In the last hour of Thursday's session, the NSE Nifty 50 and BSE Sensex declined steeply after the Ministry of Defence said that they negated Pakistan's missile attack on cities near India's western and northern borders. In defense, India's security forces also intercepted Lahore's air defence system. The Nifty 50 declined 1.08% to the day's low of Rs 24,150.2. The BSE Sensex declined 0.94% to 79,987.61.

The market cap of NSE companies fell Rs 5.05 lakh crore Rs 416.36 lakh crore on Thursday.

The Nifty 50 ended 140.60 points or 0.58% down at 24,273.80, and the Sensex ended 411.97 points or 0.51% down at 80,334.81.

The new development came the day after India destroyed nine terror bases located in Pakistan and Pakistan-Occupied Kashmir. This spooked investors about possibility of a war between two countries, subsequently, propelling them to take out money from domestic equities.

In the last hour of Thursday's session, the NSE Nifty 50 and BSE Sensex declined steeply after the Ministry of Defence said that they negated Pakistan's missile attack on cities near India's western and northern borders. In defense, India's security forces also intercepted Lahore's air defence system. The Nifty 50 declined 1.08% to the day's low of Rs 24,150.2. The BSE Sensex declined 0.94% to 79,987.61.

The market cap of NSE companies fell Rs 5.05 lakh crore Rs 416.36 lakh crore on Thursday.

The Nifty 50 ended 140.60 points or 0.58% down at 24,273.80, and the Sensex ended 411.97 points or 0.51% down at 80,334.81.

The new development came the day after India destroyed nine terror bases located in Pakistan and Pakistan-Occupied Kashmir. This spooked investors about possibility of a war between two countries, subsequently, propelling them to take out money from domestic equities.

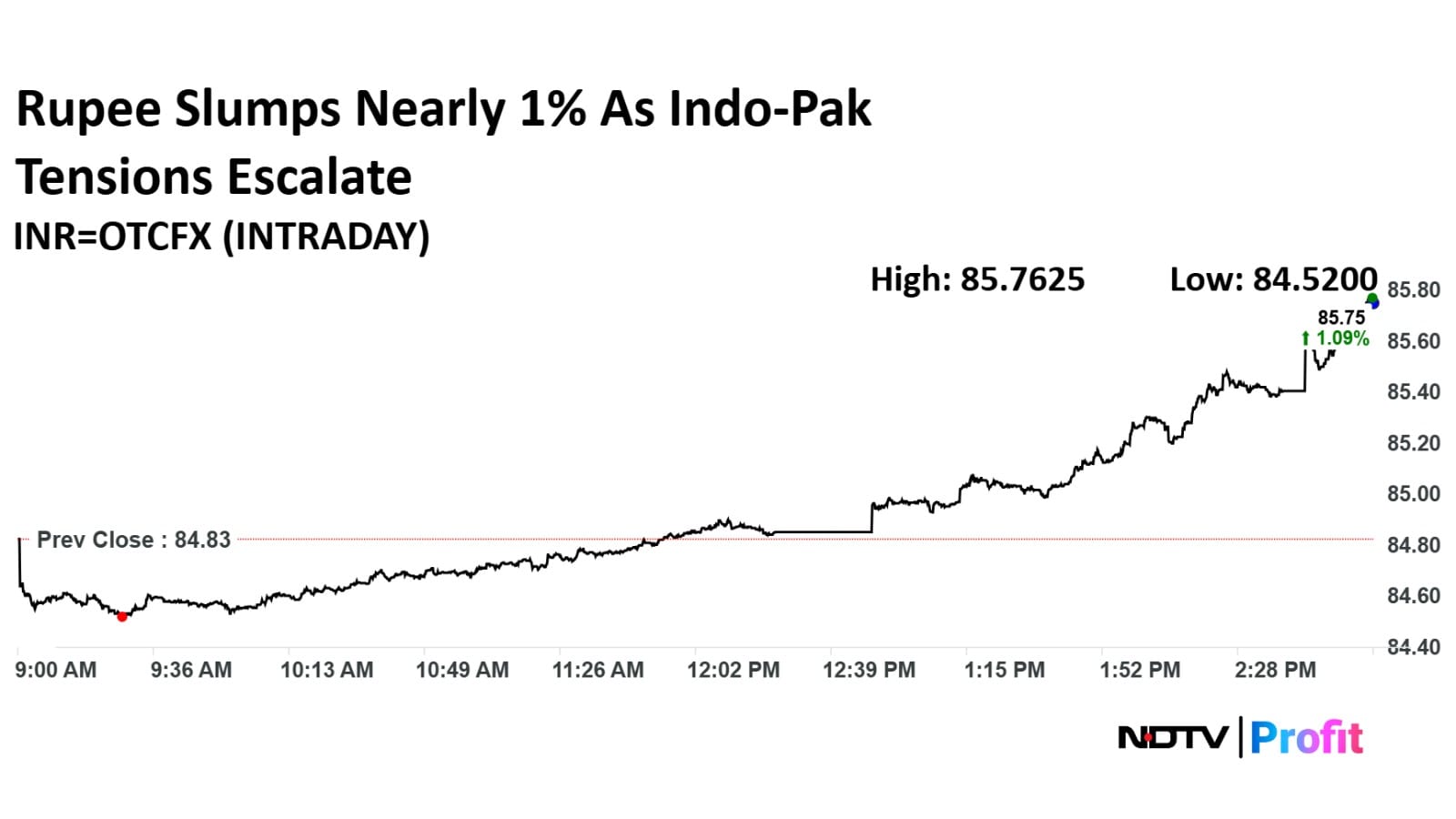

Rupee closed 89 paise weaker at 85.72 against US Dollar

It closed at 84.83 a dollar on Wednesday

Source: Bloomberg

The rupee declined 96 paise to 85.79 a dollar, while the benchmark yield on 10-year bon rose 5 basis point to 6.39% after India responded to Pakistan's unprovoked firing.

The rupee declined 96 paise to 85.79 a dollar, while the benchmark yield on 10-year bon rose 5 basis point to 6.39% after India responded to Pakistan's unprovoked firing.

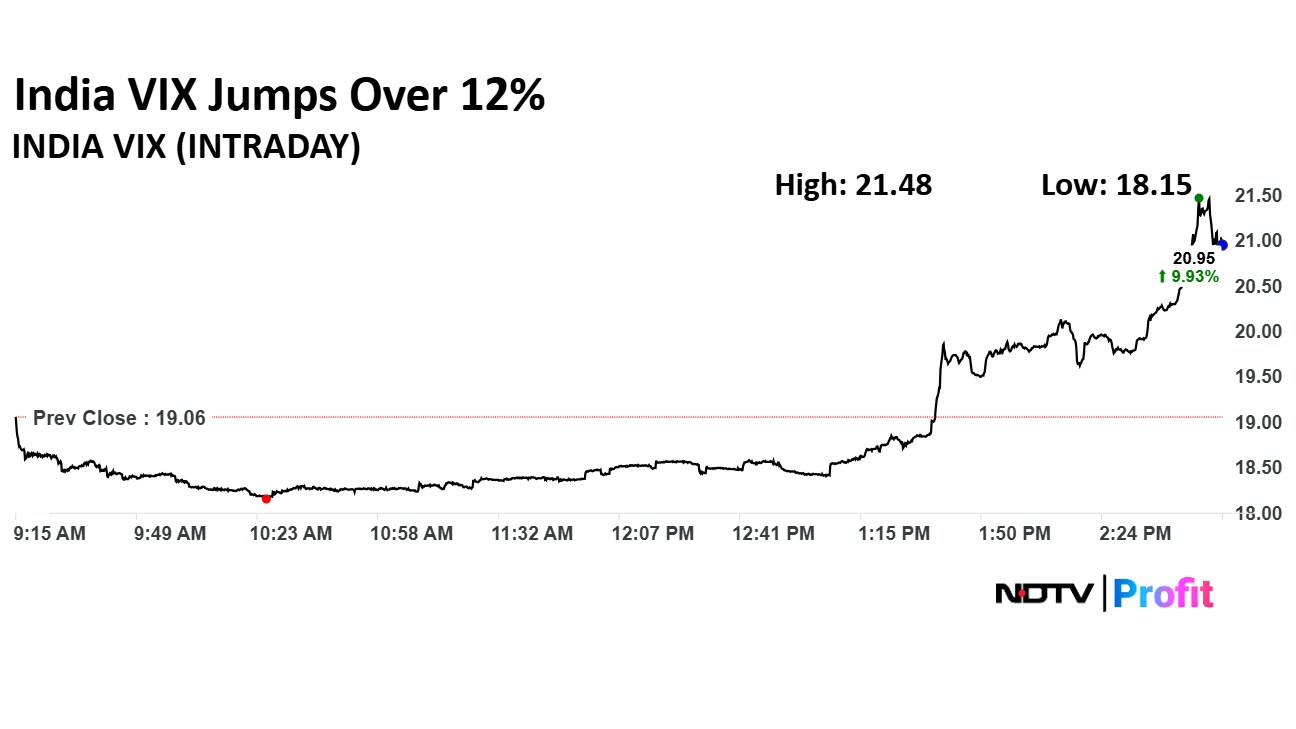

The India VIX, which measures the volatility in domestic equity marketa, jumped 12.70% to 21.48. It was trading 7.56% higher at 20.48 as of 3:05 p.m.

For live updates on India-Pakistan tension click here.

The India VIX, which measures the volatility in domestic equity marketa, jumped 12.70% to 21.48. It was trading 7.56% higher at 20.48 as of 3:05 p.m.

For live updates on India-Pakistan tension click here.

The NSE Nifty 50 and BSE Sensex extended their losses during the last leg of the trade after the Ministry of Defence said that it has neutralised Pakistan's attempt to target cities in North and West India. India's security forces responded by neutralising Lahore's air defence system.

The NSE Nifty 50 and BSE Sensex extended their losses during the last leg of the trade after the Ministry of Defence said that it has neutralised Pakistan's attempt to target cities in North and West India. India's security forces responded by neutralising Lahore's air defence system.

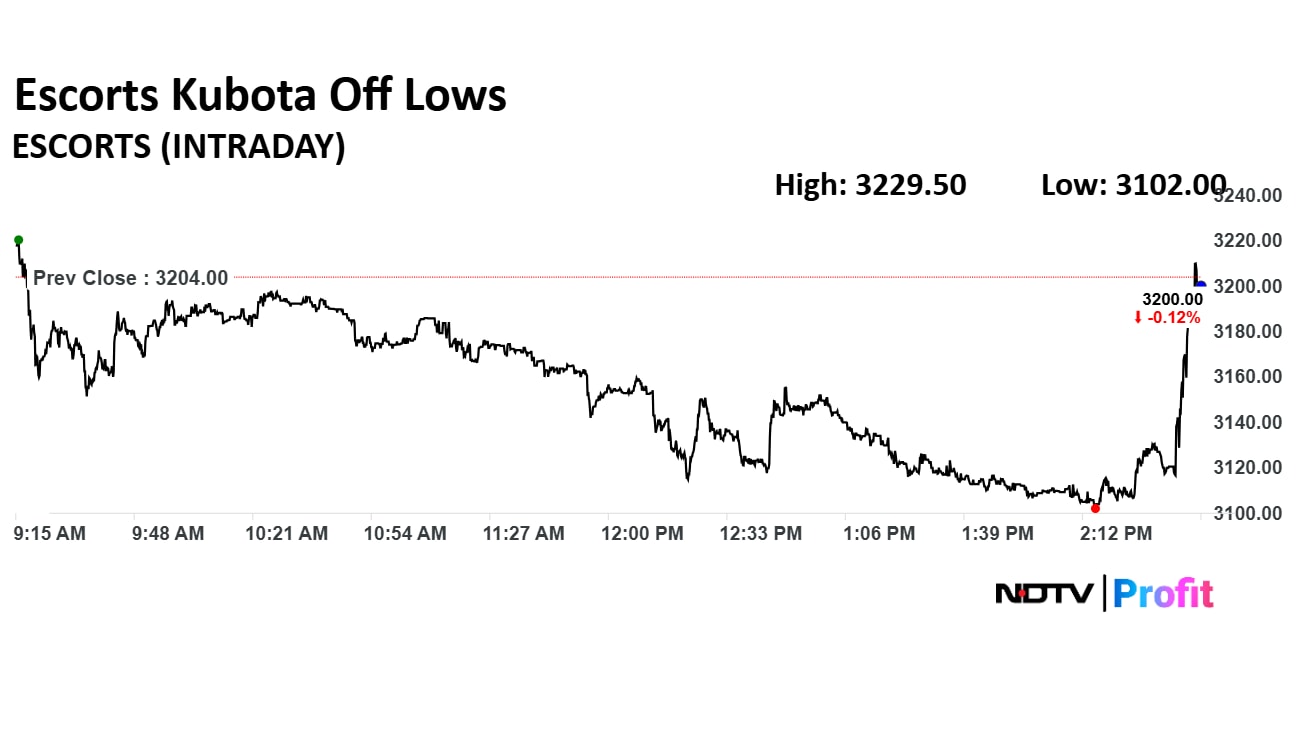

Escorts Kubota share price declined 3.18% to Rs 3,102.00 apiece earlier in the day. It erased all losses after the company said its consolidated net profit rose 8.2% on the year to Rs 297 crore during January–March. It was trading 0.22% higher at Rs 3,209.7 apiece.

Escorts Kubota share price declined 3.18% to Rs 3,102.00 apiece earlier in the day. It erased all losses after the company said its consolidated net profit rose 8.2% on the year to Rs 297 crore during January–March. It was trading 0.22% higher at Rs 3,209.7 apiece.

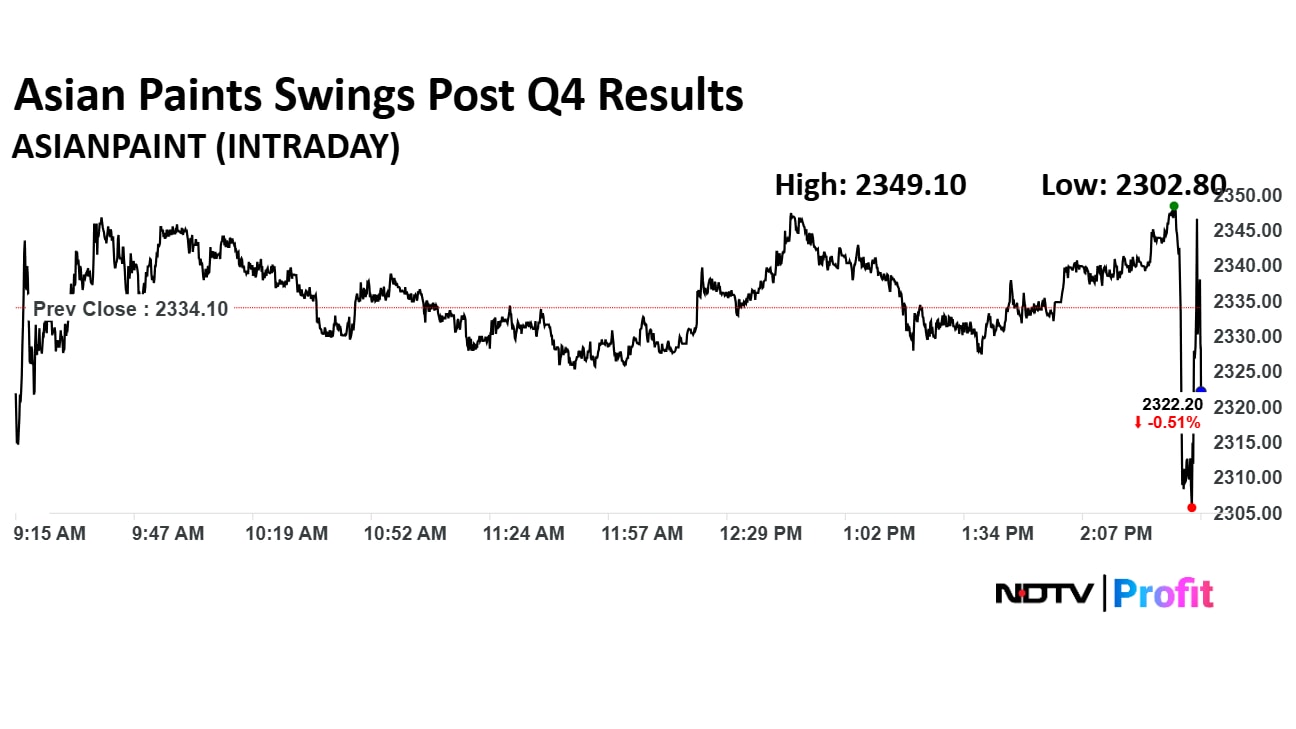

Asian Paints Ltd. share price declined 1.34% to Rs 2,302.80 apiece. The company's consolidated net profit plunged 45% to Rs 692 crore. Topline and operating profit fell 4.3% and 15% respectively.

Asian Paints Ltd. share price declined 1.34% to Rs 2,302.80 apiece. The company's consolidated net profit plunged 45% to Rs 692 crore. Topline and operating profit fell 4.3% and 15% respectively.

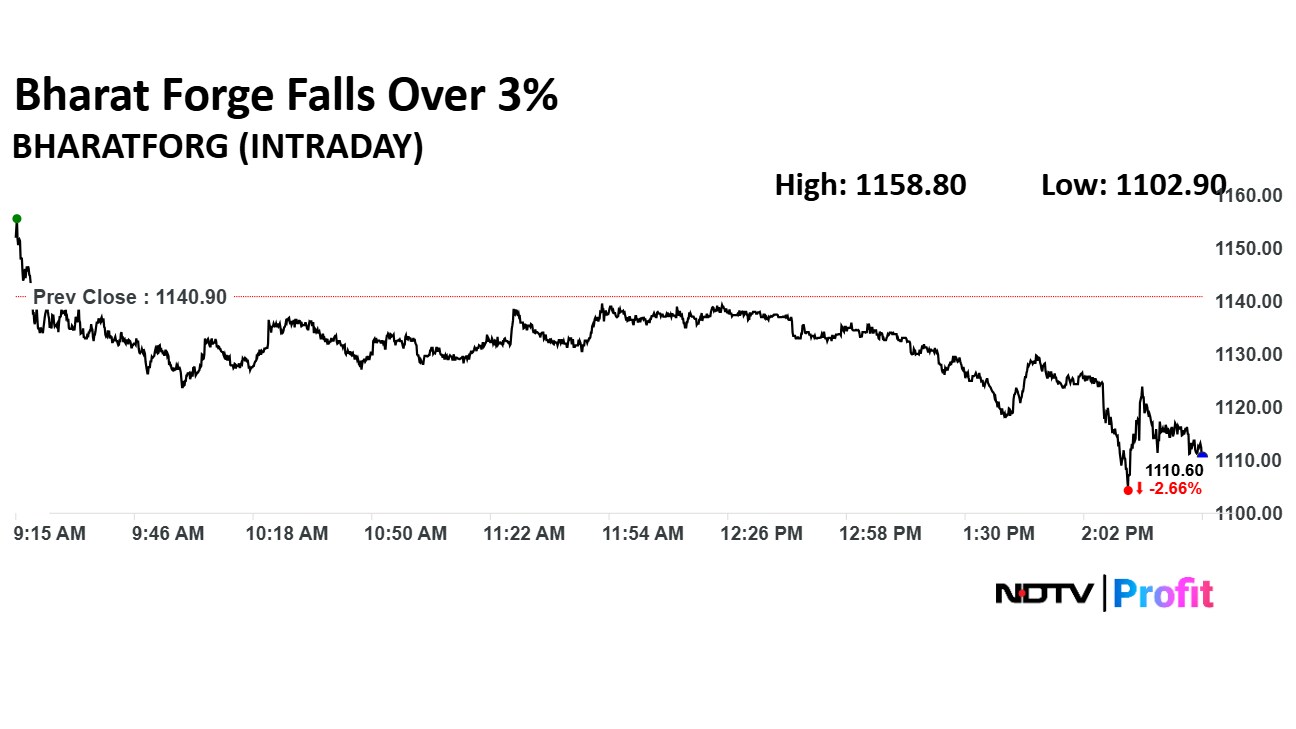

Bharat Forge Ltd. share price declined 3.33% to Rs 1,102.90 apiece. The company reported that its consolidated net profit fell 11.3% on the year to Rs 346 crore in the fourth quarter from Rs 390 crore.

Bharat Forge Ltd. share price declined 3.33% to Rs 1,102.90 apiece. The company reported that its consolidated net profit fell 11.3% on the year to Rs 346 crore in the fourth quarter from Rs 390 crore.

For faster updates on Q4 earnings click here.

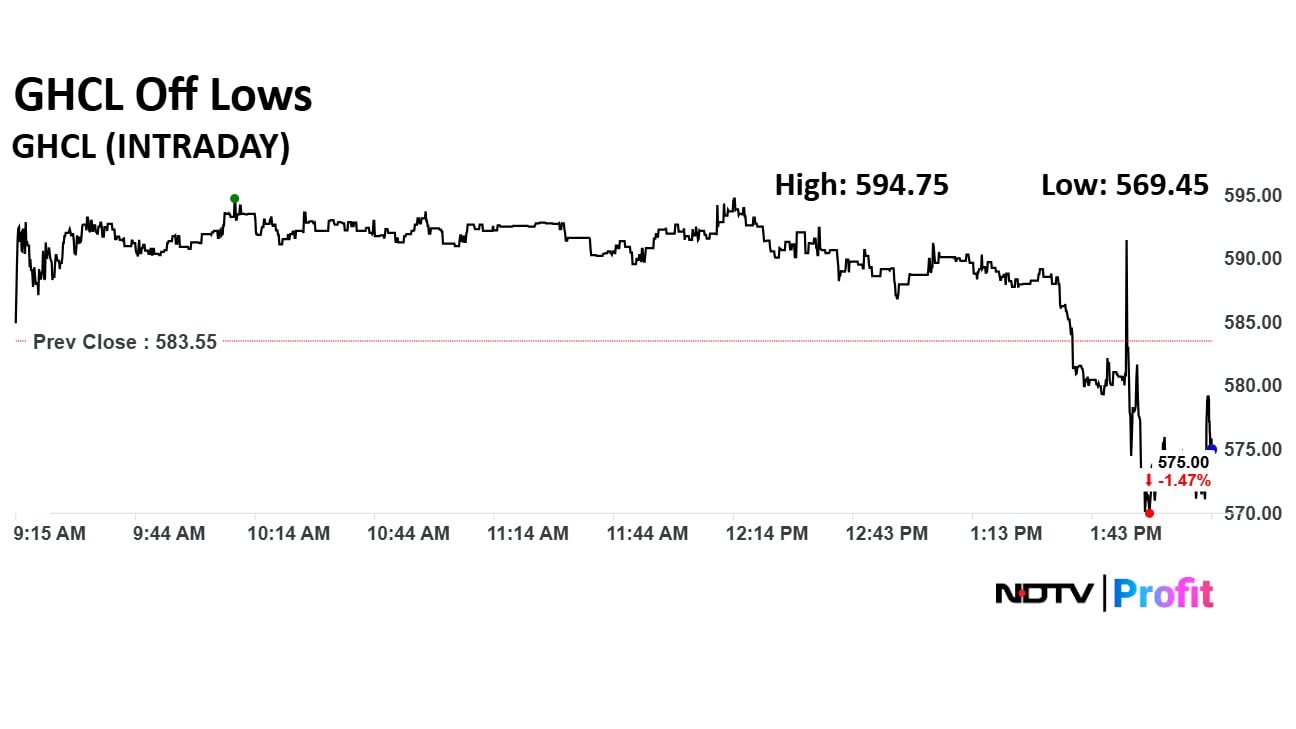

GHCL Ltd. share price declined 2.42% to Rs 569.45 apiece. The company reported 5.1% year on year decline in its consolidated net profit for January–March

GHCL Ltd. share price declined 2.42% to Rs 569.45 apiece. The company reported 5.1% year on year decline in its consolidated net profit for January–March

Astrazeneca Pharma gets approval from the government to import Tratuzumab Deruxtecan under the Brand Enhertu. Enhertu is used for treatment of Breast Cancer.

Source: Exchange filing

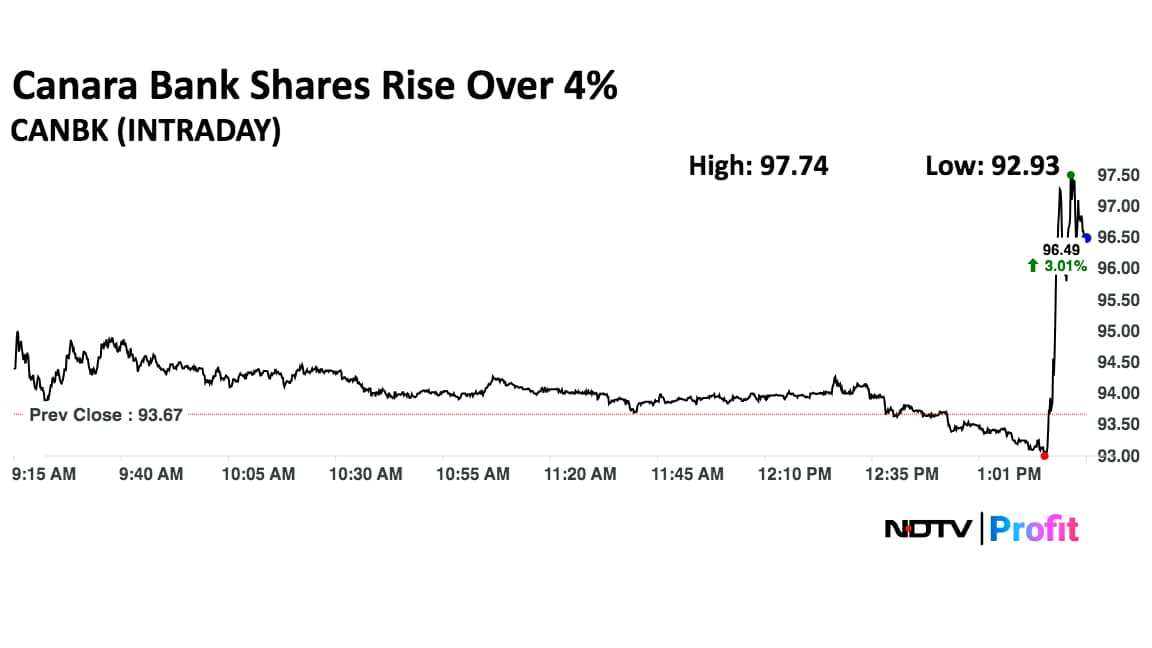

Canara Bank shares rise as much as 4.35% to Rs 97.74 per share after its fourth quarter earnings.

Canara Bank Q4 Highlights (Standalone, YoY)

Net interest income down 1.4% to Rs 9,442 crore versus Rs 9,580 crore.

Net profit up 33.1% to Rs 5,003 crore versus Rs 3,757 crore.

Net NPA at 0.70% versus 0.89% (QoQ).

Gross NPA at 2.94% versus 3.34% (QoQ).

Operating profit up 12% at Rs 8,284 crore versus Rs 7,387 crore.

Provisions down 26.2% at Rs 1,832 crore versus Rs 2,482 crore.

Other income up 21.7% at Rs 6,351 crore versus Rs 5,218.

Board recommends dividend of Rs 4 per share.

Canara Bank shares rise as much as 4.35% to Rs 97.74 per share after its fourth quarter earnings.

Canara Bank Q4 Highlights (Standalone, YoY)

Net interest income down 1.4% to Rs 9,442 crore versus Rs 9,580 crore.

Net profit up 33.1% to Rs 5,003 crore versus Rs 3,757 crore.

Net NPA at 0.70% versus 0.89% (QoQ).

Gross NPA at 2.94% versus 3.34% (QoQ).

Operating profit up 12% at Rs 8,284 crore versus Rs 7,387 crore.

Provisions down 26.2% at Rs 1,832 crore versus Rs 2,482 crore.

Other income up 21.7% at Rs 6,351 crore versus Rs 5,218.

Board recommends dividend of Rs 4 per share.

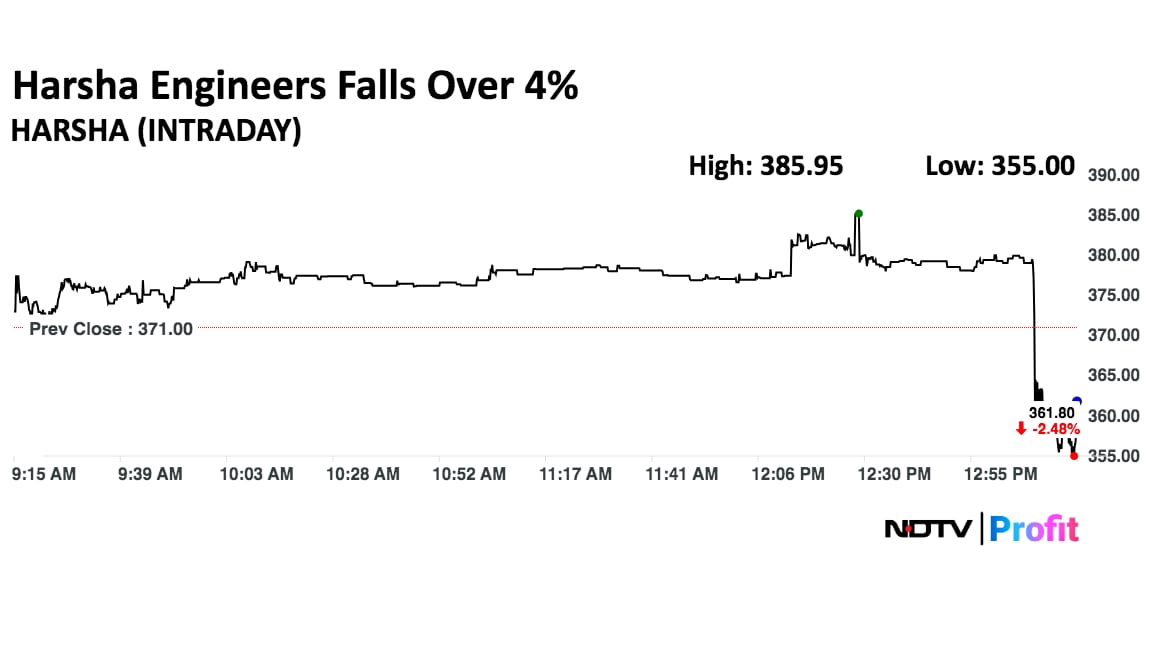

Harsha Engineers shares fell as much as 4.31% to Rs 355 per share after its fourth quarter earnings.

Harsha Engineers International Q4 Highlights (Consolidated, YoY)

Revenue down 2% to Rs 373 crore versus Rs 380 crore

Net loss of Rs 2.4 crore versus Rs 36.8 crore

Ebitda down 35.5% to Rs 35.2 crore versus Rs 54.5 crore

Margin at 9.4% versus 14.3%

Recommends dividend of Re 1 per share

Want live updates on Q4 Results, read it here.

Harsha Engineers shares fell as much as 4.31% to Rs 355 per share after its fourth quarter earnings.

Harsha Engineers International Q4 Highlights (Consolidated, YoY)

Revenue down 2% to Rs 373 crore versus Rs 380 crore

Net loss of Rs 2.4 crore versus Rs 36.8 crore

Ebitda down 35.5% to Rs 35.2 crore versus Rs 54.5 crore

Margin at 9.4% versus 14.3%

Recommends dividend of Re 1 per share

Want live updates on Q4 Results, read it here.

Havells India has received a Letter of Intent for acquiring 50 acres of land to set up a new electronics manufacturing unit.

Mastek has entered into a partnership with Zulekha Healthcare Group to facilitate their digital transformation using Oracle Fusion Cloud.

Uno Minda Ltd. has announced plans to establish a manufacturing facility for 2-wheeler alloy wheels in Haryana. This facility will involve an investment of Rs 200 crore and will have an installed production capacity of 1.5 million alloy wheels per year, the company said in an exchange filing.

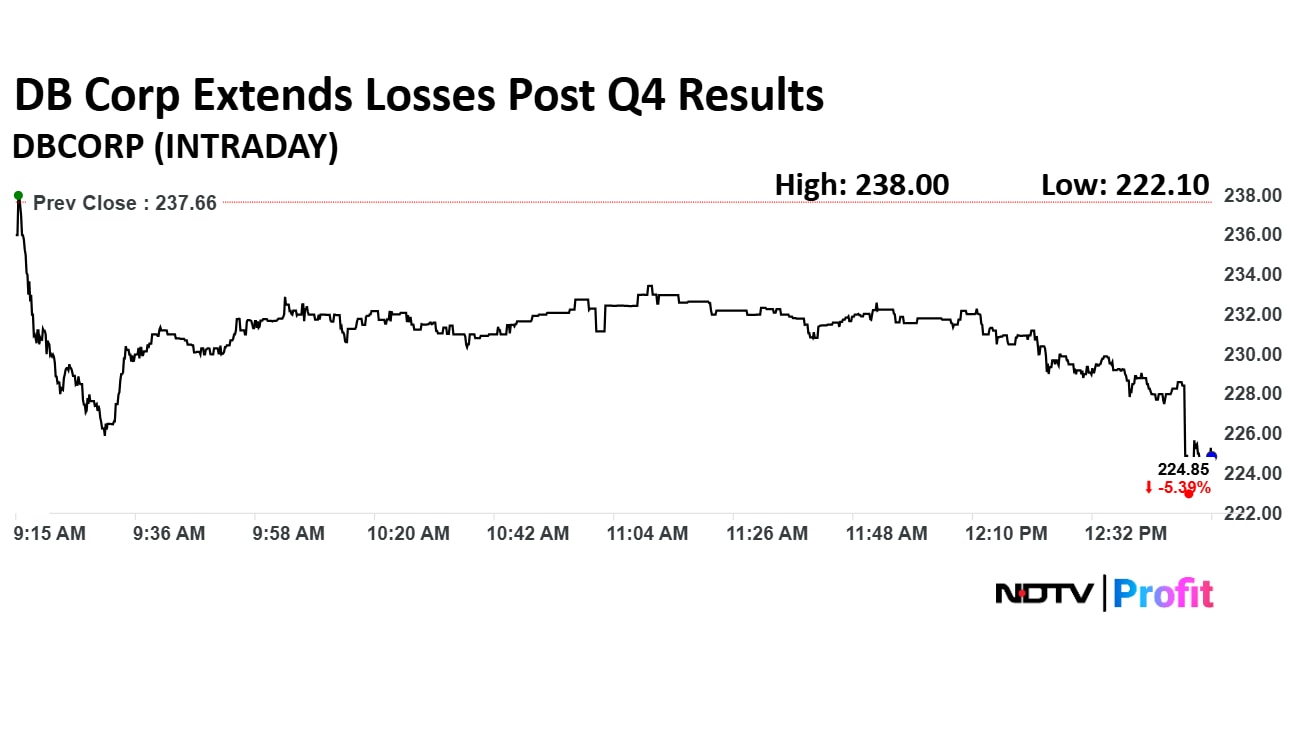

DB Corp Ltd. share price plunged 6.55% to Rs 222.10 apiece as the company reported that it's net profit halved in January–March. The consolidated net profit declined 57.3% on the year to Rs 52.3 crore. DB Corp's topline and operating profit also declined.

DB Corp Ltd. share price plunged 6.55% to Rs 222.10 apiece as the company reported that it's net profit halved in January–March. The consolidated net profit declined 57.3% on the year to Rs 52.3 crore. DB Corp's topline and operating profit also declined.

IDBI Bank has announced the re-appointment of TN Manoharan as the Part-time Chairman, effective May 9. This decision was confirmed through an exchange filing.

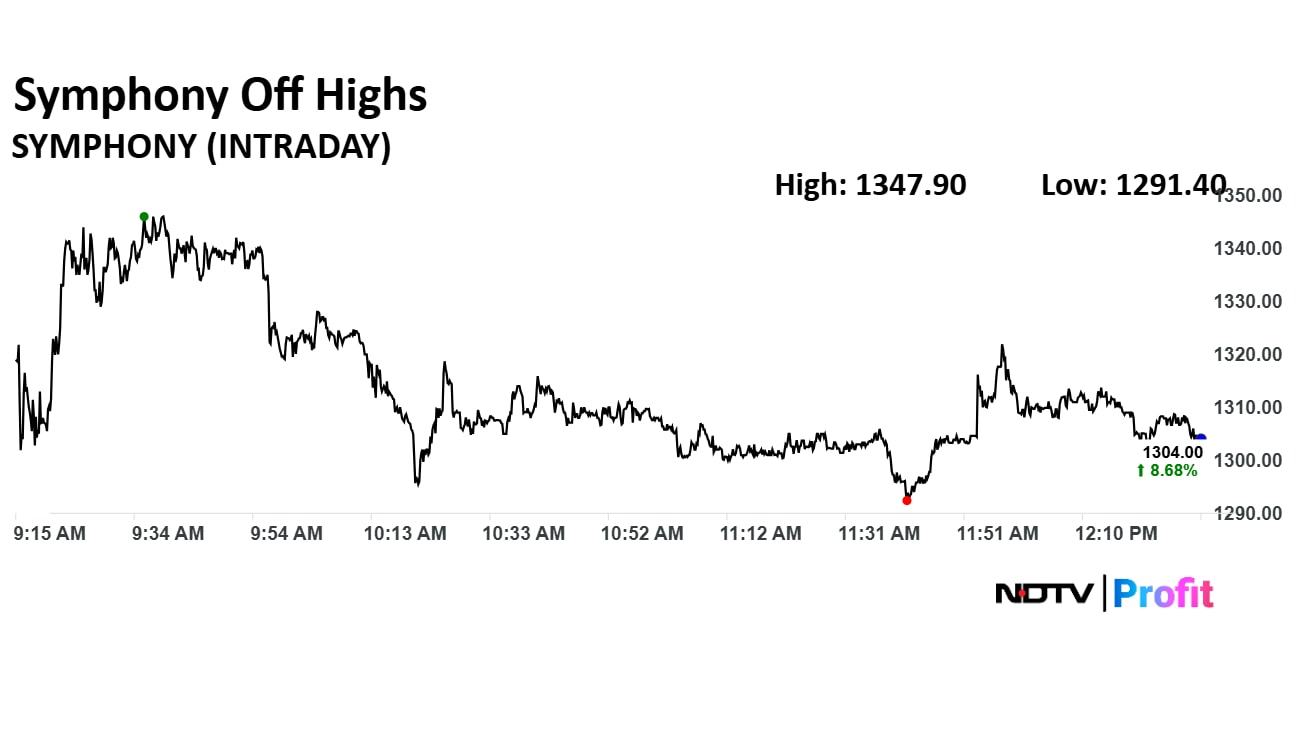

Symphony Ltd. share price jumped as high as 12.33% at Rs. 1347.90 after the company's consolidated net profit rose 65% in the quarter ended March 31.

Symphony Ltd. share price jumped as high as 12.33% at Rs. 1347.90 after the company's consolidated net profit rose 65% in the quarter ended March 31.

S&P Global Ratings has warned that the outbreak of hostilities between India and Pakistan has heightened regional credit risks, particularly for the two countries involved. While no immediate rating actions have been taken, the situation introduces material uncertainty that could weigh on sovereign credit profiles if tensions persist.

Read the full article here.

Tata Steel Ltd. share price moved in the narrow range of Rs 1.96 so far in Thursday's session as traders await from it fourth quarter results. The company is expected to post a strong set of number for January–March. the bottom line will likely be at Rs 1,167 crore compared to Rs 415 crore in the previous quarter.

As of 11:44 a.m., Tata Steel share price was trading 0.66% down at Rs 145.03 apiece.

Tata Steel Ltd. share price moved in the narrow range of Rs 1.96 so far in Thursday's session as traders await from it fourth quarter results. The company is expected to post a strong set of number for January–March. the bottom line will likely be at Rs 1,167 crore compared to Rs 415 crore in the previous quarter.

As of 11:44 a.m., Tata Steel share price was trading 0.66% down at Rs 145.03 apiece.

Advait Energy Solutions has secured an order worth Rs 7 crore for the commissioning of a 180 megawatt project in Gujarat.

Niva Bupa Health Insurance Co. Ltd. share price rose 14.65% to Rs 92.90 apiece, the highest level since Dec 11. The insurance company's consolidated net loss narrowed to Rs 56 crore in fourth quarter from Rs 850 crore.

Niva Bupa Health Insurance Co. Ltd. share price rose 14.65% to Rs 92.90 apiece, the highest level since Dec 11. The insurance company's consolidated net loss narrowed to Rs 56 crore in fourth quarter from Rs 850 crore.

Bajaj Allianz General Insurance April gross Direct premium underwritten at Rs 2,403 crore

Bajaj Allianz Life Insurance April total premium at Rs 719 crore

Source: Exchange filing

Tata Motors Ltd. share price rose 3.56% to Rs 704.50 apiece, the highest level since March 26. The share price rose at a time when Nifty 50 is trading in a narrow range as Tata Motors is expected to get most benefits from the India-UK Free Trade Agreement.

Certain variants of Land Rover Sports Utility Vehicles may get cheaper in India as the FTA brings down tariff to 10% from 100%.

Tata Motors Ltd. share price rose 3.56% to Rs 704.50 apiece, the highest level since March 26. The share price rose at a time when Nifty 50 is trading in a narrow range as Tata Motors is expected to get most benefits from the India-UK Free Trade Agreement.

Certain variants of Land Rover Sports Utility Vehicles may get cheaper in India as the FTA brings down tariff to 10% from 100%.

RateGain Travel Technologies has formed a strategic partnership with Cyprus Airways to enhance their pricing strategies. This collaboration aims to leverage RateGain's advanced technology and expertise in travel and hospitality to optimize Cyprus Airways' pricing models. The partnership is expected to improve revenue management and offer more competitive pricing options for customers.

PB Healthcare raises $218 mn in seed round led by General Catalyst

Investment to be used for establishing PB Health’s initial hospital network in Delhi NCR region

Source: Company statement

Zaggle Prepaid Ocean Services has entered into a strategic partnership with Grant Thornton Bharat LLP to develop and enhance a spend management platform. This collaboration aims to leverage Grant Thornton's expertise in financial advisory and Zaggle's innovative solutions to provide a comprehensive platform for efficient spend management. The partnership is expected to bring significant improvements in financial operations and cost management for businesses.

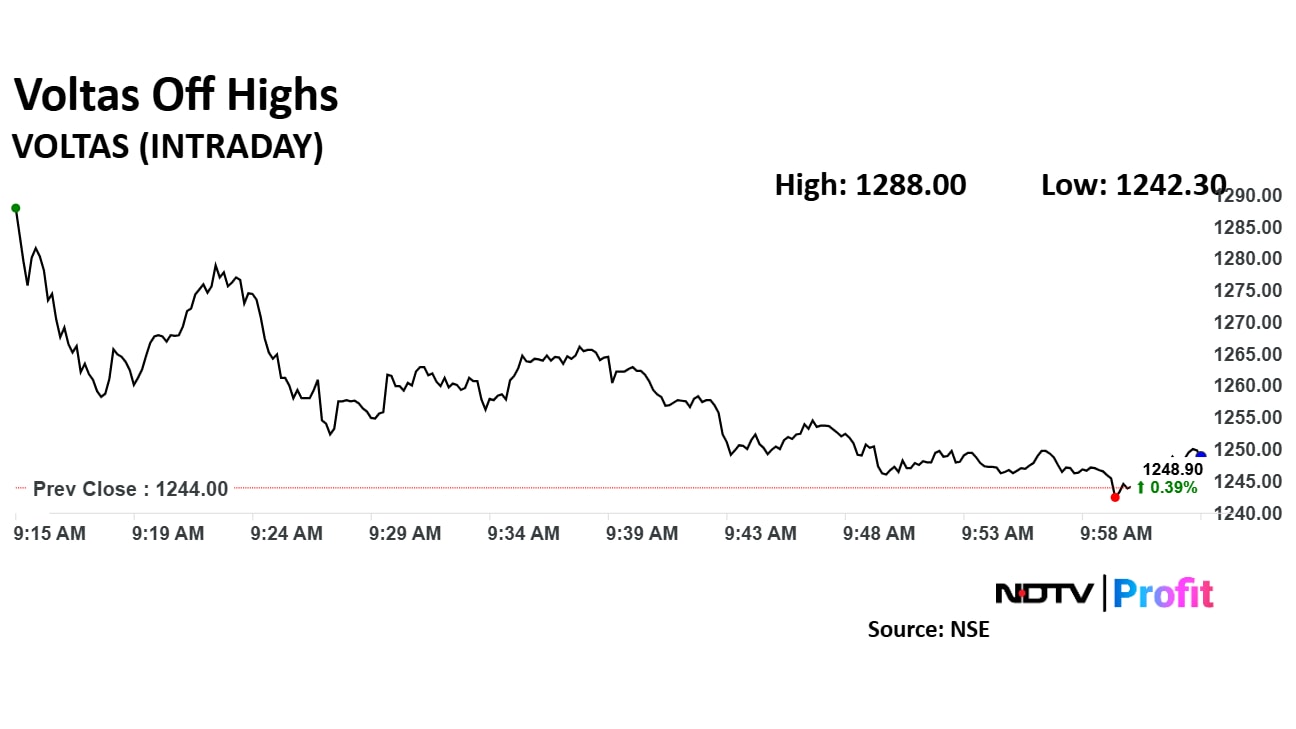

Voltas share price rose as much as 3.54% to Rs 1,288 apiece, the highest level since April 24. Voltas reported that its consolidated net profit jumped 107.8% to Rs 241 crore during January–March versus Rs 116 crore.

Voltas share price rose as much as 3.54% to Rs 1,288 apiece, the highest level since April 24. Voltas reported that its consolidated net profit jumped 107.8% to Rs 241 crore during January–March versus Rs 116 crore.

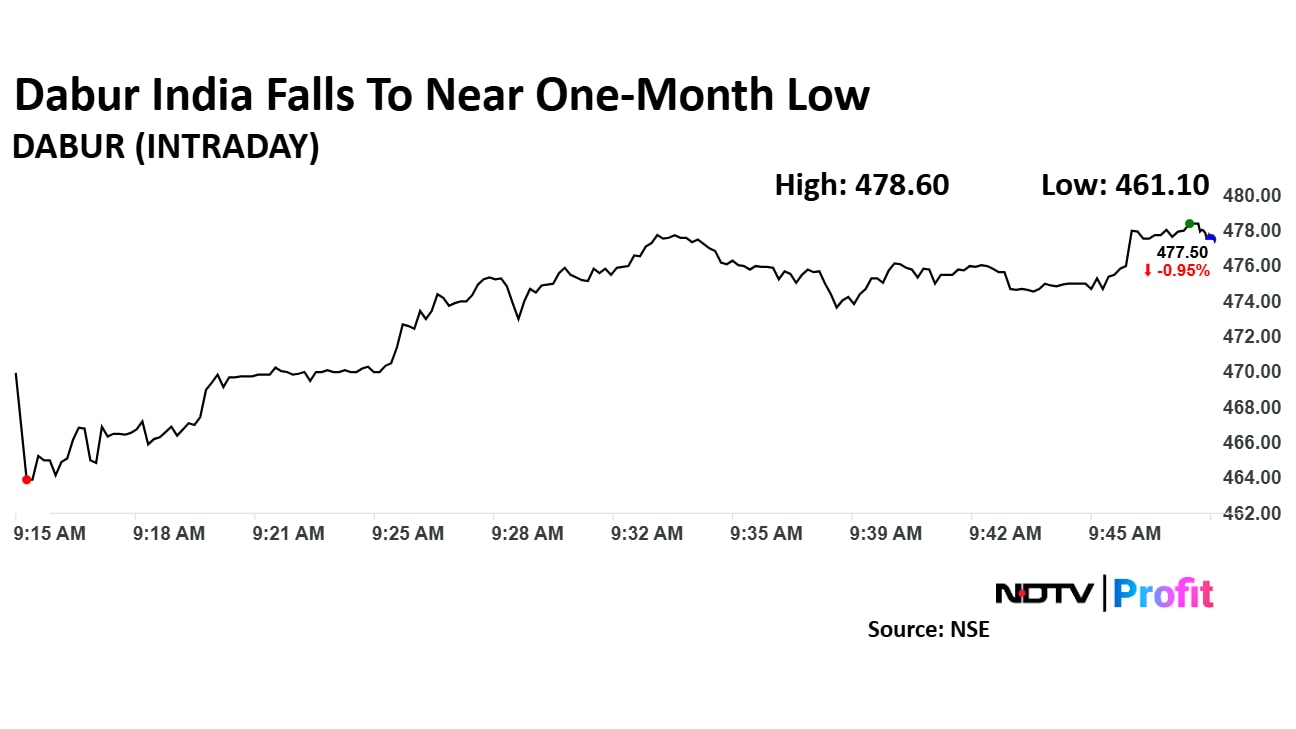

Dabur India Ltd. share price declined 4.36% to Rs 461.10 apiece, the lowest level since April 11. The share price declined as the consolidated net profit fell 8.4% on the year to Rs 320 crore during January–March versus Rs 349 crore.

Dabur India Ltd. share price declined 4.36% to Rs 461.10 apiece, the lowest level since April 11. The share price declined as the consolidated net profit fell 8.4% on the year to Rs 320 crore during January–March versus Rs 349 crore.

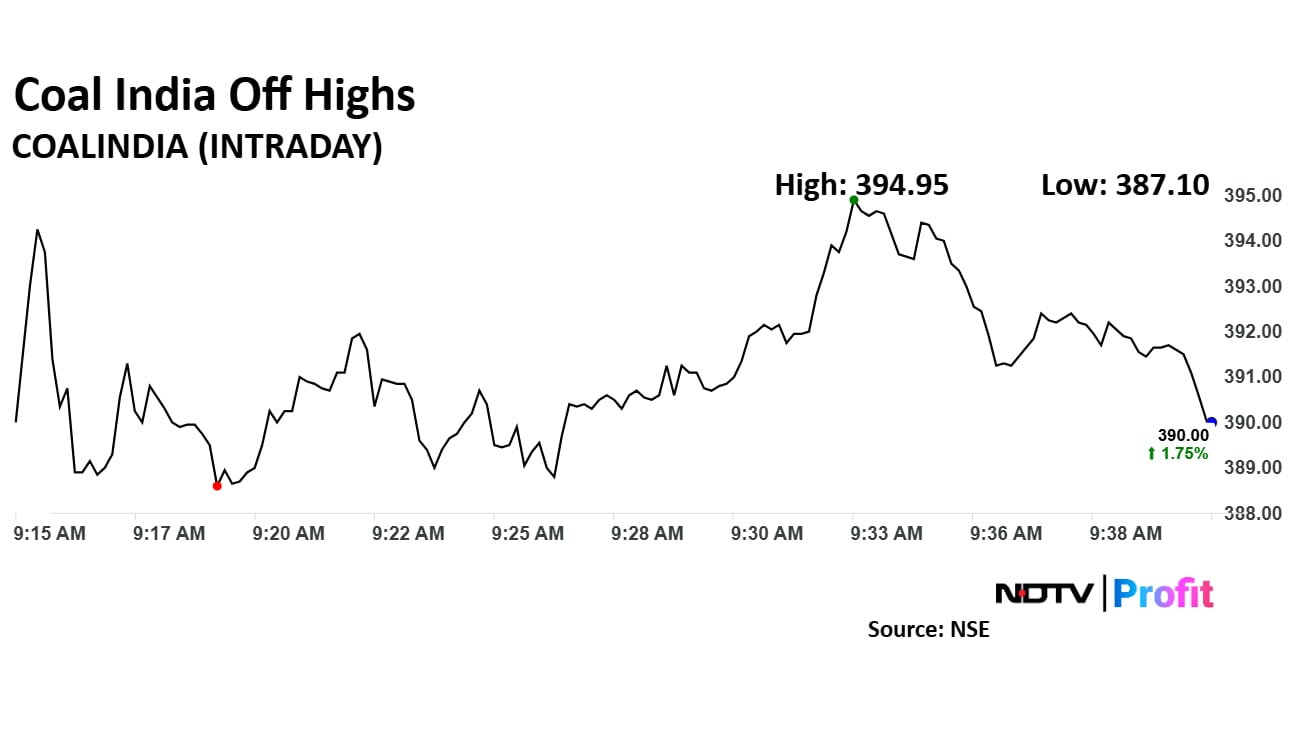

Coal India Ltd. share price rose 3.04% to Rs 394.95 apiece, the highest level since April 29. The share price rose as its consolidated net profit rose 12% on the year to Rs Rs 9,604.02 crore against Rs 8,413.5 crore estimated by analysts.

Coal India Ltd. share price rose 3.04% to Rs 394.95 apiece, the highest level since April 29. The share price rose as its consolidated net profit rose 12% on the year to Rs Rs 9,604.02 crore against Rs 8,413.5 crore estimated by analysts.

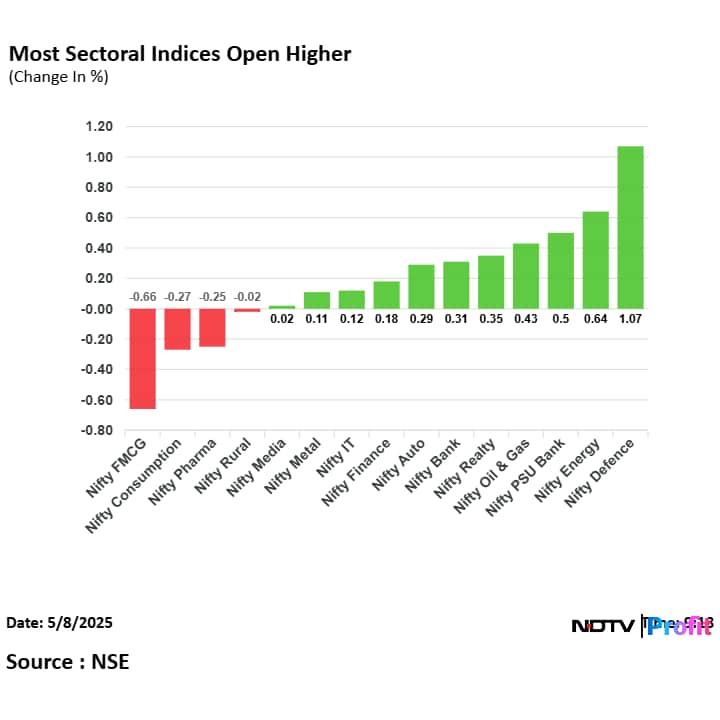

On NSE, 11 sectoral indices opened higher, and four declined out of 15. The NSE Nifty Defence rose the most, while the NSE Nifty FMCG declined the most.

On NSE, 11 sectoral indices opened higher, and four declined out of 15. The NSE Nifty Defence rose the most, while the NSE Nifty FMCG declined the most.

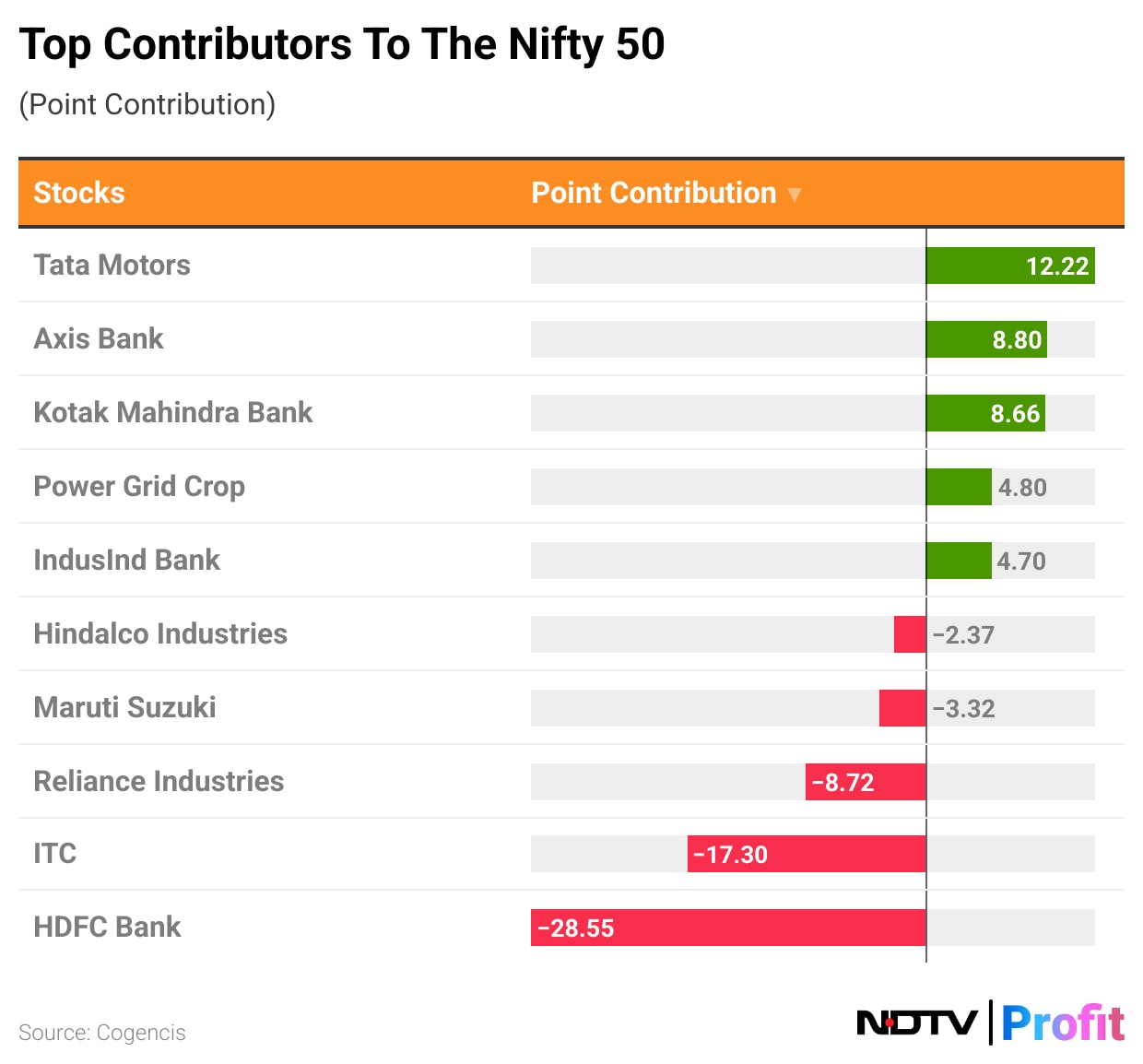

Tata Motors Ltd., Axis Bank Ltd., Kotak Mahindra Bank Ltd., Power Grid Crop of India Ltd., and IndusInd Bank added to the Nifty 50 index.

Hindalco Industries Ltd., Maruti Suzuki India Ltd., Reliance Industries Ltd., ITC Ltd., and HDFC Bank Ltd. weighed on the Nifty 50 index.

Tata Motors Ltd., Axis Bank Ltd., Kotak Mahindra Bank Ltd., Power Grid Crop of India Ltd., and IndusInd Bank added to the Nifty 50 index.

Hindalco Industries Ltd., Maruti Suzuki India Ltd., Reliance Industries Ltd., ITC Ltd., and HDFC Bank Ltd. weighed on the Nifty 50 index.

The NSE Nifty 50 and BSE Sensex opened slightly higher Thursday tracking gains in Axis Bank Ltd., Kotak Mahindra Bank Ltd., and Tata Motors Ltd. The Nifty 50 was trading 15.50 points or 0.06% down at 24,398.90, and the Sensex was trading 16.42 points or 0.02% higher at 80,763.20.

"The first bout of support will move higher to the 200-day average of 24,050 levels and on the higher side positive momentum will be only above 24,500 levels. RSI has reversed from the average line, and we expect volatility to increase in the second half with respect to the weekly expiry. Highest call OI has moved higher to 24,500 strikes while the downside the highest put is at 24,200 for the weekly expiry," said Vikas Jain, head, research, Reliance Securities

The NSE Nifty 50 and BSE Sensex opened slightly higher Thursday tracking gains in Axis Bank Ltd., Kotak Mahindra Bank Ltd., and Tata Motors Ltd. The Nifty 50 was trading 15.50 points or 0.06% down at 24,398.90, and the Sensex was trading 16.42 points or 0.02% higher at 80,763.20.

"The first bout of support will move higher to the 200-day average of 24,050 levels and on the higher side positive momentum will be only above 24,500 levels. RSI has reversed from the average line, and we expect volatility to increase in the second half with respect to the weekly expiry. Highest call OI has moved higher to 24,500 strikes while the downside the highest put is at 24,200 for the weekly expiry," said Vikas Jain, head, research, Reliance Securities

At pre-open, the NSE Nifty 50 was trading 0.07% higher at 24,431.50, and the BSE Sensex was trading 0.21% higher at 80,912.34.

The yield on the 10-year bond opened flat at 6.33%

Source: Bloomberg

Rupee opened 19 paise stronger at 84.64 against US Dollar

It closed at 84.83 a dollar on Wednesday

Source: Bloomberg

Downgrade to Neutral from Buy; Cut TP to Rs 680 from Rs 1500

Facing challenges on multiple fronts – tariff, slowdown in CV and inventory write-off

Weakening global CV cycle; tariff-induced slowdowns to weigh in

Recent one-time inventory write-off could adversely impact projections

Longer-term thesis of Indian companies' higher share of global forging remains intact

Medium-term factors dampen the growth and profitability outlook, warranting a wait-and-watch strategy

Cut FY26/27 earnings estimates 17%/23% taking into account the current scenario

Couple of such prior incidents over the past decade have de-escalated with minimal impact on financial markets

An escalation cannot be ruled out, though

Any potential escalation would be negative for tourism and high beta stocks in particular

Any consequent market correction would be shortlived, in our view

Maintain outperform with a target price of Rs 1,520

UCP margin surprises

Project business back to losses

Summer panning out weaker than expected

Believe near-term upside will be capped; Havells preferred

Gold future prices rebounded in Asia session after falling 2% in the previous day as the US Federal Reserve Chair Jerome Powell said that there's no rush to reduce interest rates in the world's largest economy anytime soon. The central bank is in good position to wait and assess the impact of tariffs.

Gold future was trading 0.61% higher at $3,411.94 an ounce as of 8:11 a.m. The prices settled at $3,391.9 an ounce Wednesday.

Oil future prices rebounded sharply Thursday as US President Donald Trump said in Truth Social media that a news conference will be held to provide update about major trade deals. This development came shortly after US and China agreed to meet to negotiate trade over the weekend in Switzerland.

July future contract of brent crude was trading 0.51% higher at $61.44 a barrel as of 7:49 a.m. It settled at $61.12 a barrel on Wednesday.

Share indices in Asia-Pacific region were trading on a mixed note Thursday morning as traders parsed US Federal Reserve's policy decisions, and wait for more developments in US and China trade negotiations.

US and Chinese officials will meet to negotiate trade tariffs over thee weekend in Switzerland. US President Donald Trump also announced that there'll be a news conference to update about trade deal with major partners.

The Nikkei 225 was 0.36% higher, while S&P ASX 200 was flat as of 7:39 a.m.

US share indices ended Wednesday with gains as Federal Reserve Chair Jerome Powell expressed his assurance on US economy. According to him, the world's largest economy remained sound. However, he sounded worried about higher inflation and unemployment.

The S&P 500 halted two-day decline with the help of chip stocks as Bloomberg reported Trump administration may rescind Biden-era restrictions on the industry.

On Wednesday, the Dow Jones Industrial Average and S&P 500 ended 0.70% and 0.43% higher, respectively. The Nasdaq Composite ended 0.27% higher.

The GIFT Nifty was trading 0.25% higher at 24,384.00 as of 6:45 a.m., which implied 30 points higher open for the benchmark Nifty 50. Traders will continue to assess the situation between India and Pakistan.

Coal India Ltd., Dabur India Ltd., Voltas Ltd., and Mahindra Mahindra Ltd. share prices will be key monitorable in Thursday's session as the companies released their fourth quarter results and business update.

India's benchmark equity indices reversed a one-day decline to close higher on Wednesday. The NSE Nifty 50 closed 34.80 points, or 0.14% higher at 24,414.4, while the BSE Sensex ended 105.71 points, or 0.13% up at 80,746.78.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.