The local currency strengthened 3 paise to close at 82.89 against the U.S dollar on Monday.

It closed at 82.92 on Friday.

Source: Bloomberg

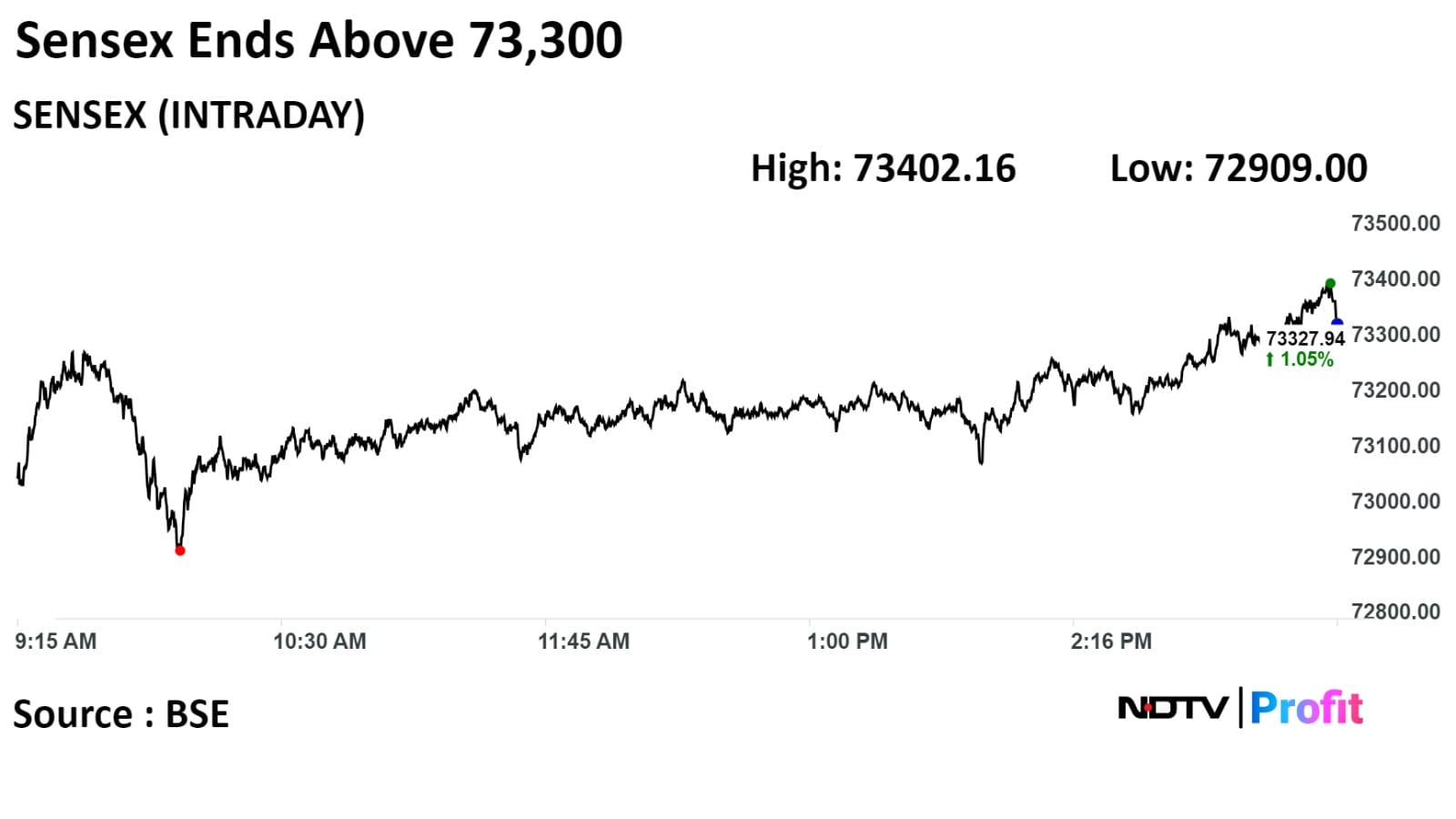

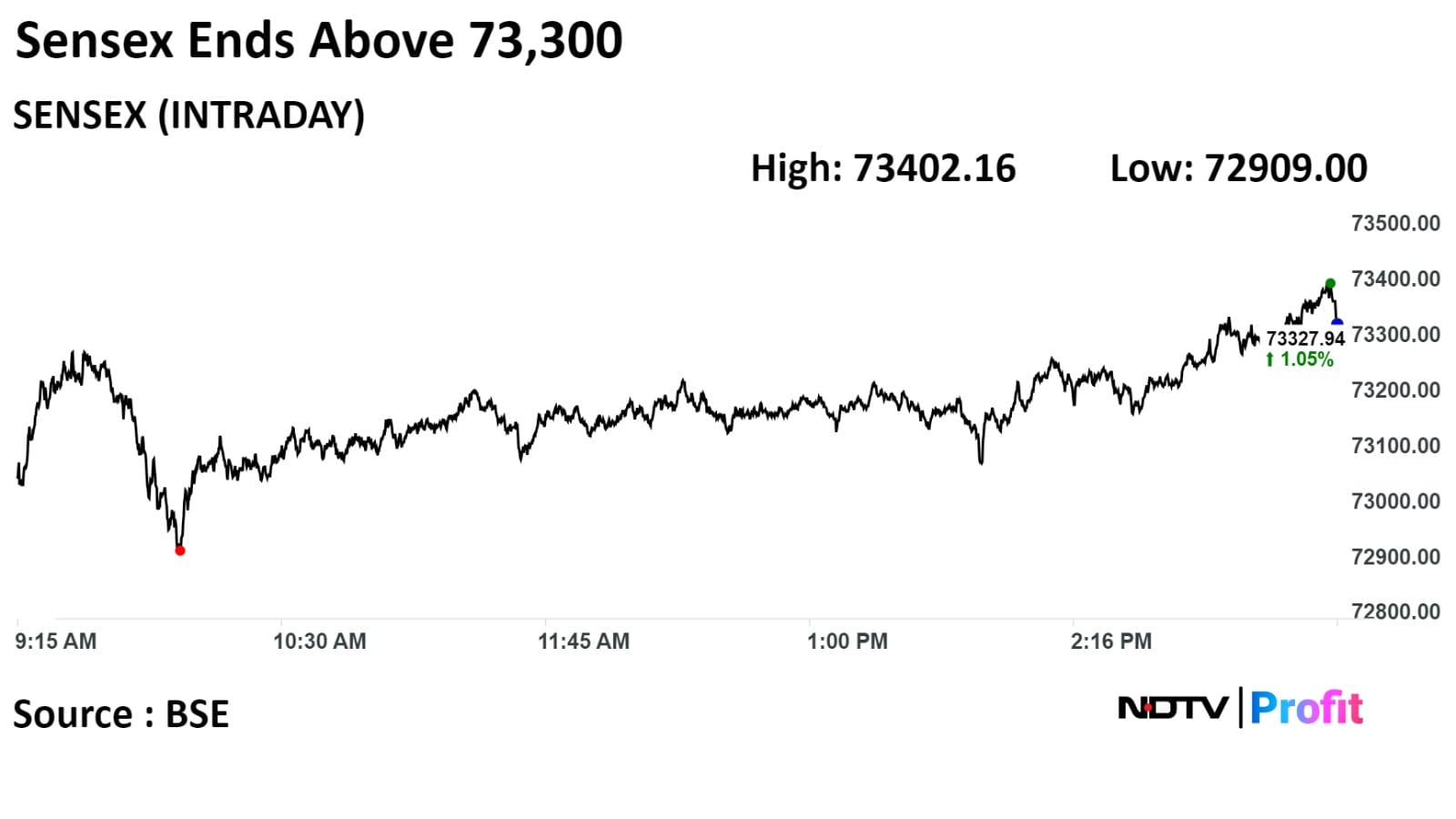

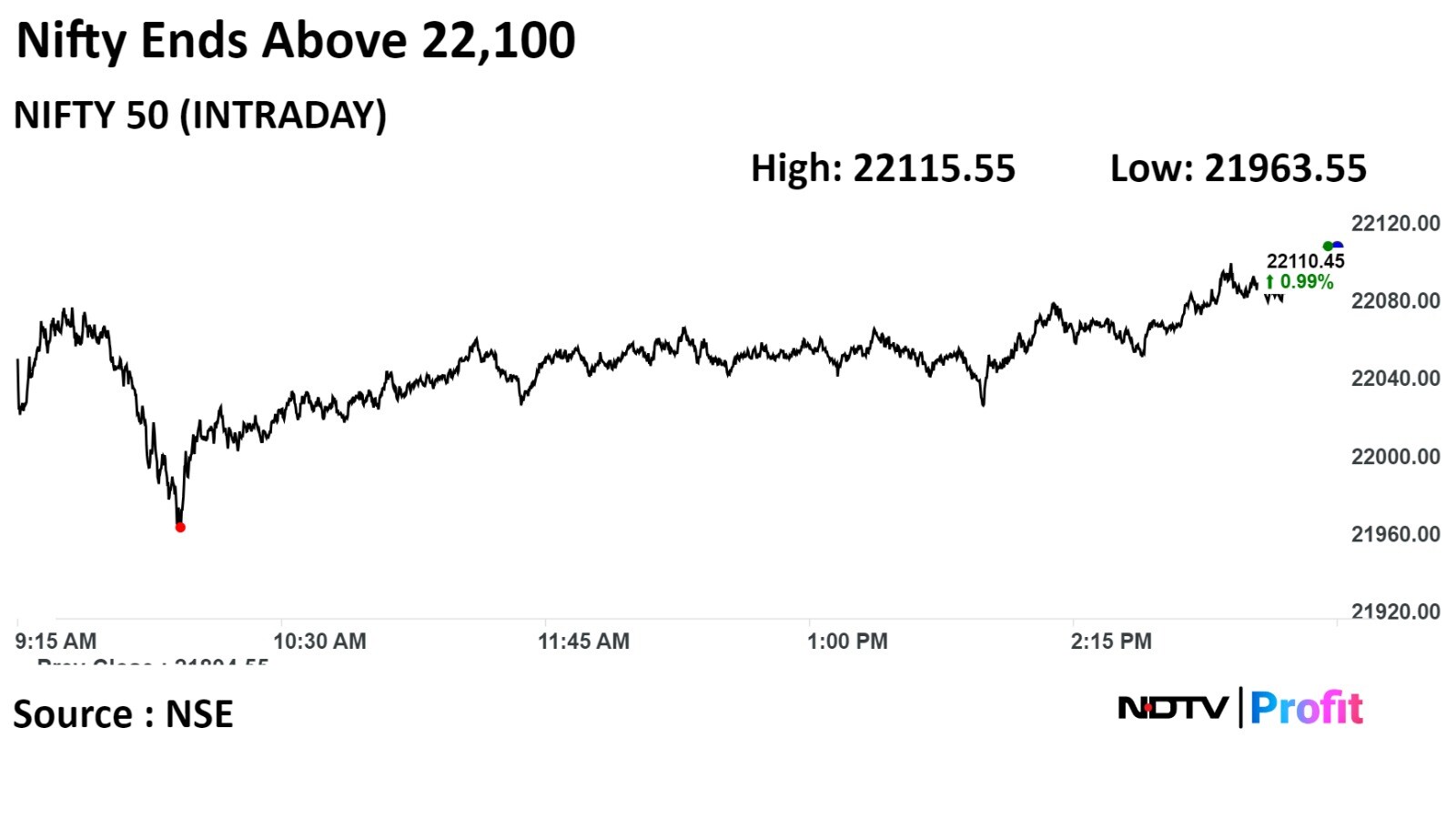

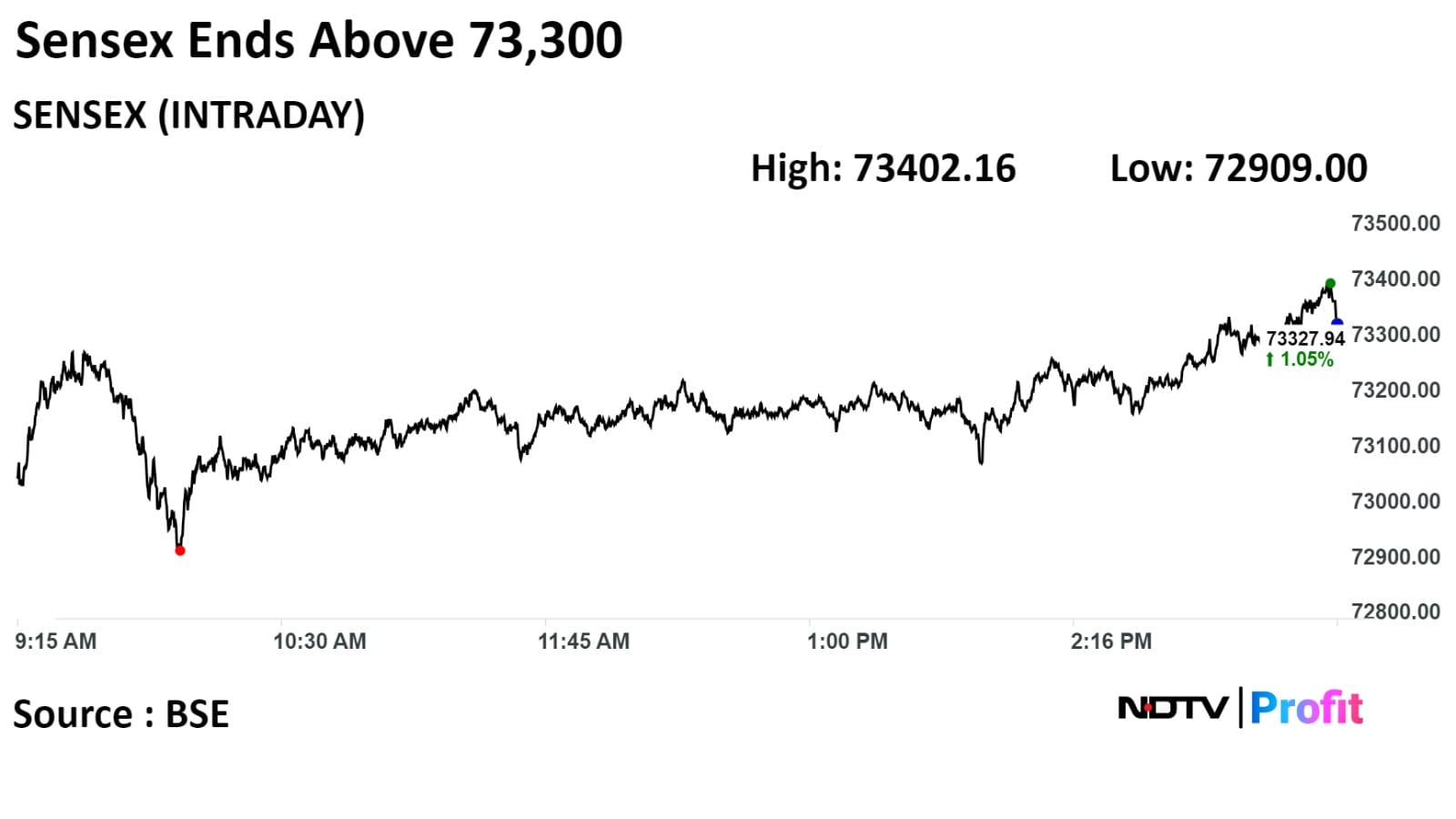

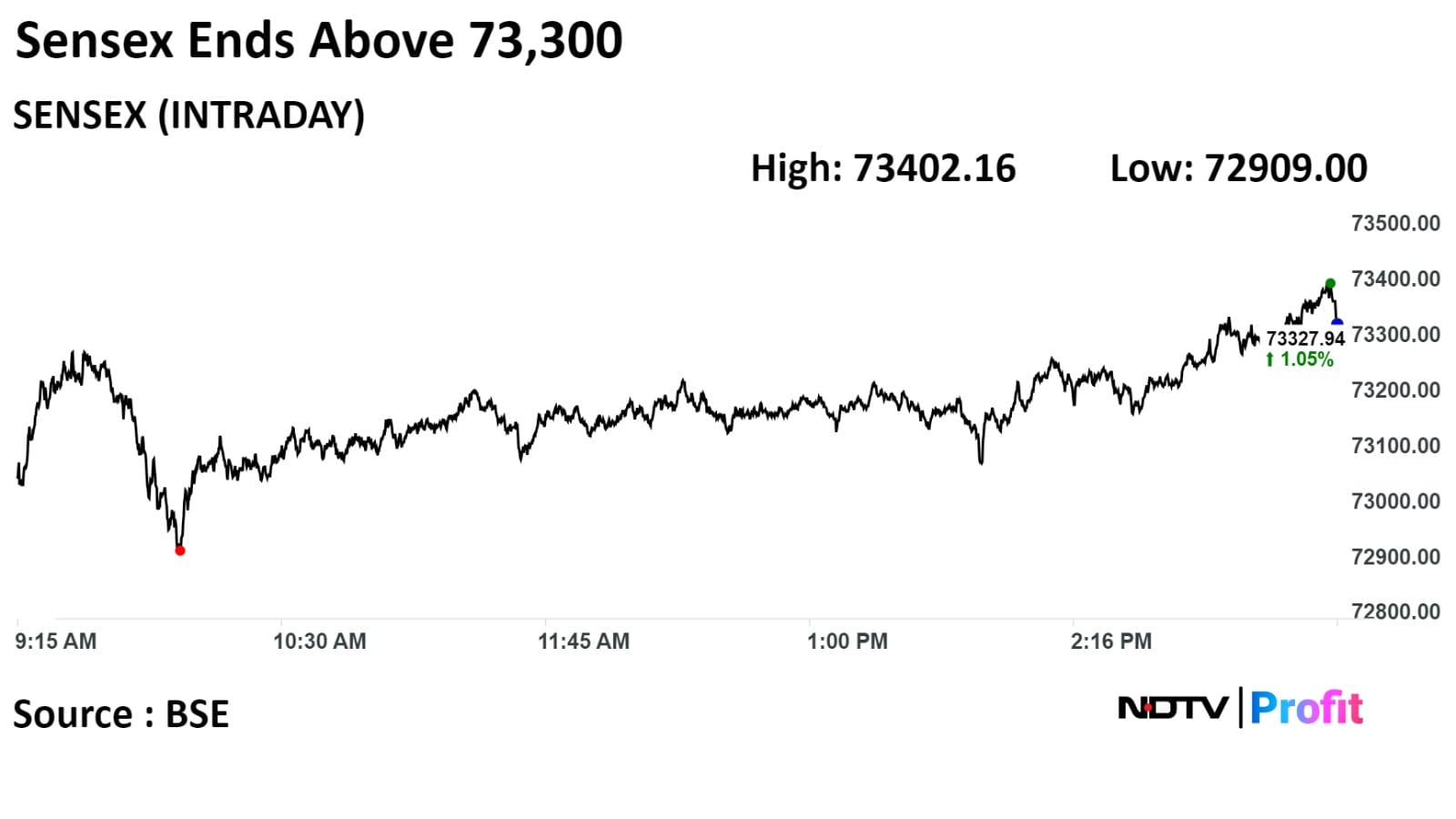

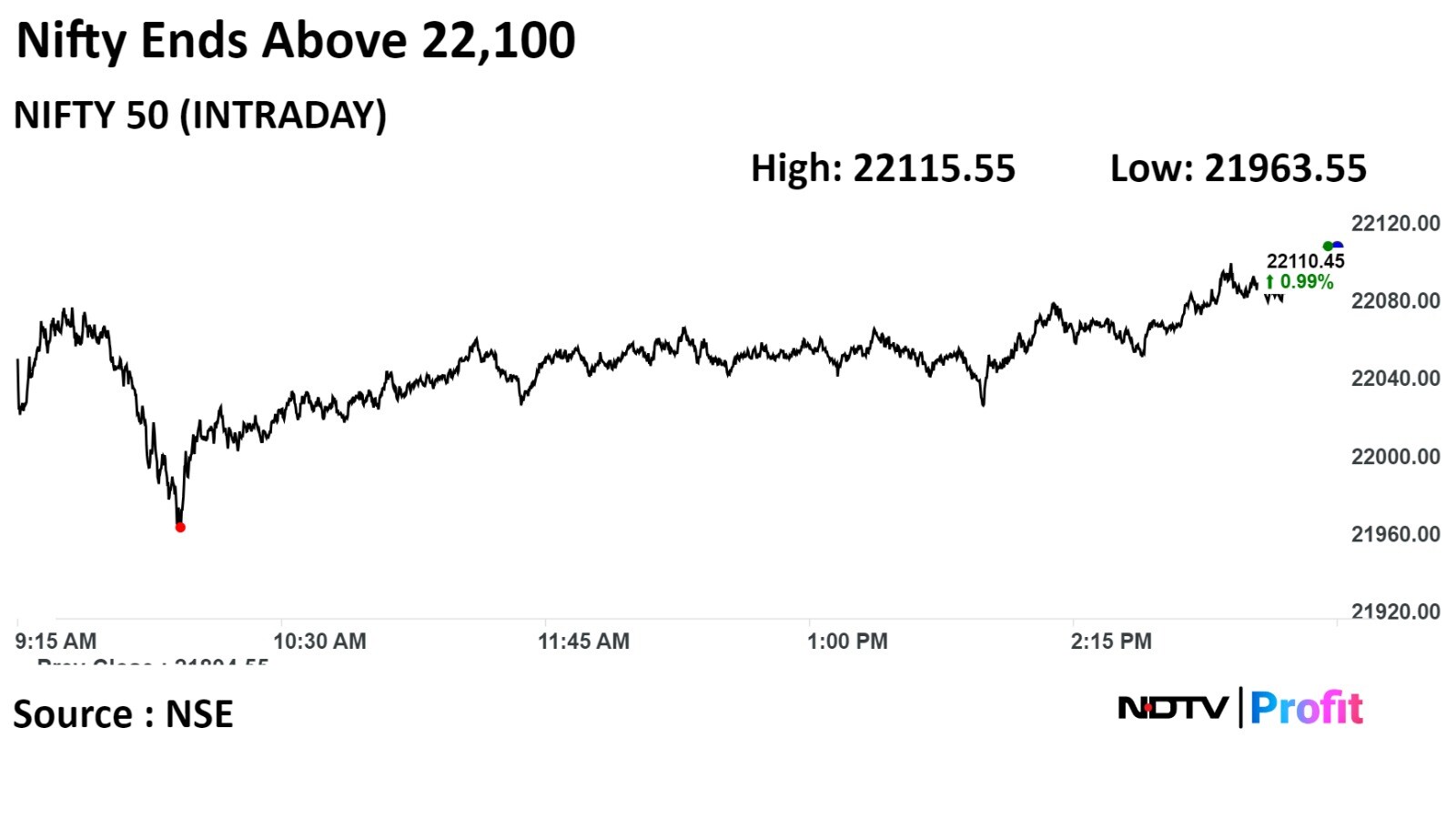

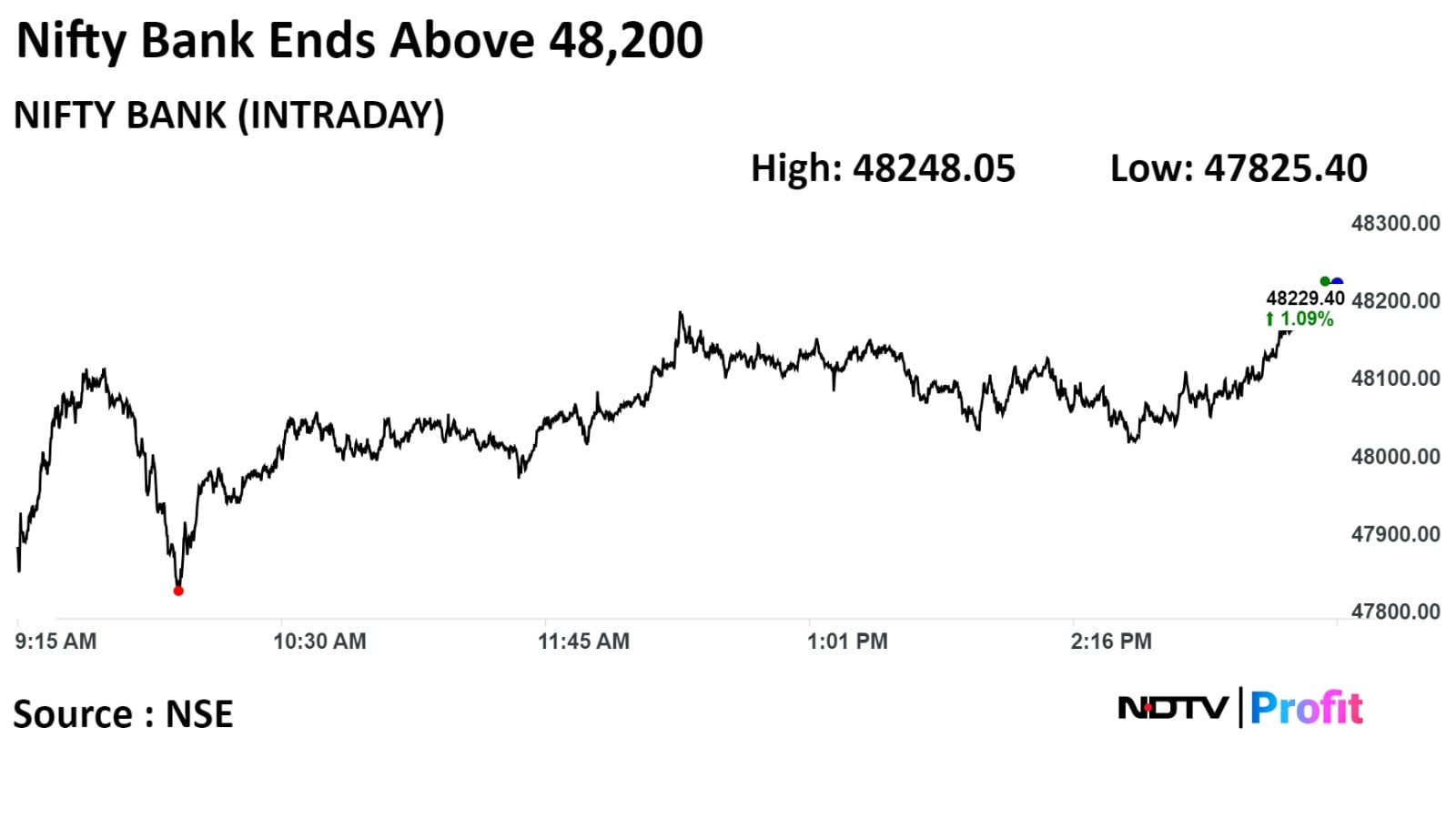

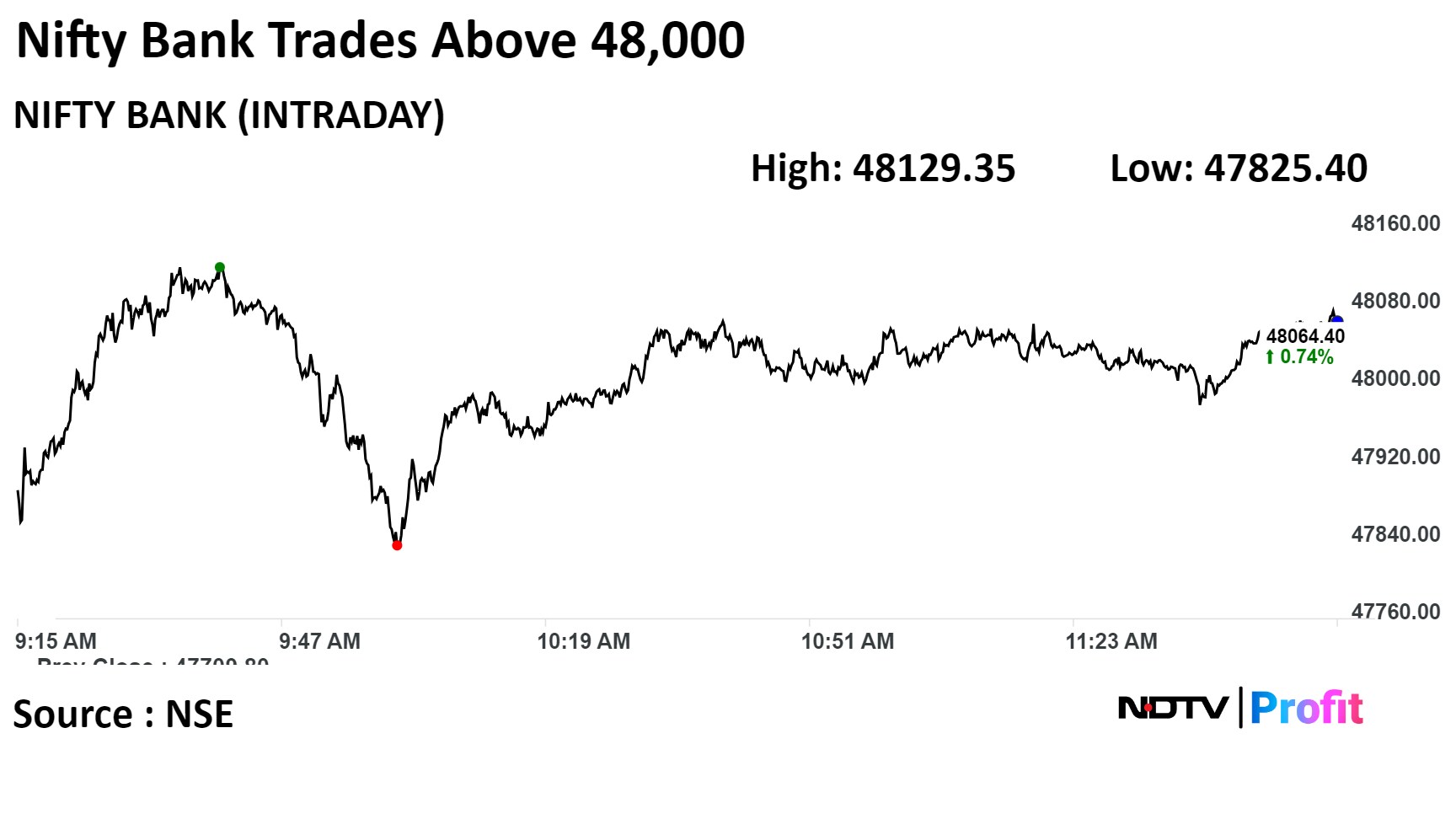

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

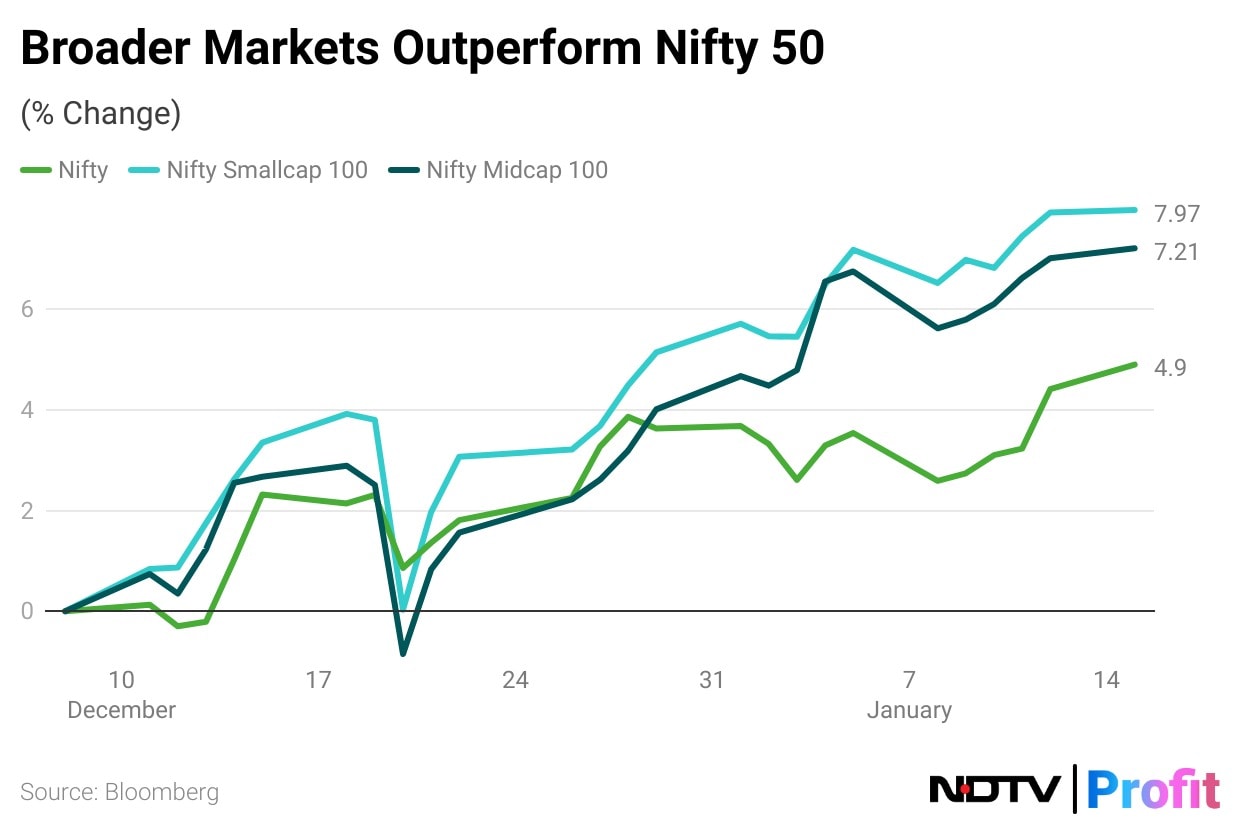

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

India's benchmark indices settled at fresh highs for second day in a row on Monday as HDFC Bank Ltd, Reliance Industries Ltd, and Infosys gained.

The NSE Nifty 50 ended 0.93% or 215.90 points higher at 22,110.45, while the S&P BSE Sensex settled 1.05% or 759.49 at 73,327.94.

The Nifty 50 index touched a record high of 22,115.55, and Sensex rose to a fresh high of 73,402.16.

"We are of the view that, the larger texture of the market is still in to the positive side but due to temporary overbought conditions we could see range bound activity in the near future. For the traders, 22000-21950/73000-72800 would be the key supports levels while 22150-22225/73500-73800 could act as a key resistance zones. . However, below 21950/72800, uptrend would be vulnerable Buying on intraday corrections and sell on rallies would be the ideal strategy for the day traders," said Shrikant Chouhan, head, equity research, Kotak Securities.

"The IT sector has led the Nifty rally this month and has spiked significantly in the last two trading sessions because of decent results backed by cheaper valuations. However, the recent upswing warrants a certain degree of caution as, many times, such sharp rallies do not sustain. Thus, we believe that the near-term view will be cautious and suggest profit booking in areas of exuberance, especially in the small-cap space," said Pranav Haridasan, MD and CEO at Axis Securities

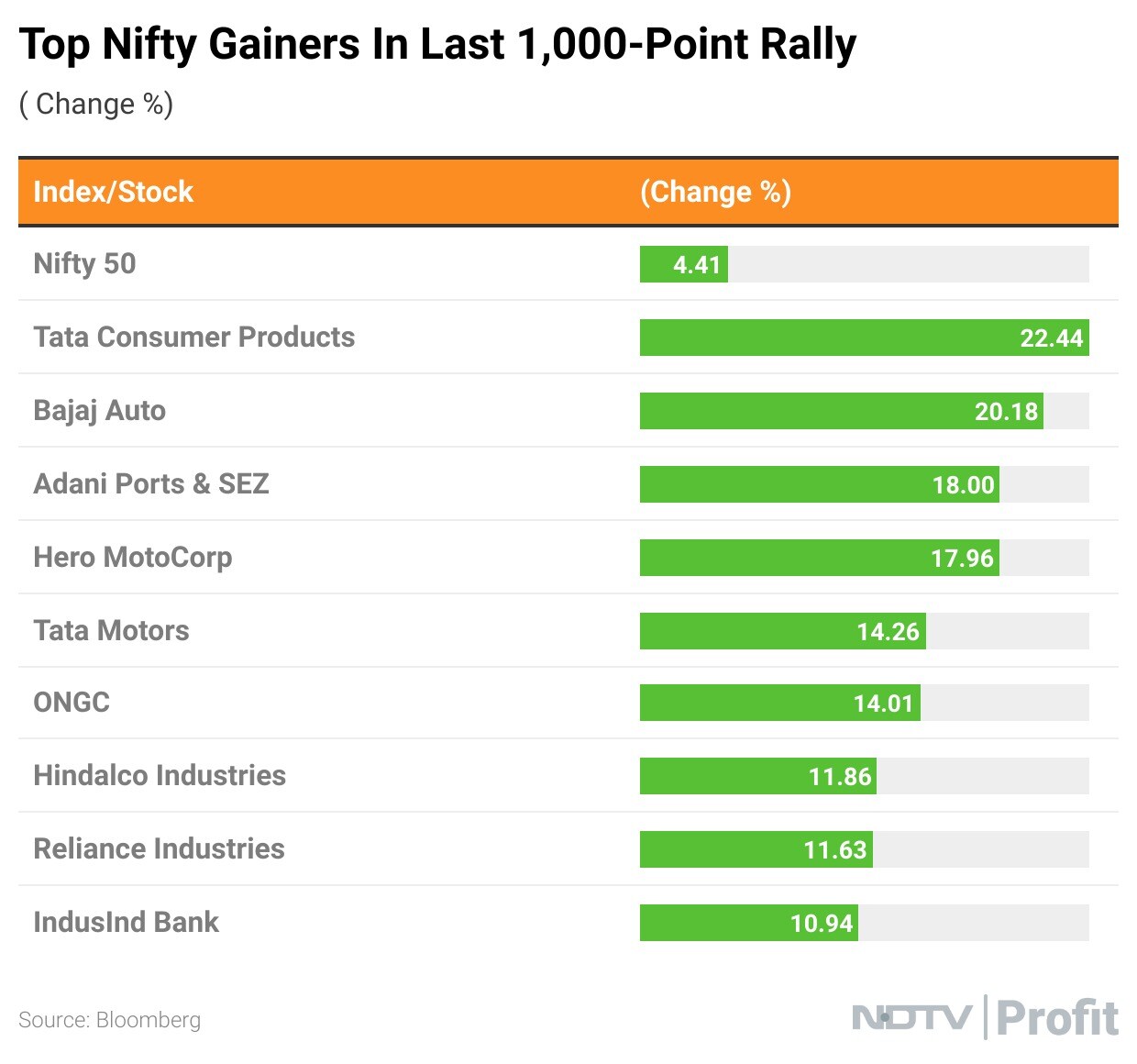

HDFC Bank Ltd, Reliance Industries Ltd, Infosys Ltd, Bharti Airtel, and HCL Technologies Ltd contributed positively to the indices.

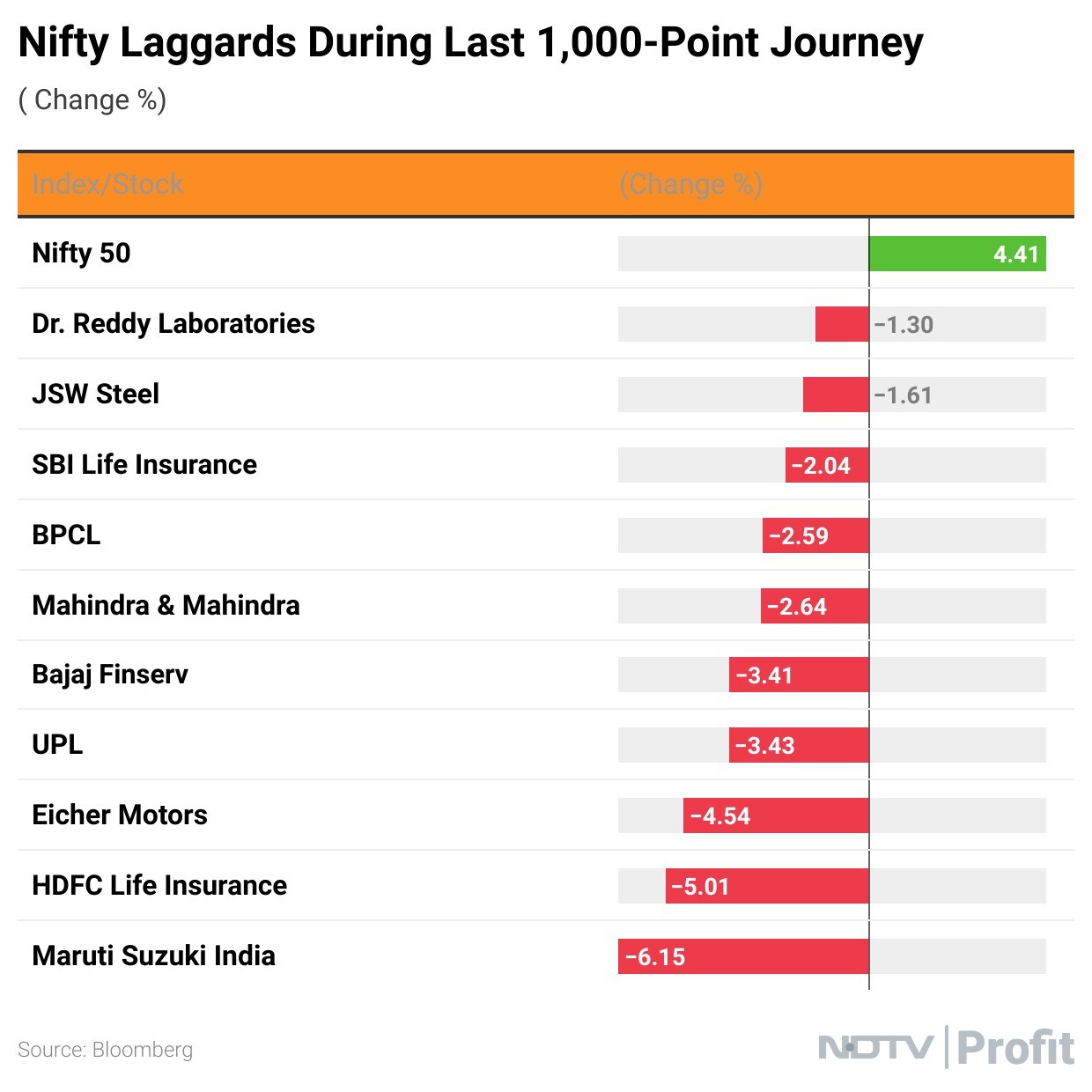

Bajaj Finance Ltd, Larsen & Toubro Ltd, HDFC Life Insurance Company Ltd, and Hindalco Industries Ltd, Bajaj Finserv Ltd exerted pressure on the indices.

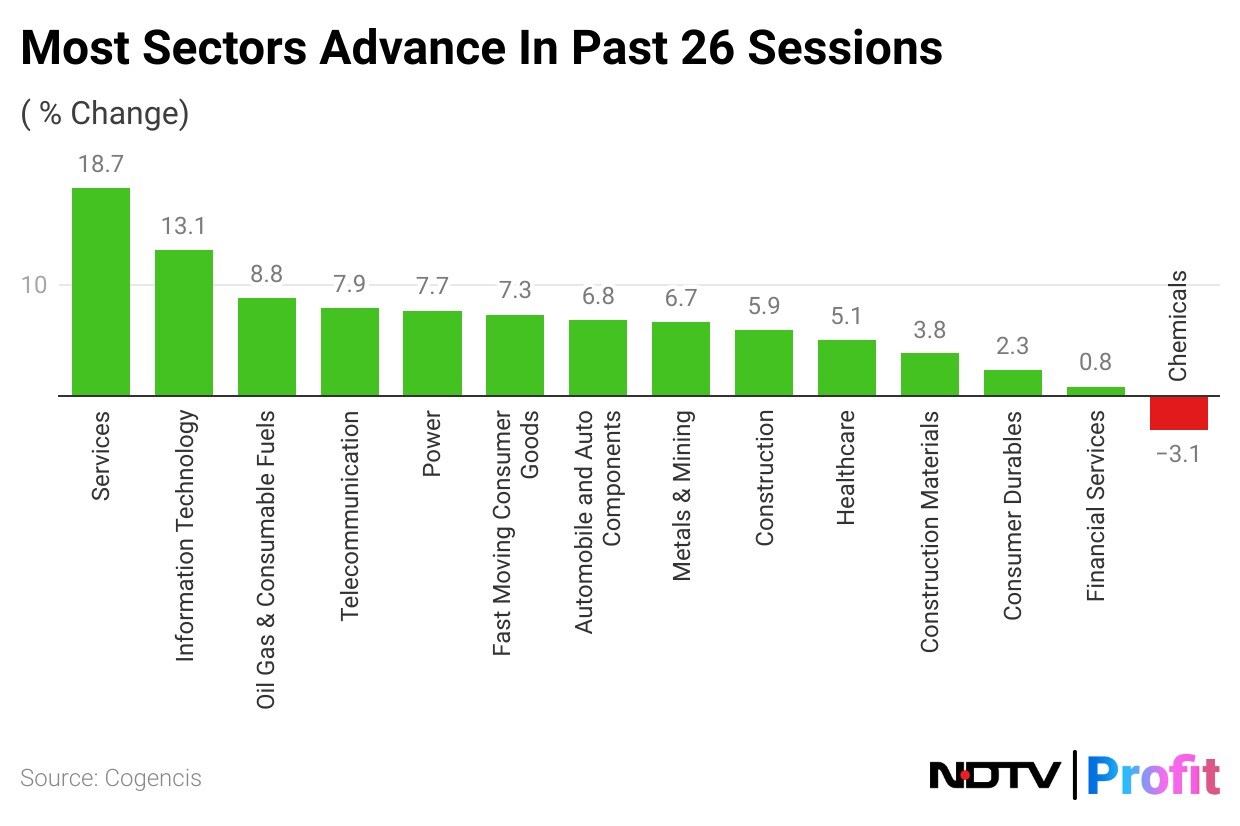

On NSE, 10 sectors out of 12 advanced with the Nifty IT rising 1.86% to become the top performer among sectoral indices. Around two sectors declined, Nifty Media declined the most.

The broader markets underperformed as the BSE MidCap rose 0.67%, while the BSE SmallCap was 0.11% higher. Eighteen out of the 20 sectors compiled by the BSE advanced, while two declined.

BSE Information Technology and BSE Oil & Gas rose the most.

The market breadth was skewed in the favour of buyers. As many as 2,102 stocks advanced, 1,843 declined and 116 remained unchanged on the BSE.

NBCC received an order worth Rs 76.6 crore from HSCC India

Source: Exchange Filing

SJVN Ltd has 10.5 lakh shares changed hands in a large trade

The company's 0.03% equity changed hands at Rs 100.05 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Bank of Maharashtra has 10.6 lakh shares changed hands in a large trade

0.01% equity changed hands at Rs 50.3 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Pidilite Industries Ltd inked a pact with Italy's Syn-Bios to expand supply of leather chemicals across south Asia

Company will handle sales and distribution of Syn-Bios products in India, Sri Lanka, Bangladesh, Vietnam

Companies to also engage in technical collaboration to offer comprehensive solutions for the leather industry

Source: Exchange filing

1.17 mn tons of waste handled in Q3, up 12% YoY

C&T business' volume handled at 0.48 mn tons, up 19% YoY

Source: Exchange filing

Revenue at Rs 83.2 crore vs Rs 74.2 crore, up 12.1%

Ebitda at Rs 16.3 crore vs Rs 15.1 crore, up 7.9%

Margin at 19.59% vs 20.35% down 75 bps

Net profit at Rs 6.15 crore vs Rs 5 crore, up 23%

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

Indian benchmark stock indices traded near lifetime highs through midday on Monday, on the back of strong gains in index heavyweight Reliance Industries Ltd. and, information technology and banking stocks .

At 12:06 p.m., the NSE Nifty 50 rose 157.50 points, or 0.72%, to 22,051.60, while the S&P BSE Sensex gained 586.32 points, or 0.8%, to 73,154.77. The Nifty and Sensex hit record highs of 22,081.95 and 73,288.78, respectively.

The Nifty has further upside potential at 22,300 levels, with bias and sentiment remaining strong, along with frontline stocks participating, indicating strength and gaining momentum, according to Prabhudas Lilladher Pvt.

"For the Nifty, the support for the day is seen at 21,750 and the resistance is seen at 22,100," the brokerage said.

HDFC Bank Ltd., HCLTechnologies Ltd., Infosys Ltd., Reliance Industries Ltd. and Wipro Ltd. were positively contributing to the Nifty 50.

Whereas, Bajaj Finance Ltd., HDFC Life Insurance Co., Hindalco Industries Ltd., Larsen & Toubro Ltd. and Tata Consumer Products Ltd. were weighing on the index.

Most sectoral indices on the NSE gained, with Nifty IT, Nifty Oil & Gas, Nifty Pharma, and Nifty Energy gaining over 1%. Nifty Media fell 1.4%.

The broader markets gained but underperformed the benchmarks, with the BSE MidCap rising 0.49% and the BSE SmallCap gaining 0.17% through midday trade on Monday.

Eighteen of the 20 sectors compiled by BSE Ltd. advanced, while two declined.

The market breadth was skewed in favour of the buyers. As many as 2,031 stocks advanced, 1,805 declined, and 141 remained unchanged on the BSE.

Revenue at Rs 1,656.76 crore vs Rs 1,363.33 crore, up 21.52%

Ebitda at Rs 278.94 crore vs Rs 163.37 crore, up 70.74%

Margin at 16.83% vs 11.98%, up 485 bps

Net profit at Rs 147.98 crore vs Rs 97.15 crore, up 52.32%

Retail deposit competition seems to have settled

Wholesale deposit rates show no signs of peaking

Banks withdrew some of festive offers; saw last leg of MCLR hike coming through

NIM pressure to sustain as book repricing continues

Gradual contraction in NIMs to continue on structural change

Big four banks (ex ICICI) increased FD rates for bulk deposit

PSBs withdrew festive offers but FD promo extended

Bandhan Bank more aggressive in bulk deposits

GAIL has 11.5 lakh shares changed hands in a large trade

The company's 0.02% equity changed hands at Rs 166.3 apiece

Buyers and sellers not known immediately

Source: Bloomberg

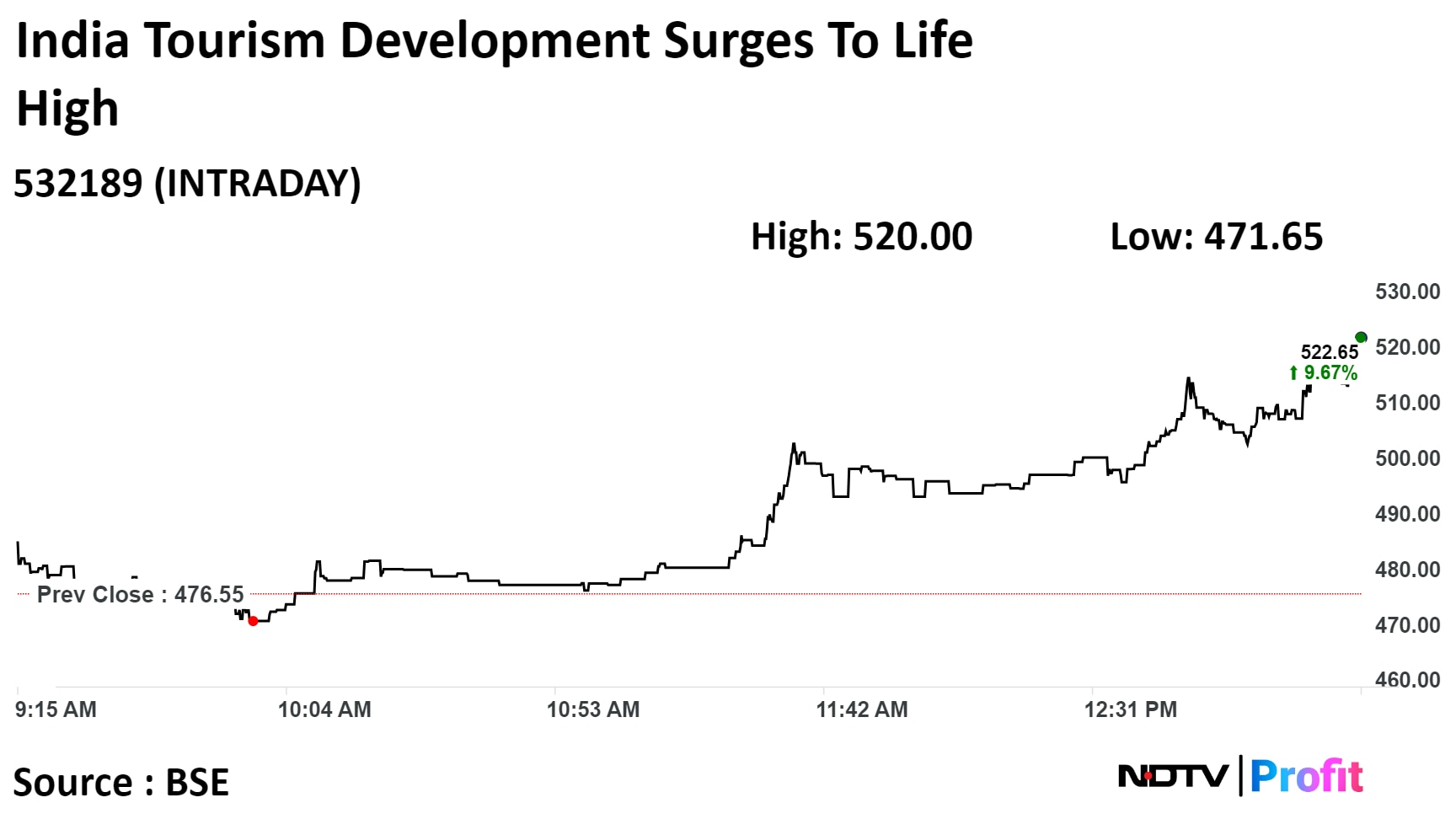

Scrips of India Tourism Development Corp Ltd surged 9.01% to Rs 519.80. It was trading 8.65% higher at Rs 518.10 as of 1:22 p.m. This compares to 0.77% advance on NSE Nifty 50 index.

It has risen 49.41% in 12 months. Total traded volume so far in the day stood at 5.5 times its 30-day average. The relative strength index was at 71.20.

Scrips of India Tourism Development Corp Ltd surged 9.01% to Rs 519.80. It was trading 8.65% higher at Rs 518.10 as of 1:22 p.m. This compares to 0.77% advance on NSE Nifty 50 index.

It has risen 49.41% in 12 months. Total traded volume so far in the day stood at 5.5 times its 30-day average. The relative strength index was at 71.20.

Subex has 10 lakh shares changed hands in a large trade

0.2% equity changed hands at Rs 39.24 apiece

Buyers and sellers not known immediately

Source: Bloomberg

Tiger Logistics (India) Ltd received a sea import and export handling order from BHEL

Source: Exchange filing

The yield on the 10-year bond trades 5 bps lower at 7.13% on Monday, lowest level since Sept 25.

It closed at 7.18% on Friday.

Source: Bloomberg

Manorama Board approves splitting each share into 5

Source: Exchange Filing

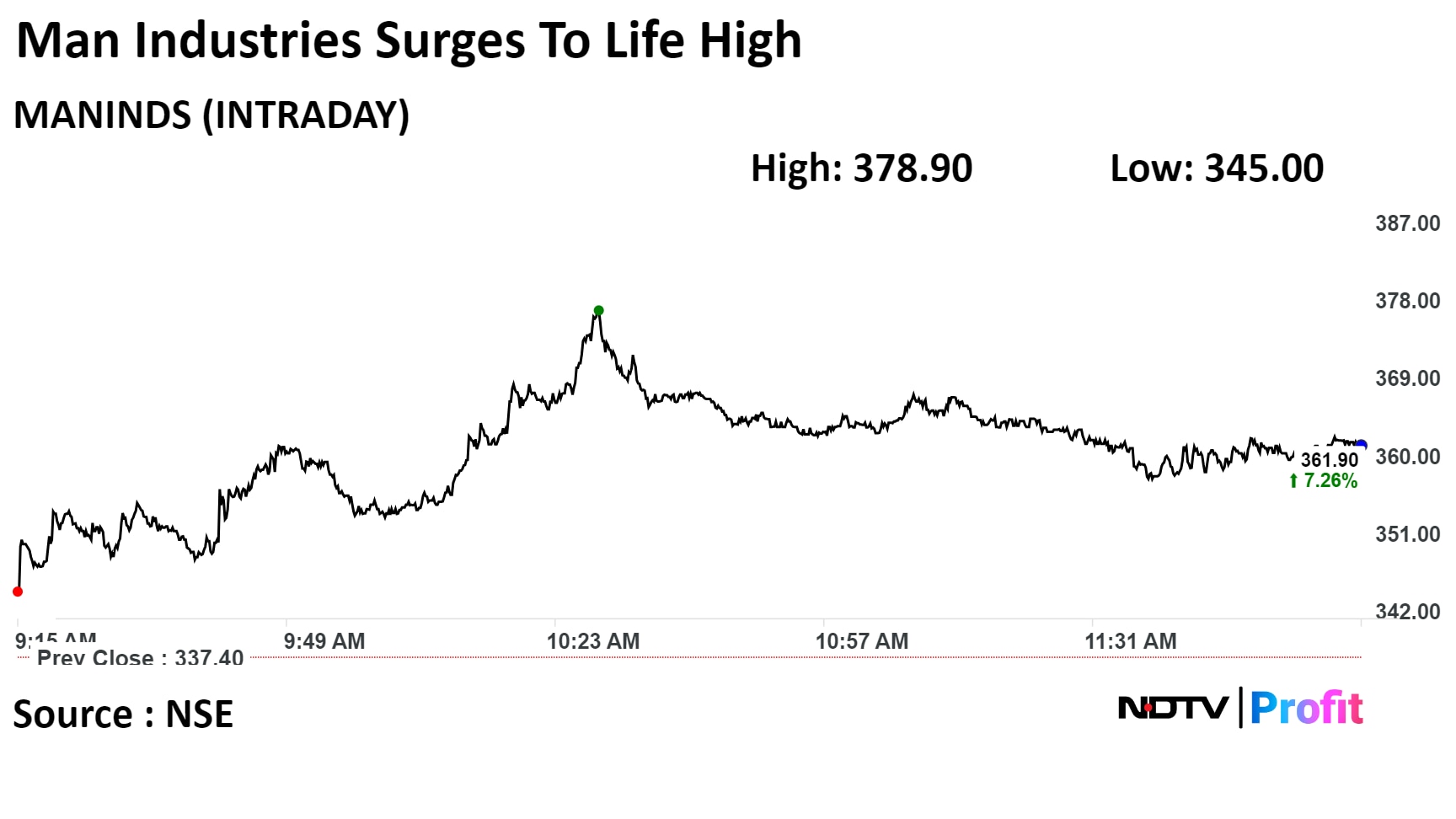

Man Industries' stock rose as much as 12.30% during the day to Rs 378.90 apiece on the NSE. It paired gains to trade 6.56% higher at Rs 359.55 per share compared to 0.73% advance in the benchmark Nifty 50 at 11: 50 a.m.

The share price has risen 352.97% in the last 12 months. The total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 80.389, which means that the stock was overbought.

One analyst tracking Man Industries has a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 357.8%.

Man Industries' stock rose as much as 12.30% during the day to Rs 378.90 apiece on the NSE. It paired gains to trade 6.56% higher at Rs 359.55 per share compared to 0.73% advance in the benchmark Nifty 50 at 11: 50 a.m.

The share price has risen 352.97% in the last 12 months. The total traded volume so far in the day stood at 3.5 times its 30-day average. The relative strength index was at 80.389, which means that the stock was overbought.

One analyst tracking Man Industries has a 'buy' rating on the stock, according to Bloomberg data. The average of 12-month analyst price targets implies a potential upside of 357.8%.

Dec WPI inflation rate at 0.73% vs 0.26% in Nov

Dec WPI fuel and power inflation at -2.41% vs at -4.61% in Nov

Dec WPI primary articles inflation at 5.78% vs 4.76% in Nov

Dec WPI food inflation at 5.39% vs 4.69% in Nov

Dec WPI manufactured products inflation at -0.71% vs -0.64% in Nov

Source: Ministry of Commerce

Titagarh Rail Systems Ltd launched first 25T Bollard Pull Tug to carry out wide range of naval ops for Indian Navy

Source: Exchange Filing

Procter & Gamble Hygiene & Health Care at 11.53x its 30 day average

Mas Financial Services at 10.49x its 30 day average

Accelya Solutions India at 5.32x its 30 day average

Alembic Pharmaceuticals at 4.49x its 30 day average

Wipro at 4.35x its 30 day average

Shares of HCL Technologies Ltd. jumped to hit their lifetime high as the company reported a higher than expected profit in the quarter ended December

The shares rose today even as the company lowered its revenue guidance for the current financial year to 5-5.5% from 6% earlier.

The scrip rose as much as 5.11% to Rs 1,619.60 piece, the highest level. It pared gains to trade 2.55% higher at Rs 1,580.15 apiece, as of 11:16 a.m. This compares to a 0.7% advance in the NSE Nifty 50 Index.

It has risen 47% in the last twelve months. Total traded volume so far in the day stood at 6.3 times its 30-day average. The relative strength index was at 74.25, indicating that the stock may be overbought.

Out of 42 analysts tracking the company, 19 maintain a 'buy' rating, 15 recommend a 'hold,' and eight suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 1.1%.

Shares of HCL Technologies Ltd. jumped to hit their lifetime high as the company reported a higher than expected profit in the quarter ended December

The shares rose today even as the company lowered its revenue guidance for the current financial year to 5-5.5% from 6% earlier.

The scrip rose as much as 5.11% to Rs 1,619.60 piece, the highest level. It pared gains to trade 2.55% higher at Rs 1,580.15 apiece, as of 11:16 a.m. This compares to a 0.7% advance in the NSE Nifty 50 Index.

It has risen 47% in the last twelve months. Total traded volume so far in the day stood at 6.3 times its 30-day average. The relative strength index was at 74.25, indicating that the stock may be overbought.

Out of 42 analysts tracking the company, 19 maintain a 'buy' rating, 15 recommend a 'hold,' and eight suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 1.1%.

Power Grid had 10.5 lakh shares changed hands in a large trade

0.01% equity changed hands at Rs 238 apiece

Buyers and sellers not known immediately

Source: Bloomberg

HDFC Life Insurance Company Ltd fell as much as 3.50% to Rs 615.30, the lowest level since Nov 13, 2023. The scrip was trading 3.25% lower at Rs 616.85 as of 11:39 a.m. This compares to 0.63% advance on NSE Nifty 50 index.

It has risen 2.09% in 12 months. Total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 31.29.

Out of 34 analysts tracking the company, 28 maintain a 'buy' rating, eight recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.7%.

HDFC Life Insurance Company Ltd fell as much as 3.50% to Rs 615.30, the lowest level since Nov 13, 2023. The scrip was trading 3.25% lower at Rs 616.85 as of 11:39 a.m. This compares to 0.63% advance on NSE Nifty 50 index.

It has risen 2.09% in 12 months. Total traded volume so far in the day stood at 4.6 times its 30-day average. The relative strength index was at 31.29.

Out of 34 analysts tracking the company, 28 maintain a 'buy' rating, eight recommend a 'hold,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 19.7%.

Mahindra Group, Ontario Teachers’ co-sponsor SEIT with Rs 2,262.8 crore offer size

SEIT made its debut on NSE today

Alert: SEIT stands for Sustainable Energy Infra Trust

Alert: SEIT is India’s largest InvIT in the renewable energy space

Source: Exchange Filing

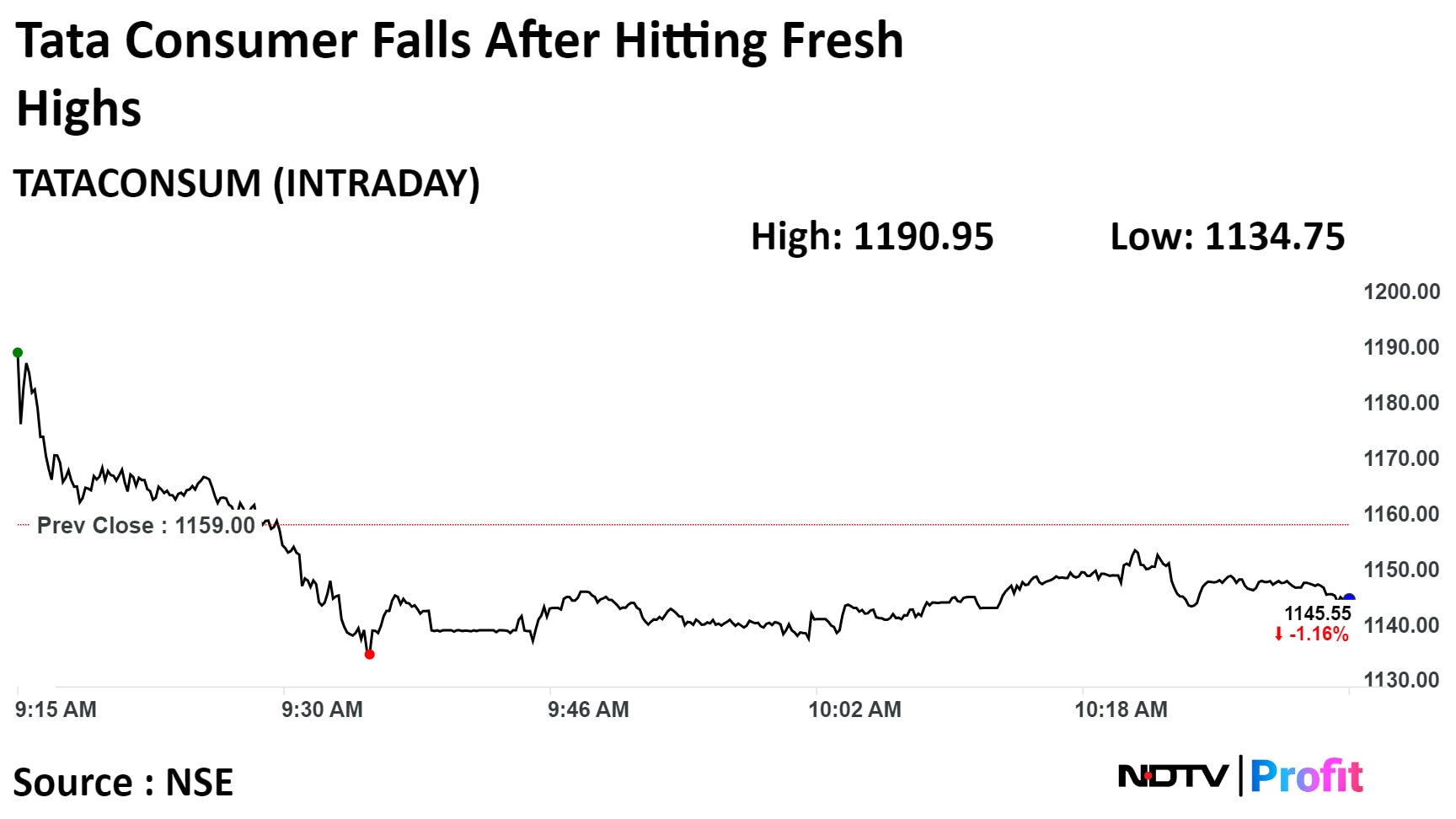

Tata Consumer Products declined after touching record high on Monday as the company announced to acquire Capital Foods Pvt. and Organic India Ltd.

The company announced the acquisition on Friday. TCPL will acquire 75% stake of Capital upfront for Rs 5,100 crore. The remaining 25% stake will be acquired in over three years, the company said in an exchange filing.

In case of India Organic, TCPL will acquire 100% stake upfront for Rs 1,900 crore.

Shares of Tata Consumer Products Ltd rose as much as 2.76% to Rs 1,190.95, the highest level since its listing on Nov 18, 1999. It erased all gains and was trading 1.10% lower at Rs 1,146.25 as of 10:39 a.m. This compares to 0.59% advance on NSE Nifty 50 index.

Tata Consumer Products declined after touching record high on Monday as the company announced to acquire Capital Foods Pvt. and Organic India Ltd.

The company announced the acquisition on Friday. TCPL will acquire 75% stake of Capital upfront for Rs 5,100 crore. The remaining 25% stake will be acquired in over three years, the company said in an exchange filing.

In case of India Organic, TCPL will acquire 100% stake upfront for Rs 1,900 crore.

Shares of Tata Consumer Products Ltd rose as much as 2.76% to Rs 1,190.95, the highest level since its listing on Nov 18, 1999. It erased all gains and was trading 1.10% lower at Rs 1,146.25 as of 10:39 a.m. This compares to 0.59% advance on NSE Nifty 50 index.

Man Industries Ltd received orders worth Rs 400 crore for pipes supply

Source: Exchange Filing

SpiceJet Ltd has received an in-principle approval from BSE for fund infusion of Rs 2,242 crore

Source: Press Release

Gujarat Natural Resources has found new oil reservoirs in Allora, Dholasan

Oil column exceeding 90 meters identified

Source: Exchange Filing

Scrips of Indian Railway Finance Corporation rose as much as 14.51% to Rs 129.85, the highest level since its listing on Jan 29, 2021. Its shares were trading 12.70% higher at Rs 128.14 as of 10:18 a.m. This compares to 0.55% advance on NSE Nifty 50 index.

IRFC has gained 287.93% in 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 88.43, which implied stock is overbought.

One analyst, tracking the company maintained 'Hold' rating. The average 12-month consensus price target implied a downside of 74.9%.

Scrips of Indian Railway Finance Corporation rose as much as 14.51% to Rs 129.85, the highest level since its listing on Jan 29, 2021. Its shares were trading 12.70% higher at Rs 128.14 as of 10:18 a.m. This compares to 0.55% advance on NSE Nifty 50 index.

IRFC has gained 287.93% in 12 months. Total traded volume so far in the day stood at 4.2 times its 30-day average. The relative strength index was at 88.43, which implied stock is overbought.

One analyst, tracking the company maintained 'Hold' rating. The average 12-month consensus price target implied a downside of 74.9%.

Wipro Ltd had 23.4 lakh shares or 0.04% equity changed hands in two large trades

Buyers and sellers not known immediately

Source: Bloomberg

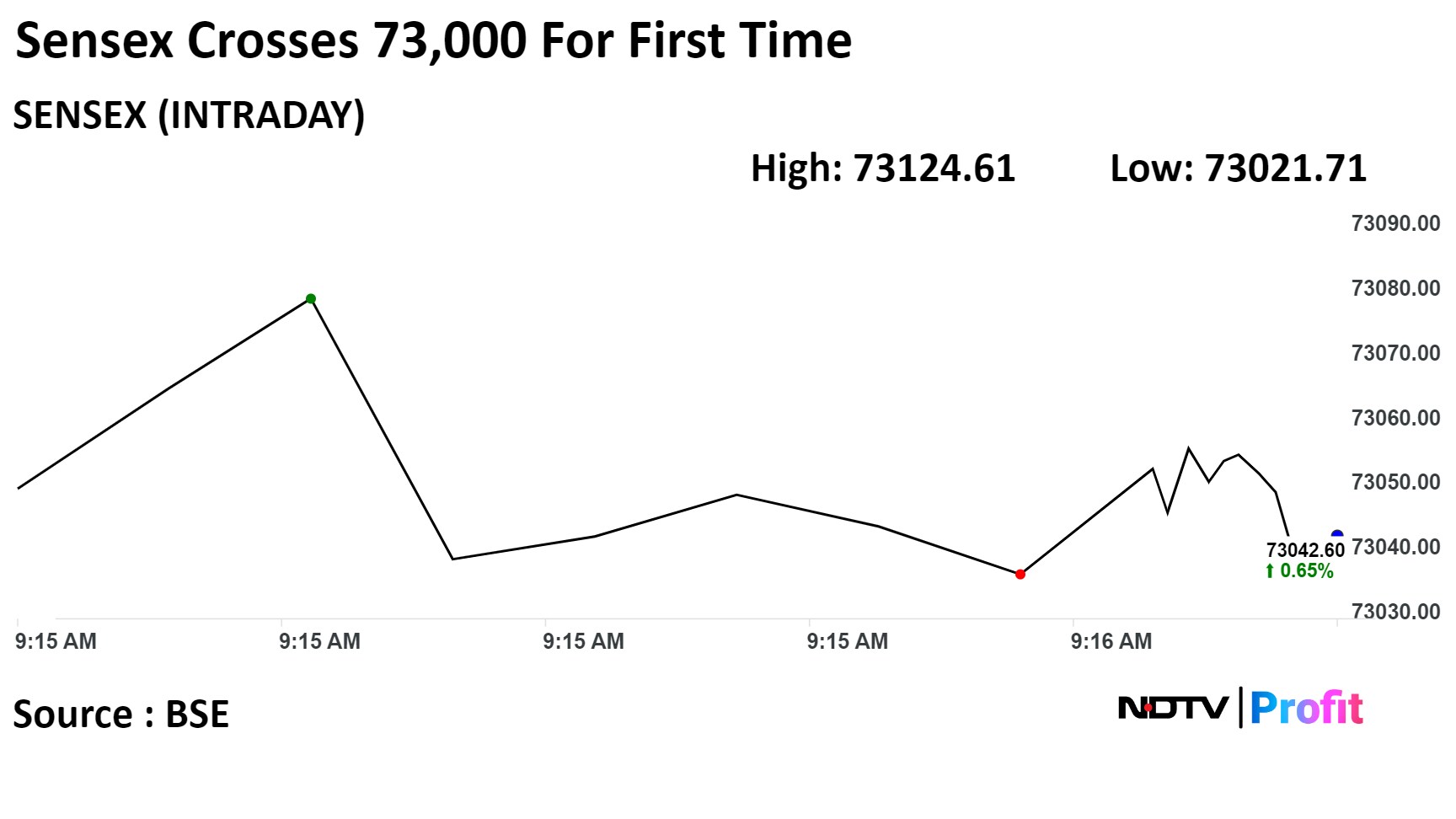

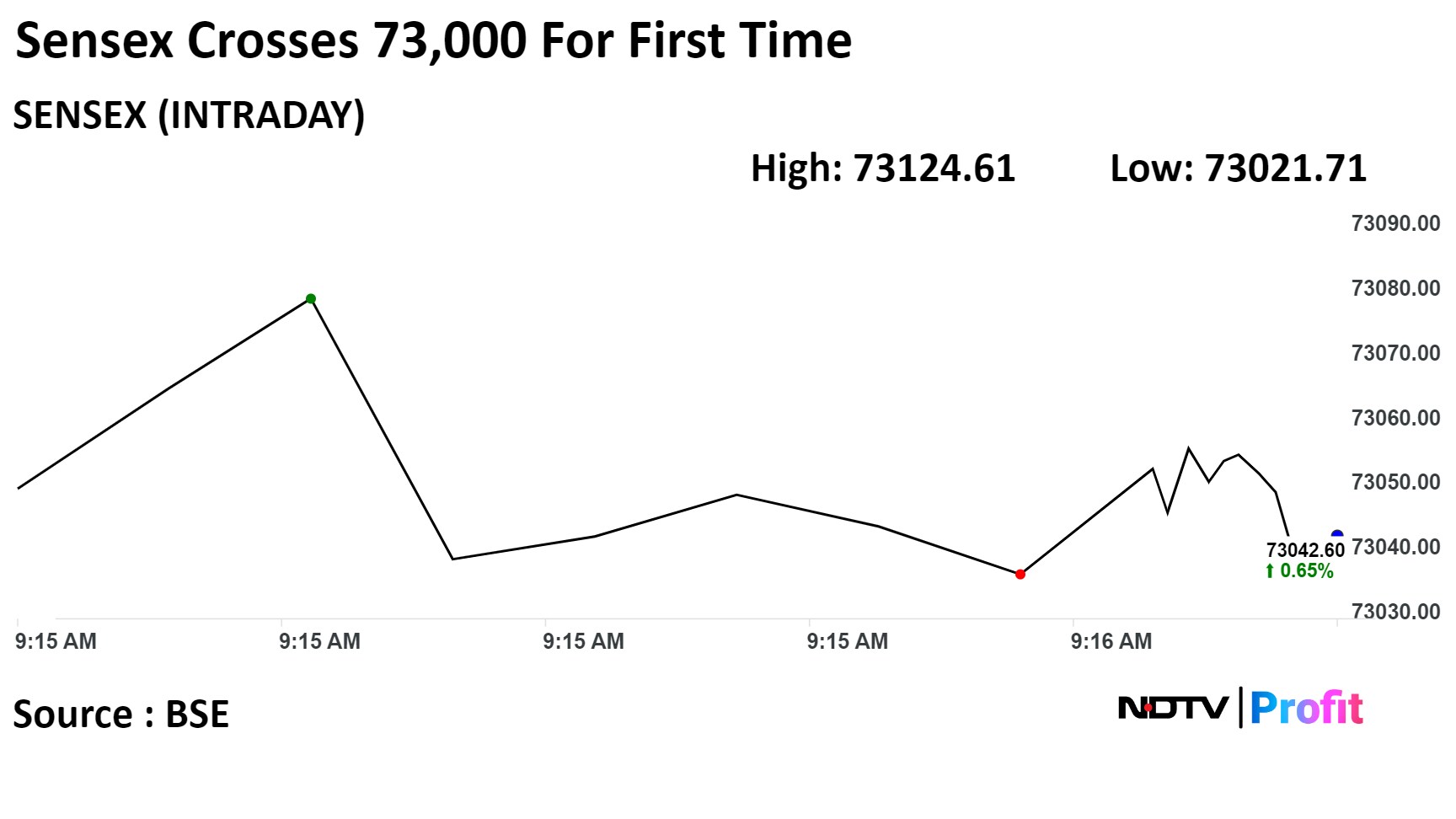

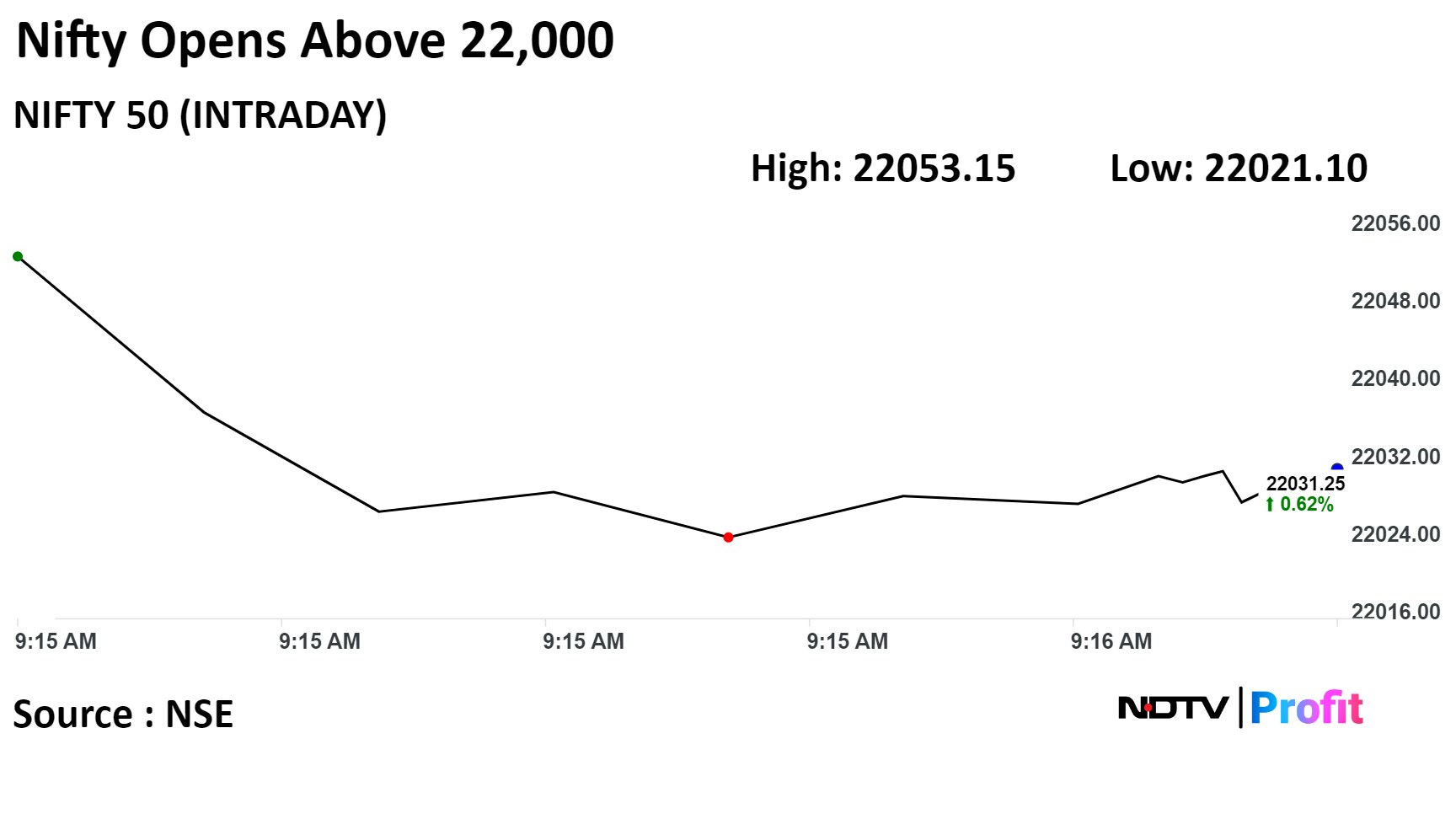

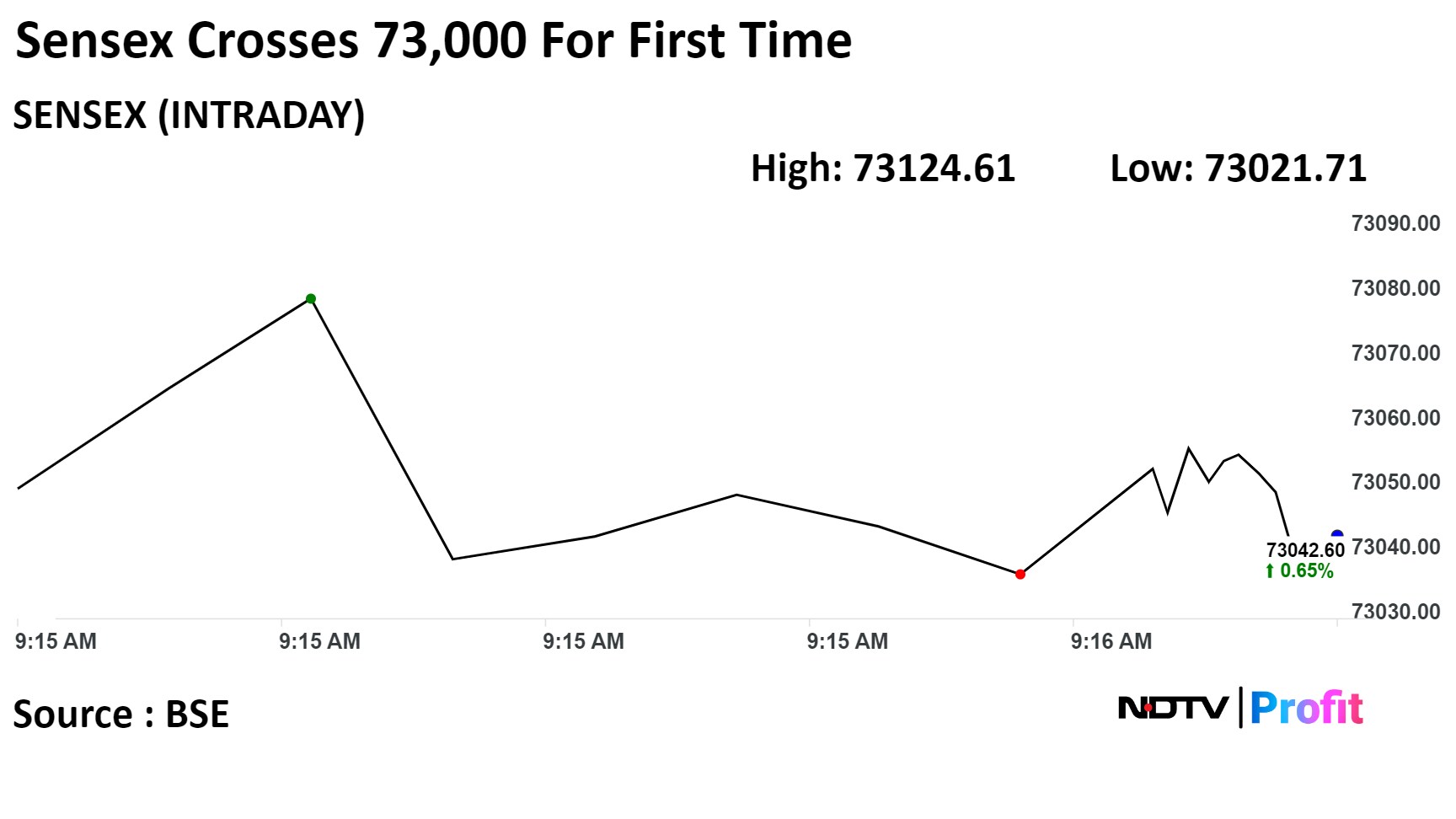

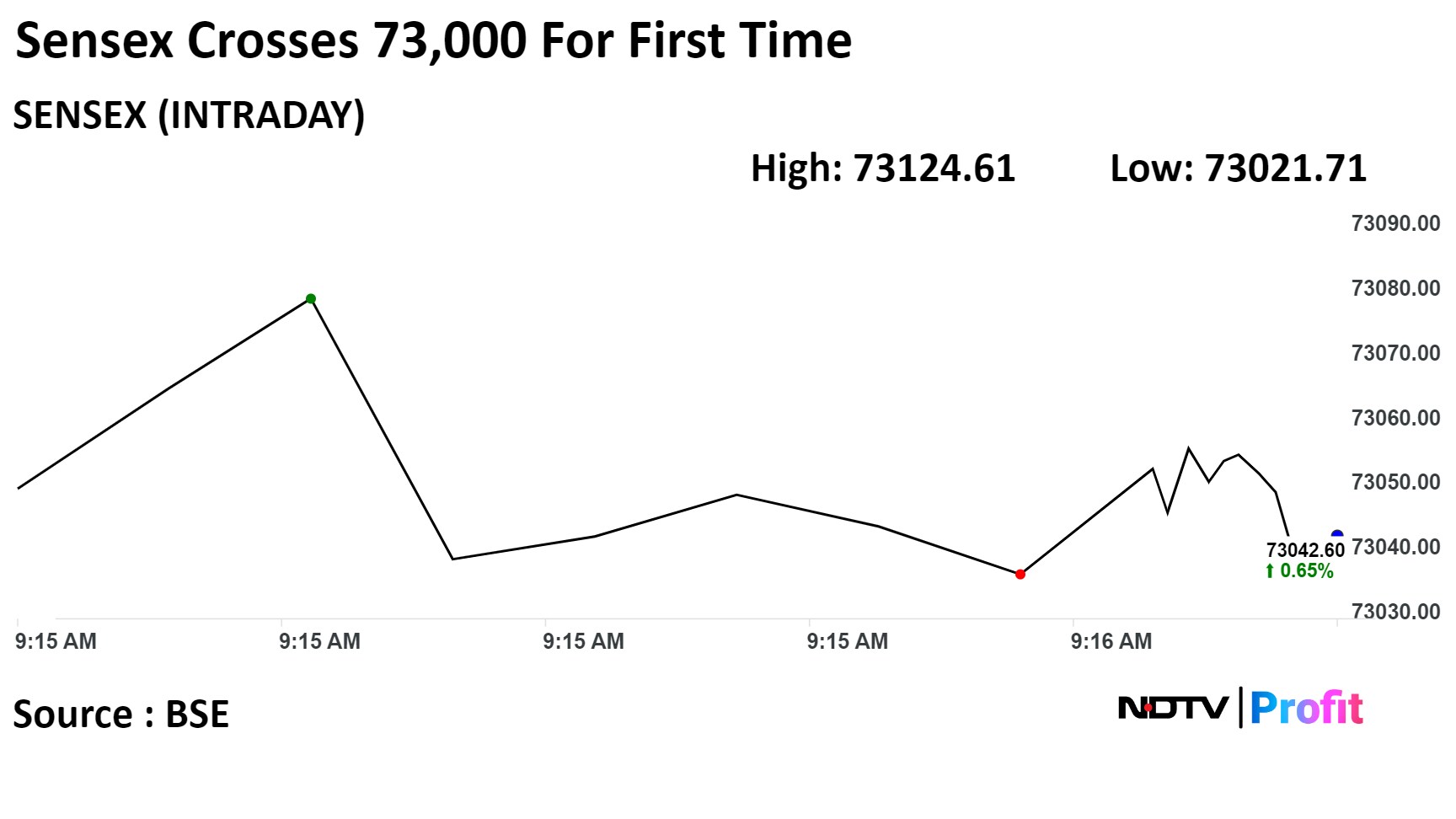

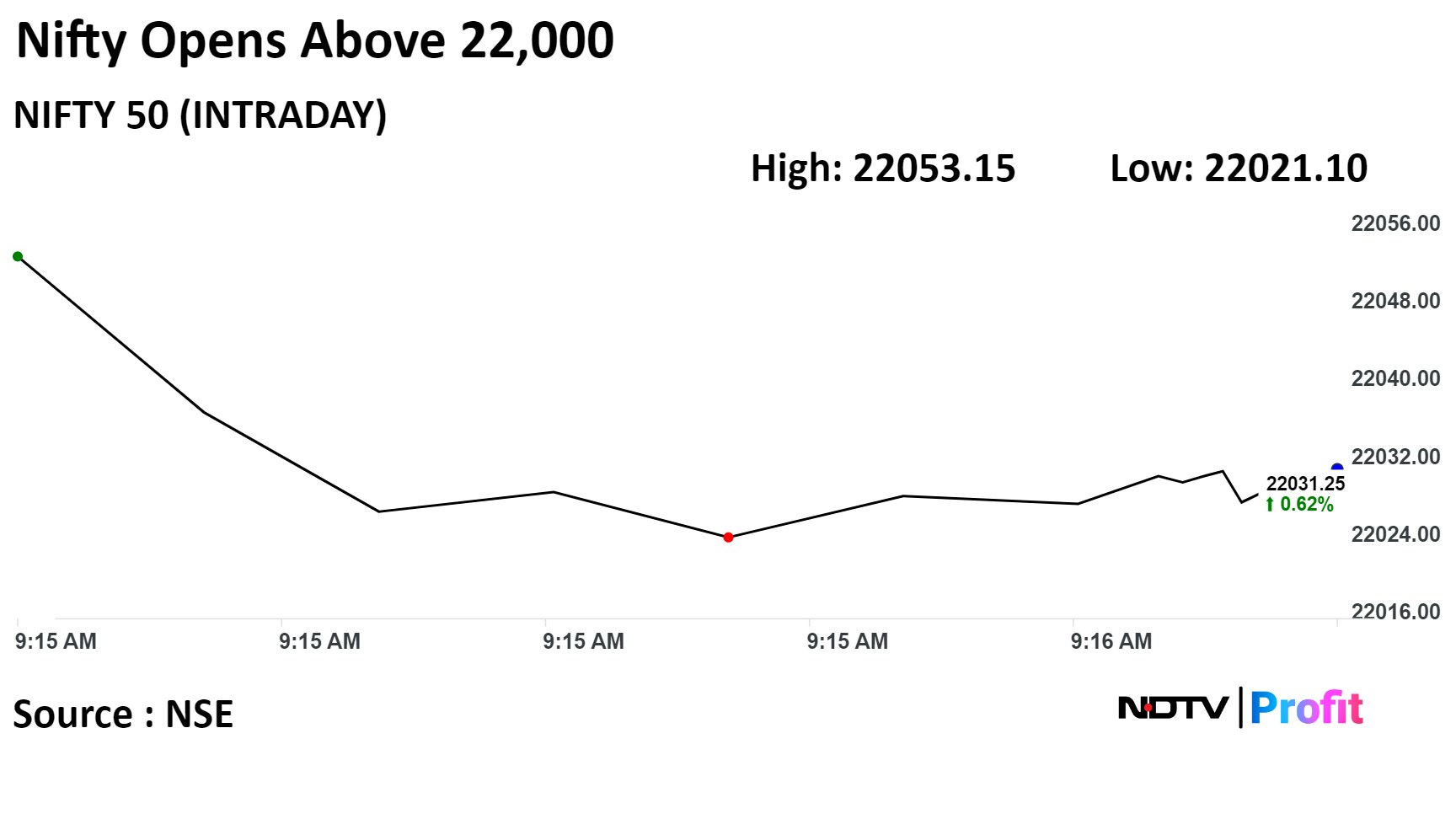

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

India's benchmark indices touched fresh record highs at opening on Monday tracking sharp gains in IT stocks lead by HCL Technologies Ltd, and Infosys Ltd.

As of 09:21 a.m., the NSE Nifty 50 was trading 0.76% or 167.20 points higher at 22,061.75, while the S&P BSE Sensex was trading 0.84% or 665.84 points higher at 73,230.70.

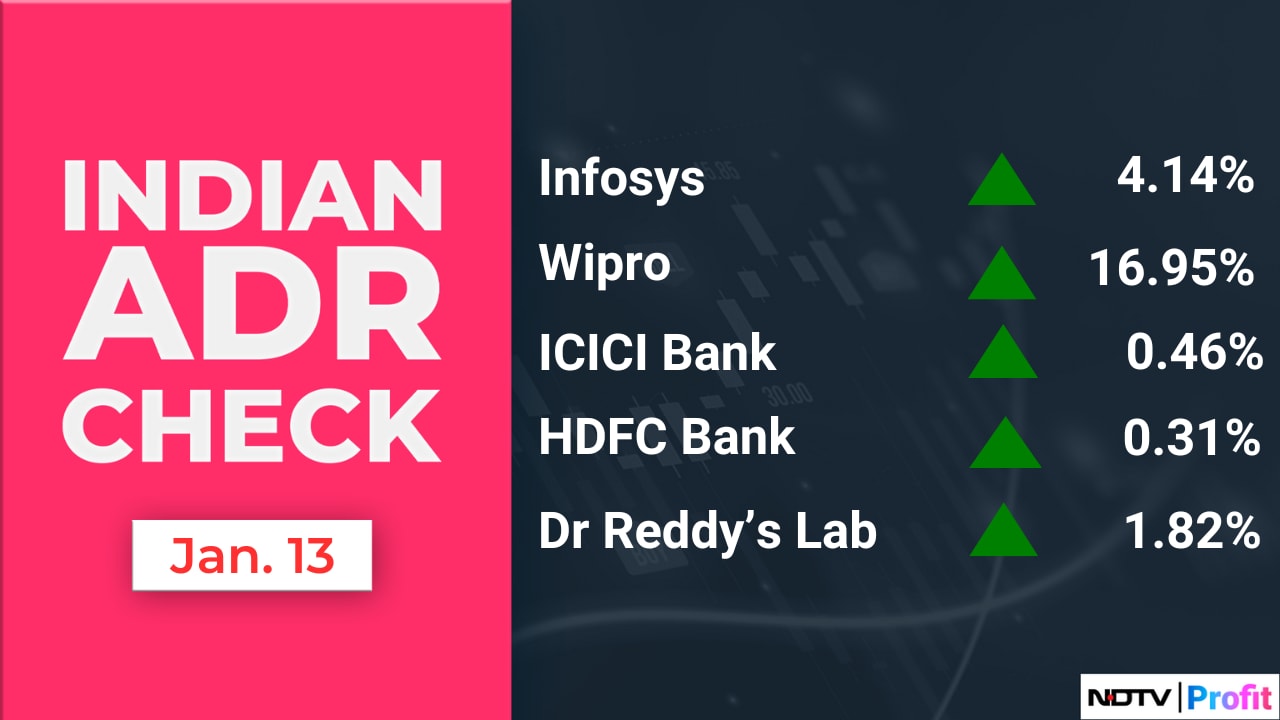

Infosys Ltd, HDFC Bank Ltd, Wipro Ltd, Tata Consultancy Services Ltd, and HCL Technologies Ltd were contributing positively to the indices.

HDFC Life Insurance Company Ltd, Bajaj Finance Ltd, Eicher Motors Ltd, Sun Pharmaceutical Industries Ltd, and Divi's Laboratories Ltd were weighing on the indices.

On NSE, 11 sectors out of 12 advanced, and one declined. Nifty IT surged 3.70% to become the top performer among sectoral indices, while Nifty Media fell -0.04% to become the top loser.

The broader markets underperformed benchmark indices. The S&P BSE Smallcap Index rose 0.54%, whereas S&P BSE MidCap Index was 0.43% higher. On BSE, 19 out of 20 sectors rose, while one fell. S&P BSE IT rose the most among sectoral indices, while BSE FMCG declined.

The market breadth was skewed in favour of buyers. Around 2120 stocks rose, 1063 stocks declined, and 120 remained unchanged on BSE.

At pre-open, the NSE Nifty 50 was 0.72% or 158.60 points higher at 22,053.15, while the S&P BSE Sensex was 0.66% or 481.42 points higher at 73,049.87.

Zomato Ltd had 4.5 crore shares or 0.5% equity changed hands in multiple pre-market large trades

Buyers and sellers not known immediately

Source: Bloomberg

Nomura maintained 'Neutral' rating on HCL Technologies Ltd with a target price at Rs 1,500 from Rs 1,420.

HCL Technologies Ltd's Q3FY24 performance a beat on all counts; growth led by telecom and manufacturing

Execution of Verizon deal should help post strong Q4

For FY24F, margin guidance of 18-19% retained, revenue growth moderated from top end

Raised EPS for FY24-26 BY 1-2%

Upside risks: Revenue growth and margin expansion.

Downside risk: Unexpected ramp downs hurting revenue

The brokerage has a 'sell' rating with a target price of Rs 810

Q3 revenues (+3% QoQ) were 5% below Citi estimates

Cost reductions enabled in-line EBITDA ~23%

Traffic growth recovery is key for decent growth and margin sustenance/expansion

EBIT estimates are +7%/+8% vs earlier. Continue to value at 16x ex-cash PE (unchanged but rolled forward)

See risk to earnings estimate on continued slowdown in consumer discretionary segment (ex-jewellery), slower store expansion

Maintain sell with price target of Rs3,200 (Rs3,100 earlier)

Oct-Dec PAT was 4% below Citi estimate, revenue was in-line post the trading update

Avg revenue per square feet fell by 10% (Citi estimate; flat on year), GM fell by 80 bps to 14.2% vs Q3FY20 (pre-covid period)

Trim medium-term VNB estimates by 3-5% on slower growth

Rate neutral with price target of Rs 675 (earlier Rs 710)

Raise medium-term EV estimates by 1% on favorable investment variance in base

Valuation premium to private peers likely to further reduce without visible stimulus driving growth

Benign Dec CPI print (5.69% YoY) despite unfavorable base reflected softness

Q4FY24 headline inflation is tracking at 4.6% YoY, 60bps below RBI forecast

Supply fears on food prices not playing out, core inflation remains subdued

Retain FY25 average headline inflation forecast at 4.5% YoY

See balance of risk tilted towards the downside rather than upside

Expect MPC stance change to neutral in April

February now becoming a ‘live’ policy for its consideration

See 50bps cumulative repo rate cut in 2024 starting August

Maintain neutral with price target of Rs 520

See Q3 result as positive given continued miss against estimates over last few quarters

Higher deal wins commentary in Consulting indicates drag from the segment is bottoming out

FY24 revenue growth rate to be one of the lowest among Tier-1 IT Services peers

Expect 3.9% CAGR in IT Services revenue over FY23-26

To return to growth in FY25 after a decline in FY24

Could reach 17% EBIT margin guidance in FY25, implying 8% PAT CAGR in FY23-26

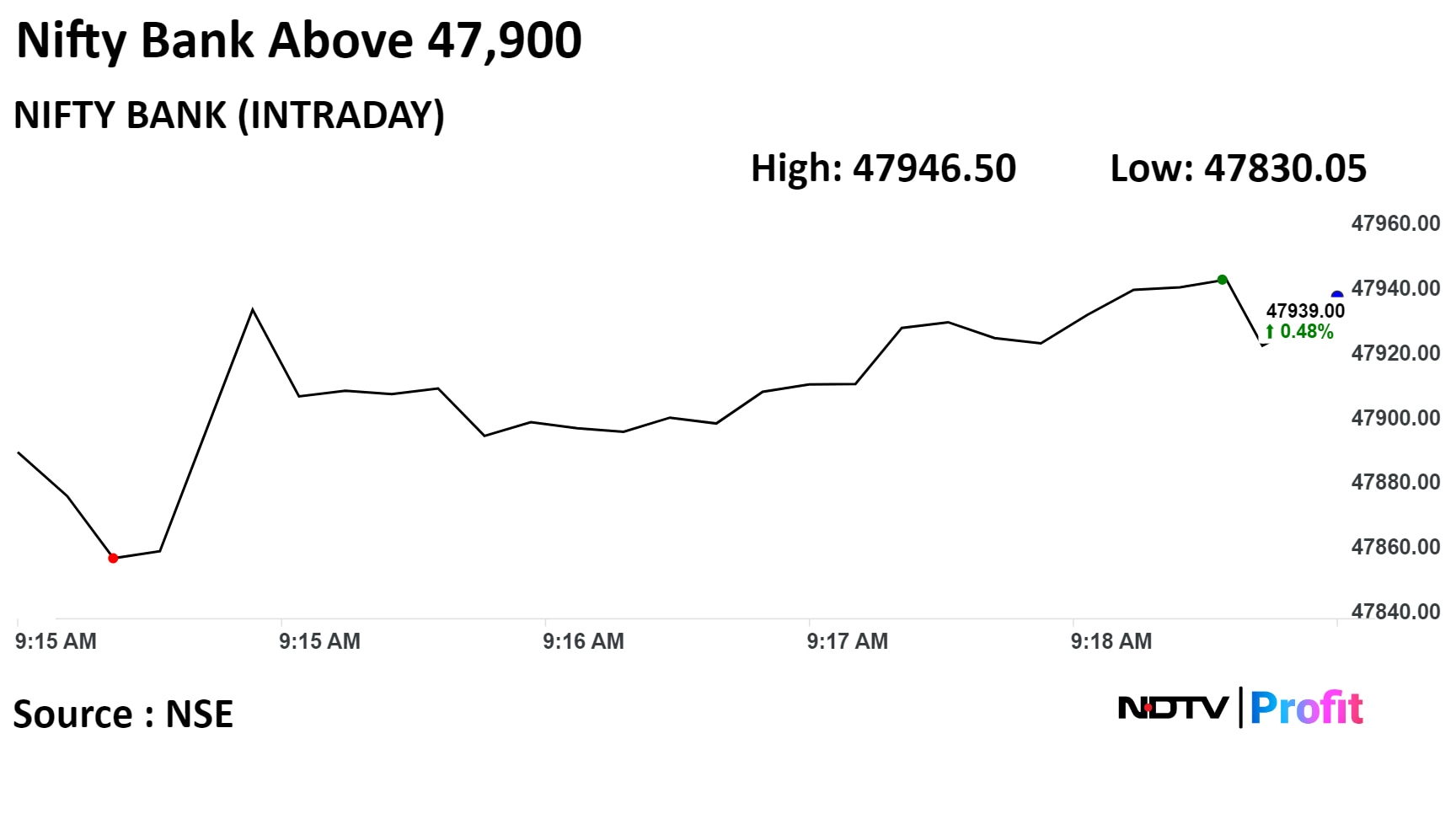

Nifty January futures up by 1.34% to 21,968.95 at a premium of 74.4 points.

Nifty January futures open interest up by 2.4%.

Nifty Bank January futures up by 0.69% to 47,900.20 at a premium of 190.4 points.

Nifty Bank January futures open interest down by 10.3%.

Nifty Options Jan 18 Expiry: Maximum Call open interest at 22,500 and Maximum Put open interest at 21,700.

Bank Nifty Options Jan 17 Expiry: Maximum Call Open Interest at 50,000 and Maximum Put open interest at 45,000.

Securities in the ban period: Bandhan Bank, Bharat Heavy Electronics, Chambal Fertilizers, Delta Corp, Escorts Kubota, Hindustan Copper, India Cements, Indus Tower, Metropolis Healthcare, National Aluminium, Piramal Enterprise, Polycab India, PVRINOX, SAIL, and Zee Entertainment.

Medplus Health Services: Promoter Agilemed Investments revoked a pledge of 1.13 crore shares on Jan. 12.

Mrs. Bectors Food Specialties: To meet analysts and investors on Jan. 18.

Windlas Biotech: To meet analysts and investors on Jan. 15.

NLC India: To meet analysts and investors on Jan. 17 and 18.

Sky Gold: To meet analysts and investors on Jan. 18.

Anand Rathi Wealth: To meet analysts and investors on Jan. 17 and 18.

Moved into a short-term ASM framework: AGS Transact Technology, Easy Trip Planners, Polycab India, Suven Lifesciences.

Moved out of short-term ASM framework: Indo Amines, Sigachi Industries.

Sical Logistics: Pristine Malwa Logistics Park sold 6 lakh shares (0.92%) while Negen Capital Services bought 6 lakh shares at Rs 270.55 apiece.

FSN E-Commerce Ventures: Lexdale International sold 2.62 crore shares (0.91%) at Rs 188.83 apiece.

Gillette India: Adventz Finance sold 6 lakh shares (1.84%) at Rs 6,757.6 apiece while Nippon India Mutual Fund bought 3.3 lakh shares (1.01%) at Rs 6,755 apiece.

Accelya Solutions: Plutus Wealth Management LLP bought 0.74 lakh shares (0.5%) at Rs 1,709.99 apiece.

Cupid: Minerva Ventures Fund bought 0.75 lakh shares (0.56%) at Rs 1,637.64 apiece.

Medi Assist Healthcare: The IPO will open for bids on Monday. It will comprise offer for sale of Rs 1,171.6 crore. The price band is fixed at Rs 397-418 per share. The company has raised Rs 351.4 crore from anchor investors.

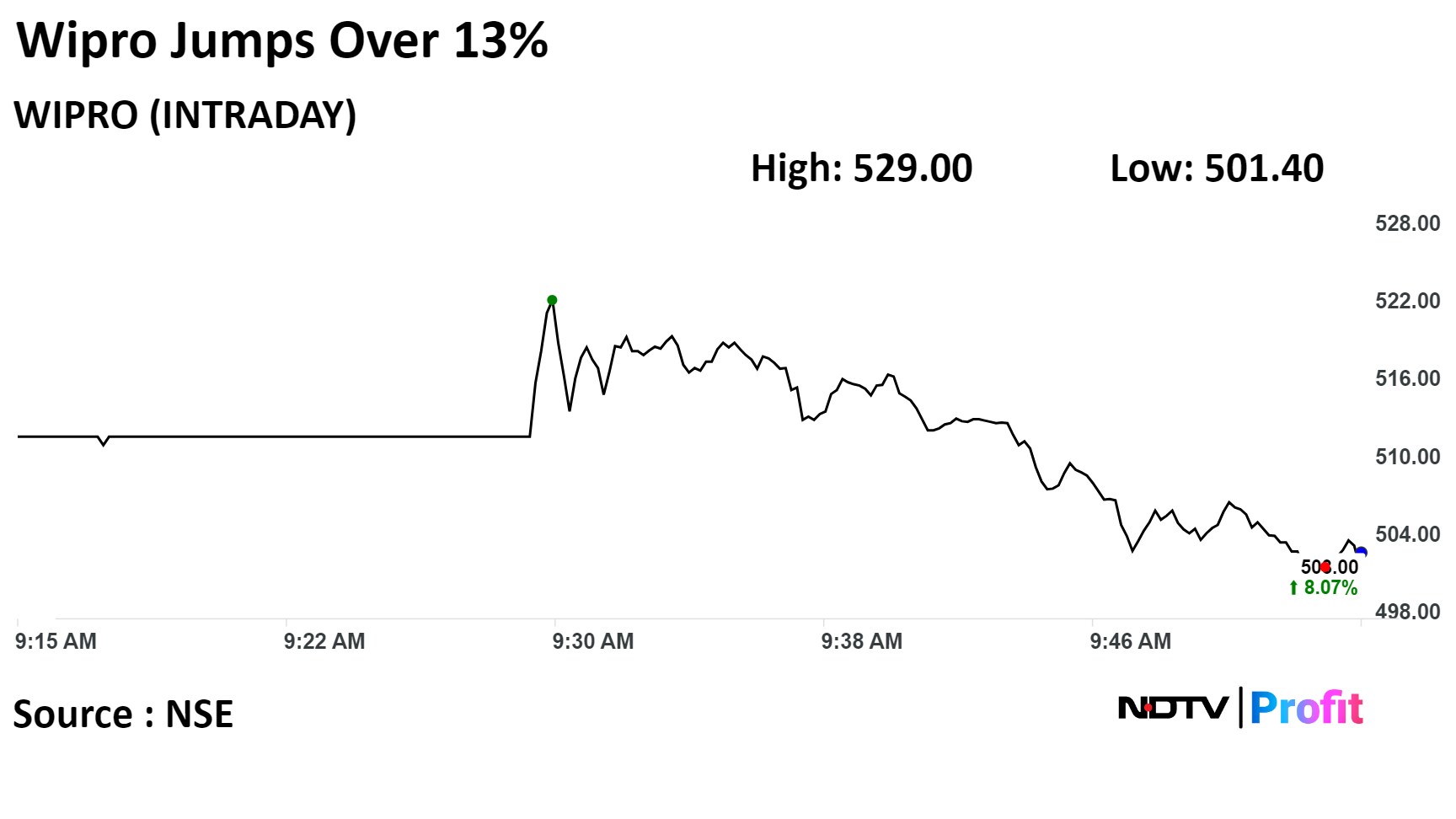

Wipro Q3 FY24 (Consolidated, QoQ)

Revenue down 1.39% at Rs 22,205.1 crore (Bloomberg estimate Rs 23,229 crore).

EBIT up 6.22% at Rs 3,267.1 crore (Bloomberg estimate Rs 3,240.50 crore).

EBIT margin at 14.71% (Bloomberg estimate: 14.60%).

Net profit up 1.24% at Rs 2,700.6 crore (Bloomberg estimate: Rs 3,029 crore).

HCLTech Q3 FY24 (Consolidated, QoQ)

Revenue up 6.65% at Rs 28,446 crore (Bloomberg estimate: Rs 28,075.1 crore).

EBIT up 14.7% at Rs 5,644 crore (Bloomberg estimate: Rs 5,256.9 crore).

EBIT margin at 19.84% (Bloomberg estimate: 18.7%).

Net profit up 13.51% at Rs 5,874 crore (Bloomberg estimate: Rs 4,124.4 crore).

Just Dial Q3 FY24 (Consolidated, YoY)

Revenue at Rs 265 crore vs Rs 260.6 crore, up 1.7% (Bloomberg estimate: Rs 269.8 crore).

Net profit at Rs 92 crore vs Rs 71.8 crore, up 28.1% (Bloomberg estimate: Rs 93.6 crore).

Ebitda at Rs 60.3 crore vs Rs 48.8 crore, up 23.6% (Bloomberg estimate: Rs 54.8 crore).

Ebitda margin at 22.75% vs 18.72% (Bloomberg estimate: 20.3%).

Anand Rathi Wealth Q3 FY24 (Consolidated, YoY)

Revenue at Rs 182.43 crore vs Rs 138 crore, up 32.19% (Bloomberg estimate: Rs 188.1 crore).

Net profit at Rs 58.04 crore vs Rs 43.22 crore, up 34.28% (Bloomberg estimate: Rs 56.5 crore).

Den Networks Q3 FY24 (Consolidated, YoY)

Revenue at Rs 272.9 crore vs Rs 276.9 crore, down 1.45%.

Net profit at Rs 47.8 crore vs Rs 49.3 crore, down 3.04%.

Ebitda at Rs 40.5 crore vs Rs 37.3 crore, up 8.57%.

Ebitda margin at 14.84% vs 13.47%.

Angel One, Brightcom Group, Choice International, Jai Balaji Industries, Jio Financial Services, Kesoram Industries, and PCBL.

Tata Consumer Products: The company has agreed to buy Capital Foods Pvt., the owner of Ching’s Secret and Smith & Jones, and Fabindia-backed Organic India in two separate deals valued at about Rs 7,000 crore as it expands its portfolio of high-margin businesses. The board will meet on Jan. 19 to consider fundraising via equity or debt issues.

Adani Enterprises: Unit Adani New Industries received the Letter of Award to set up a manufacturing capacity of 198.5 megawatts per annum for electrolysers under the Strategic Interventions for Green Hydrogen Transition scheme from Solar Energy Corp.

Bharat Heavy Electricals, NLC India: BHEL received a letter of award worth Rs 15,000 crore for an EPC package for the 3x800 MW Talabira thermal power project from NLC India.

Life Insurance Corp: The state-run insurer received a tax demand worth Rs 1,370.6 crore from the Mumbai tax authority.

Avalon Technologies: The company entered into an agreement with the Centre for Development of Advanced Computing for indigenously manufactured HPC servers, ‘RUDRA’.

Sheela Foam: The company has completed the acquisition of a 2.57% stake in KEL for Rs 55.33 crore. The company now holds 97.23% of KEL.

Emudhra: The company opened its QIP at a floor price of Rs 443.56, which indicates a discount of 5% to the current market price.

Century Plyboards: The company’s newly set-up laminate unit started its commercial production on Jan. 12.

Goodluck India: The company opened its QIP at Rs 989.40 per share, which indicates a discount of 10% to the current market price.

Anant Raj: The company opened its QIP at Rs 310.78 per share, which indicates a discount of 5% of the current market price.

IRB Infrastructure Trust: The company has now executed concession agreements with the National Highways Authority of India for the tolling, operation, maintenance and transfer of the Kota Bypass and Cable Stay Bridge on NH-76 in Rajasthan and the Gwalior-Jhansi section. The estimated cost of the project is Rs 1,896 crore.

All Cargo Gati: The company total monthly volume, including surface and air express, stood at 105 kilo tonne, up 7% YoY.

Hampton Sky Realty: The company received approval to start construction of the hospital project under the name of Hampton Narayana Super Speciality Hospital in Chandigarh, with a projected investment of Rs 200 crore.

Kaynes Technology: The company will acquire Mixx Technologies for a consideration of $30 million to establish itself as a “silicon to systems” manufacturer for artificial intelligence and high-performance computing infrastructure. Post-acquisition, it will hold a 13.20% stake in Mixx Technologies.

Dilip Buildcon: The company sold its entire 51% stake in DBL Nidagatta Mysore Highways for Rs 61.6 crore.

Alkem Laboratories: The company appointed Nitin Agrawal as the Chief Financial Officer w.e.f. Feb. 1. A cyber security incident happened at the company’s subsidiary, which compromised the business email IDs of certain employees. The incident resulted in a fraudulent transfer of funds of approximately Rs 52 crore.

Most markets in Asia-pacific region gained as Market participants assessed the Taiwan's election outcome, released over the weekend.

Nikkei was trading 0.57% higher at 35,780.25, while S&P ASX 200 was up 0.03% higher at 7,500.30 as of 07:44 a.m.

The island nation's citizens has chosen Democratic Progressive Party.

Meanwhile, share indices in mainland China declined, with the CSI 300 trading 0.06% lower at 3,282.37 as of 07:44 a.m. People's Bank of China has kept its one-year medium term lending rate unchanged at 2.5%, contrary to the expectation of 10-bps cut. The bank also injected cash via MLF for 14 months.

U.S. Treasury two-year yields dropped to the lowest level since May while stocks came under pressure as a surprise decline in producer prices reinforced bets on Federal Reserve rate cuts this year, reported Bloomberg.

The S&P 500 Index rose 0.08% while the Nasdaq 100 settled 0.07 higher as of Friday. The Dow Jones Industrial Average fell by 0.31%.

Brent crude jumped 0.08% to $78.21 a barrel. Gold was down 0.06% at $2,047.86 an ounce.

The GIFT Nifty was trading 0.01% or 2.5 points down at 22,041.00 as of 07:41 a.m.

India's benchmark stock indices ended at a record closing high on Friday as a sharp rise in information technology stocks followed the Q3 results of heavyweights Infosys and Tata Consultancy Services.

The S&P BSE Sensex jumped 847.27 points, or 1.18%, to close at 72,568.45, while the NSE Nifty 50 surged 260.80 points, or 1.20%, to end at 21,908.

Overseas investors remained net sellers of Indian equities for the fourth consecutive session on Friday. Foreign portfolio investors offloaded stocks worth Rs 340.1 crore, while domestic institutional investors stayed net buyers and mopped up equities worth Rs 2,911.2 crore, the NSE data showed.

The Indian rupee strengthened 11 paise to close at 82.92 against the U.S. dollar on Friday.

Most markets in Asia-pacific region gained as Market participants assessed the Taiwan's election outcome, released over the weekend.

Nikkei was trading 0.57% higher at 35,780.25, while S&P ASX 200 was up 0.03% higher at 7,500.30 as of 07:44 a.m.

The island nation's citizens has chosen Democratic Progressive Party.

Meanwhile, share indices in mainland China declined, with the CSI 300 trading 0.06% lower at 3,282.37 as of 07:44 a.m. People's Bank of China has kept its one-year medium term lending rate unchanged at 2.5%, contrary to the expectation of 10-bps cut. The bank also injected cash via MLF for 14 months.

U.S. Treasury two-year yields dropped to the lowest level since May while stocks came under pressure as a surprise decline in producer prices reinforced bets on Federal Reserve rate cuts this year, reported Bloomberg.

The S&P 500 Index rose 0.08% while the Nasdaq 100 settled 0.07 higher as of Friday. The Dow Jones Industrial Average fell by 0.31%.

Brent crude jumped 0.08% to $78.21 a barrel. Gold was down 0.06% at $2,047.86 an ounce.

The GIFT Nifty was trading 0.01% or 2.5 points down at 22,041.00 as of 07:41 a.m.

India's benchmark stock indices ended at a record closing high on Friday as a sharp rise in information technology stocks followed the Q3 results of heavyweights Infosys and Tata Consultancy Services.

The S&P BSE Sensex jumped 847.27 points, or 1.18%, to close at 72,568.45, while the NSE Nifty 50 surged 260.80 points, or 1.20%, to end at 21,908.

Overseas investors remained net sellers of Indian equities for the fourth consecutive session on Friday. Foreign portfolio investors offloaded stocks worth Rs 340.1 crore, while domestic institutional investors stayed net buyers and mopped up equities worth Rs 2,911.2 crore, the NSE data showed.

The Indian rupee strengthened 11 paise to close at 82.92 against the U.S. dollar on Friday.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.