The shares of Senco Gold Ltd., Sky Gold Ltd. and Kalyan Jewellers India Ltd. rose on Tuesday as the yellow metal hit a life high amid tensions between US President Donald Trump and Federal Reserve Chair Jerome Powell.

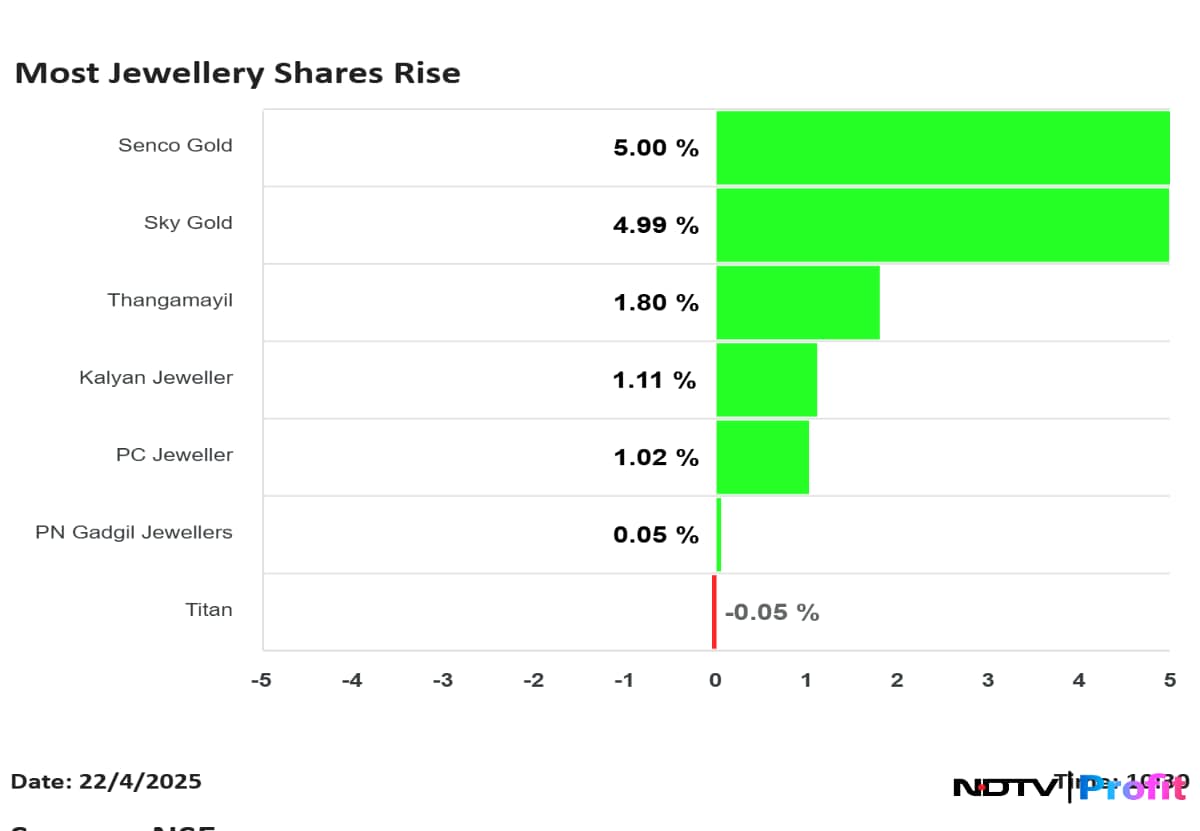

While Senco Gold and Sky Gold hit the upper circuit of 5%, Thangamayil Jewellery Ltd. rose 2.67%. Kalyan Jewellers, PN Gadgil Jewellers Ltd. and PC Jeweller Ltd. also rose 1.89%, 1.46% and 0.66%, respectively.

On the other hand, Titan Ltd. that owns brands like Tanishq, CaratLane and Zoya was trading 0.42% lower at Rs 3,322 per share.

The futures prices for the yellow metal on Multi Commodity Exchange rose to Rs 99,100 for the June. 5 futures. The gold price crossed the Rs 99,000 per 10 grams mark for the first time on Tuesday.

Gold price in India rose to a fresh life high of Rs 99,170 per 10 grams as of 10:23 a.m. on April 22, according to the India Bullion Association.

Rates in New Delhi saw a rise to Rs 98,810 per 10 grams, according to the association. The price in Mumbai was higher at Rs 98,990. In Kolkata, the rate rose to Rs 98,850. While in Bengaluru, the rate was at 99,060. With the price at Rs 99,270, Chennai continued to see the highest rate in the country.

Gold bullion climbed to trade above $3,486 an ounce. The rally has been fuelled by criticism of the US Federal Reserve, a weakening dollar, and ongoing trade tensions—all of which have intensified the appeal of safe-haven assets, as per Bloomberg.

"I think precious metals is the place to be. There is going to be a considerable upside for these markets," Peter McGuire, chief executive officer of XM Australia, told NDTV Profit. "The global demand for these metals is going to increase."

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.