(Bloomberg) -- Indian equity bulls may find the going tough if a slew of derivatives data is on point.

The NSE Nifty 50 Index has rallied more than 15% from a June low, outperforming most global benchmarks amid a plethora of headwinds, most notably inflation. Recent data, however, point to risks for the rally.

Futures flows show foreign investors are scaling back their optimism on Indian stocks as the Nifty flirts with its 18,000 resistance level, while local retail traders have started piling back in.

Here are four charts that show how positioning is pivoting toward a more cautious outlook on the Nifty.

Fading Optimism

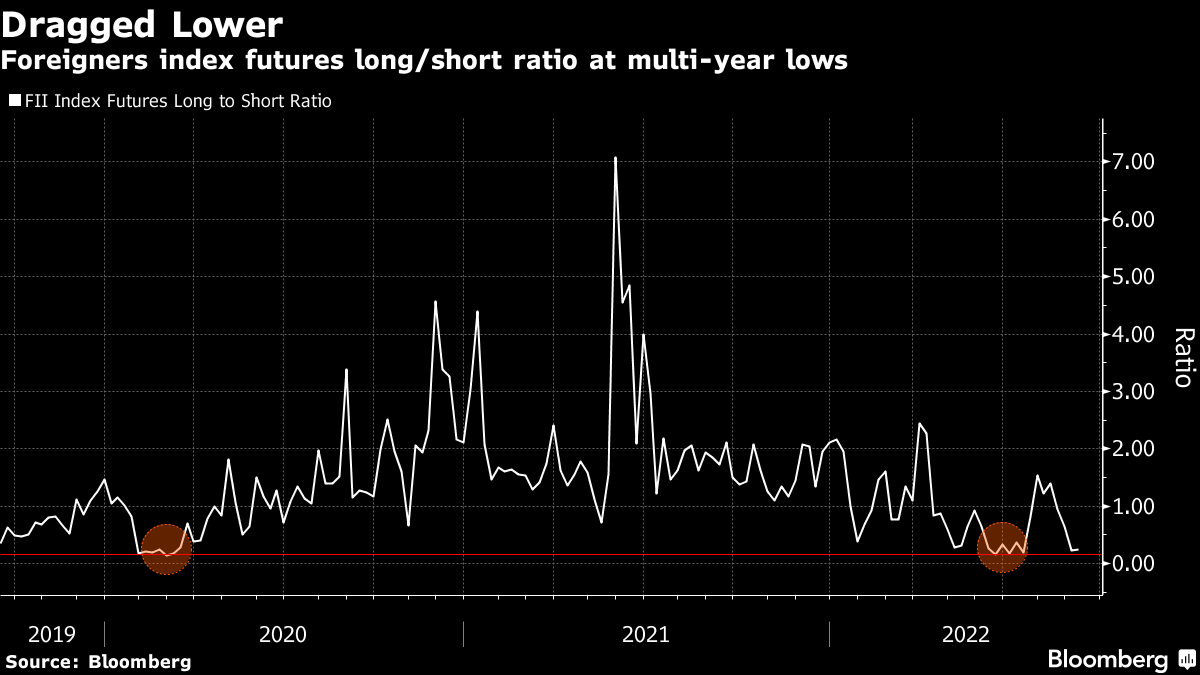

Foreign institutions are reducing their long exposure, with the ratio of their bullish to bearish bets collapsing again after a recent burst of optimism.

“Foreigners' long-to-short positioning in index futures has tumbled to 0.32 from the August peak of 1.99, suggesting overseas investors' expectations that any further rally is most likely in its last stretch”, said Shrinivas Balasubramanian, director of institutional equity sales trading at JM Financial Institutional Securities Ltd..

A similar downturn can be seen in foreign sentiment on individual stocks. Since peaking out in early July at 1.60, the long-to-short ratio has dropped significantly and is now quoting below both its one- and five-year averages of 1.47 and 1.42, respectively.

Retail Confidence

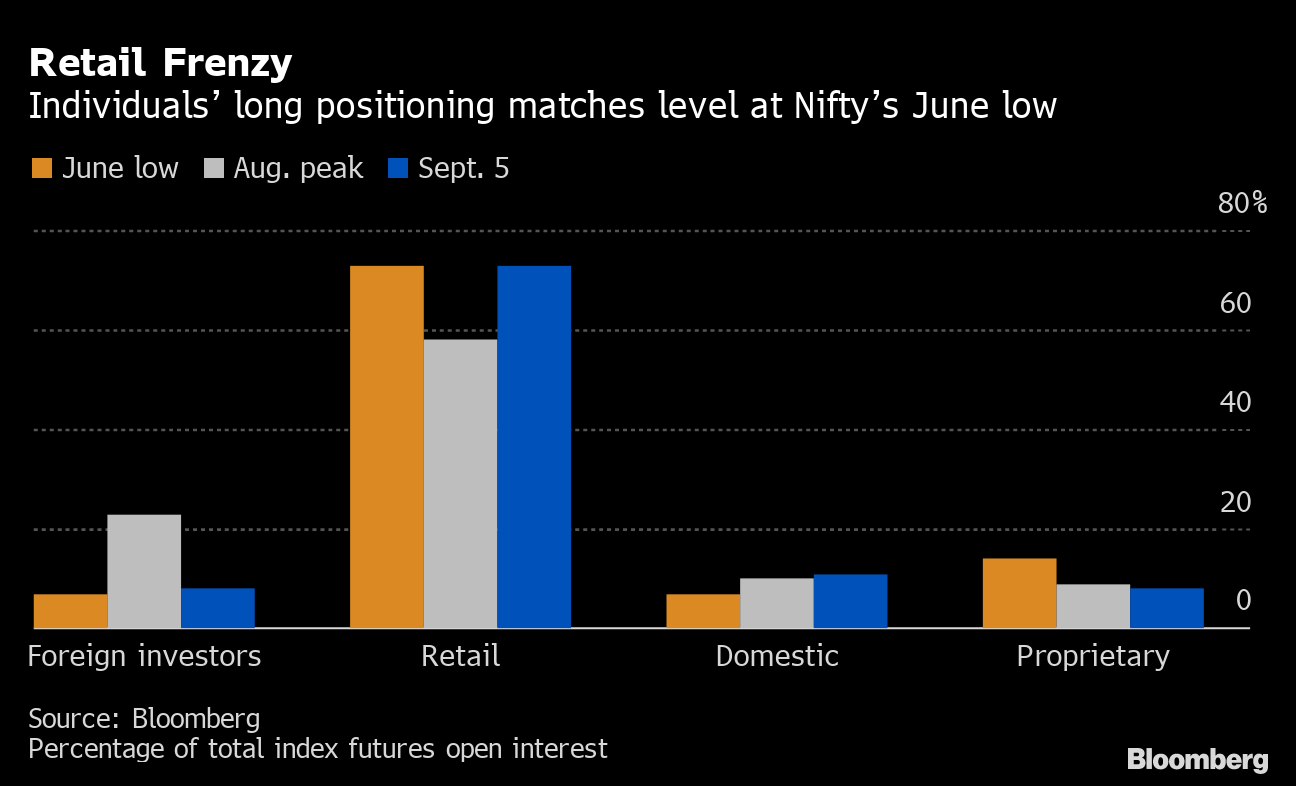

Retail traders remain optimistic, which has proven in the past to be a bearish signal, such as just before the pandemic selloff. The ratio of their long to short index futures positions tumbled from the middle of June through July, while the Nifty rose about 14%, but has rebounded this month as the index has struggled to make further headway.

“We are seeing unbridled retail optimism via long futures bets at the same time that call open interest at strikes above 17,500 continue to see an uptick,” Curl Capital co-founder and strategist Kusal Kansara wrote in a note. “This will present a significant challenge to a continuing rally in the Nifty”.

Retail positioning as a percentage of total index futures open interest was at 73% on Monday, matching the reading at Nifty's June low.

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.

:max_bytes(150000):strip_icc():focal(722x523:724x525):format(webp)/Savannah-Guthrie-mother-Nancy-Guthrie-020226-02-0368cb6ddb864bf09919fd100fe546b0.jpg?im=FeatureCrop,algorithm)