Shares of Tata Motors Ltd. rose over 2% in early trade on Monday, after its UK subsidiary, Jaguar Land Rover, resumed exports to the United States, after a month-long pause, despite an auto tariff still in place.

On April 2, an executive order issued by US President Donald Trump actualised a 25% tariff on all foreign carmakers. The import tariff was applicable on fully assembled cars immediately and on auto components from May 3.

As a result, JLR paused its US exports for a month on May 5. Now, with the shipments resuming, the first vehicles are likely to reach American shores by May 20.

“The USA is an important market for JLR's luxury brands and 25% tariffs on autos remain in place,” a spokesperson for the British marquee said in an email on Saturday. “As we work towards addressing the US trading terms with our business partners, we are enacting our planned short-term actions.”

In FY24, US contributed 23% to JLR's revenue and 26% to its wholesale volumes from the US. That jumped to 33% in the nine months through Dec. 31.

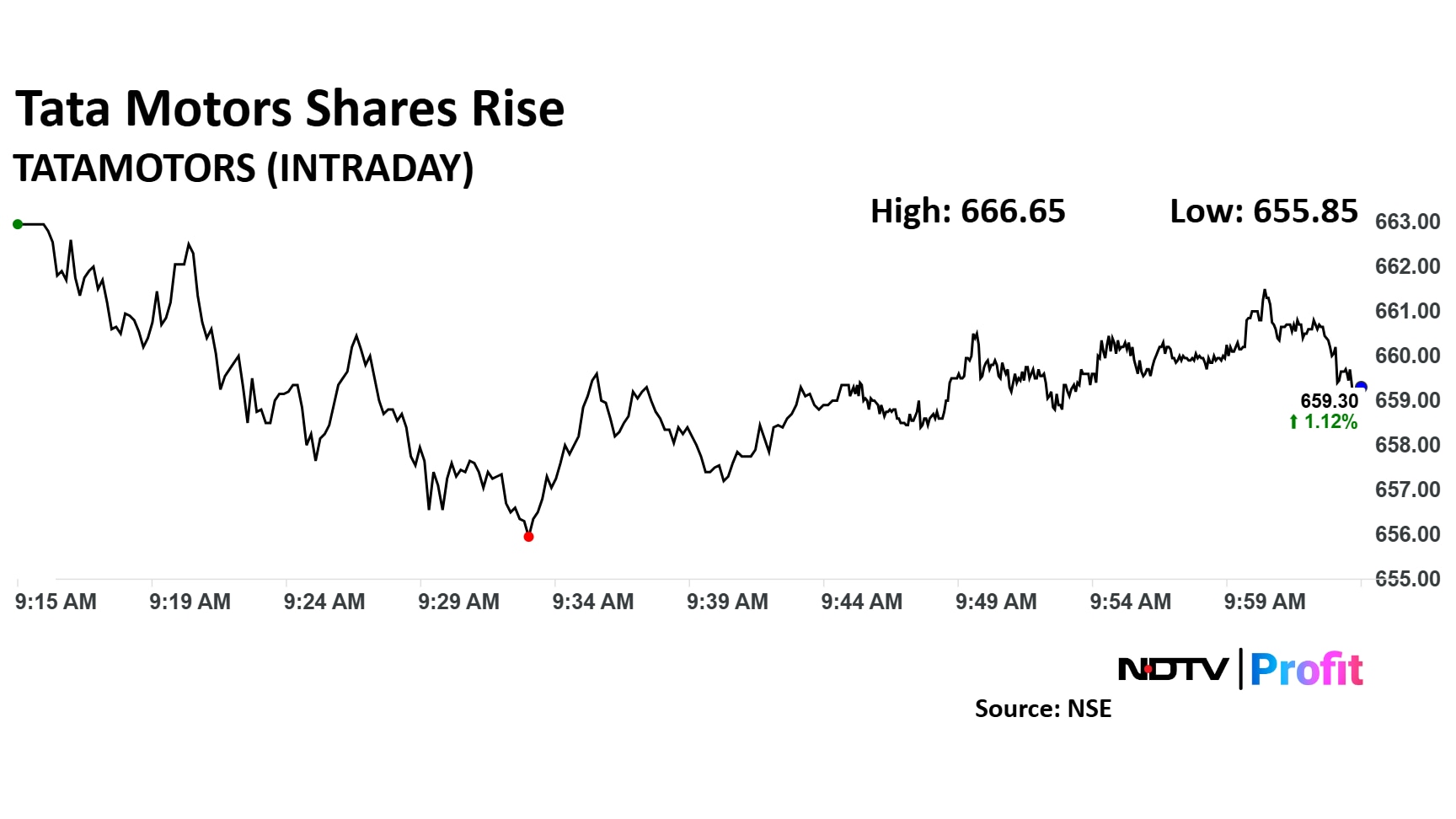

Tata Motors Share Price

Source: NDTV money

The scrip rose as much as 2.25% to Rs 666.65 apiece, the highest level since April 30. It pared gains to trade 0.84% higher at Rs 657.50 apiece, as of 9:45 a.m. This compares to a 0.48% advance in the NSE Nifty 50.

Share price has fallen 10.92% on a year-to-date basis, and 34.96% in the last 12 months. Total traded volume so far in the day stood at 16.13 times its 30-day average. The relative strength index was at 55.95.

Out of 34 analysts tracking the company, 20 maintain a 'buy' rating, eight recommend a 'hold' and six suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 16.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.