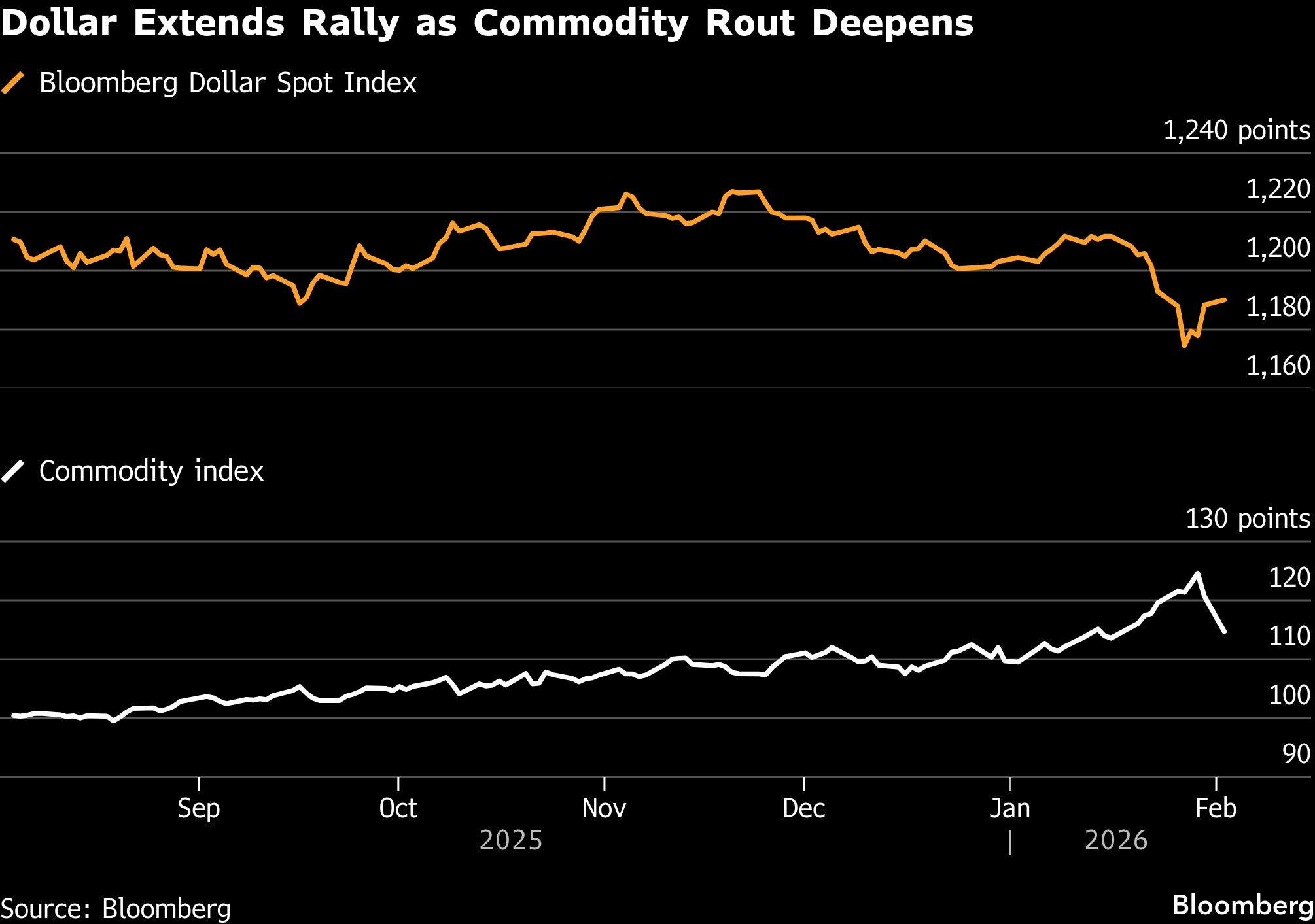

The dollar strengthened again Monday, advancing the most against currencies sensitive to commodity prices, as a plunge in gold and silver rippled across markets.

The greenback rallied the most against the currencies of Australia, New Zealand and Norway in early London trading, as gold extended losses after its biggest plunge in more than a decade on Friday. Silver sank as much as 16% Monday after its intraday loss on Friday was the steepest on record.

“Once precious metals did start to come under pressure, there were plenty of factors adding fuel to the fire,” Michael Brown, senior research strategist at Pepperstone Group in London, wrote in a research note. “The question everyone is now asking is what happens next?”

Photo Credit: Bloomberg

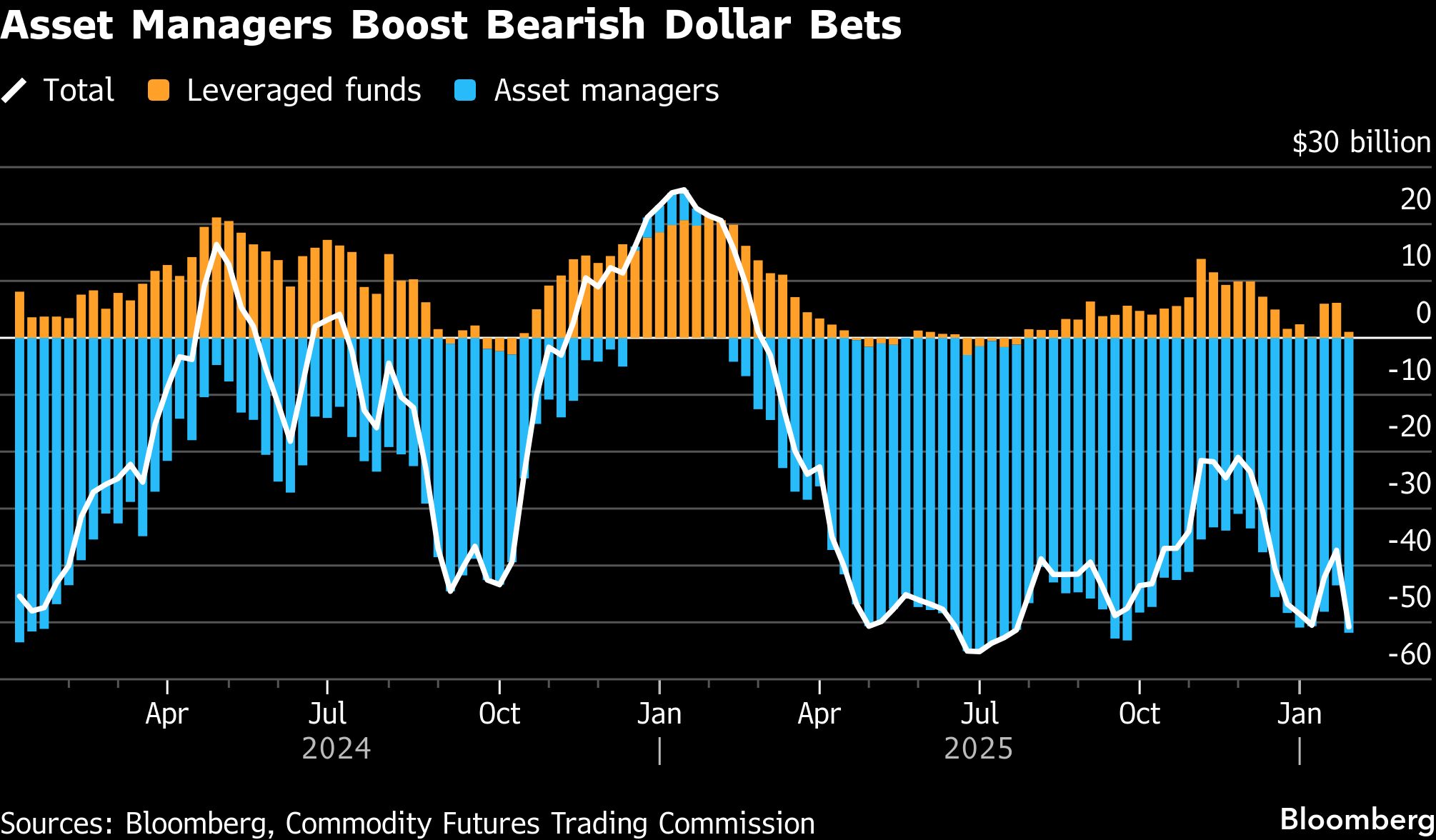

The dollar's gain of about 1% over Friday and Monday comes after the world's reserve currency slumped in the second half of January. The bounceback may have caught some investors off guard, given shorting the greenback was one of the most popular macro trades last month. Until the end of last week, US threats against Greenland and President Donald Trump's apparent embrace of the currency's selloff had only fueled debate around the greenback's long-term decline.

Asset managers boosted their bearish dollar positioning just days before news of Kevin Warsh's nomination as Federal Reserve chair triggered the greenback's biggest gain since May. But traders were reminded that the weakness will be far from linear when the dollar jumped Friday as investors saw Warsh as a more hawkish candidate than some of the other names mentioned.

Photo Credit: Bloomberg

Despite the recovery in the dollar, many market participants are warning of further weakness. DoubleLine Capital chief executive officer Jeffrey Gundlach said last week the greenback hadn't acted like a haven currency for a while, and Trump's unpredictable policy making and the US's large deficits continue to weigh on the dollar.

“This is not a volatility event. It is currency devaluation,” Ahmad Saidali, founder and chairman of multi-family office and real estate advisory firm Redwood Heritage Group, wrote of the dollar's decline since last January.

What Bloomberg Strategists Say...

“The greenback's rebound looks to be partly driven by expectations Warsh will be more hawkish than some had feared the next Fed chair might turn out to be”, says Garfield Reynolds, Markets Live strategist.

As February trading gets underway, many strategists are sticking to their calls for more pressure on the dollar.

Goldman Sachs Group Inc., Manulife Investment Management and Eurizon SLJ Capital all see a weaker US currency ahead, though any decline is likely to be far from smooth. In fact, swings in currencies and precious metals are now bigger than those in equities despite concerns about AI stock bubbles.

“It is notable that FX volatility has increased by a similar magnitude as it did last April, while rates and equities have not,” Goldman strategists including Kamakshya Trivedi wrote in a note. “The recent injection of policy uncertainty will be sufficiently durable to keep the dollar from making up lost ground.”

ALSO READ: Budget 2026: Are You A Salaried Taxpayer? Here's What Changes For You

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.