Nifty trades above 24,800 mark led by Realty and Pharma

Jio Financial, LT and Reliance Industries gain the most in Nifty.

Asian Paints gains nearly 2% post its Q1 results

Nifty close higher after falling for the last 3 straight sessions

All Sectoral Indices gain in trade barring Nifty Defence

Nifty gains more than 200 points from the day’s low

Nifty Realty gains more than 1.5% for the day, led by Oberoi Realty and Godrej Properties

Realty, Metal, Pharma and Oil and Gas gain more than 1% for the day.

Nifty Realty snaps 5-day losing streak, emerges as top gaining sector for the day.

Nifty Pharma gains for the 5th day in a row.

Nifty Oil and Gas, Financial Services and Nifty Bank snaps 3-day losing streak.

Nifty Metal, Auto, and PSU bank gains after losing for the last 2 sessions.

Nifty Media snaps 5-day losing streak.

Nifty FMCG gains for the second straight session.

Nifty trades above 24,800 mark led by Realty and Pharma

Jio Financial, LT and Reliance Industries gain the most in Nifty.

Asian Paints gains nearly 2% post its Q1 results

Nifty close higher after falling for the last 3 straight sessions

All Sectoral Indices gain in trade barring Nifty Defence

Nifty gains more than 200 points from the day’s low

Nifty Realty gains more than 1.5% for the day, led by Oberoi Realty and Godrej Properties

Realty, Metal, Pharma and Oil and Gas gain more than 1% for the day.

Nifty Realty snaps 5-day losing streak, emerges as top gaining sector for the day.

Nifty Pharma gains for the 5th day in a row.

Nifty Oil and Gas, Financial Services and Nifty Bank snaps 3-day losing streak.

Nifty Metal, Auto, and PSU bank gains after losing for the last 2 sessions.

Nifty Media snaps 5-day losing streak.

Nifty FMCG gains for the second straight session.

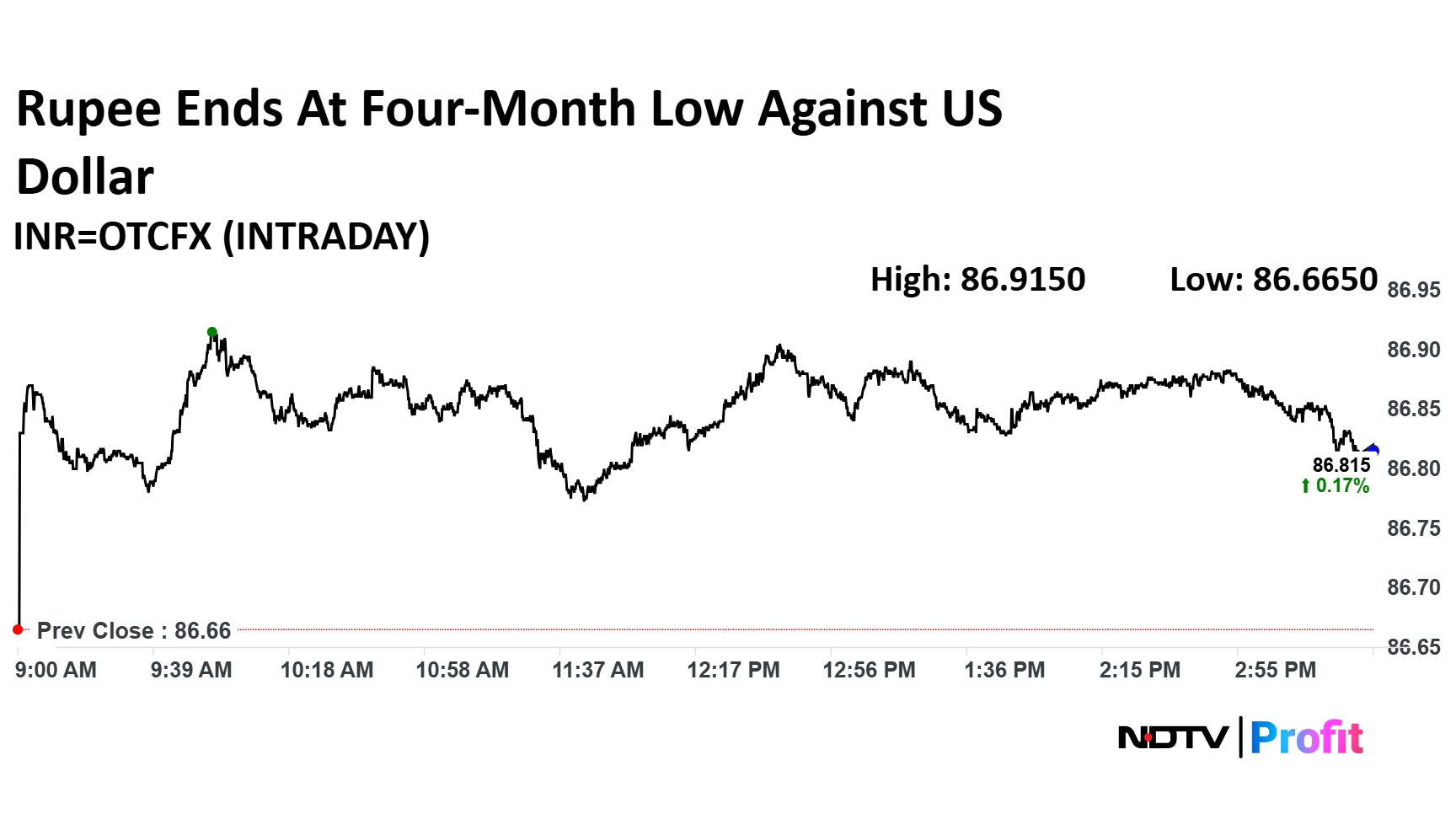

Rupee closed 15 paise weaker at 86.82 against US Dollar

It's the lowest close level since March 13

It closed at 86.67 a dollar on Friday

Source: Cogencis

Rupee closed 15 paise weaker at 86.82 against US Dollar

It's the lowest close level since March 13

It closed at 86.67 a dollar on Friday

Source: Cogencis

MMRDA deposits Rs 560 crore as 50% of the award amount in favour of JV MMOPL, as per Reliance Infrastructure Ltd.'s exchange filing.

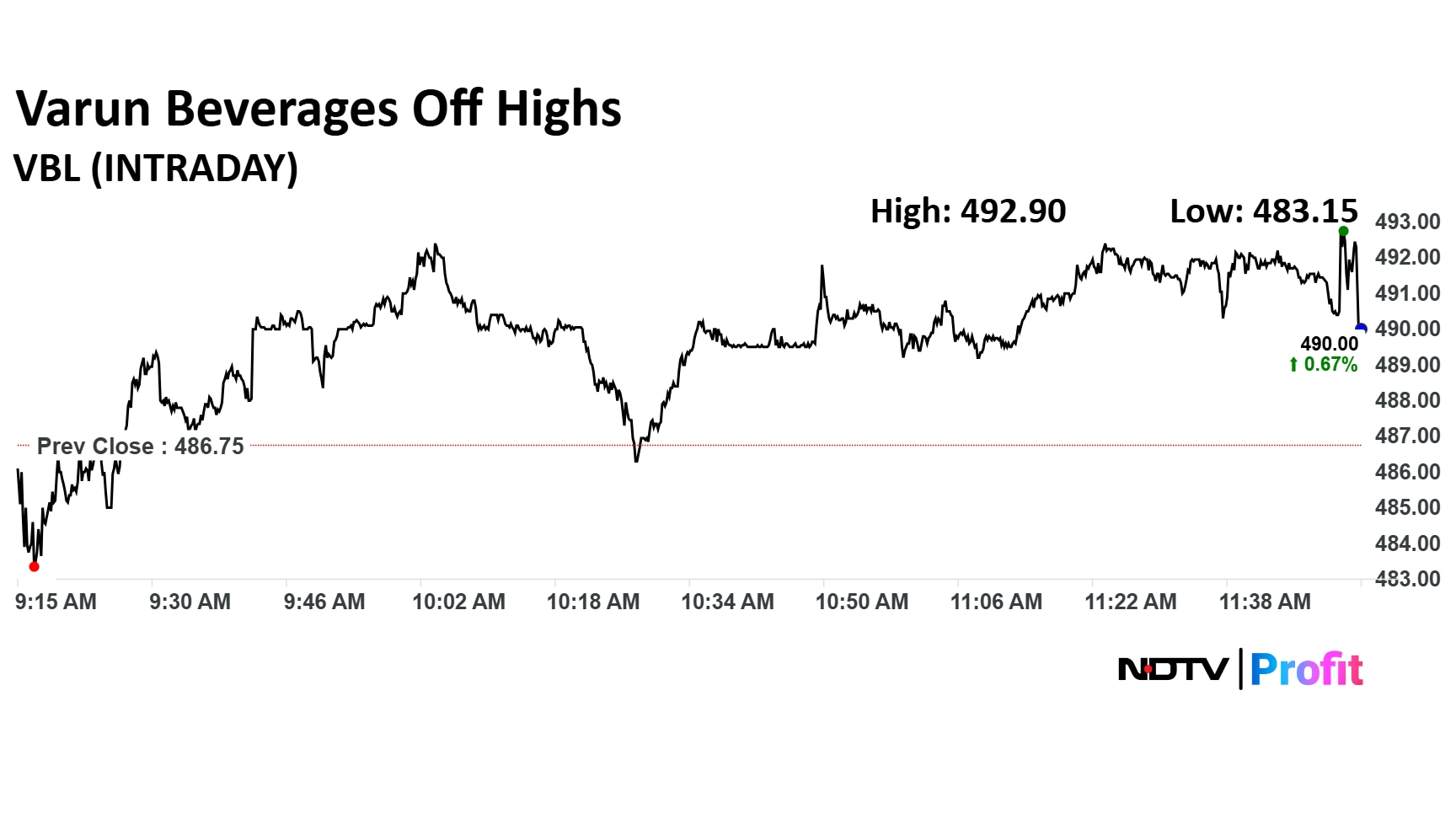

Company ended quarter with a positive PAT growth, despite 3% decline in consolidated sales volumes

Varun Beverages Morocco has commenced commercial production of PepsiCo’s snacks product ‘Cheetos’

Although unseasonal rains have impacted performance during the quarter, we have successfully navigated such challenges in the past and emerged stronger

Robust capacities now operational

Well-positioned to capture emerging opportunities and drive sustainable, long-term value creation for all stakeholders

Peyush Bansal, Shark Tank judge and founder of eyewear company Lenskart Solutions Ltd., is looking to raise approximately Rs 2,837 crore, based on the most recent secondary market transaction he undertook with various investors.

The company has filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) for a fresh issue of Rs 2,150 crore and an Offer for Sale (OFS) of 13.22 crore shares. Based on the July 2025 secondary share transfer price of Rs 52 per share—between Bansal and other investors—the OFS is valued at Rs 688 crore.

Aditya Infotech Ltd.'s initial public offering was fully subscribed on the first day of bidding on Tuesday, led by demand from retail and non-institutional investors.

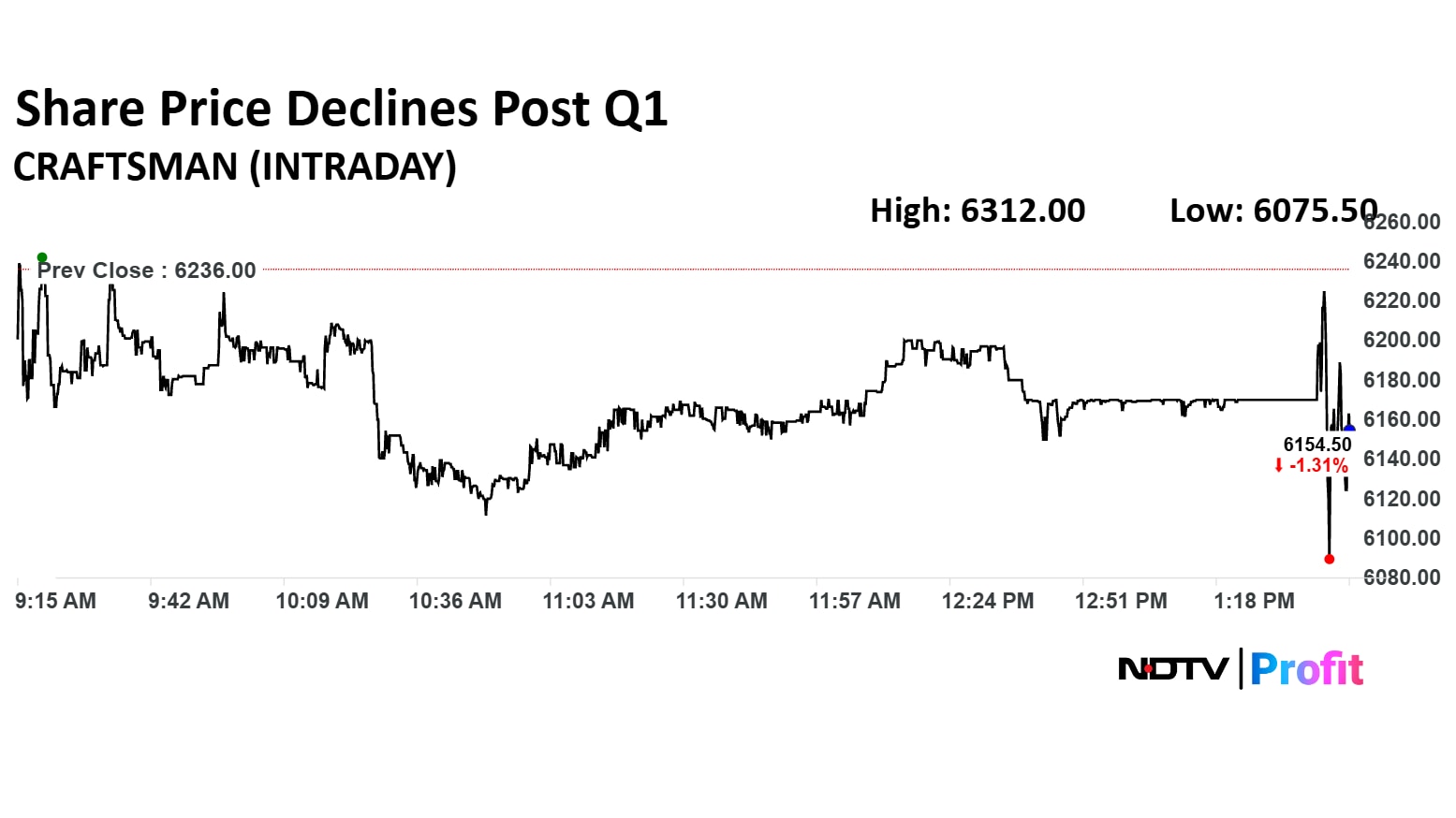

Craftsman Automation share price fell post Q1 results for FY26. The share price fell 1.22% at intraday.

Craftsman Automation share price fell post Q1 results for FY26. The share price fell 1.22% at intraday.

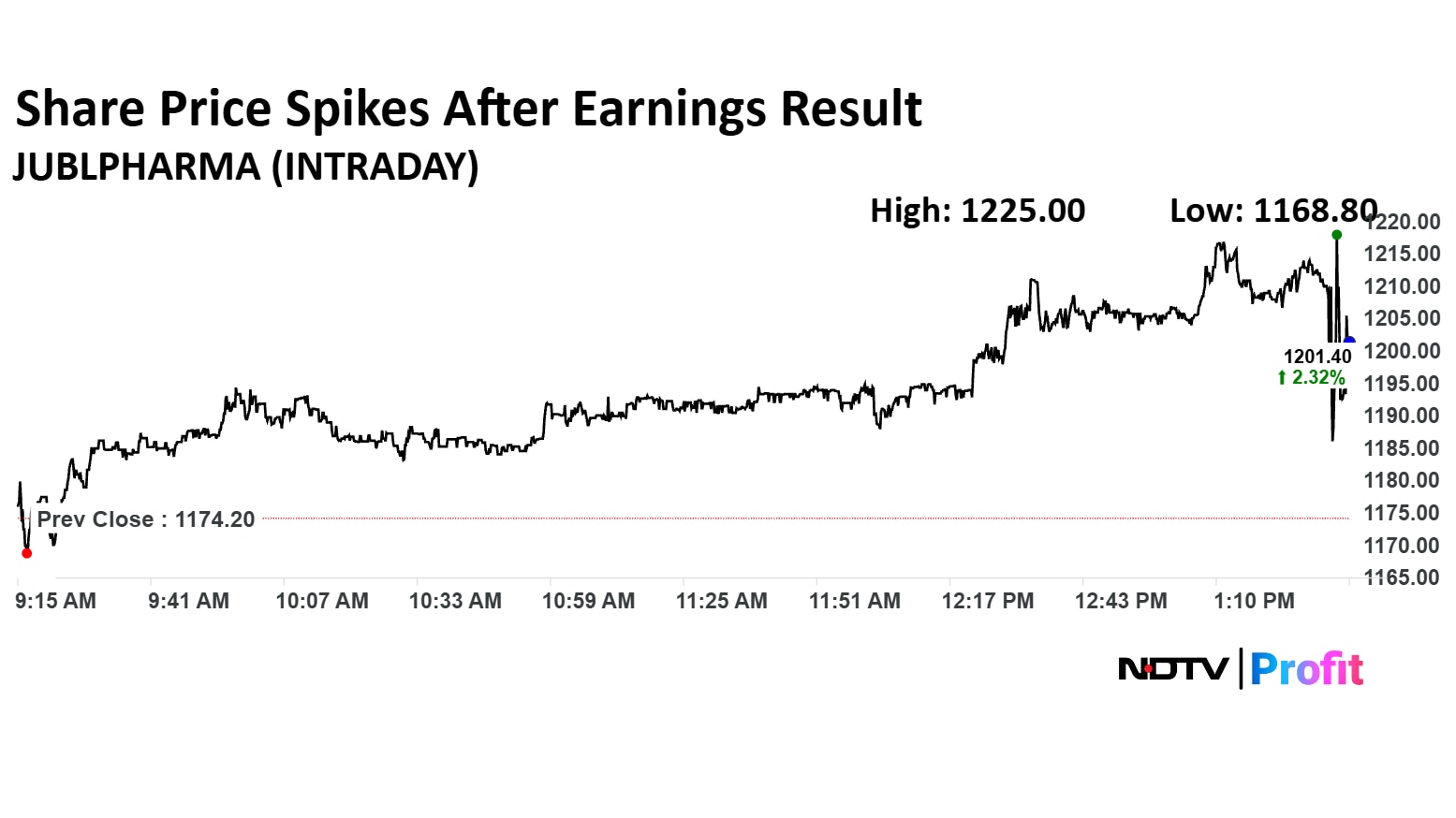

Jubilant Pharmova share price spiked post Q1 results for FY26. The share price rose over 4.33% at intraday. The company reported a 9% spike in revenue.

Jubilant Pharmova share price spiked post Q1 results for FY26. The share price rose over 4.33% at intraday. The company reported a 9% spike in revenue.

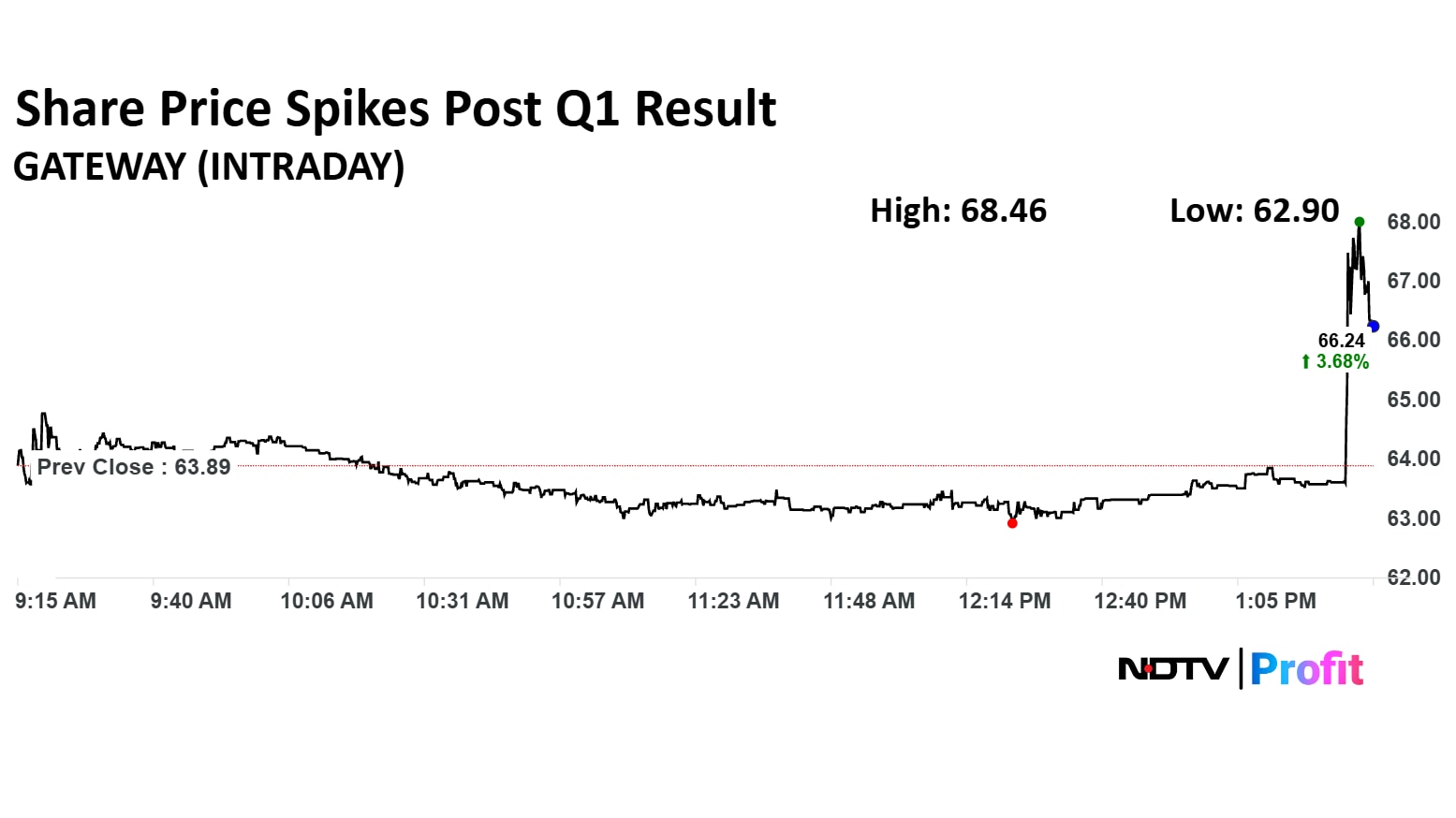

Gateway Distriparks share price spiked post Q1 results for FY26. The share price rose over 7% at intraday. The company reported a 24% spike in net profit

Gateway Distriparks share price spiked post Q1 results for FY26. The share price rose over 7% at intraday. The company reported a 24% spike in net profit

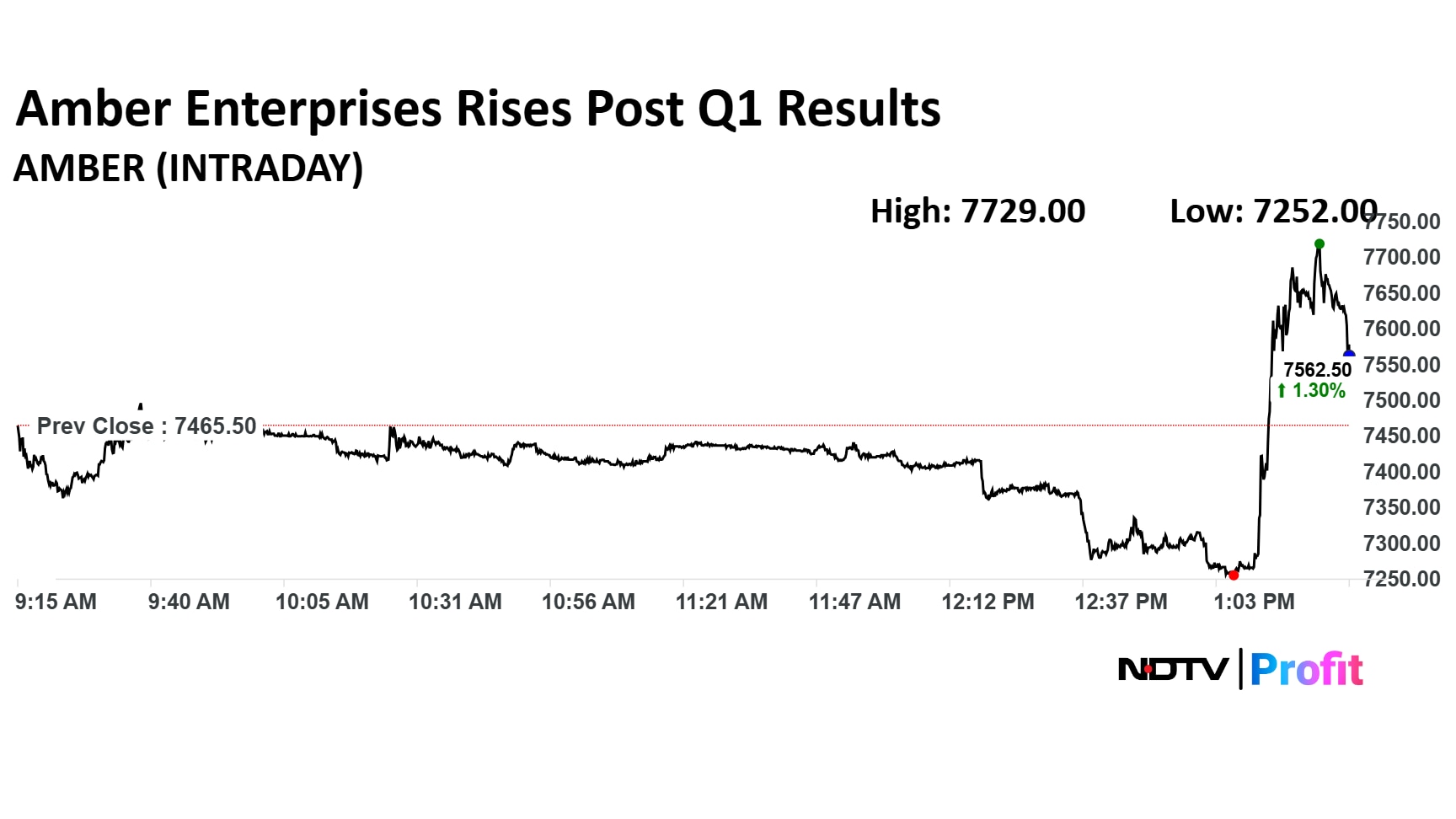

Amber Enterprises Q1 Highlights (Consolidated, YoY)

Revenue up 43.6% to Rs 3,449 crore versus Rs 2,401 crore.

Ebitda up 31% to Rs 257 crore versus Rs 196 crore.

Margin at 7.4% versus 8.2%.

Net Profit up 43.6% to Rs 104 crore versus Rs 72.3 crore.

Amber Enterprises Q1 Highlights (Consolidated, YoY)

Revenue up 43.6% to Rs 3,449 crore versus Rs 2,401 crore.

Ebitda up 31% to Rs 257 crore versus Rs 196 crore.

Margin at 7.4% versus 8.2%.

Net Profit up 43.6% to Rs 104 crore versus Rs 72.3 crore.

Bharti Airtel has completed its investment in Aduna Global Holding, acquiring nearly 5% membership interest.

Brigade Enterprises signs joint development agreements for two residential projects in Hyderabad. The projects are expected to generate revenue exceeding Rs 970 crore.

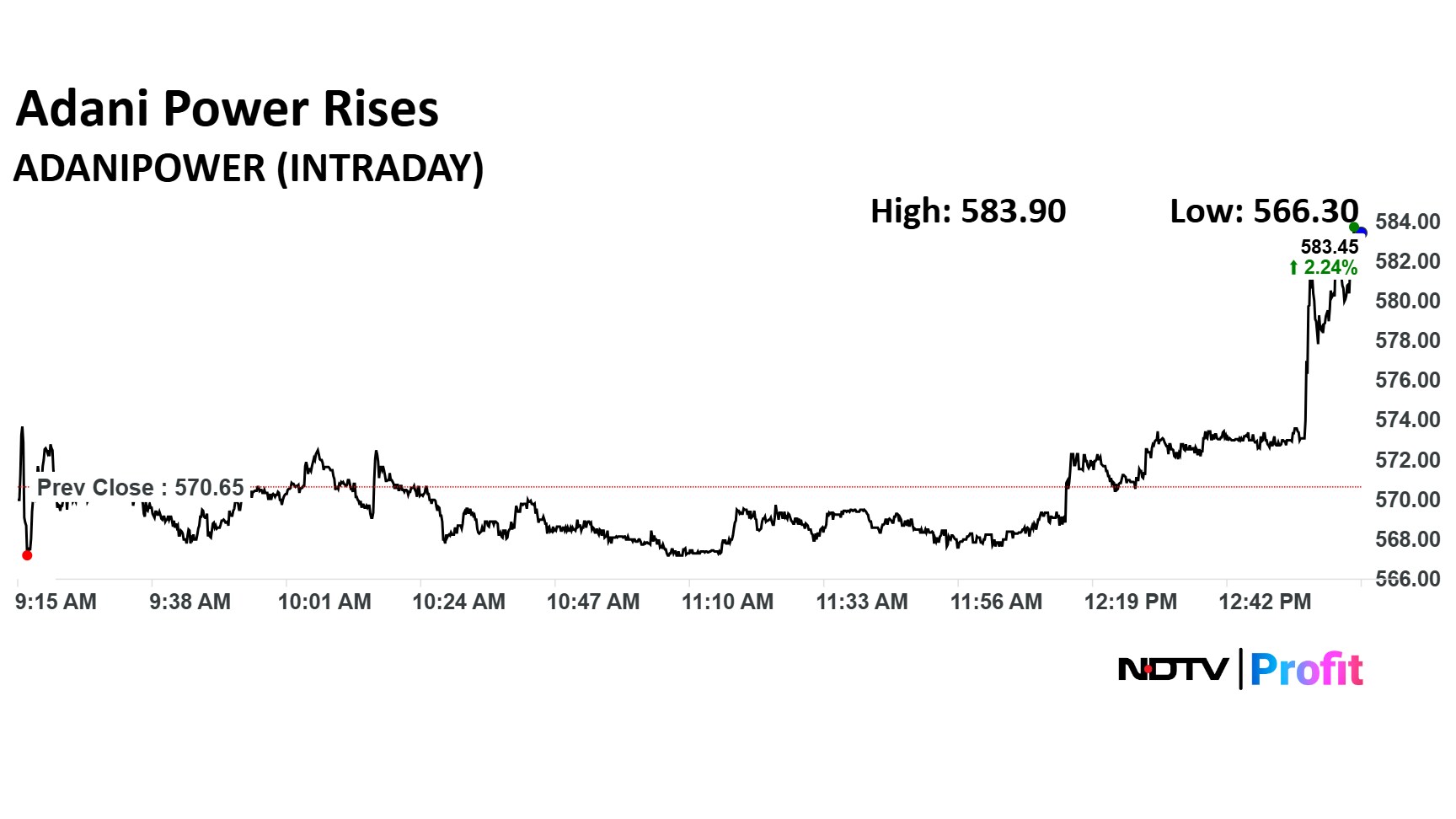

Adani Power Ltd. share price rose after the company said that the board will consider a stock split on August.

Adani Power Ltd. share price rose after the company said that the board will consider a stock split on August.

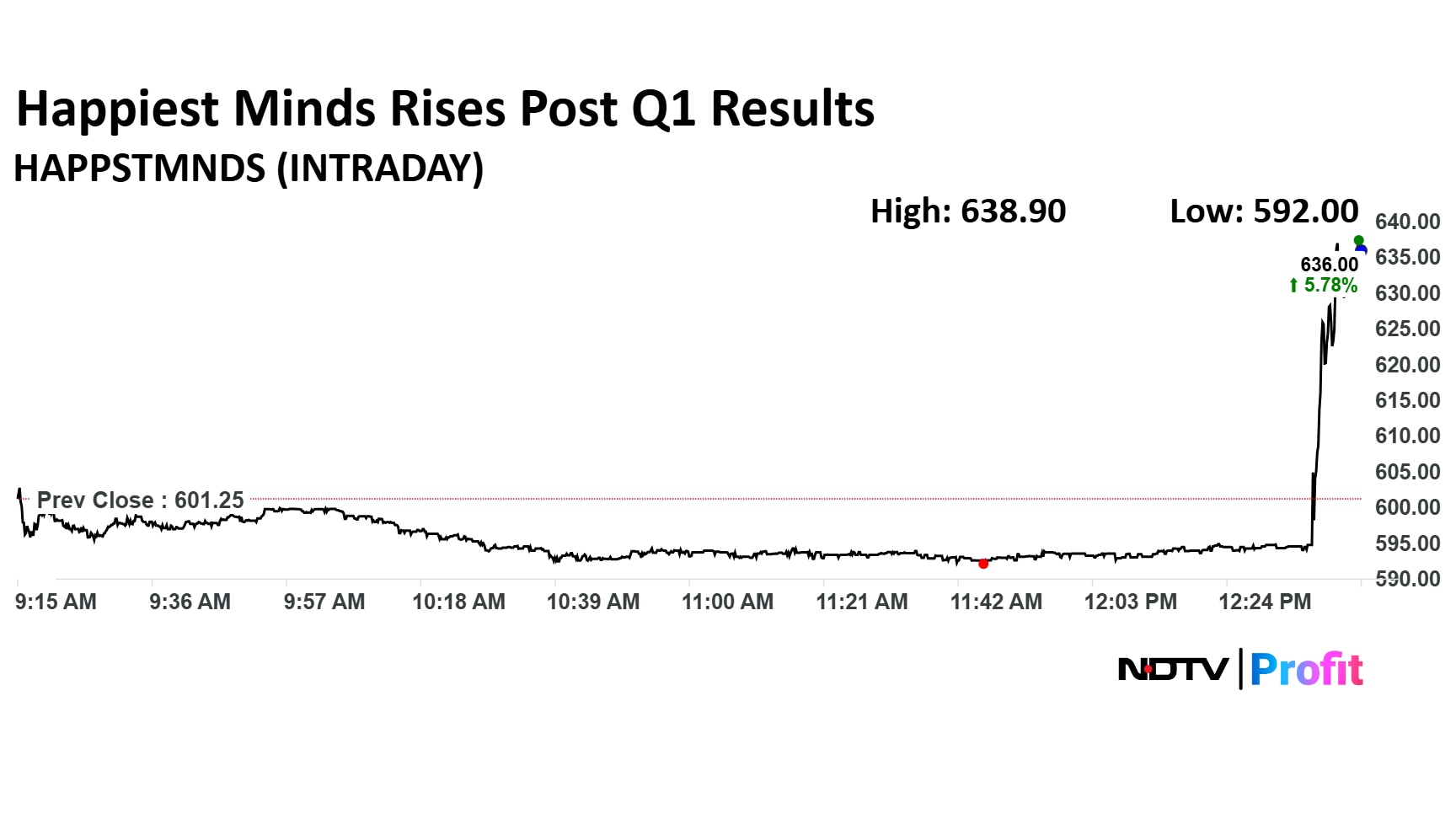

Happiest Minds Q1 Highlights (Consolidated, QoQ)

Revenue up 1% to Rs 550 crore versus Rs 545 crore.

Ebit up 16.8% to Rs 71.7 crore versus Rs 61.3 crore.

Ebit Margin at 13% versus 11.3%.

Net Profit up 68% to Rs 57.1 crore versus Rs 34 crore.

Happiest Minds Q1 Highlights (Consolidated, QoQ)

Revenue up 1% to Rs 550 crore versus Rs 545 crore.

Ebit up 16.8% to Rs 71.7 crore versus Rs 61.3 crore.

Ebit Margin at 13% versus 11.3%.

Net Profit up 68% to Rs 57.1 crore versus Rs 34 crore.

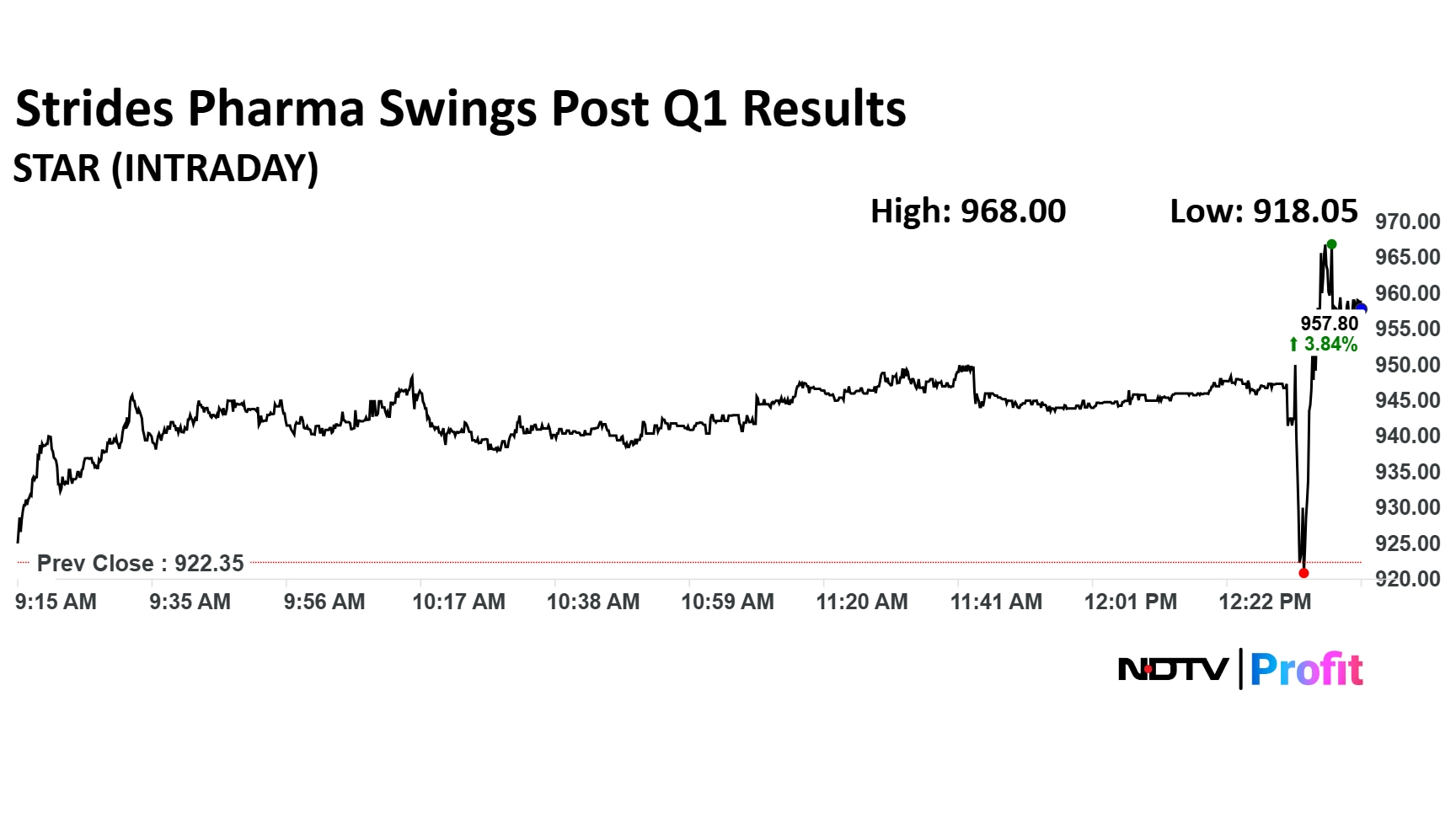

Strides Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 6.2% to Rs 1,120 crore versus Rs 1,054 crore.

Ebitda up 14.7% to Rs 218 crore versus Rs 190 crore.

Margin at 19.5% versus 18%.

Net Profit down 97% to Rs 99.6 crore versus Rs 3,351 crore.

Strides Pharma Q1 Highlights (Consolidated, YoY)

Revenue up 6.2% to Rs 1,120 crore versus Rs 1,054 crore.

Ebitda up 14.7% to Rs 218 crore versus Rs 190 crore.

Margin at 19.5% versus 18%.

Net Profit down 97% to Rs 99.6 crore versus Rs 3,351 crore.

AIA Engineering to discontinue manufacturing operations at its Nagpur unit. The shutdown aims to boost productivity and logistics without impacting overall business operations.

Welspun Corp has revised its coated spiral pipe order to Rs 735 crore. The company’s consolidated order book now stands at Rs 19,000 crore.

Varun Beverages share price rose 1.26% to Rs 492.90 apiece after the company reported an increase of 5.1% in its consolidated net profit

Before earnings are here, it's on NDTV Profit's earnings blog. Click here for faster updates.

Varun Beverages share price rose 1.26% to Rs 492.90 apiece after the company reported an increase of 5.1% in its consolidated net profit

Before earnings are here, it's on NDTV Profit's earnings blog. Click here for faster updates.

Shares of Tata Chemicals Ltd. rallied 5.21% on Tuesday, buoyed by a bullish outlook from Morgan Stanley, which upgraded the stock to ‘Overweight’ from ‘Underweight’ and raised its target price by over 34% to Rs 1,127 from Rs 839.

The global brokerage cited multiple tailwinds for the company, including a recovery in earnings, operational turnaround in overseas units, and easing capital expenditure pressures.

Shares of Waaree Energies Ltd. surged over 5% on Tuesday after the company reported its first-quarter results for fiscal 2025-26. The company reported a rise of 89% in consolidated net profit to Rs 745 crore, compared to Rs 394 crore in the corresponding period last year.

Lenskart aimed to raise Rs 2,150 crore via its initial public offer. It has filed draft red herring prospectus to offer 26.3 crore shares. Out of the total offer 13.2 crore shares are part of the offer for sales.

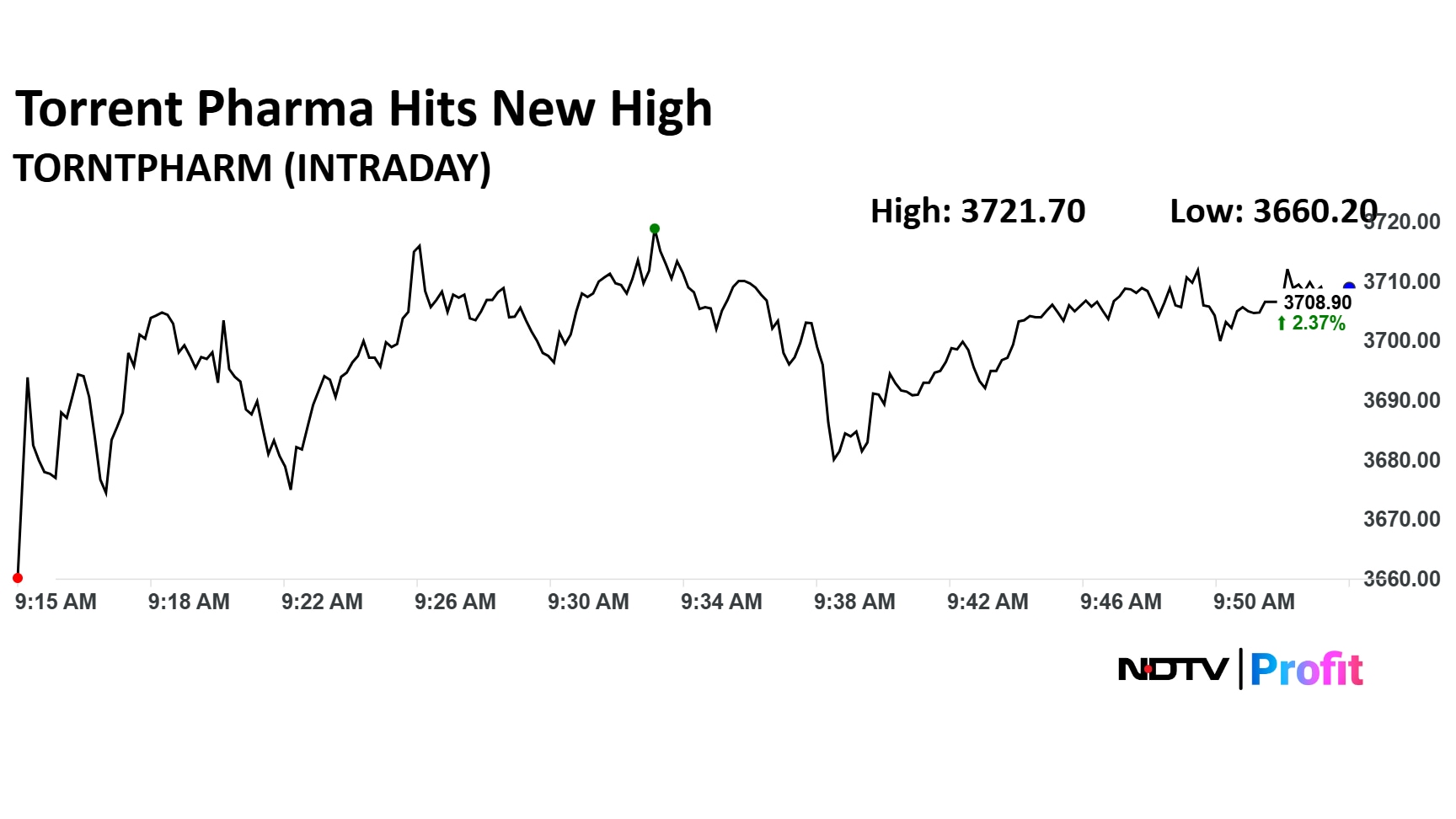

Torrent Pharmaceuticals share price rose to a record high as Citi Research hiked target price to Rs 4,380 from Rs 4,000.

Torrent Pharmaceuticals share price rose to a record high as Citi Research hiked target price to Rs 4,380 from Rs 4,000.

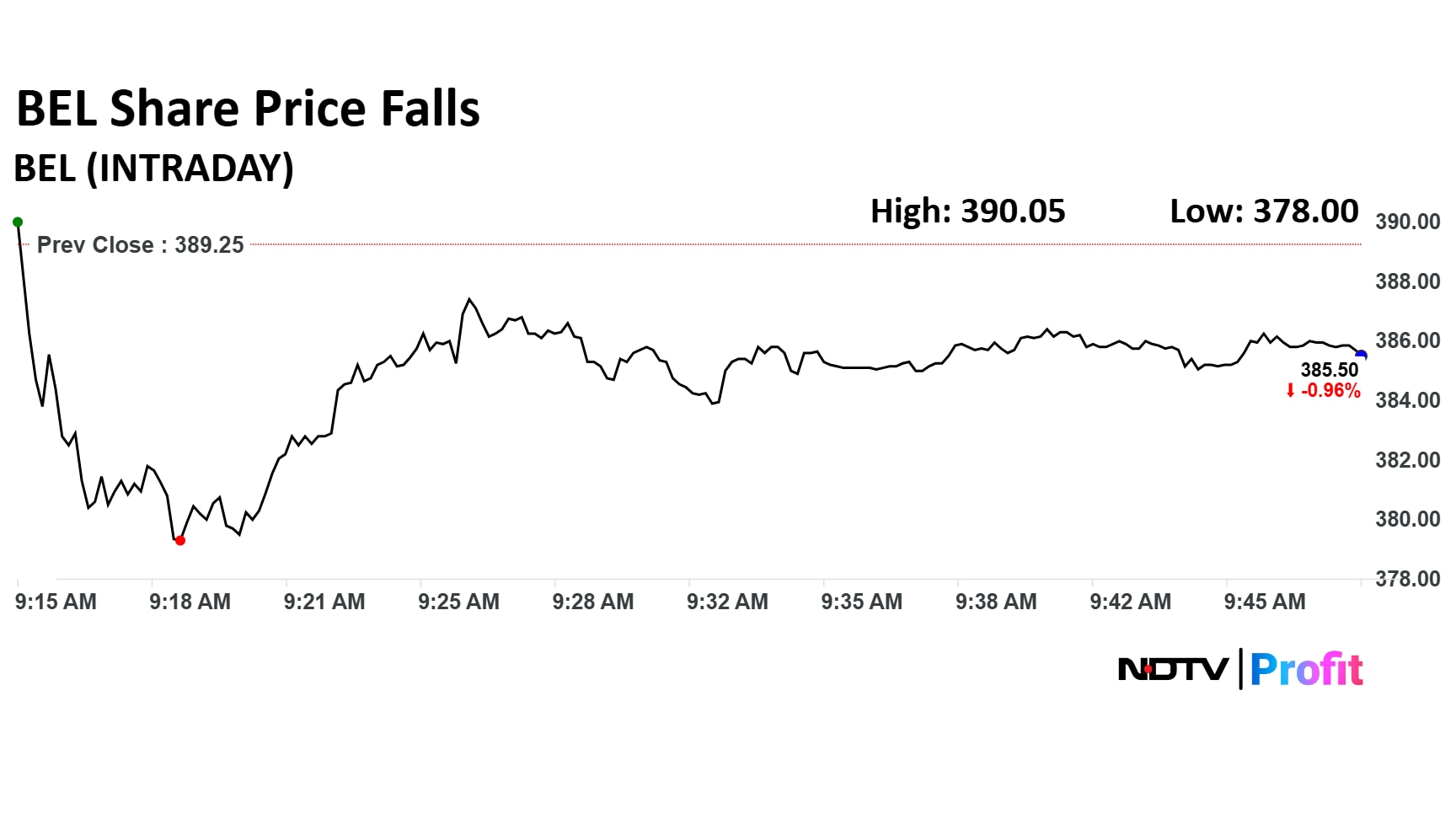

Bharat Electronics share price declined 2.89% to Rs 378 apiece. It was trading 0.82% down at Rs 386.15 apiece as of 9:51 a.m.

Bharat Electronics share price declined 2.89% to Rs 378 apiece. It was trading 0.82% down at Rs 386.15 apiece as of 9:51 a.m.

Upgrade to Overweight from Underweight; Hike target price to Rs 1,127 from Rs 839

Earnings trough now behind us

Benefit from higher volumes from expanded capacities in India

See turnaround in UK operations evidenced in Q1

See stronger contribution from Rallis as the global agri-cycle normalises

Peak capex for Tata Chemical is now behind us

China soda ash prices are near cycle troughs

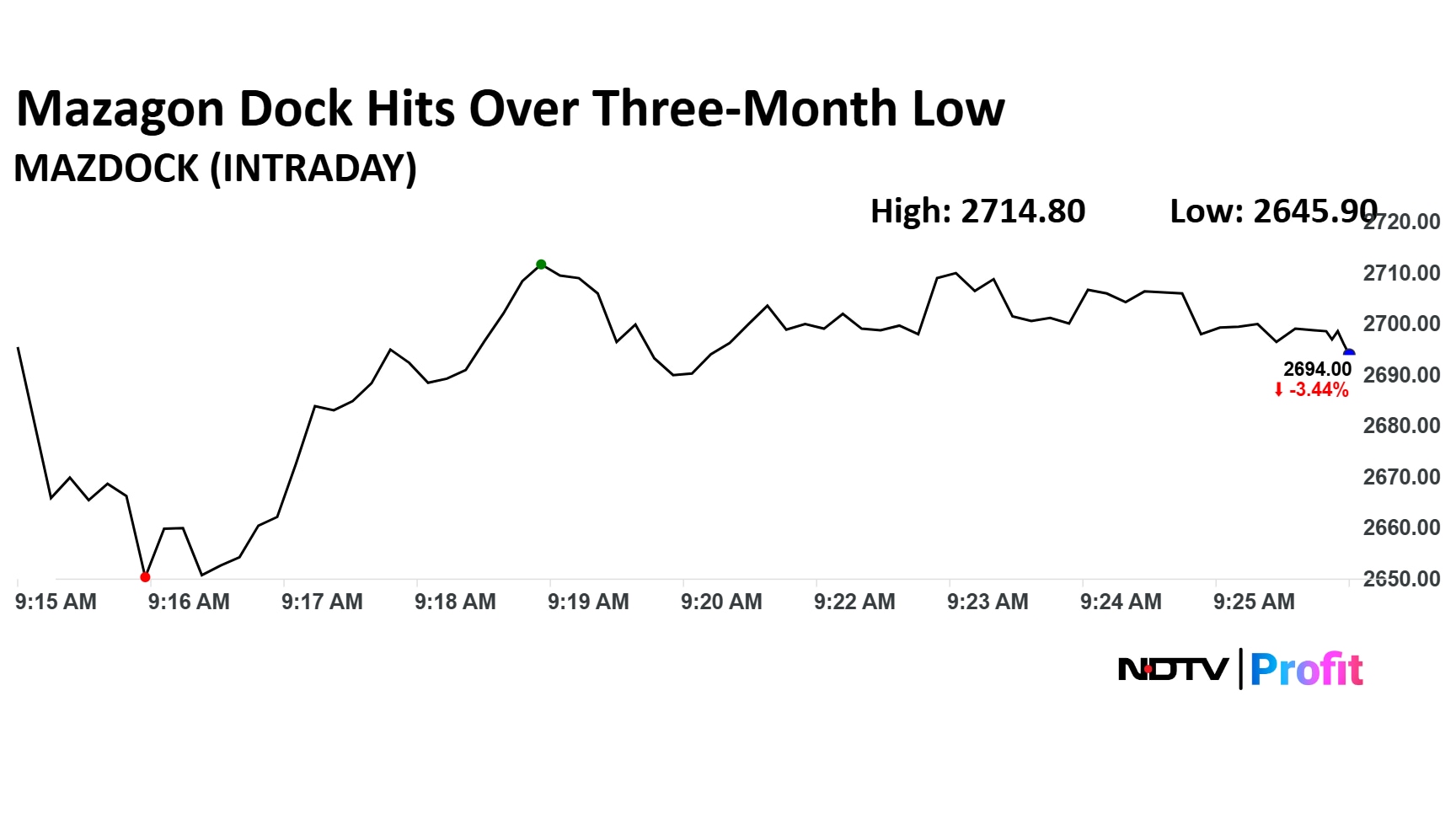

Mazagon Dock Shipbuilders Ltd. share price slumped 5.16% to Rs 2,645.90 apiece, the lowest level since April 25. It was trading 4.08% down at Rs 2,676.10 apiece as of 9:28 a.m., as compared to 0.01% advance in the NSE Nifty 50 index.

Mazagon Dock Shipbuilders Ltd. share price slumped 5.16% to Rs 2,645.90 apiece, the lowest level since April 25. It was trading 4.08% down at Rs 2,676.10 apiece as of 9:28 a.m., as compared to 0.01% advance in the NSE Nifty 50 index.

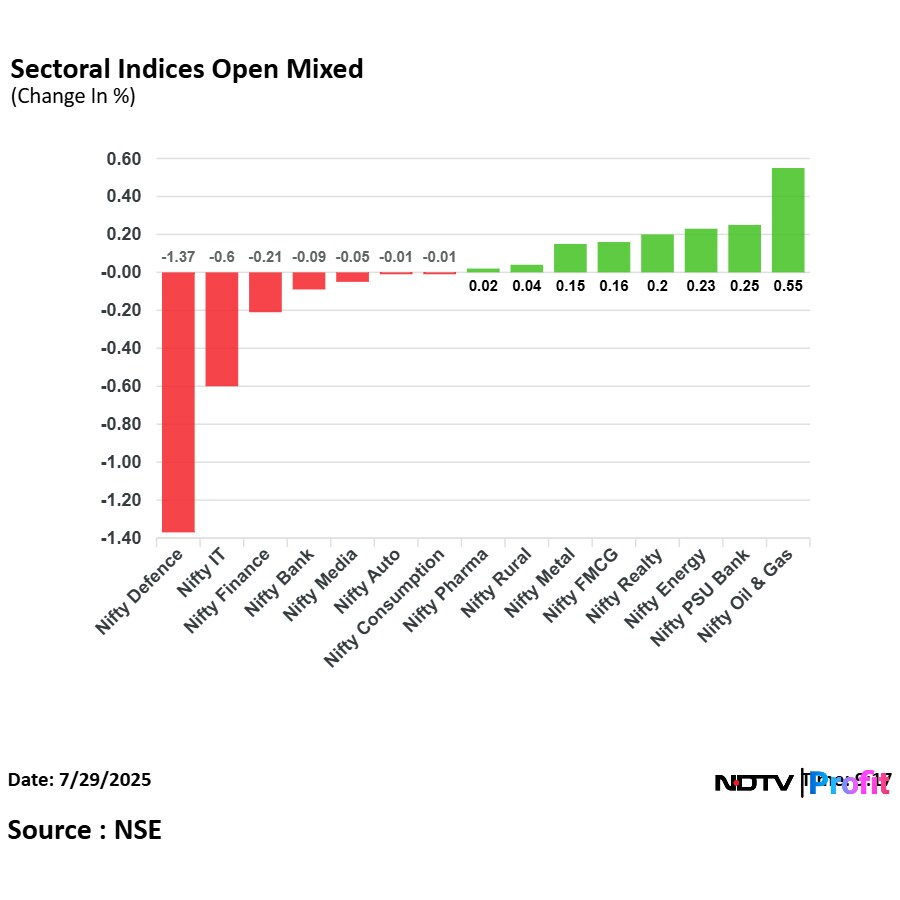

On National Stock Exchange Ltd., five sectoral indices declined, six advanced, and four remained flat out of 15. The NSE Nifty Defence declined the most, and the NSE Nifty Oil & Gas rose the most.

On National Stock Exchange Ltd., five sectoral indices declined, six advanced, and four remained flat out of 15. The NSE Nifty Defence declined the most, and the NSE Nifty Oil & Gas rose the most.

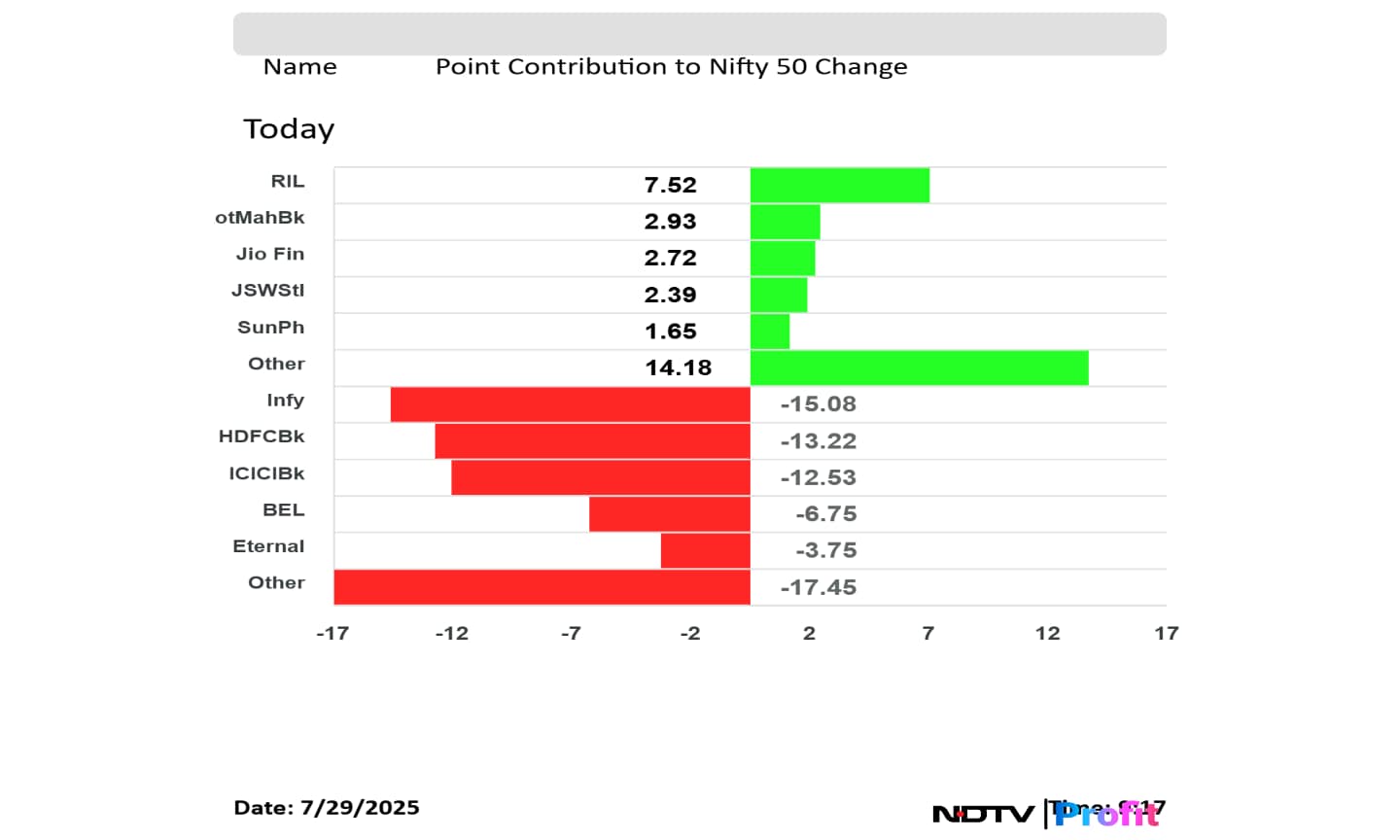

Infosys Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Bharat Electronics Ltd., and Eternal Ltd. weighed on the Nifty 50 index.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Jio Financial Services Ltd., JSW Steel Ltd., and Sun Pharmaceutical Industries Ltd. added to the Nifty 50 index.

Infosys Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Bharat Electronics Ltd., and Eternal Ltd. weighed on the Nifty 50 index.

Reliance Industries Ltd., Kotak Mahindra Bank Ltd., Jio Financial Services Ltd., JSW Steel Ltd., and Sun Pharmaceutical Industries Ltd. added to the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex extended losses to a fourth day as ICICI Bank and Infosys Ltd. shares dragged. The indices were trading 0.07% and 0.14% down, respectively as of 9:21 a.m.

The NSE Nifty 50 and BSE Sensex extended losses to a fourth day as ICICI Bank and Infosys Ltd. shares dragged. The indices were trading 0.07% and 0.14% down, respectively as of 9:21 a.m.

CLSA has initiated coverage on Radico Khaitan, one of India’s leading spirits manufacturers, with an ‘Outperform’ rating and a target price of Rs 3,098, implying a potential upside of 16% from current levels. The firm sees Radico as a robust long-term premiumisation play in India’s evolving alcoholic beverages market.

“Radico Khaitan is the leading manufacturer of white spirits (vodka, gin etc) in India and is building a portfolio of premium and luxury brands across the spirits categories,” CLSA said in its initiation note.

The 10-year bond yield opened flat at 6.38%

Source: Bloomberg

Rupee opened 16 paise weaker at 86.83 against US Dollar

It's the lowest level since June 19

It closed at 86.67 a dollar on Friday

Source: Cogencis

At least 100 companies are set to report their Q1FY26 financial results on July 29. These earnings will reflect the financial performance of these companies for the April-June period. It will be their first quarterly update for FY2025-26.

Some of the prominent names include NTPC, Asian Paints, Bank of India, Blue Dart Express, among companies spread across different sectors. In the upcoming results, investors and analysts will focus on key financial metrics, including revenue, profit, and margins. These figures will offer insights into consumption trends, sectoral performance and overall economic health of India.

Jane Street Group LLC is expected to argue that its controversial Indian options trades were a response to outsized demand from retail investors, people familiar with the matter said.

The trading giant has been working on its defense against market manipulation allegations from the Securities and Exchange Board of India. The regulator in early July alleged Jane Street had taken large positions that artificially influenced prices in the country’s stock and futures markets, moving them in favor of its options bets on multiple days.

Deepak Fertilisers' subsidiary has revised the cost of its Gopalpur Technical Ammonium Nitrate (TAN) project to Rs 2,675 crore, up from the earlier estimate of Rs 2,223 crore. The increase is attributed to geopolitical challenges and consequent rises in material and other input costs.

Bernstein has downgraded Indian Energy Exchange (IEX) to Underperform and set a target price of Rs 99 per share, implying a 29% downside from Monday’s close. The brokerage cited regulatory risks from market coupling as more severe than previously anticipated.

Bharat Electronics Ltd.'s expansion in operating margin in the first quarter of the current fiscal and a strong order book have kept analysts bullish on the stock.

JPMorgan said the muted revenue growth, which missed estimates, is not a concern, as it is primarily impacted by fluctuations in product delivery rather than underlying business performance.

Maintain Sell with a target price of Rs 765

Earnings Reset in Progress; Eyes on CEO Appointment

Slippages normalized after one-offs in 1Q, though remains elevated

See weaker growth and higher credit cost, partially offset by better NIM and treasury gains

Cut earnings lower by 2-3% for FY26E/FY27E

Upcoming trigger will be CEO announcement and strategic roadmap under new leadership

Maintain Underweight with a target price of Rs 750

Q1: NII beat; Fee income miss

Core PPoP, excluding IT refund and others, was 11% below estimates

Slippages remained high at 3% of loans, as did credit costs

Have reduced earnings by 15-20% in FY26-28

Expect FY26 to be very weak with RoA of 0.6%, with a gradual recovery in FY27/FY28 to 0.8%/1%

Oil prices extended gain to a second day after US President Donald Trump warned of a secondary sanction in case Moscow does not end hostility inside Ukraine. Trump would likely impose a 10–12 days of deadline.

The Brent crude's October future contract was trading 0.30% down at $69.36 a barrel.

Markets across Japan, South Korea, and Australia were trading lower as market participants await more details on US and China trade negotiations. Further, they also await the outcome of the US Federal Reserve's policy meeting, scheduled for release on Wednesday.

The Nikkei 225 and TOPIX were trading 0.81% and 0.82% down, respectively as of 7:00 a.m. The KOSPI and S&P ASX 200 were trading 0.06% and 0.23% down, respectively.

Most US futures were trading higher in Asia session as trade optimism continued to fuel risk-on sentiment. The S&P 500 and Nasdaq 100 futures were trading 0.07% and 0.21% higher, respectively as of 6:55 a.m.

The GIFT Nifty was trading 0.04% or 10 points higher at 24,660 as of 6:32 a.m., which implied a tepid start for the benchmark index.

Gail (India) Ltd., IndusInd Bank Ltd., Mazagon Dock Shipbuilders Ltd., and NTPC Green Energy Ltd. shares were in focus because of the first-quarter earnings.

India's benchmark equity indices extended their decline to the third day as weak first-quarter results from Kotak Mahindra Bank Ltd. weighed the most.

The NSE Nifty 50 settled 156.1 points or 0.63% lower at 24,680.9, while the BSE Sensex shed 572.07 points or 0.7% to close at 80,891.02.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.