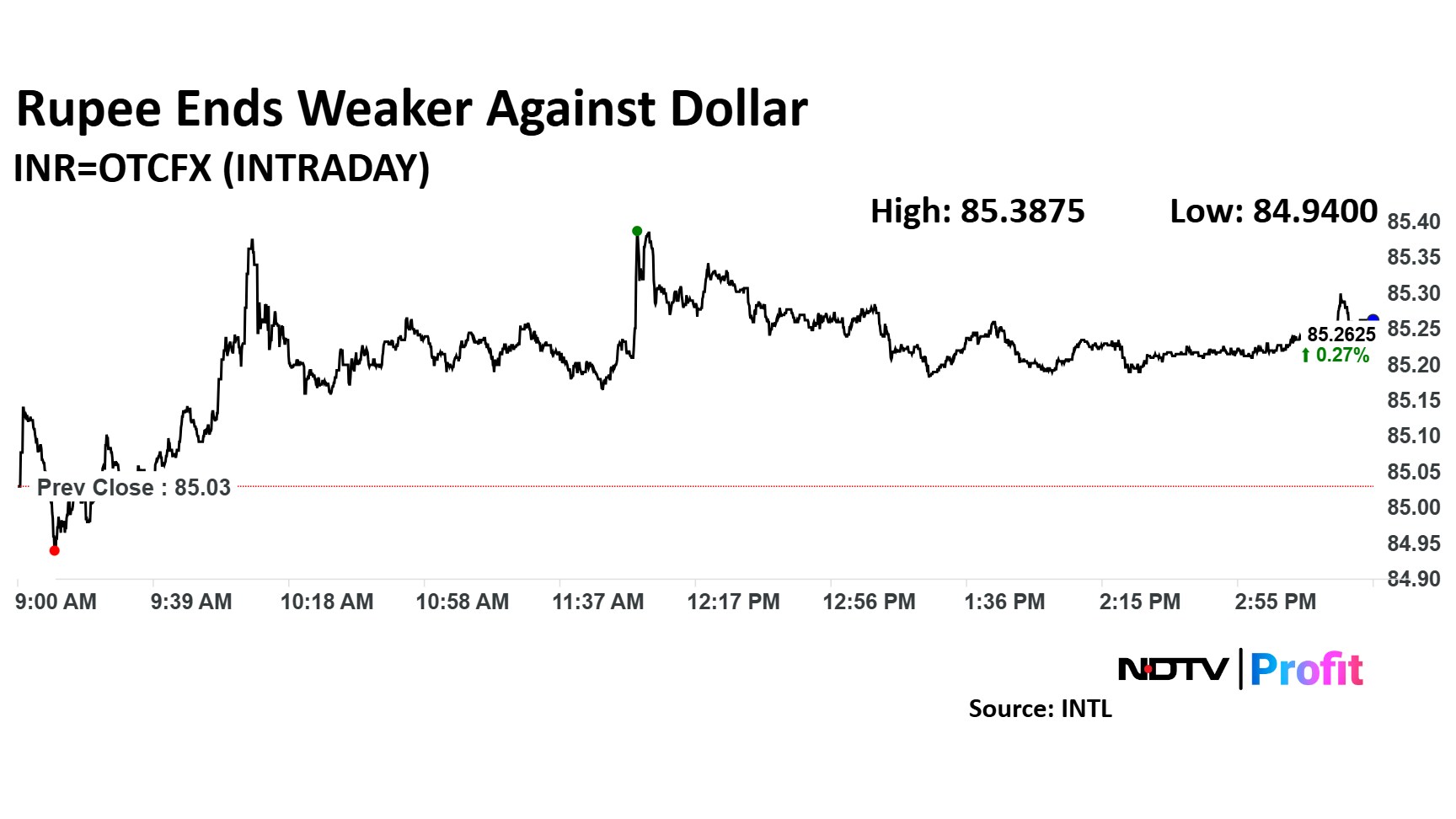

The Indian rupee closed 22 paise weaker against the US Dollar on Tuesday at 85.26, in contrast to a stronger close at 85.03 on Monday, according to Bloomberg.

The currency hit an intraday high of 84.95, compared to its highest intraday on Monday. It had opened higher in the last two sessions, breaking two consecutive weak starts but has since then weakened again.

"Bargain buying by hedgers and speculators exerted downward pressure on the rupee against the US dollar. Furthermore, the recovery of the dollar index, fueled by easing trade tariff concerns, also weighed on the local currency," said Dilip Parmar, research analyst at HDFC Securities.

The Dollar Index had eased at open and rose 0.19% to 98.97 as of 3:00 p.m. on Tuesday. "US president Donald Trump's tariffs have rattled faith in US assets and even though numerous backdowns have helped S&P to recover from its recent lows, the dollar has only steadied without any big rebound," said Kunal Sodhani, vice president at Global Trading Centre, FX & Rates Treasury, Shinhan Bank India.

Oil extended a drop as the global trade tensions tampered with demand, indicating a strained US and Chinese economy. Brent traded at $65 a barrel, extending losses for a second day. “Weak economic data suggests downside risks for demand,” remarked ANZ Group Holdings analysts Brian Martin and Daniel Hynes in a note to Bloomberg.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.