The shares of Siemens Ltd. rose on Wednesday, extending its advance for the third straight day. In this month alone the shares have risen nearly 9%, while it has declined over 13% this year.

Siemens Energy on Monday had allotted 35.6 crore equity shares to shareholders of Siemens after the company's demerger scheme. The allotment, carried out in a 1:1 ratio, was approved by the listing committee on April 14.

The demerger, which separated Siemens Ltd.'s energy business into Siemens Energy India, became effective on April 7, the same day as the record and ex-date. Shareholders of Siemens Ltd. will receive one share of Siemens Energy India for each share held. The new entity is expected to list on the stock exchanges within 30 to 90 days from the record date.

Siemens rose over 26% after it hit its upper circuit on the ex-date. However, the stock has given up some of its gains and is up over 17% since April 7.

Siemens Energy India focuses on delivering products, solutions, and services across the energy value chain. Its portfolio includes grid technologies, industrial power generation, gas services, and project execution in power generation, transmission, and industrial applications.

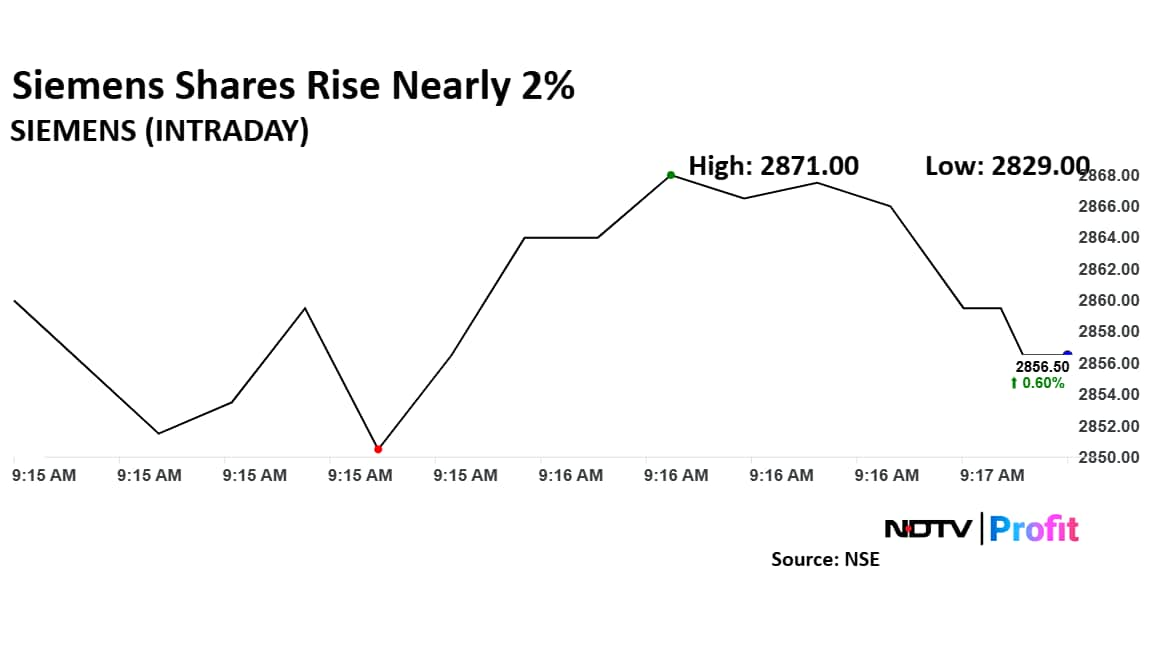

Siemens Share Price Today

The shares of Siemens rose as much as 1.11% to Rs 2,871 apiece, the highest level since April 8. It pared gains to trade 1% higher at Rs 2,866 apiece, as of 9:16 a.m. This compares to a 0.14% decline in the NSE Nifty 50 Index.

It has risen 3.56% in the last 12 months and 13.49% year-to-date. Total traded volume so far in the day stood at 0.75 times its 30-day average. The relative strength index was at 62.

Out of 25 analysts tracking the company, 15 maintain a 'buy' rating, five recommend a 'hold', and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 28.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.