Shares of SRF Ltd. rose over 2% on Friday to hit a fresh life high after Citi Research hiked its target price to Rs 2,000 from the earlier Rs 1,800 per share, highlighting a stronger-than-expected third-quarter performance.

The company reported an Ebitda of Rs 620 crore, beating Citi's estimate of Rs 515 crore, marking a 9% year-on-year growth and a 15% quarter-on-quarter rise. The Chemicals segment was the main driver, posting a 13% year-on-year and 48% quarter-on-quarter increase in EBIT. Packaging films and technical textiles also saw growth, though packaging films experienced a slight quarter-on-quarter decline, said the brokerage.

The standout performance in the chemicals segment came from strong volume growth in refrigerant gases, particularly in the domestic market. The agrochemicals sector is also showing signs of improvement, although competition from China remains a challenge. The packaging films segment saw a 27% year-on-year revenue growth, while technical textiles struggled with a 14% year-on-year EBIT decline.

While upside risks exist—such as a sharper-than-expected recovery in specialty chemicals and reduced competition from China, Citi remains cautious on SRF and maintains a 'Buy' rating due to its current high valuation and recent stock price rally.

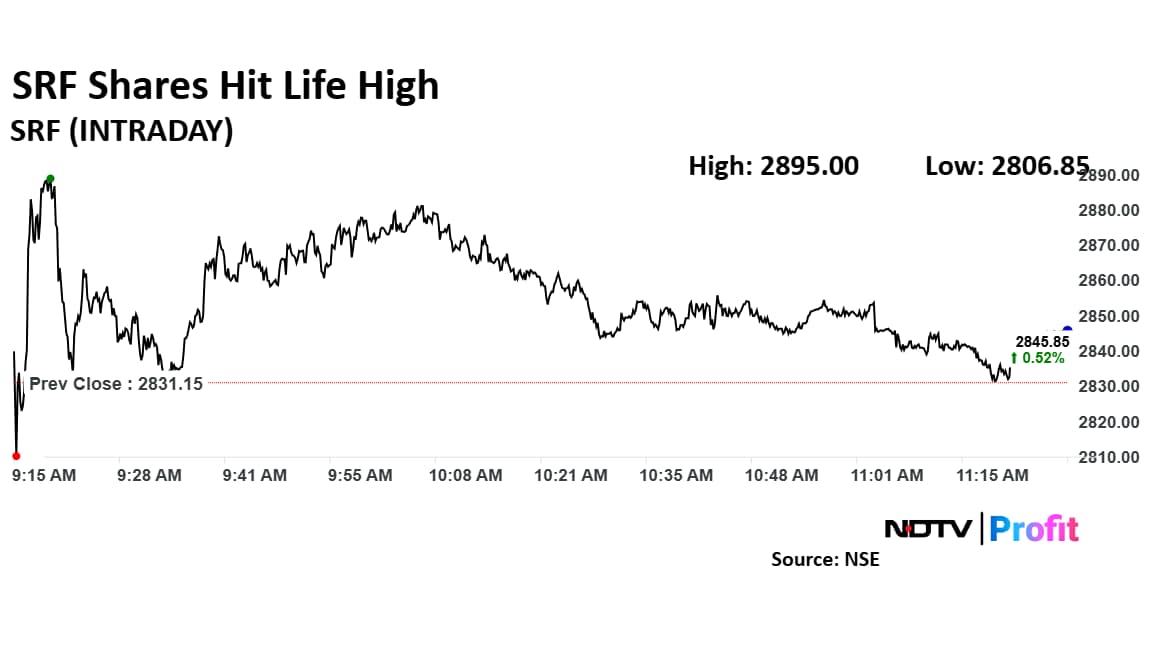

SRF Shares Hit Life High

SRF share price rose as much as 2.26% to Rs 2,895 apiece to hit fresh life high. It pared gains to trade 0.14% higher at Rs 2,834 apiece, as of 11:20 a.m. This compares to a 0.82% advance in the NSE Nifty 50 index.

It has risen 22.27% in the last 12 months. Total traded volume so far in the day stood at 2 times its 30-day average. The relative strength index was at 75, indicating it was overbought.

Out of 32 analysts tracking the company, 11 maintain a 'buy' rating, 10 recommend a 'hold,' and 11 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 9.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.