Shares of Siemens Ltd. rose nearly 8% on Wednesday to hit over one-month high after it received National Company Law Tribunal's approval for the demerger of the company's energy business arm — Siemens Energy India Ltd.

Siemens Energy India will be listed separately on the stock exchanges.

As part of the restructuring, shareholders of Siemens will get one share of the demerged entity for every share held by them in the company, according to an exchange filing on Tuesday. The record date for the share allotment has been set as April 7.

Notably, the demerger exercise comes around five years after Siemens AG—the global parent of the Indian company—demerged its energy business globally in 2020.

Siemens Energy Q1 Result

Siemens Energy India, a wholly owned subsidiary of Siemens that follows the October-September cycle, saw its net profit more than double in the first quarter of financial year 2025. This was the first time the Indian parent entity reported financials of the unit.

Siemens Energy India was the parent company's major growth driver this quarter. While the revenue for the non-energy businesses fell 3% annually and 22% sequentially, the top line for the energy business was up 28% on a year-on-year basis.

The energy segment also saw its bottom line in the first quarter increase 2.5 times to Rs 243 crore. The segment's EBIT margins stood at 21.5%, which was a 1,060-basis point expansion from the same period a year ago.

Siemens Share Price Rise

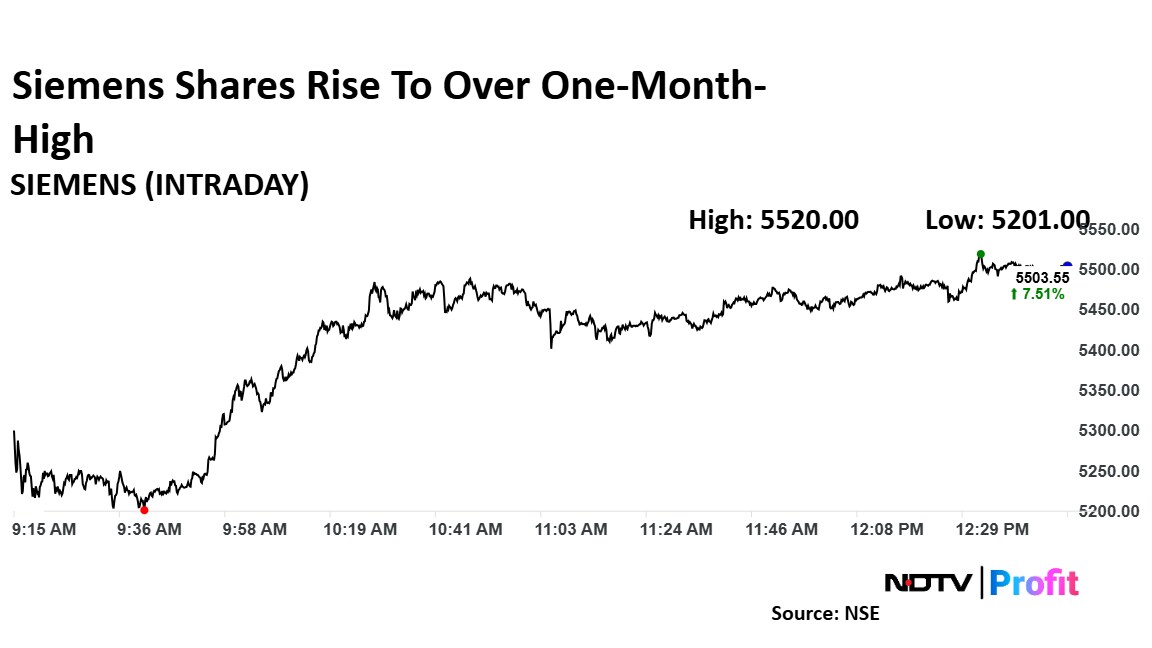

Shares of Siemens on Wednesday rose as much as 7.83% to Rs 5,520 apiece on the NSE, the highest level since Feb. 10. It pared gains to trade 7.53% higher at Rs 5,504.4, as of 12:48 p.m. This compares to a 0.14% decline in the benchmark Nifty 50 index.

The company's stock has risen by 7.9% in the last 12 months and fallen by 17.03% year-to-date. Total traded volume so far in the day stood at 6.7 times its 30-day average. The relative strength index was at 60.

Out of 25 analysts tracking the company, 15 maintain a 'buy' rating, five recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a potential upside of 13.1%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.