Sterlite Technologies' share price gained nearly 50% in the last five sessions as the company is set to benefit from artificial intelligence development. On Tuesday, the stock price jumped over 13% and hit the highest level in 19 months. The share price has been rising for a second day in a row after it has launched a new-generation data centre solution.

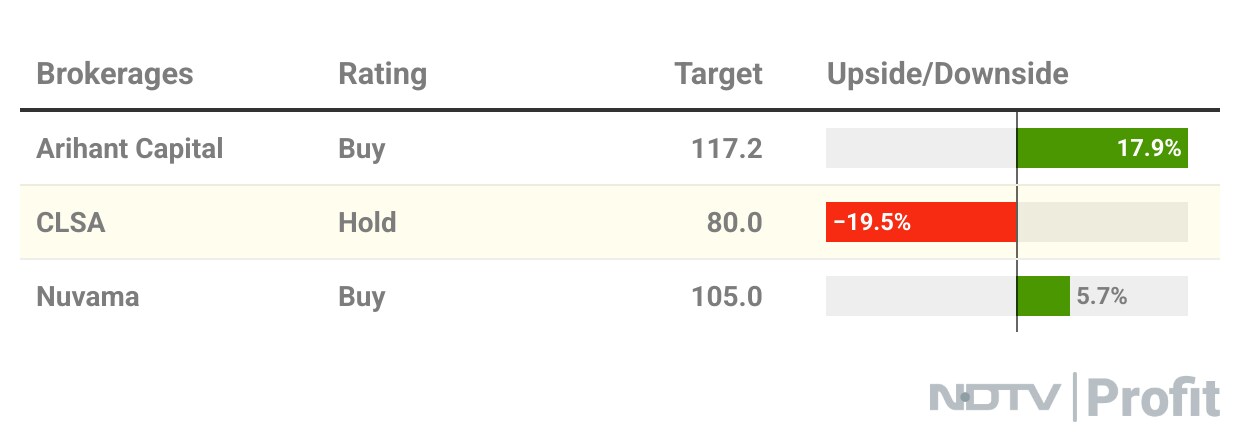

Out of three analysts tracking the company, two maintain a 'buy' rating, and one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies a downside of 16.9%.

Sterlite Technologies's newly launched data centre solutions range from cabling to end-to-end connectivity offerings which are designed to power the relentless demands of AI-driven data centre infrastructure, the company said in a press release on Monday.

The new-age data centre solution is made to meet the exact requirements of hyperscalers, colocation players, enterprises and telecom service providers to build agile, scalable, and sustainable data centre infrastructure, the press release said.

However, it is just a product launch, and Sterlite Technologies have not received any order for this product yet. The order win of Rs 2,631 crore, notified in March, is for a demerged entity but not for Sterlite Technologies. The company will supply supply cables for this order, which will be a fraction of the order amount.

In June, Sterlite Technologies rallied 38%, marking the best month since April 2020.

Sterlite Technologies Ltd. share price surged 13.40% to Rs 112.70 apiece, the highest level since Nov 17, 2023. The share

The stock rose 10.44% in 12 months and 31.75% on a year-to-date basis. Total traded volume so far in the day stood at 49 times its 30-day average. The relative strength index was at 87.46, which implied the stock is overbought.

Nevertheless, the market opportunity is huge in data centres.

As far as Sterlite Technologies' performance is concerned, its operating performance has improved in the past two quarters as inventory de-stocking comes to the final stage.

The net debt-to-equity falls to 0.7 times from 1.4 times, owing to the demerger and the fund raise of Rs 1,000 crore. The net debt and net debt-to-Ebitda are still high at Rs 1,350 crore and 3 times. Management is aiming to reduce the leverage to two times.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.