Hello and welcome to our live coverage of Indian stock markets, where we follow the Sensex and Nifty after the Budget day session and the proposed rise in the Securities Transaction Tax on derivatives.

Indian equity benchmarks rebounded from opening losses. Sensex opened about 100 points lower and Nifty dipped below 24,800, then both moved higher. Sensex rose as much as 400 points after falling as much as 242.33 points, while Nifty gained as much as 0.2% to 24,874.25. Asian Paints led the gains with a 3% rise, followed by L&T up 2.7% and Tata Motors PV up 2.1%.

The move follows Sunday's Budget session, when the benchmark indices registered their worst budget session since 2020 after the Finance Minister Nirmala Sitharaman proposed a higher Securities Transaction Tax on futures and options. Nifty closed down 495.20 points, or 1.96%, at 24,825.45, and Sensex ended down 1,546.84 points at 80,722.94, after both fell nearly 3% at the day's low. The government said the STT change aims to curb excessive speculation in the futures and options segment.

That's all for today folks. But before you leave some interesting reads for you.:

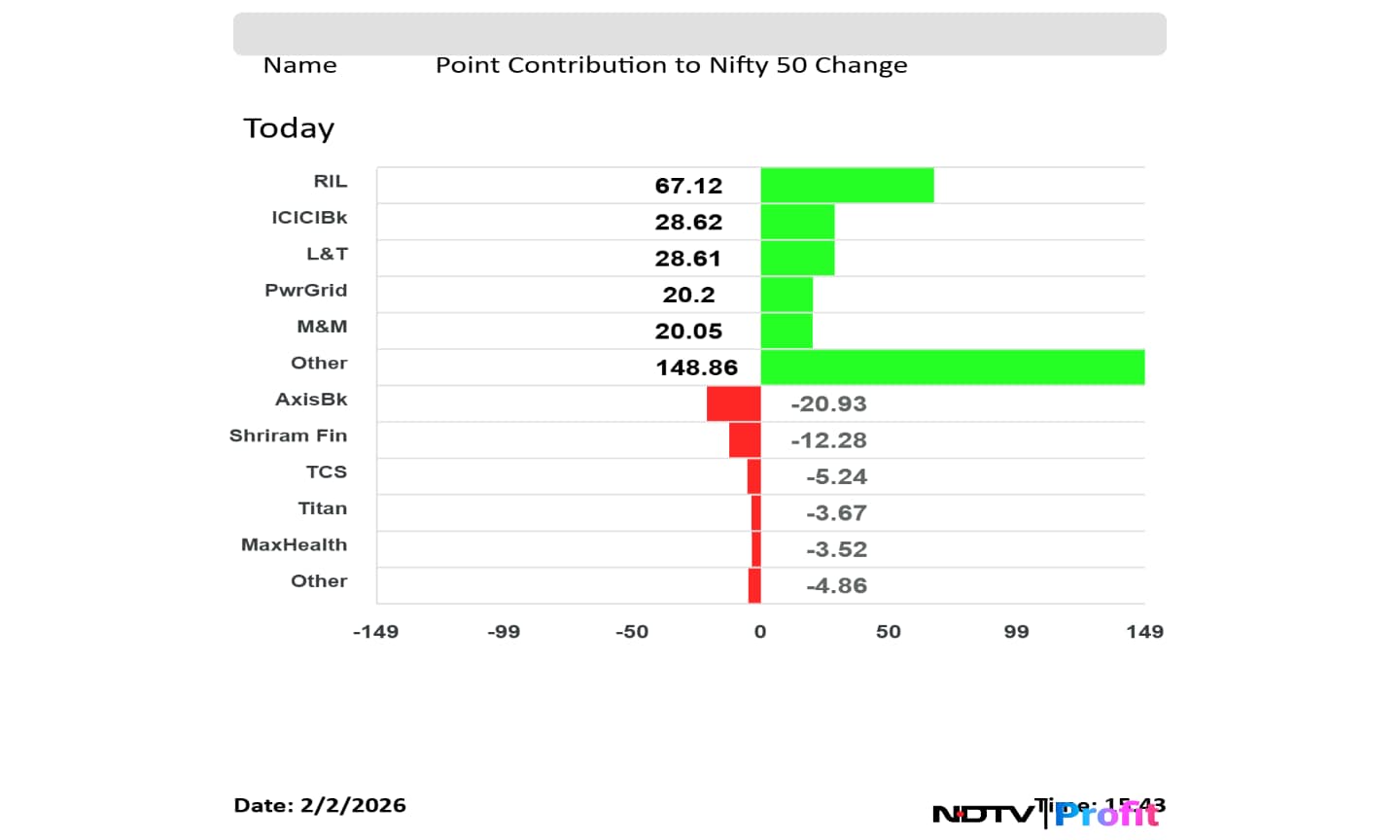

RIL, ICICI Bank, L&T, Power Grid, and M&M emerged as the top gainers for the day.

On the other hand, Axis Bank, Shriram Finance, TCS, Titan and Max Health were the worst performers of the Nifty 50 index.

Broader indices ended in positive. Nifty Midcap 150 ended 0.99% higher and Nifty Smallcap 250 closed 0.56% higher.

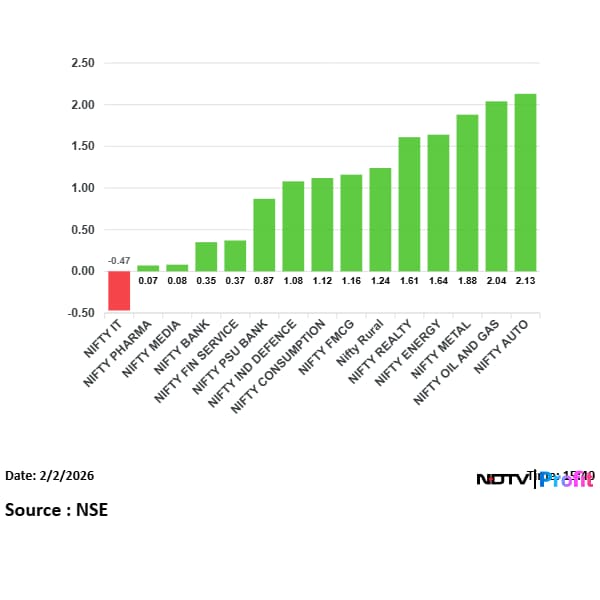

Most sectoral indices rose with Nifty Auto and Nifty oil and Gas were leading the advance, while Nifty IT was the only sector in the red.

The market breadth was skewed in the favour of sellers, as 2,206 stocks declined, 2,047 advanced and 175 remained unchanged on the BSE.

Indian equities opened in the red but gave up gains to close in green extending snapping its two day fall.

Intraday, both Nifty and Sensex fell nearly 0.60% but gained over 1%.

Nifty ends 262.95 points or 1.06% higher at 25,088.40.

Sensex ends 909.11 points or 1.13% higher at 81,632.05.

Finance Minister Nirmala Sitharaman said the government has not changed its stance on disinvestment, but will look at more disinvestment and asset monetisation, and will pursue a higher public float in central public sector enterprises (CPSEs).

She said the pace and direction of disinvestment will set the tone for revenue generation. She also said the government will “certainly” look at more on disinvestment and asset monetisation.

Sitharaman said the government is looking at more public float by CPSEs.

Latent View Analytics

Intellect Design Arena

Bharat Dynamics

Sharda Cropchem

Power Grid Corporation of India

Northern ARC Capital

Bharat Electronics Ltd. is back on the screen after Morgan Stanley raised its price target to Rs 508 from Rs 418, citing multi-year revenue visibility and a large order book. BEL fell as much as 10% on Budget day.

The brokerage pointed to BEL’s order book and indigenisation levels of about 70%-73%, and flagged programmes in the pipeline such as QRSAM and Kusha as largely indigenous by design. It also noted the Budget’s defence capex increase of 18% for FY27 to Rs 2.2 lakh crore, with 75% of procurement from the domestic market.

In early London trade, the greenback rose most versus the Australian, New Zealand and Norwegian currencies as gold extended losses after Friday’s biggest fall in more than a decade. Silver fell as much as 16% on Monday after logging its steepest intraday drop on record on Friday.

Click through to see the full FX and metals moves in one place.

The Budget centres on “strategic resilience”, with emphasis on rare earths and a push for construction equipment and chemical manufacturing, Chief Economic Adviser Anantha Nageswaran said.

He said reforms have continued through the year outside the Budget cycle, and said the Budget did not need “big bang” announcements because those have been happening through the year. He also pointed to a new Electricity Bill to remove cross-subsidisation, along with lower customs duties and exemptions on certain goods, and said the Budget keeps focus on manufacturing and services, as well as AI, the “orange economy” and tourist guides.

Nageswaran said manufacturing can support the rupee over time and help bring down the cost of capital, though he said it will take time. He also said the purpose is not revenue generation but to help households use savings to maximise wealth, and cited a SEBI paper on how people lose money through F&O. Click through to read the full remarks and the key lines in context.

If you’re scanning the market for what’s dragging, IT stocks are in focus after the rupee strengthened, following RBI intervention.

Infosys fell 1.78% and LTIM dropped 1.56%, while Mphasis slid 1.19%, Oracle Financial Services eased 1.15% and Persistent Systems fell 0.68%. HCLTech rose 0.88% and Tech Mahindra added 0.13%. Keep an eye on the rupee move as you track whether the selling stays concentrated in IT or spreads wider.

Markets are swinging after Sunday’s Budget session, with Reliance and L&T helping lift the Nifty. Keep Nifty’s support zone in view around 24,800, with the 24,600-24,800 band in focus.

Bank shares are showing more strain than the Nifty, while options positioning points to no clear direction. The rupee has firmed after RBI intervention, broader indices are weaker than the benchmarks, and the overhang from foreign investor selling remains.

After the Budget session on Sunday, Dalal Street shifts focus to earnings on Monday, with about 75 companies set to report December-quarter results.

The key names due today include Hyundai Motor India, Railtel, PB Fintech and Bajaj Housing Finance. Ather Energy, Awfis Space Solutions, Bharat Wire Ropes, Corona Remedies, Mahindra Lifespace Developers, Olectra Greentech and Tata Chemicals are also scheduled to report.

Want to track the numbers as they drop? Click through to our Q3 Results LIVE updates.

A quick check on precious metals: gold fell again after its biggest drop in more than a decade, and silver extended its reversal after a rally that ran too far, too fast.

In Asian trading on Monday, spot gold fell as much as 6.3% and silver dropped as much as 11.9%. Silver swung during the session, rising more than 3% at one point before turning lower again, after its steepest intraday fall on record in the previous session.

If you are tracking Asia’s movers today, South Korea is in focus after a sharp slide tested confidence in a market that had kept rising even when the global AI trade cooled elsewhere.

The Kospi dropped as much as 5.6%, with uncertainty over interest-rate policy and fresh questions about how long AI-led spending can hold up weighing on tech shares.

Lupin said it has introduced Dasatinib tablets in the US, according to an exchange filing. Dasatinib tablets are used to treat leukaemia.

Want the quick read on how one brokerage sees the Budget? Jefferies India called it a “pragmatic approach” with “no fireworks” and said it does not see an immediate trigger for equity markets, while it points to a medium-term growth setup and a continued push on export competitiveness.

Here are the themes to track: Jefferies highlighted a renewed capex focus, led by defence, and said slower fiscal consolidation helped that stance. It also flagged support for data centres and electronics components, but warned that higher bond yields could pressure rate-sensitive sectors. Jefferies also called the STT hike a negative and said it signals discomfort with high derivatives (F&O) volumes.

Jefferies also pointed to a large disinvestment budget and said the IDBI Bank divestment could conclude in FY27, while it outlined sector moves tied to infra capex, defence, electronics manufacturing, data centres and digital payments — and flagged pressure points linked to yields, capital markets and the STT change.

Click through to see Jefferies’ full scorecard, sector calls and the key lines to watch next.

Now, turning to EMS stocks, Budget 2026 put electronics components in focus, with the government doubling the electronics component manufacturing scheme (ECMS) budget to Rs 40,000 crore for FY27. The announcement also sits within the wider push for India Semiconductor Mission 2.0.

Two broker notes then zeroed in on Dixon Technologies. Jefferies flagged the mobile PLI allocation and said it sees no extension, while Morgan Stanley kept an underweight rating with a target price of Rs 8,157 and pointed to a low chance of any extension beyond March 2026 as policy focus shifts to higher value addition. Despite the notes, Dixon shares opened slightly higher on Monday.

Click through to see the full breakdown of the Budget linkage and what the broker notes mean for EMS names.

Nuvama Wealth Management said a fall in crude prices can support paint makers’ costs and help Asian Paints in the March quarter, as it forecast 11% volume growth for the company in Q4.

The brokerage firm said that the crude is a key raw material input for paint players and noted crude was down 5% on the day. It linked that move to the cost base for the sector.

The research firm also pointed to expected changes in competitive behaviour, including a pullback in promotions and a more measured pricing approach, as factors it will track for Asian Paints.

Shares of Meesho were locked in 5% lower circuit for the second consecutive trading session.

That came after the online marketplace's losses widened during the three months ended December, primarily due to a surge in expenses during festive season. The company had posted a loss of Rs 37.43 crore in the year-ago period.

Shares of MRPL halted a two-day losing streak. The stock rose as much as 6.8% to Rs 173.79. The scrip had declined nearly 10% on Sunday.

Shares of Anant Raj extended gains for the second consecutive trading session. The stock rose as much as 7.4% to Rs 570.55 apiece.

The real estate developer had rallied over 14% on Sunday after the Finance Minister Nirmala Sitharaman announced a tax holiday for overseas firms offering cloud services for India-based data centres.

Indian equity benchmarks fluctuated between gains and losses after Sunday's worst Budget trading session in six years. The BSE Sensex opened 100 points lower while the NSE Nifty 50 fell to below 24,800.

At 9:23 am, the 30-stock index had erased losses and rose over 200 points, while the NSE Nifty 50 trade at 24878.85.

Indian government bonds fell after the government announced a record gross borrowing plan of 17.2 trillion rupees ($187 billion) on Sunday for fiscal 2027. The 10-year yield rose as much as 8 basis points to 6.78%, the highest since Jan. 17, 2025.

The market is already dealing with adverse demand-supply dynamics, Bloomberg reported quoting Puneet Pal, head of fixed income at PGIM India Mutual Fund.

The Indian rupee strengthened by 19 paise to 91.76 at the open against the US dollar.

At least 75 companies are set to announce their Q3FY26 results today.

Key companies declaring results include Ather Energy Ltd., Hyundai Motor India Ltd., Mahindra Lifespace Developers Ltd., PB Fintech Ltd., and Tata Chemicals Ltd. After announcing the Q3FY26 results, most of the companies will hold an earnings conference call to discuss the Q3 performance and outlook. Some may also announce dividends as a reward for the shareholders.

Click here to see the full list

If you are tracking bullion prices this morning, here is the key move first. Silver fell to Rs 2.66 lakh per kg in the national capital on Monday, while gold dropped to Rs 1.48 lakh per 10 grams, as investors booked profits amid a wider global selloff linked to geopolitical events, according to the India Bullions website.

The slide also showed up in early global trade. Spot gold fell as much as 4%, and silver dropped by a similar margin while holding above $80 an ounce after briefly falling as much as 12%. The recent swing followed Friday’s drop after news that U.S. President Donald Trump plans to nominate Kevin Warsh as the next Fed chair, which strengthened the dollar and changed trader expectations.

Check the latest city-wise gold and silver prices here.

A quick look at Asian markets: Stocks cut early losses and metals swing in Monday trading.

Asian shares were down 0.3% and Nasdaq 100 futures slipped 0.2%, both off their session lows. The Bloomberg Dollar Spot Index erased earlier gains to trade flat after the dollar logged its strongest day since May on Friday, following President Donald Trump’s nomination of Kevin Warsh as the next Federal Reserve chair. The yen moved up and down after Japan’s prime minister said a weak yen can be an opportunity for export industries.

Read the full story here.

Cigarette prices have risen by at least Rs 22 to Rs 25 for a 10-stick pack after additional excise duty took effect on Sunday. Distributors said some 76 mm premium brands may go up by Rs 50 to Rs 55 per 10-stick pack, depending on the brand.

What to watch: manufacturers have not issued revised MRP declarations yet, but distributors have started billing old stock to retailers with 40% GST. With wholesale markets shut on Sunday, distributors expect fresh stock with new MRPs to start moving from Monday.

Price checks shared by distributors include Wills Navy Cut (76 mm) moving from Rs 95 to about Rs 120 for 10 sticks, 84 mm brands priced at Rs 170 moving to about Rs 220 to Rs 225 for 10 sticks, and Classic Connect (97 mm) moving to about Rs 350 for 20 sticks. Distributors expect packs with new MRPs from manufacturers by month-end, while some companies have put stocks on hold, a stockist said. AICPDF said India has about 8,000 to 9,000 stockists of cigarettes and tobacco products.

Hero MotoCorp reported a 26% rise in total January sales from a year earlier to 557,871 units.

Domestic sales rose 26% to 520,208 units, while exports increased 24% to 37,663 units. Motorcycle sales climbed 24% to 495,889 units — keep an eye on how the domestic and exports split shapes the overall run rate.

The Finance Bill 2026 proposes to tax buybacks as capital gains for shareholders who hold 10% or less of a company’s equity. It sets long-term capital gains tax at 12.5% plus surcharge, while promoters — defined as holders above 10% — would continue to be taxed as dividend income at 22% or 30% for promoters other than domestic companies, plus surcharge.

Why it matters: The proposal seeks a more uniform tax approach to buyback income and could affect how listed companies use buybacks. The updated rules, framed under the Income Tax Act, 2025, are scheduled to take effect on April 1, 2026, and may raise questions around setting off capital losses against buyback proceeds, according to Vaibhav Gupta of Dhruva Advisors.

The Union Budget 2026 proposed a sharp rise in the Securities Transaction Tax on derivatives trades, in a move the government said would curb excessive speculation in the futures and options segment.

Proposed changes:

Also Read: STT Hike Undertaken To Curb Speculative Activity In F&O, Says Govt

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.