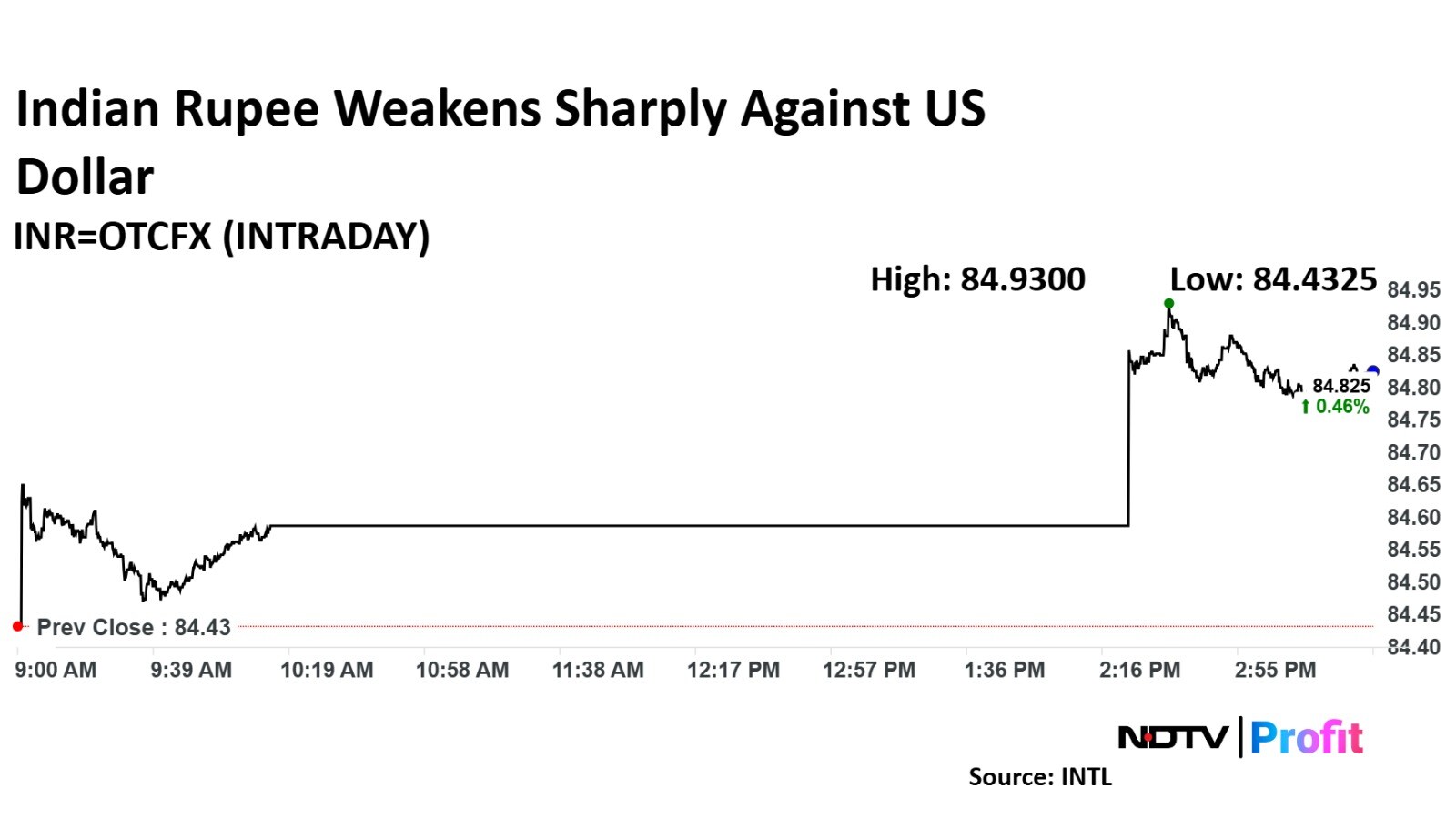

Rupee closes 39 paise weaker at 84.83 against US Dollar

It closed at 84.44 a dollar on Tuesday

Source: Bloomberg

Rupee closes 39 paise weaker at 84.83 against US Dollar

It closed at 84.44 a dollar on Tuesday

Source: Bloomberg

The NSE Nifty 50 and BSE Sensex erased losses in the second half to end slightly higher

The Nifty 50 and Sensex ended 0.14% and 0.15% higher, respectively.

The Nifty Auto is the best performer. It ended 1.66% higher at 23,114.10

The Nifty Defence declined the most. It ended 1.01% down at 6,393.95.

On NSE, X number of sectoral indices ended higher, and X lower out of 15

The NSE Nifty Midcap 150 ended 1.51% higher at 19,943.65.

The NSE Nifty Smallcap 250 ended 1.19% higher at 15,362.70.

The NSE Nifty 50 and BSE Sensex erased losses in the second half to end slightly higher

The Nifty 50 and Sensex ended 0.14% and 0.15% higher, respectively.

The Nifty Auto is the best performer. It ended 1.66% higher at 23,114.10

The Nifty Defence declined the most. It ended 1.01% down at 6,393.95.

On NSE, X number of sectoral indices ended higher, and X lower out of 15

The NSE Nifty Midcap 150 ended 1.51% higher at 19,943.65.

The NSE Nifty Smallcap 250 ended 1.19% higher at 15,362.70.

Reliance Power has announced the allotment of 1.05 crore shares, valued at Rs 348 crore, following the conversion of warrants. This information was disclosed in an exchange filing.

Apcotex Industries Ltd. share price jumped 14.62% to Rs 350 apiece. The company reported 9.4% on-the year rise in its net profit during January–March.

Apcotex Industries Ltd. share price jumped 14.62% to Rs 350 apiece. The company reported 9.4% on-the year rise in its net profit during January–March.

Lloyds Engineering Ltd. share price pared most gains from day's high as it reported a 20% fall in net profit during January–March. The share price rose 3.69% to Rs 53.90 apiece so far today. It was trading 2.15% higher at Rs 53.08 apiece as of 2:41 p.m.

Lloyds Engineering Ltd. share price pared most gains from day's high as it reported a 20% fall in net profit during January–March. The share price rose 3.69% to Rs 53.90 apiece so far today. It was trading 2.15% higher at Rs 53.08 apiece as of 2:41 p.m.

Reacting to the strikes carried out by India on nine terrorist bases in Pakistan on Wednesday, Vallabh Bhansali, founder and chairman, Enam Holdings, said that the move had both — aim to weaken the enemy on a long-term basis and avoidance of war — as the country only attacked targeted entities.

He noted that India's Operation Sindoor's success coincides with execution of free trade agreement with the UK. It gives the picture that India continues to remain a growth story, Bhansali said.

Read the full article here.

Sapphire Foods Q4 Highlights (Consolidated, YoY)

Revenue up 12.6% to Rs 711 crore versus Rs 632 crore.

Ebitda up 3% to Rs 106 crore versus Rs 103 crore.

Margin at 15% versus 16.3%.

Net profit down 25% to Rs 1.8 crore versus Rs 2.4 crore.

Get live updates here.

Lloyds Engineering shares rise over 3% after fourth quarter results.

Lloyds Engineering Q4 Highlights (Standalone, YoY)

Revenue down 5% to Rs 178.48 crore versus Rs 187.90 crore.

Net profit down 20% to Rs 16.87 crore versus Rs 21.13 crore.

Gensol did not get any relief in appeal against SEBI order. SAT has asked SEBI to give a confirmatory order for Gensol in four weeks.

In addition, two weeks are given to Gensol to reply to SEBI interim order.

Company failed to reply to SEBI's order before filing an appeal.

On April 15 SEBI barred Gensol Engineering and its promoters from markets. This was due to fund diversion, governance concerns.

The shares of the company continue to be locked in lower circuit.

Trimax Biosciences got certificate of suitability from EDQM for Metformin Hydrochloride. EDQM stands for European Directorate For The Quality Of Medicines & Health Care, the company said in an exchange filing.

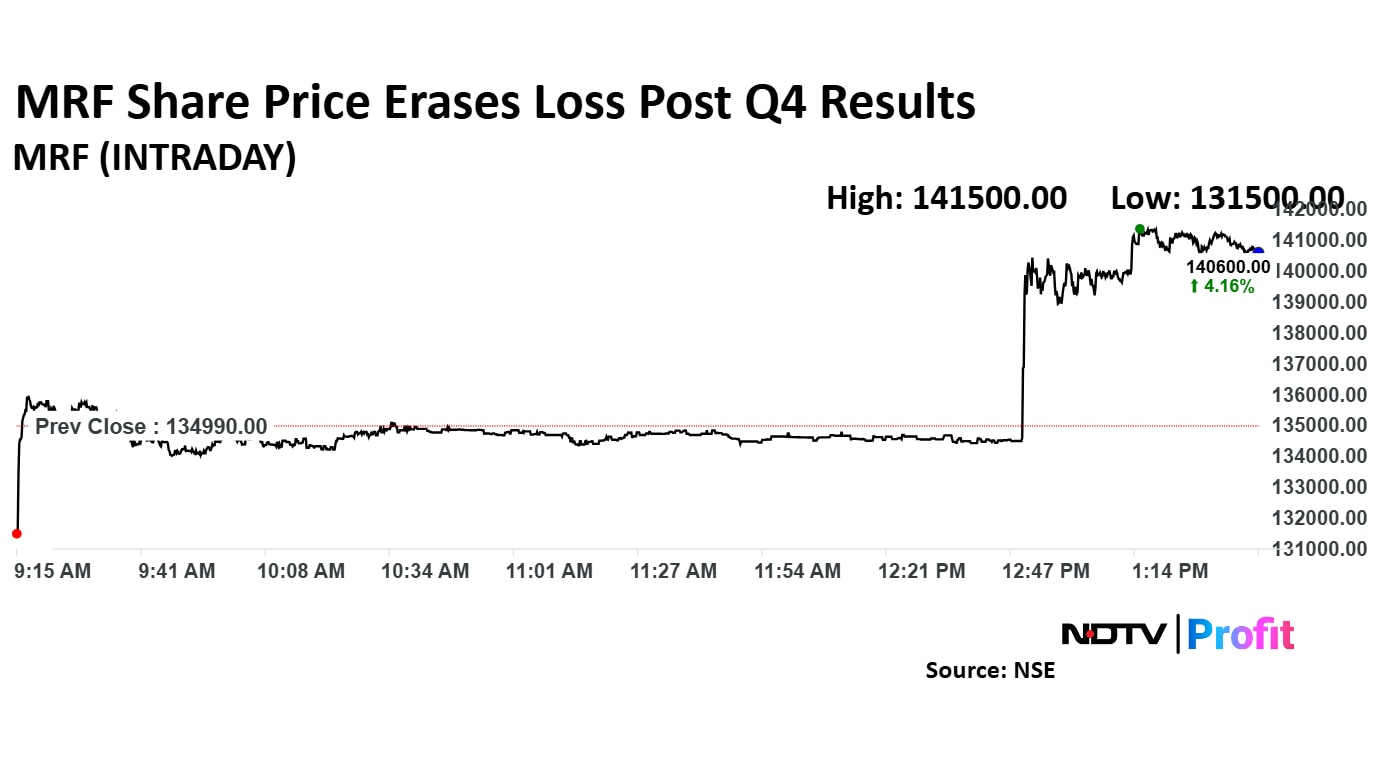

MRF Ltd. share price rose 4.82% to Rs 1,41,500 after the company reported a 29.3% on the year increase in its net for January–March.

For faster updates on fourth quarter earning click here.

MRF Ltd. share price rose 4.82% to Rs 1,41,500 after the company reported a 29.3% on the year increase in its net for January–March.

For faster updates on fourth quarter earning click here.

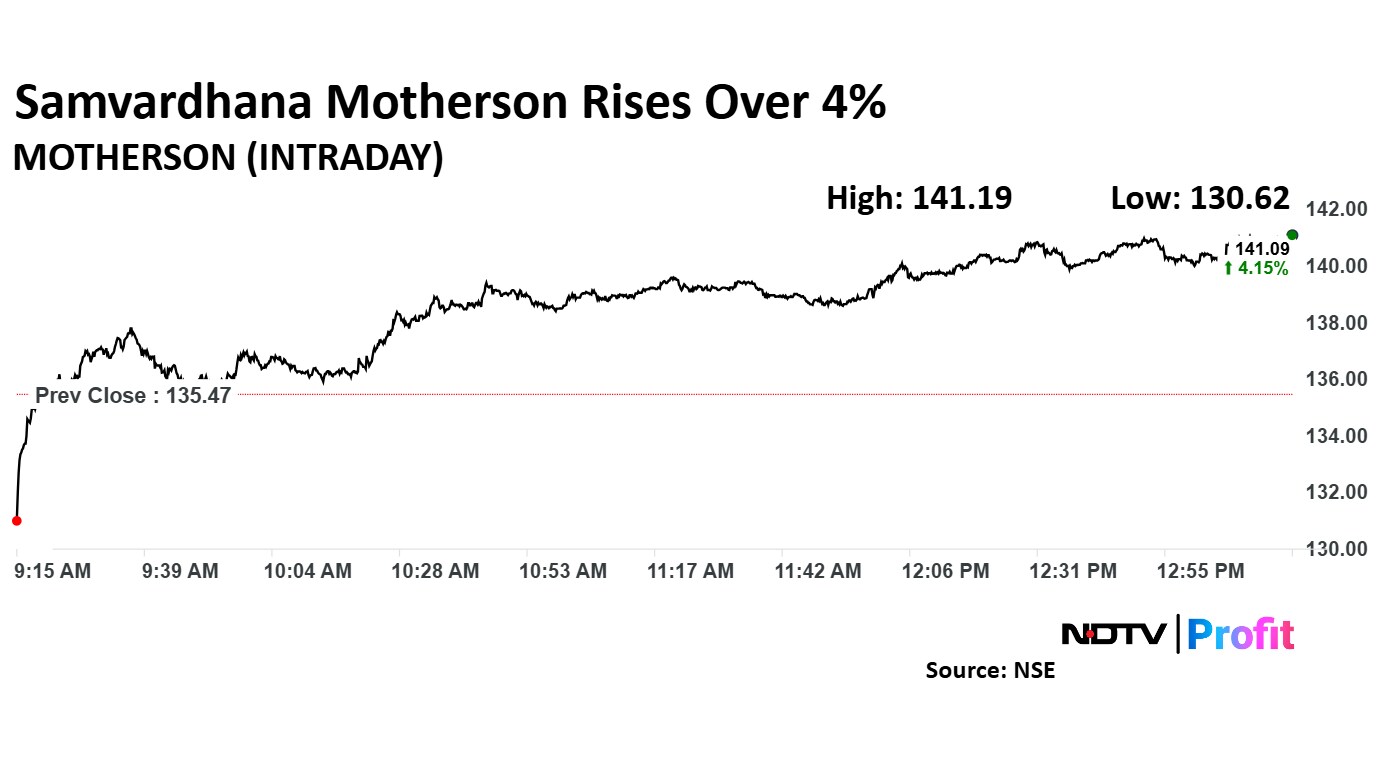

Samvardhana Motherson Internation Ltd. share price rose 4.22% to Rs 141.19 apiece, the highest level since Feb 4. It was trading 4.07% higher at Rs 141.02 apiece as of 1:24 p.m.

Samvardhana Motherson Internation Ltd. share price rose 4.22% to Rs 141.19 apiece, the highest level since Feb 4. It was trading 4.07% higher at Rs 141.02 apiece as of 1:24 p.m.

Oil India Ltd's board has approved an 18% equity participation in a joint venture for an Ammonia-Urea Complex in Assam. Additionally, the board has given the green light to incorporate a wholly owned subsidiary at GIFT City.

Shares of Ather Energy Ltd. debuted on the National Stock Exchange at Rs 328 apiece, at a premium of 2.18%. The stock listed on the BSE at Rs 326.05 per share, marking a premium of 1.57% over the issue price of Rs 321.

Website usage restricted for overseas users after discussion between exchange representatives and SEBI officials

Webiste usage likely to have been restricted after government directive on the same

Website access likely restricted over heightened threat of cyber and digital attacks

Restriction of NSE & BSE websites does not affect trading activity

Individual overseas users are allowed to contact exchanges to remove restrictions on their IP addresses

Suven Pharmaceuticals Ltd. has received government approval to change its name to 'Cohance Lifesciences Limited.' This update was officially communicated through an exchange filing.

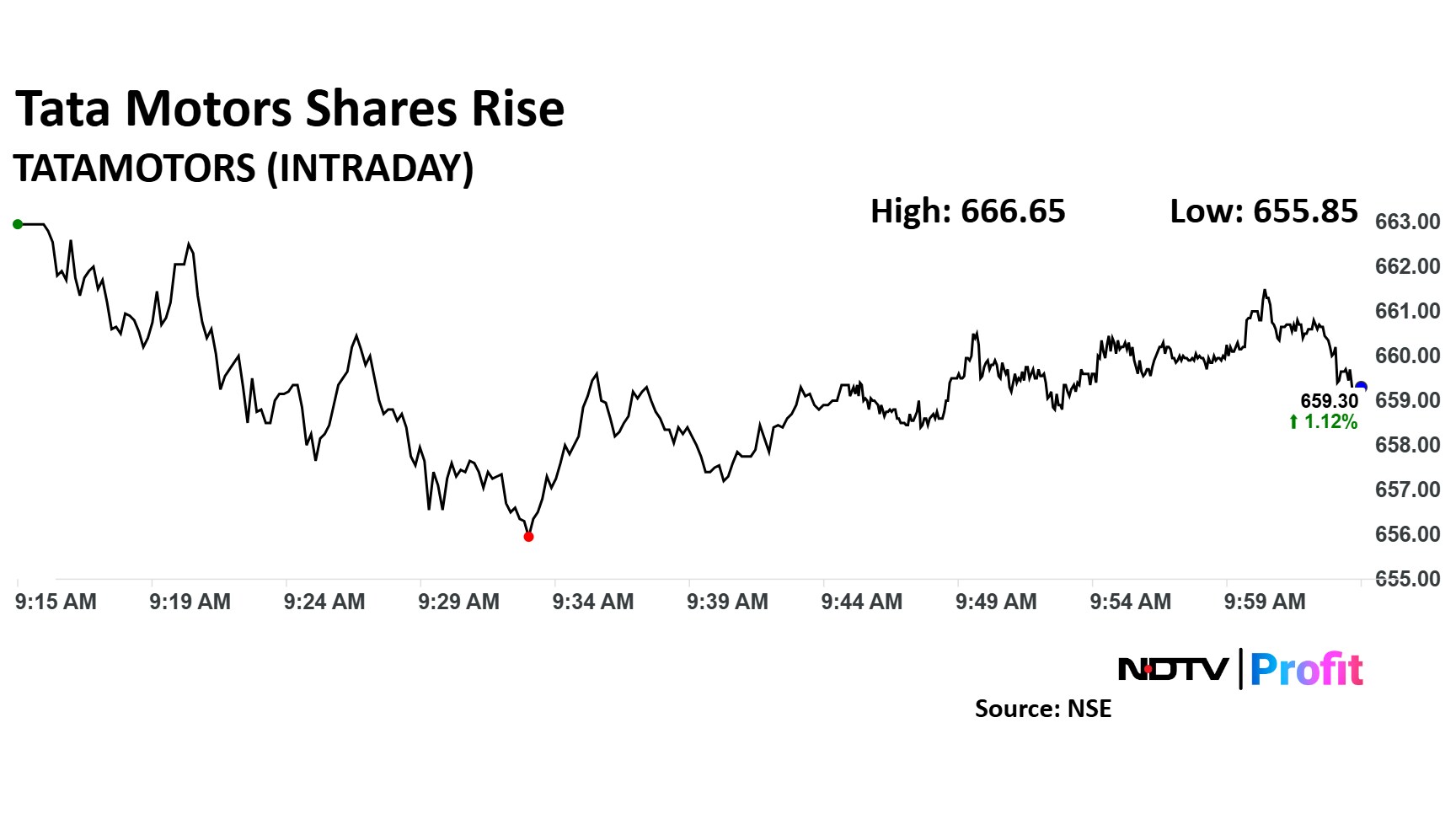

Shares of Tata Motors Ltd. rose over 2% in early trade on Monday, after its UK subsidiary, Jaguar Land Rover, resumed exports to the United States, after a month-long pause, despite an auto tariff still in place.

Read the full article here.

Shares of Tata Motors Ltd. rose over 2% in early trade on Monday, after its UK subsidiary, Jaguar Land Rover, resumed exports to the United States, after a month-long pause, despite an auto tariff still in place.

Read the full article here.

Pakistan’s stock markets tumbled on Wednesday as investors reacted sharply to India’s military operation — called Operation Sindoor — in response to the deadly April 22 terror attack in Pahalgam, Jammu and Kashmir.

The benchmark KSE-30 index dropped more than 6%, while the broader KSE-100 index plunged as much as 5.7% in early trade before trimming some of its losses. The sharp selloff underscores investor concerns over a potential military escalation between the two nuclear-armed neighbours.

Read the full article here.

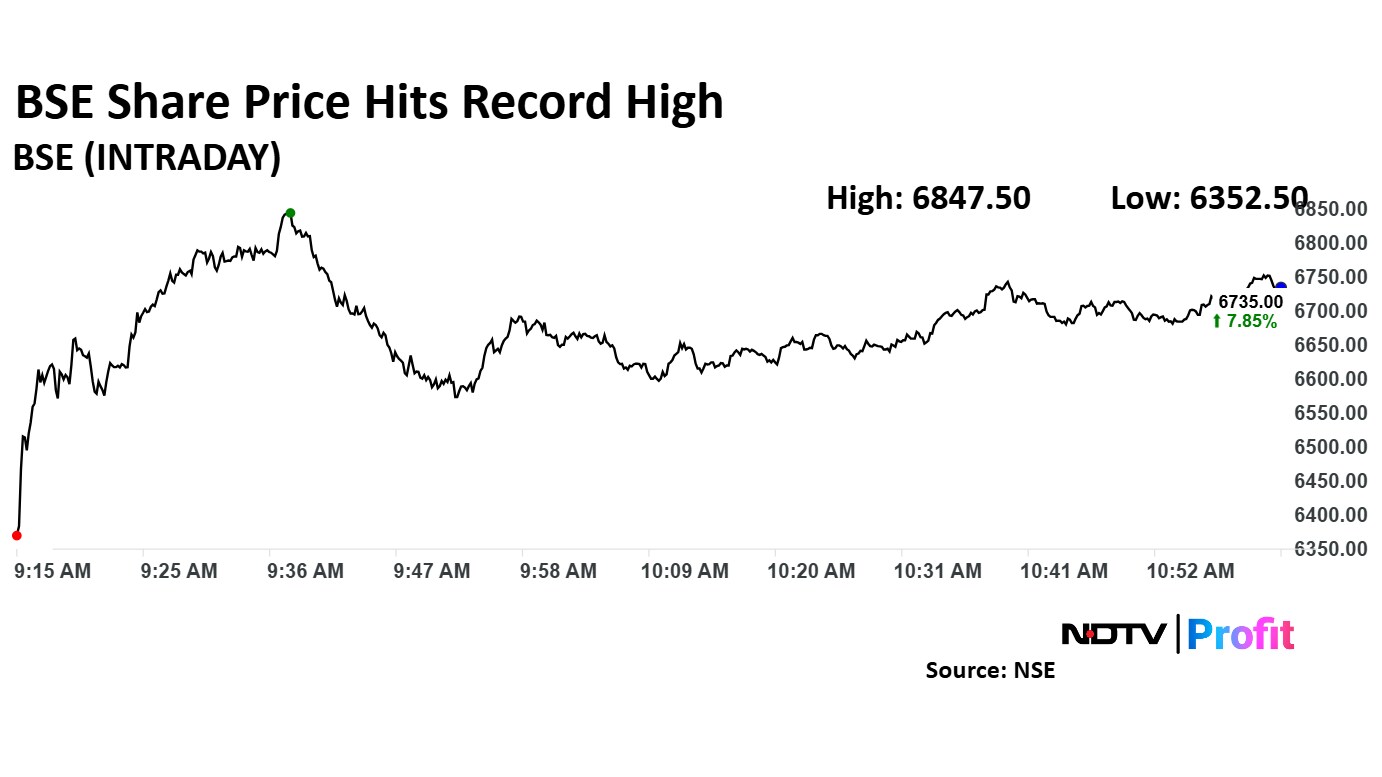

BSE Ltd. share price jumped 9.65% to record high of Rs 6,847.50. BSE reported 127% on the year surge in its consolidated net profit during January–March.

BSE Ltd. share price jumped 9.65% to record high of Rs 6,847.50. BSE reported 127% on the year surge in its consolidated net profit during January–March.

In wee hours of Wednesday, India hit nine terror bases in Pakistan in retaliation of the deadly terrorist attack in Pahalgam, Kashmir on April 22, the Ministry of Defence said in a release. The Ministry presented details of the strike in press briefing. However, officials did not entertain questions from media.

To track live updates on Operation Sindoor click here.

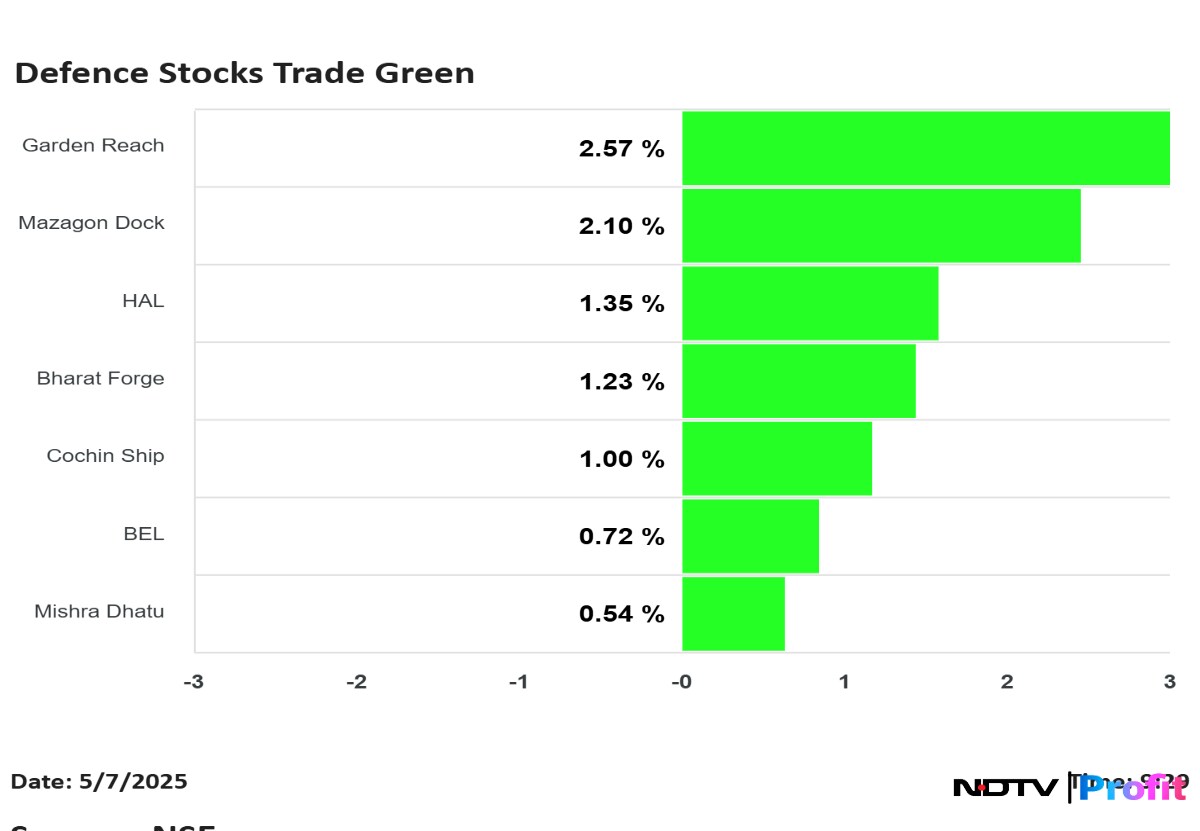

Defence counters, including Garden Reach Shipbuilders & Engineers Ltd., Mazagon Dock Shipbuilders Ltd., Hindustan Aeronautics Ltd. and Bharat Forge Ltd. rose in early trade on Wednesday, as broader markets traded on a muted note.

This development comes in the wake of rising geopolitical tensions. In the early hours of Wednesday, India had targeted terrorist infrastructures in Pakistan in precision strikes, in response to the Pahalgam terror attacks.

Defence counters, including Garden Reach Shipbuilders & Engineers Ltd., Mazagon Dock Shipbuilders Ltd., Hindustan Aeronautics Ltd. and Bharat Forge Ltd. rose in early trade on Wednesday, as broader markets traded on a muted note.

This development comes in the wake of rising geopolitical tensions. In the early hours of Wednesday, India had targeted terrorist infrastructures in Pakistan in precision strikes, in response to the Pahalgam terror attacks.

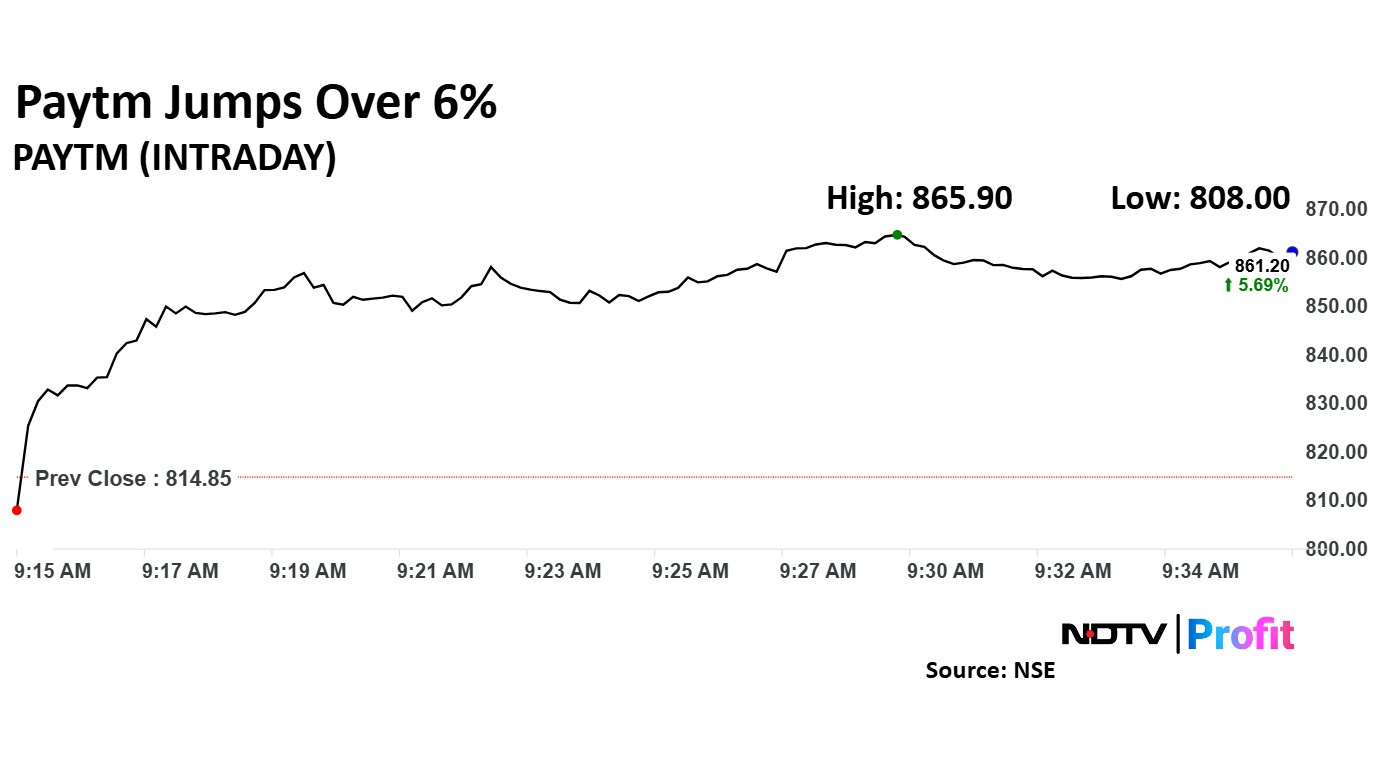

One 97 Communication share price jumped over 6% in Wednesday's session as the company posted a better profitability for January–March despite incurring a one-time loss.

Paytm share price rose 6.26% to Rs 865.90 apiece. It was trading 5.93% higher at Rs 864.85 apiece as of 9:41 a.m.

One 97 Communication share price jumped over 6% in Wednesday's session as the company posted a better profitability for January–March despite incurring a one-time loss.

Paytm share price rose 6.26% to Rs 865.90 apiece. It was trading 5.93% higher at Rs 864.85 apiece as of 9:41 a.m.

With India launching a strike on nine terrorist bases in Pakistan, following rising tensions, investors and businesses are bracing for sharper fallout — not just at the border, but across India’s consumption landscape and financial markets. While past conflicts show markets often recover swiftly, the immediate impact is expected to ripple through key sectors.

Know more here.

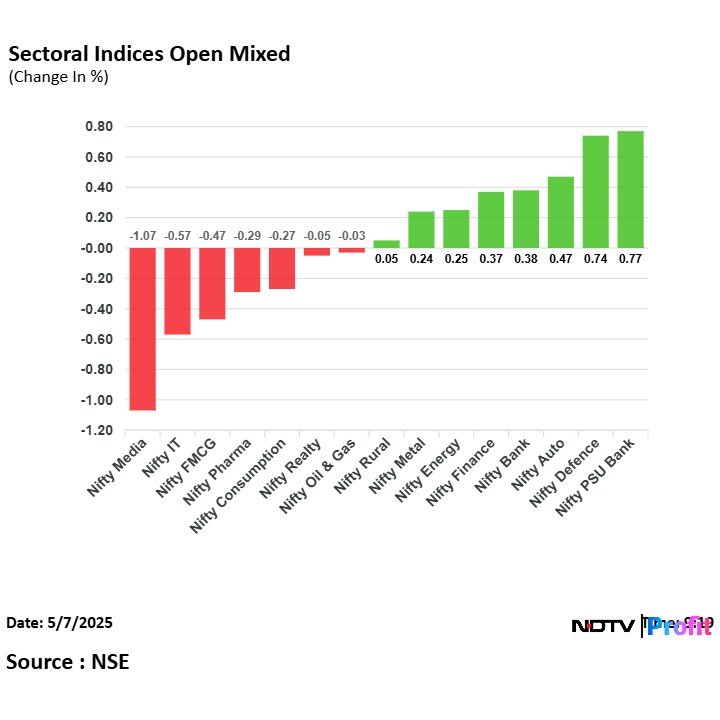

On NSE, eight sectoral indices advanced and seven declined out of 12. The NSE Nifty Media declined the most, and the NSE Nifty PSU Bank rose the most.

On NSE, eight sectoral indices advanced and seven declined out of 12. The NSE Nifty Media declined the most, and the NSE Nifty PSU Bank rose the most.

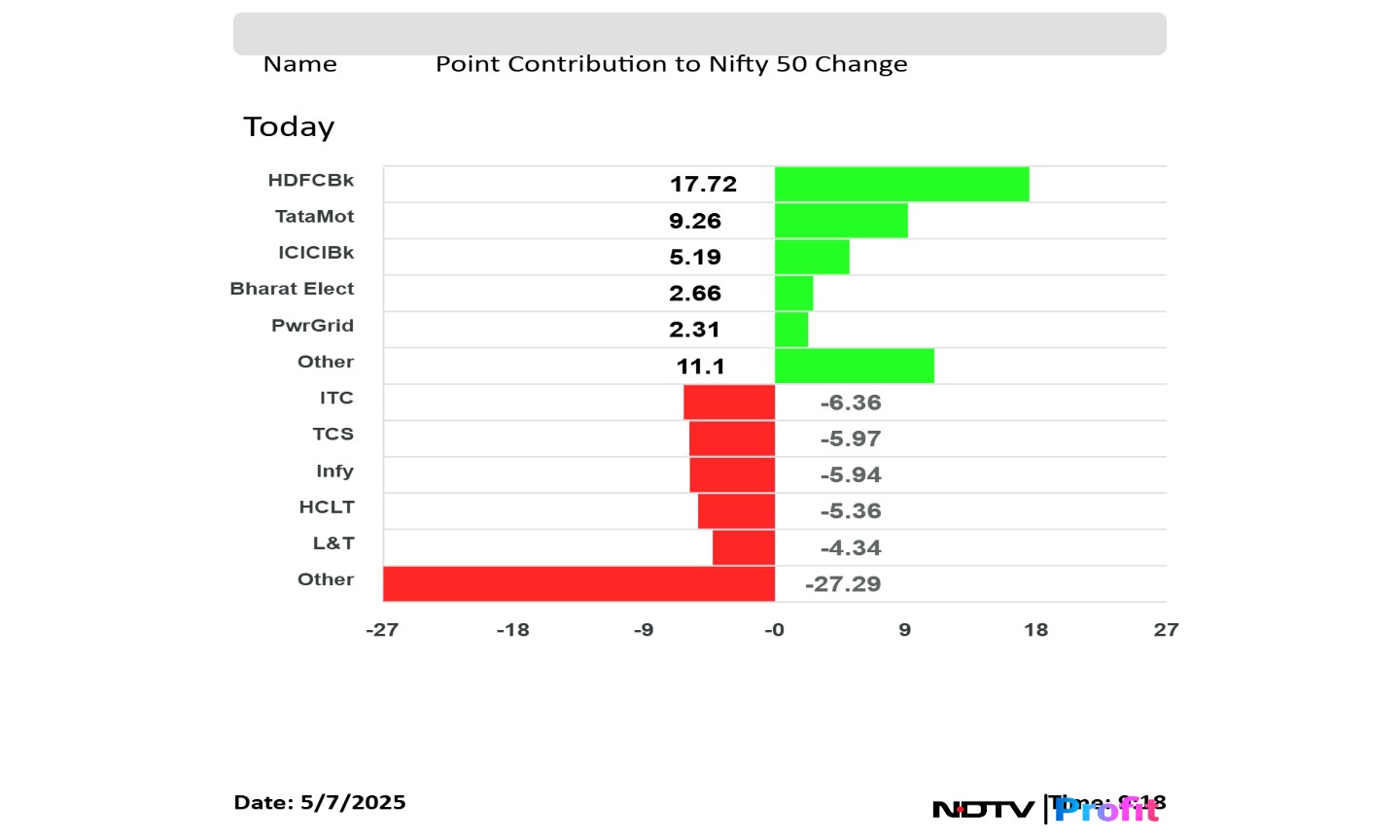

ITC Ltd., Tata Consultancy Services Ltd., Infosys Ltd., HCLTech Ltd., and Larsen & Toubro Ltd. weighed on the Nifty 50 index.

HDFC Bank Ltd., Tata Motors Ltd., ICICI Bank Ltd., Bharat Electronics Ltd., and Power Grid Crop of India added to the Nifty 50 index.

ITC Ltd., Tata Consultancy Services Ltd., Infosys Ltd., HCLTech Ltd., and Larsen & Toubro Ltd. weighed on the Nifty 50 index.

HDFC Bank Ltd., Tata Motors Ltd., ICICI Bank Ltd., Bharat Electronics Ltd., and Power Grid Crop of India added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex extended losses at open from previous session as geopolitical tension between India and Pakistan following the former's strike at terror bases hamper risk-on mood. The Nifty 50 and Sensex opened 0.60% and 0.86% down, respectively.

"A bearish candle on daily charts and a lower top formation on intraday charts indicate further weakness from the current levels. We are of the view that as long as the market is trading below 24,500/81,000, the weak sentiment is likely to continue. On the lower side, the market could retest the level of 24,200/80,000," said Shrikant Chouhan, Head Equity Research, Kotak Securities.

The NSE Nifty 50 and BSE Sensex extended losses at open from previous session as geopolitical tension between India and Pakistan following the former's strike at terror bases hamper risk-on mood. The Nifty 50 and Sensex opened 0.60% and 0.86% down, respectively.

"A bearish candle on daily charts and a lower top formation on intraday charts indicate further weakness from the current levels. We are of the view that as long as the market is trading below 24,500/81,000, the weak sentiment is likely to continue. On the lower side, the market could retest the level of 24,200/80,000," said Shrikant Chouhan, Head Equity Research, Kotak Securities.

At pre-open, the NSE Nifty 50 fell 0.60% to 24,233.30, and the BSE Sensex declined 1.02% to 79,819.95.

The yield on the 10-year bond opened 2 basis points higher at 6.37%

It closed at 6.35% Tuesday

Source: Bloomberg

Rupee weakened 18 paise to open at 84.62 against US Dollar

It closed at 84.44 a dollar on Tuesday

Source: Bloomberg

Welspun Corp has secured additional orders worth Rs 1,950 crore for its India pipes facility since February 2025. This brings the company's current consolidated global order book to Rs 19,300 crore. The newly acquired orders are scheduled to be executed in the fiscal years 2026 and 2027.

Oil prices continued to surge in Asia session after rallying more than 3% in the previous day. Prices rebounded as US and China agreed to meet and discuss tariffs. US and China are one of the largest consumers of crude oil which improved demand outlook for oil at a time when Organization of Petroleum Exporting Countries and Allies are increasing supplies.

The brent crude was trading 0.68% higher at $62.57 a barrel as of 8:43 a.m.

Most markets in Asia-Pacific region were trading with gains in Wednesday's session as US and China will meet for the first time since President Donald Trump imposed protectionist trade policies to discuss tariffs.

Treasury Secretary Scott Bessent and Trade Representative Jamieson Greer will hold talks with Chinese counter parts in Switzerland this week, Bloomberg reported.

China reduced its benchmark seven-day policy rate to 1.4% from 1.5%. The People's Bank of China will also cut reserve requirement ratio by half a percentage point, Governor Pan Gongsheng said in a press briefing, as reported by Bloomberg.

The Hang Seng and CSI 300 were trading 1.32% and 0.47% higher, respectively. The Nikkei 225 was down 0.05% .

US share indices slumped on Wall Street Tuesday as risk-off sentiment prevailed on mixed messages from President Donald Trump. Market participants keenly wait for the outcome of the Federal Reserve policy meeting. The US central bank will likely keep rates steady.

Trump said that he's willing to prescribe concession for partner countries who wants to avoid higher tariffs. Market participants read this comment as an indication of continued change in the stance of White House on tariffs.

On Tuesday, the Dow Jones Industrial Average and S&P 500 ended 0.95% and 0.77% down, respectively. The Nasdaq Composite ended 0.87% down.

An initial drawdown in the Nifty

Followed by a recovery to pre-event levels

Media, Metals and Banks have outperformed

Financials, PSU Banks, Energy held up well

FMCG and IT lagged

Catch live updates on India's Operation Sindoor here.

The GIFT Nifty was trading 0.35% higher at 24,311.50 as of 6:55 a.m., which indicated a higher start for Indian benchmark large-cap gauges. The NSE Nifty 50 and BSE Sensex may also open higher as India sealed a free trade agreement with the UK. Further, Asia-Pacific share indices were trading higher early trade Wednesday on news that US and China will likely negotiate on tariffs this week, will also likely to support Indian indices.

India carried out precision strikes as part of the 'operation sindoor' targeting nine terror bases in Pakistan, the Government of India said in early Wednesday. This came after two weeks of a deadly terrorist attack in Pahalgam, Kashmir which claimed lives of 26 Indian civilians.

Tension between two neighbour countries increased following the strikes, which will likely sour investors' sentiment on concern of geopolitical security.

Traders will keep an eye on Godrej Consumer Products Ltd., KEI Industries Ltd., One 97 Communication Ltd. shares as these companies released their fourth quarter earnings.

India's benchmark equity indices ended higher for the second session in a row on Monday. The NSE Nifty 50 closed 114.45 points or 0.47% higher at 24,461.15, while the BSE Sensex ended 294.85 points or 0.37% up at 80,796.84.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.