South Indian Bank's share price rose more than 1% to reach an 11-month high on Friday, after the company reported a 57.6% rise in profit. The shares of the bank rose to hit nine-month high on Thursday.

Profit rose to Rs 683 crore, compared to Rs 434 crore in the year-ago period. The net interest income—the difference of interest earned and interest paid—for the quarter fell 1% to Rs 868 crore. This compares to Rs 875 crore reported in the corresponding quarter of the previous fiscal.

South Indian Bank's asset quality also improved during the quarter under review, with the gross non-performing assets ratio declining to 3.20% from 4.30% in the January-March period. In absolute terms, the gross NPA slipped to Rs 2,799.83 crore from Rs 3,735.56 crore in the first quarter.

In absolute terms, the net NPA slipped to Rs 790.52 crore from Rs 1,056.11 crore.

Moreover the company announced dividend of Rs 0.40 per equity share for the fourth quarter of fiscal 2025. The company announced distribution of Rs 104.65 crore to shareholders in the fourth quarter of this fiscal.

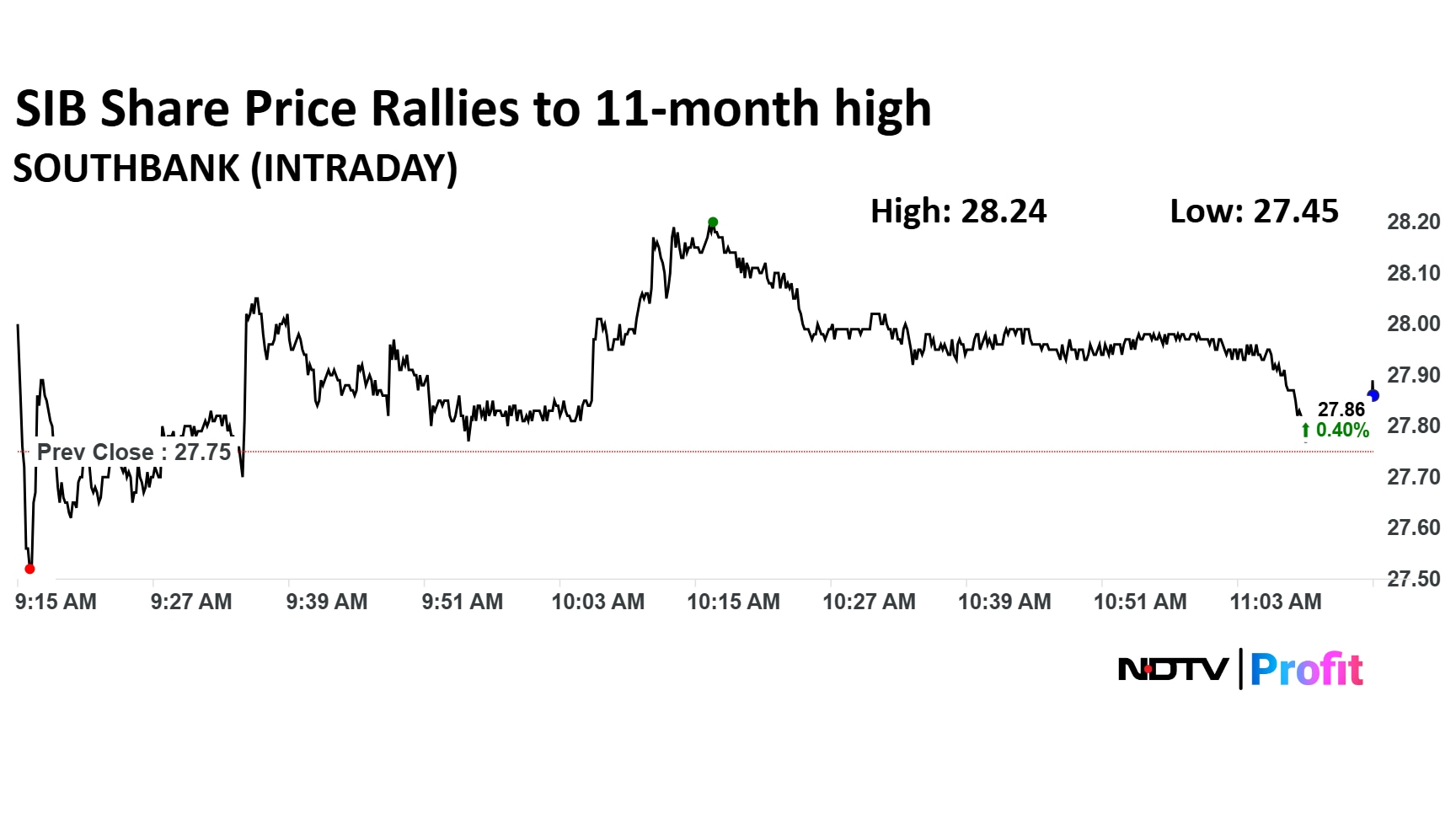

South Indian Bank Share Price

Share price of the lender rose as much as 1.26% to Rs 28.10 apiece, the highest level since June 21, 2024. It pared gains to trade 0.22% higher at Rs 27.81 apiece, as of 11:15 a.m. This compares to a 0.33% decline in the NSE Nifty 50.

The stock has risen 11.03% on a year-to-date basis, and is up 0.54% in the last 12 months. Total traded volume so far in the day stood at 3.4 times its 30-day average. The relative strength index was at 48.63.

Out of five analysts tracking the company, three maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 10.9%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.