The benchmark equity indices ended Monday on a positive note after a lower open as shares of private banks and Mahindra & Mahindra Ltd. gained.

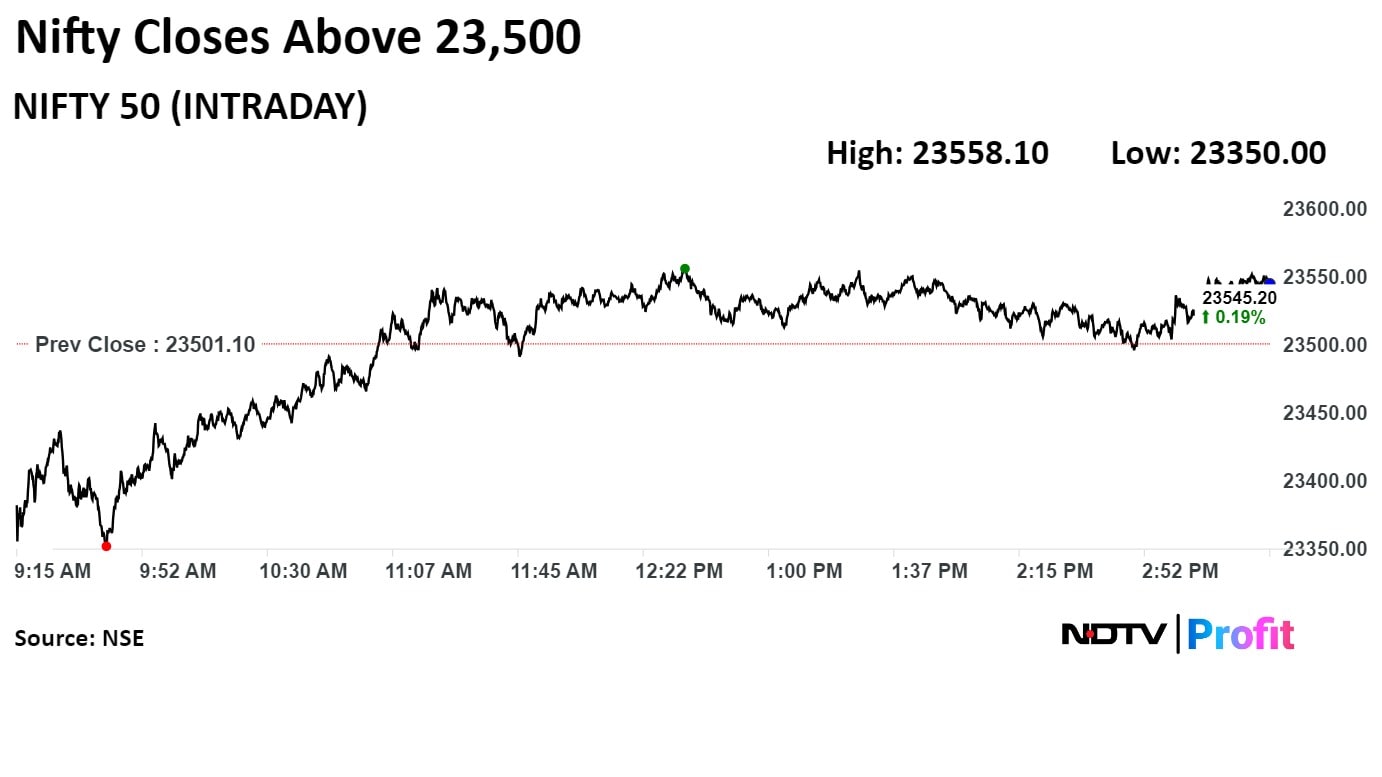

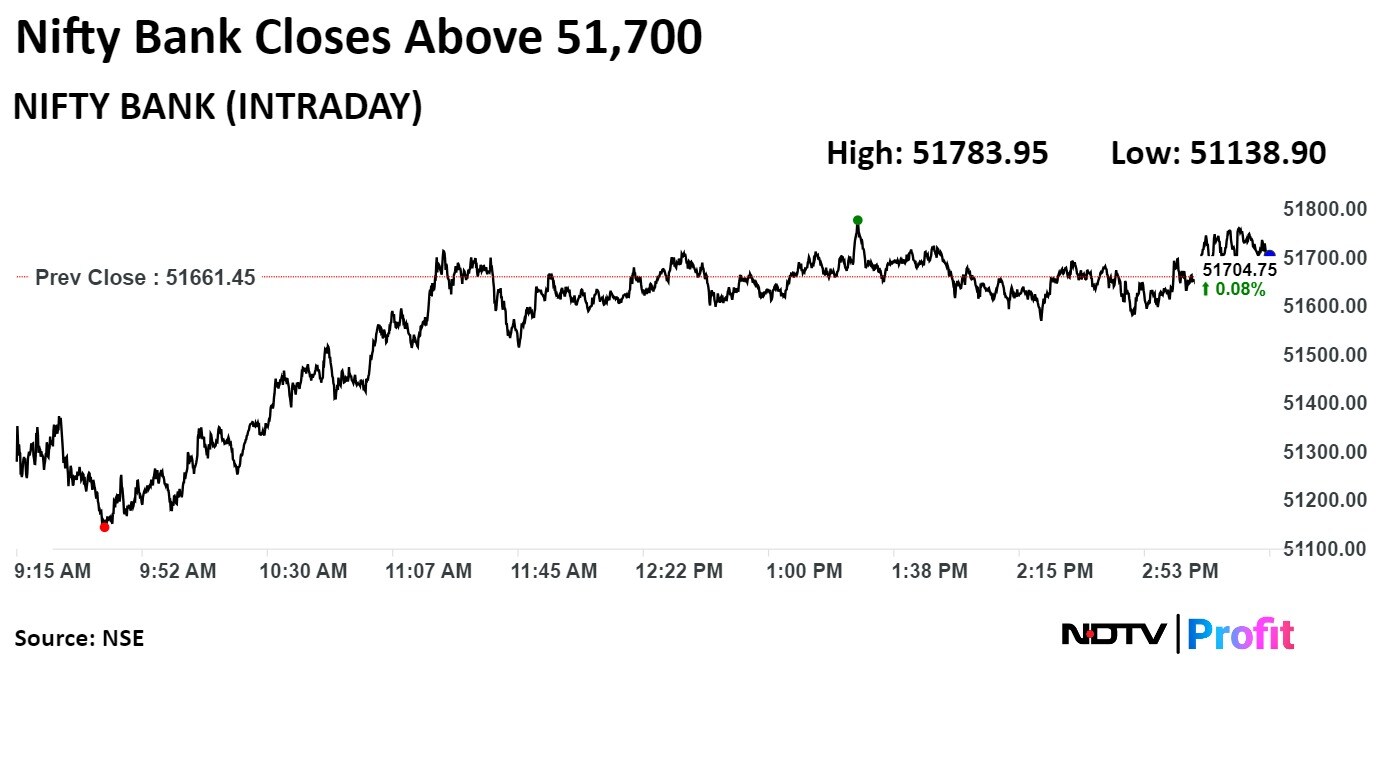

The NSE Nifty 50 closed 36.75 points or 0.16% up at 23,537.85, while the S&P BSE Sensex was 131.18 points or 0.17% higher to 77,341.08, During the day, both the indices fell as much as 0.6%.

The Nifty reversed from the lower end of the consolidation to form a green candle, with the downside being protected at 23,400, while the higher side is also capped at 23,660, according to Aditya Gaggar, director of Progressive Share Brokers. "A precise close on either side will provide a clear picture."

.jpeg)

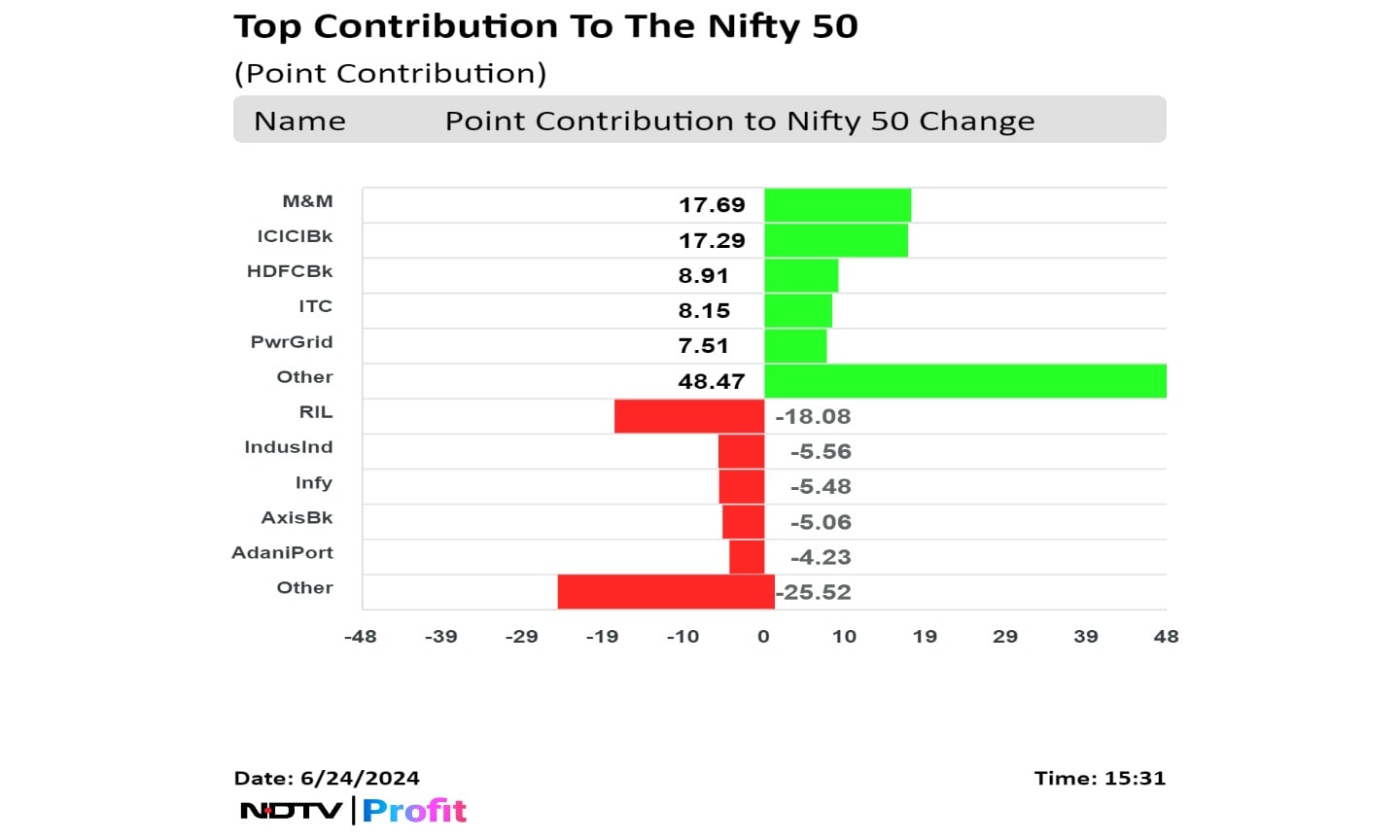

Shares of M&M, ICICI Bank Ltd., HDFC Bank Ltd., ITC Ltd. and Power Grid Corp. contributed the most to the gains in the Nifty.

Reliance Industries Ltd., IndusInd Bank Ltd., Axis Bank Ltd., Infosys Ltd., and Adani Ports & Special Economic Zone capped the upside in the index.

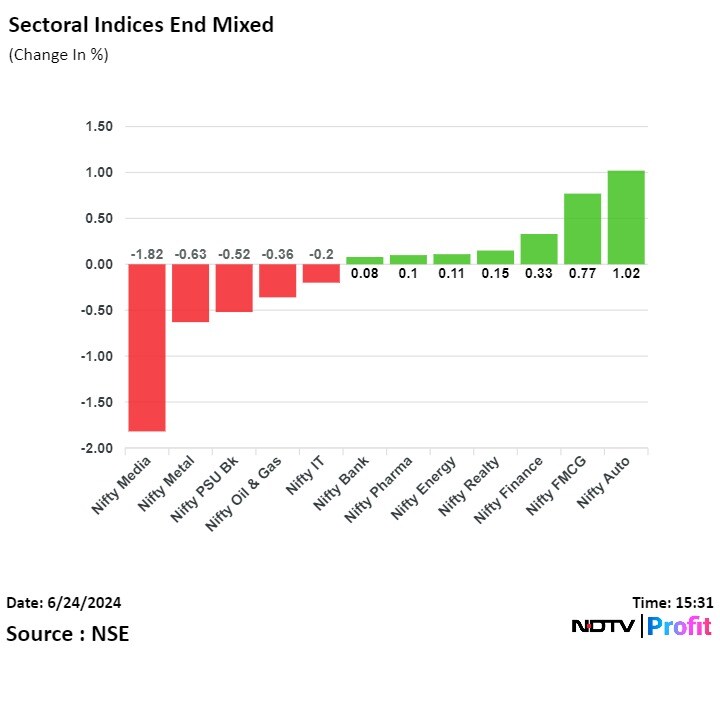

Sectoral indices on the NSE were mixed at close, with the Nifty Auto rising the most and the Nifty Media being the top loser.

The broader markets outperformed the benchmark indices as the BSE MidCap and SmallCap ended 0.37% and 0.27% higher respectively.

On the BSE, 13 out of the 20 sectoral indices advanced. Metal was the worst performing sector, while Auto rose the most to become the top performing sector.

The market breadth was skewed in favour of the buyers as 2,120 stocks rose, 1,872 declined and 164 remained unchanged on the BSE.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.