Shares of Sterlite Technologies Ltd. rose nearly 12% to hit a nine-month high after it announced that it had expanded its data centre offerings to meet the emerging requirements for artificial intelligence data centres.

The changes were to meet the exact requirements of hyperscalers, co-location players, enterprises and telecom service providers to build agile, scalable, and sustainable data centre infrastructure.

STL Data Centre solution includes high-performance fibre and copper cabling solutions designed for modern buildings, campuses, and data centres. Copper systems ensure reliable data, security, and AV connectivity, while the riser and campus fibre cabling support high-speed, low-latency networking for smart infrastructure. Pre-terminated multi-fibre systems with LC/MPO connectors provide scalable, space-efficient solutions ideal for data centres.

“In today's AI-driven era, data centre solutions aren't just about moving data—they're about enabling intelligence at scale," said Rahul Puri, chief executive officer, optical networking business, Sterlite Technologies.

This comes after Sterlite Tech, through its global services business, in consortium with Dilip Buildcon Ltd., entered into the agreement with BSNL for a deal value of Rs 2,631 crore.

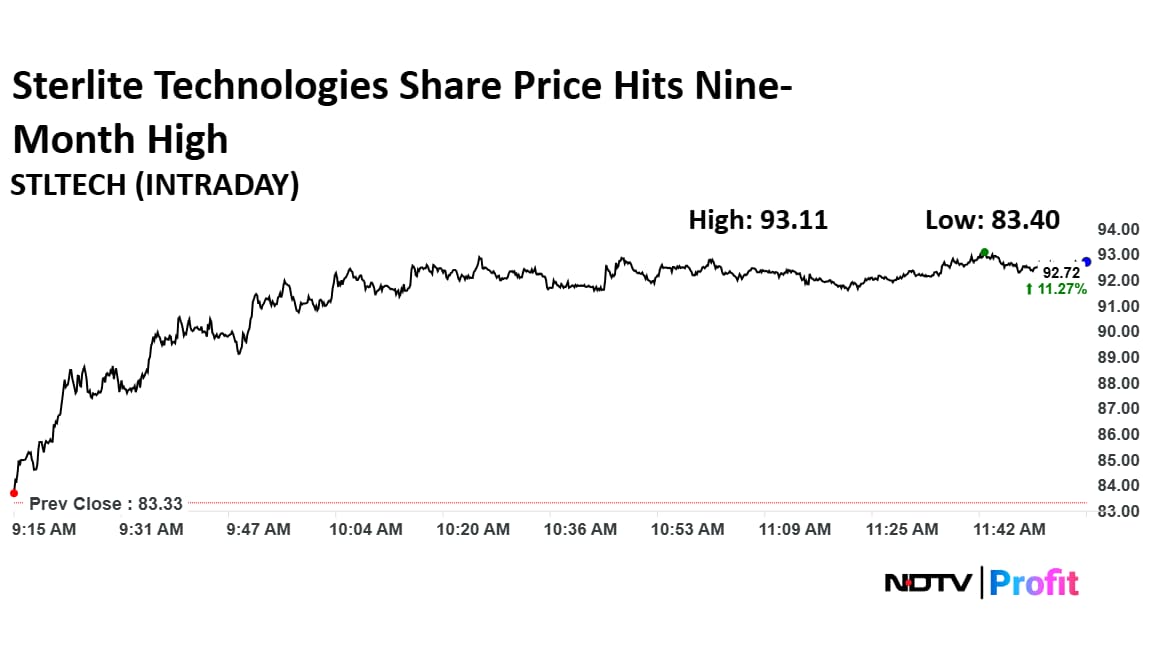

Sterlite Technologies' Share Price Advances

Shares of Sterlite Technologies rose as much as 11.52% to Rs 92.93 apiece, the highest level since Sept. 17, 2024. They pared gains to trade 10.97% higher at Rs 92.47 apiece, as of 11:10 a.m. This compares to a 0.84% advance in the NSE Nifty 50.

The stock has fallen 31.54% in the last 12 months and 19.43% year-to-date. Total traded volume so far in the day stood at 1.2 times its 30-day average. The relative strength index was at 70.

Out of three analysts tracking the company, two maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 0.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.