services Ltd. is set to seek a fresh valuation for its headquarters in Mumbai’s Bandra Kurla Complex (BKC), with expectations of a 25% jump in the property’s worth after the National Company Law Tribunal (NCLT) allowed a revision to reflect the sharp surge in real-estate prices in the financial district, ET reported quoting sources.

In November, 2025 demand picked up in second half of the month, leading to high single digit year-on-year volume growth, B&K Securities Channel Checks indicated.

Demand outlook for December 2025 remains positive.

Dealers expect companies to attempt a Rs 10-15 per bag price hike next week to restore post-GST pricing levels.

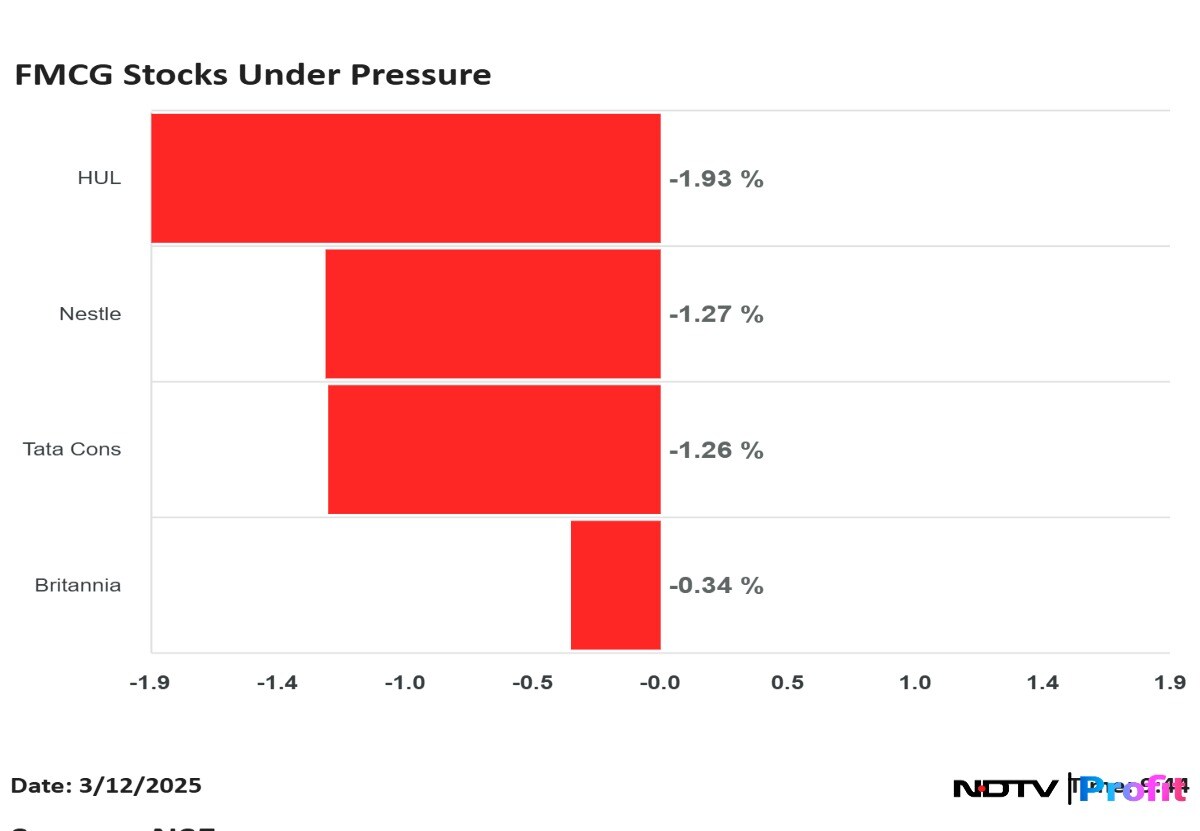

Hindustan Unilever Ltd., Nestle India Ltd., Tata Consumer Products Ltd., and Britannia Industries Ltd. shares plunged.

Hindustan Unilever Ltd., Nestle India Ltd., Tata Consumer Products Ltd., and Britannia Industries Ltd. shares plunged.

"RBI intervention seems to be not aggressive as of now, monetary policy important to watch as close call this time because of higher GDP print of 8.2% and lower CPI of 0.25%. In case of a rate cut, it invites capital outflows and thus may exert some pressure on rupee. New broader range is 88.81–90.60"Kunal Sodhani, Head, Treasury, Shinhan Bank

"The rupee’s slide toward the 90 mark has turned hedging meaningfully more expensive, with forward premiums jumping as both corporates and speculators rushed to lock in protection against further weakness. The 1-year USD/INR forward premium climbed 7 bps on Tuesday — over 12 bps in just three sessions — while the 1-month premium spiked to a seven-month high near 19.5 paisa. This move is being driven by a blend of genuine hedging demand and growing speculative appetite, reflecting conviction that the RBI may allow a deeper adjustment after letting the currency slip past the heavily defended 88.80 level."Ritesh Bhanshali, Director, Mecklai Financial Services

RBI has let the rupee find its own market level

RBI will intervene selectively to soothe volatility, but won’t control levels

Rupee may see 90.50 level

US-India trade deal is the most important trigger for rupee appreciation

Source: Forex traders to NDTV Profit

On National Stock Exchange, seven sectoral indices fall, four indices remain flat, and four advanced out of 15.

On National Stock Exchange, seven sectoral indices fall, four indices remain flat, and four advanced out of 15.

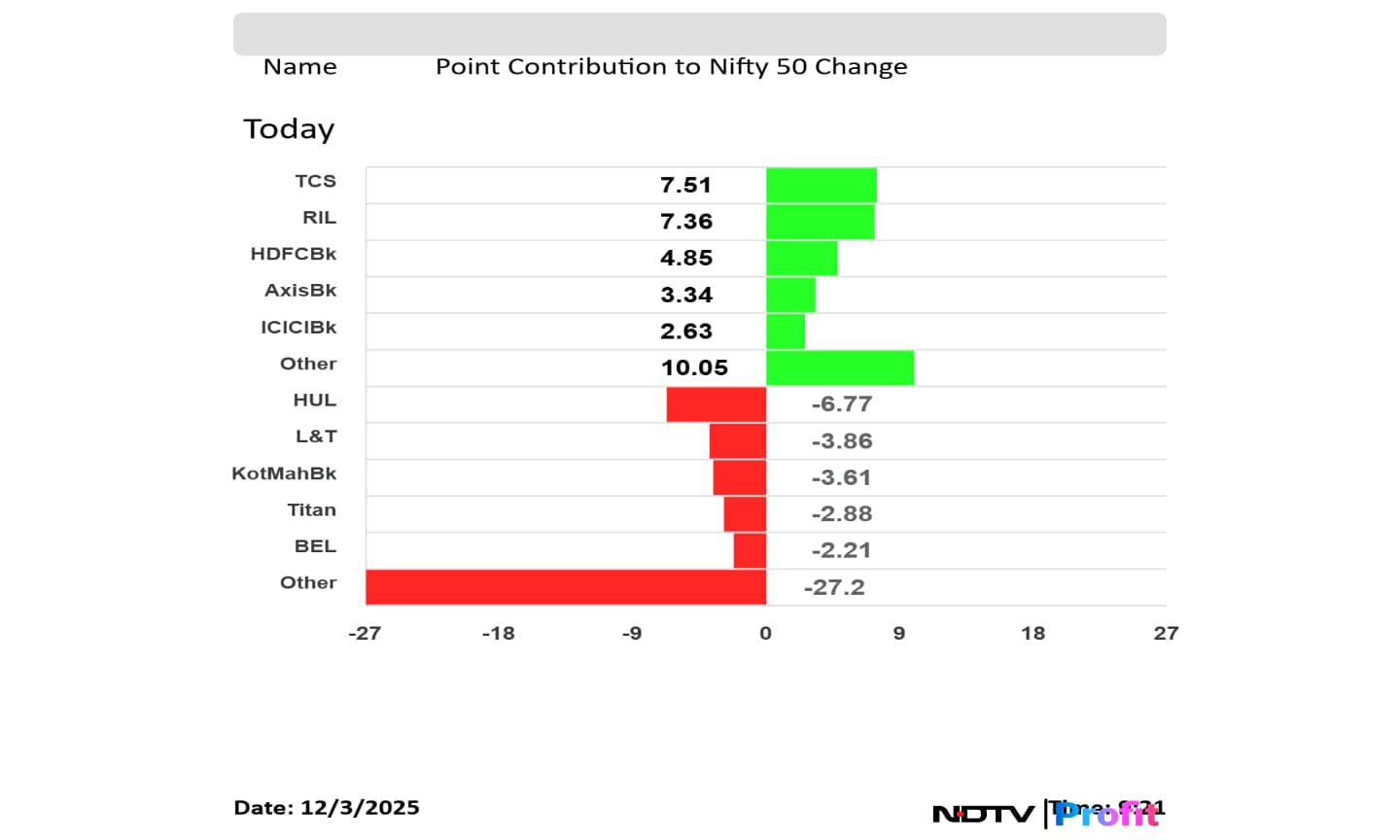

Hindustan Unilever Ltd., Larsen & Toubro Ltd., Kotak Mahindra Bank Ltd., Titan Co Ltd., Bharat Electronics Ltd. weighed on the NSE Nifty 50 index.

Tata Consultancy Services Ltd., Reliance Industries Ltd., HDFC Bank Ltd., Axis Bank Ltd., and ICICI Bank Ltd. supported the NSE Nifty 50.

Hindustan Unilever Ltd., Larsen & Toubro Ltd., Kotak Mahindra Bank Ltd., Titan Co Ltd., Bharat Electronics Ltd. weighed on the NSE Nifty 50 index.

Tata Consultancy Services Ltd., Reliance Industries Ltd., HDFC Bank Ltd., Axis Bank Ltd., and ICICI Bank Ltd. supported the NSE Nifty 50.

The NSE Nifty 50 and the BSE Sensex opened flat as market participants may remain on the sidelines, awaiting outcome of the Reserve Bank of India's Monetary Policy Committee meet. The indices were trading on a mixed note. The Nifty 0.08% down, while the Sensex 0.06% higher.

The NSE Nifty 50 and the BSE Sensex opened flat as market participants may remain on the sidelines, awaiting outcome of the Reserve Bank of India's Monetary Policy Committee meet. The indices were trading on a mixed note. The Nifty 0.08% down, while the Sensex 0.06% higher.

The rupee breached psychologically crucial mark of 90 per dollar mark at open on Wednesday. The Indian currency slumped 25 paise to a new low of 90.13 against US dollar.

Rupee opened 17 paise at new low of 90.05 against US Dollar

It closed at 89.88 a dollar on Tuesday

Source: Bloomberg

The Adani Group plans to invest $15 billion to boost passenger capacity at its airports to 200 million annually in the next five years, people familiar with the matter said, helping power India’s aviation boom as it prepares to list its airport unit.

Read the full Bloomberg article here.

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

"Despite profit taking in past two trading sessions amid volatile Asian peers, Nifty's chart structure is well positioned on multiple time frames till it is trading above 25,800-25,750 spot zones on closing basis. Hence, we suggest for the ongoing dip to over to buy again and also recommend to adopt a stocks specific trading approach."Vipin Kumar, Assistant Vice President Technical and Derivatives Research, Globe Capital Market

"Technically, the trend stays bullish but overstretched; Nifty faces hurdles at 26,326 with make-or-break support at 25,951, signalling a choppy phase ahead."Prashanth Tapse , Senior Vice President, Research Mehta Equities

"After a subdued opening, Nifty 50 remained under mild pressure throughout the session and consolidated within the 26,050–26,000 zone. The index lacked follow-through buying and closed near the lower end of the day’s range, reflecting short-term caution among traders. Immediate resistance is now placed at 26,130–26,200, while the major hurdle continues to remain at 26,300, where heavy Call writing is concentrated. A decisive breakout above 26,300 could trigger a broader range expansion and open the path toward 26,500."Ponmudi R, CEO Enrich Money

Tensions between Donald Trump and Federal Reserve Chair Jerome Powell continue to simmer as the US president drops fresh hints about who might lead the central bank once Powell’s term expires in May next year.

After Finance Minister Nirmala Sitharaman said that the ministry does not give any directive to the Life Insurance Corp of India for investing in a particular company, Economist Manish Barriarr and Political Analyst Tehseen Poonawalla spoke about India's largest insurance company's investment strategy. Both of them spoke to news agency ANI.

Adani Enterprises Ltd.'s step-down arm Astraan Defence allotted 49% stake to joint venture partner MSM Group. The holding company Agneya System's stake in ADL now diluted to 51% stake

Silver steadied near a record after rallying about 17% over the previous seven sessions as traders piled into bets for lower interest rates, while the market faced ongoing supply tightness. Gold was flat.

Investors are wagering that a new Federal Reserve chair and the release of delayed US economic data this month will support President Donald Trump’s calls for monetary easing. The recent gains in precious metals reflect the potential for cuts to gather pace after Jerome Powell’s term ends in May.

Read the full Bloomberg article here.

Indian Railway Finance Corp Ltd., Motilal Oswal Financial Services Ltd., HDFC Life Insurance Ltd., Canara Bank Ltd. and Vodafone Idea Ltd. are some of the stocks to watch on Tuesday.

Get more details here.

VGold prices in India saw a minor decline to Rs 1,29,770 and silver was down at Rs 1,81,400 on Wednesday, according to the India Bullion Association as of 6:50 a.m. However, silver in the spot market rose near its record high as traders expect lower interest rates while market faced ongoing supply tightness.

Markets in Japan, South Korea, and Australia advanced on Wednesday morning tracking overnight modest gains on Wall Street. US stocks rose as risk-on sentiment revived after cryptocurrency recovered above $90,000 level.

The Nikkei 225 and KOSPI were trading 0.79% and 1.10% higher, respectively as of 6:53 a.m.

The GIFT Nifty was trading 0.06% or 16.50 points lower at 26,190 as of 2:44 a.m., which implied a slight lower open for the NSE Nifty 50 index.

Traders will keep an eye on Hindustan Copper Ltd., Indian Railway Finance Corp Ltd., Vodafone Idea Ltd. and Chalet Hotels Ltd. share prices.

The benchmark indices fell for the third straight day on Tuesday. The Nifty closed 0.55% lower at 26,032.20, whereas the Sensex closed 0.59% lower at 85,138.27.

Profit-booking in private banks weighed on the indices, overshadowing Monday's record intraday highs.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.