The benchmark equity indices snapped its one day of advance to end in the red on Wednesday after the RBI's monetary policy committee cut the benchmark repo rate by 25 basis points.

The NSE Nifty 50 ended 136.70 points or 0.61% lower at 22,399.15, while the BSE Sensex closed 379.93 points or 0.51% down at 73,847.15. During the day, the Nifty fell as much as 0.81% to 22,353.25, while the Sensex was down 0.75% to 73,673.06.

Additionally, Asian stocks sank to the lowest level since January 2024 as US President Donald Trump hiked trade tariffs to a 100-year high and ratcheted up pressure on China. Equity-index futures for Europe also tumbled 4.4% and contracts for US stocks retreated more than 2.5%.

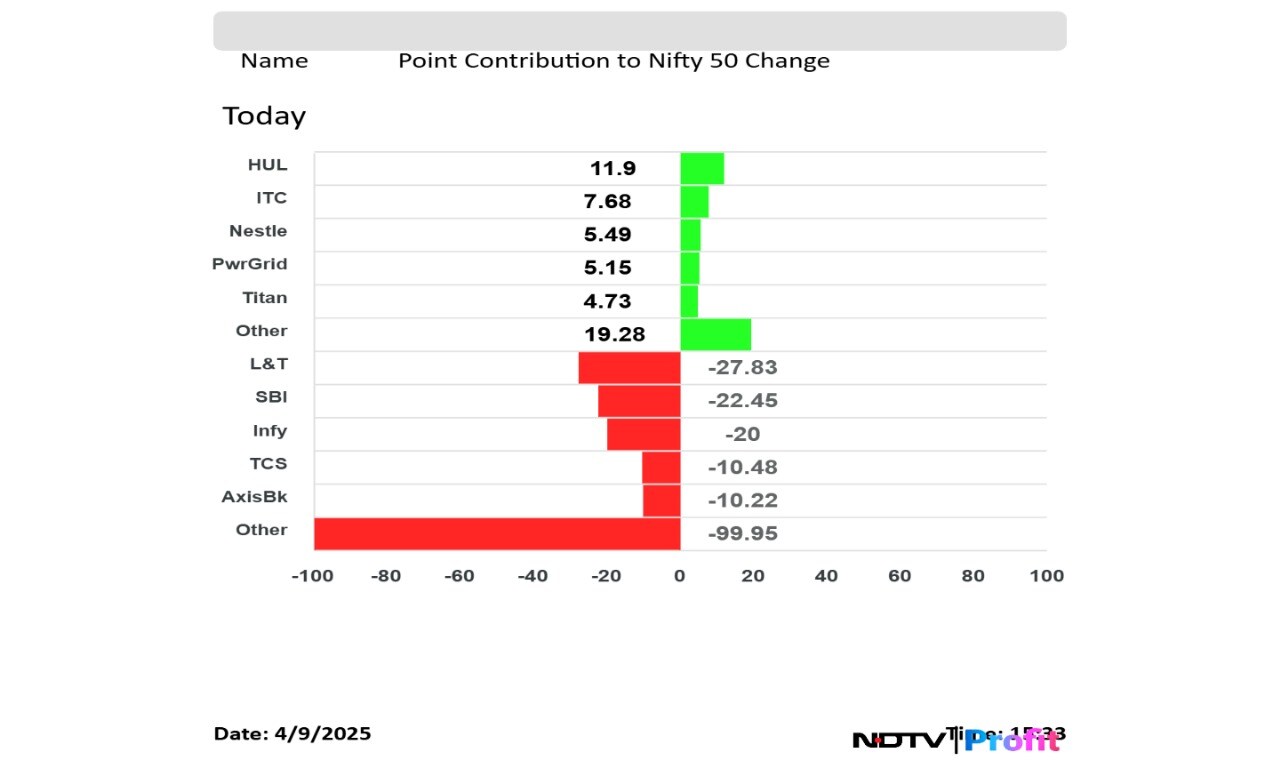

Hindustan Unilever Ltd., ITC Ltd., Nestle India Ltd., Power Grid Corp. and Titan Co. led the gains in the Nifty.

Larsen & Toubro Ltd., State Bank of India, Infosys Ltd., Tata Consultancy Services Ltd. and Axis Bank Ltd. weighed on the index the most.

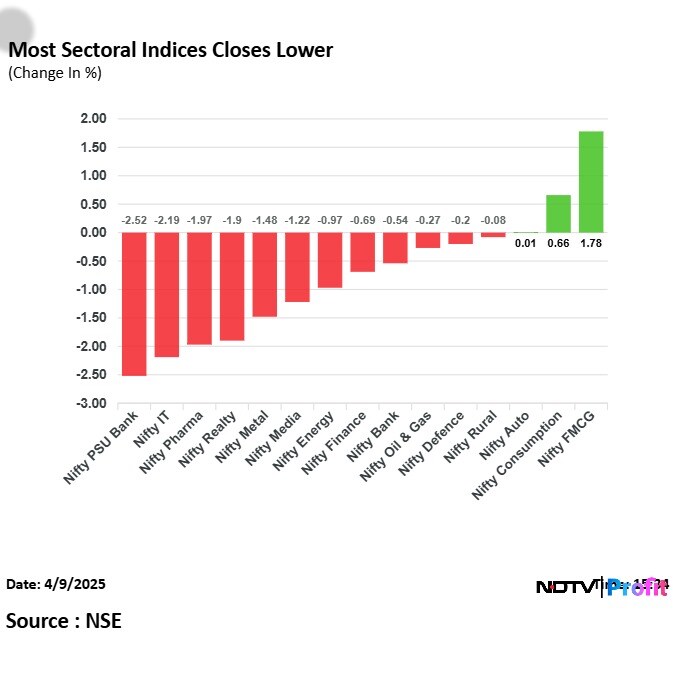

On the NSE, 12 out of the 15 sectors fell, with the Nifty PSU Bank, IT, Pharma and Realty declining the most.

On the BSE, 18 of the 21 sectors fell, with Information Technology and BSE Focused IT leading the decline.

The broader markets ended lower, with the BSE MidCap ending with losses of 0.73% and the SmallCap fell 1.08%.

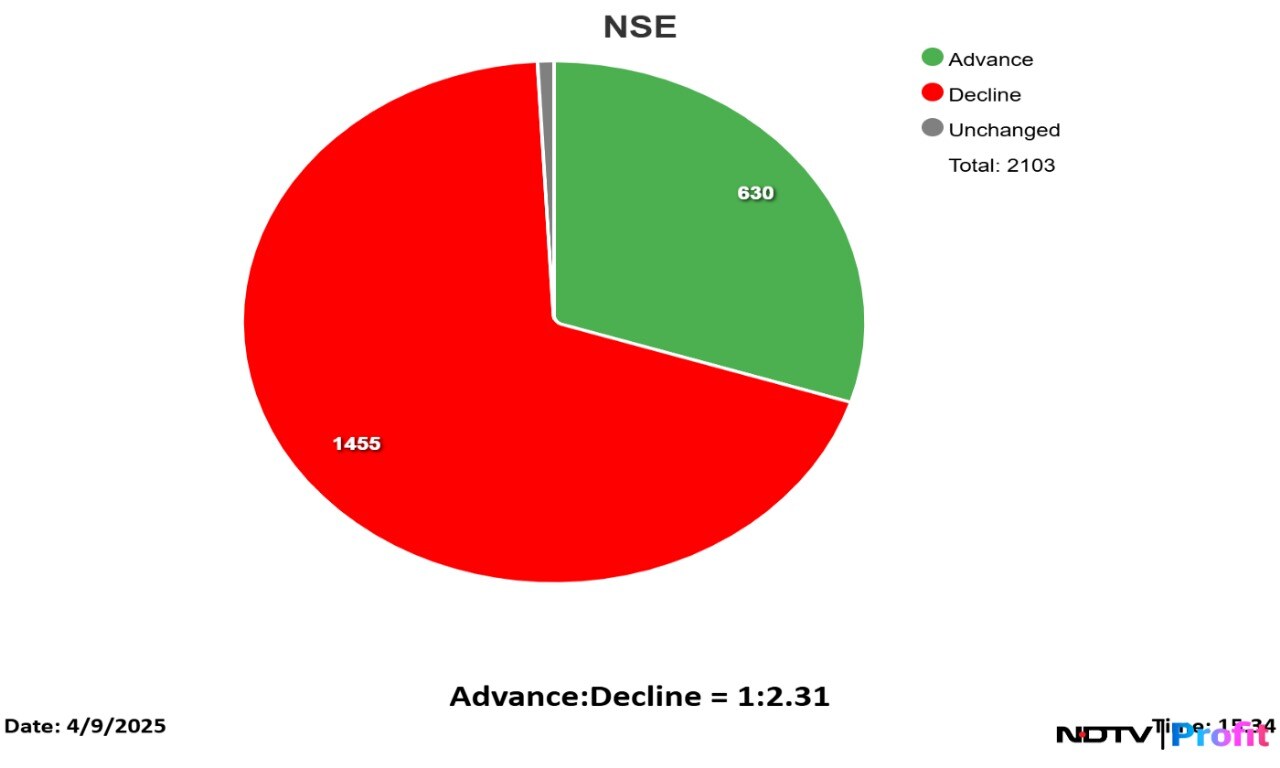

The market breadth was skewed in favour of the sellers as 2,359 stocks declined, 1,529 advanced and 142 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.