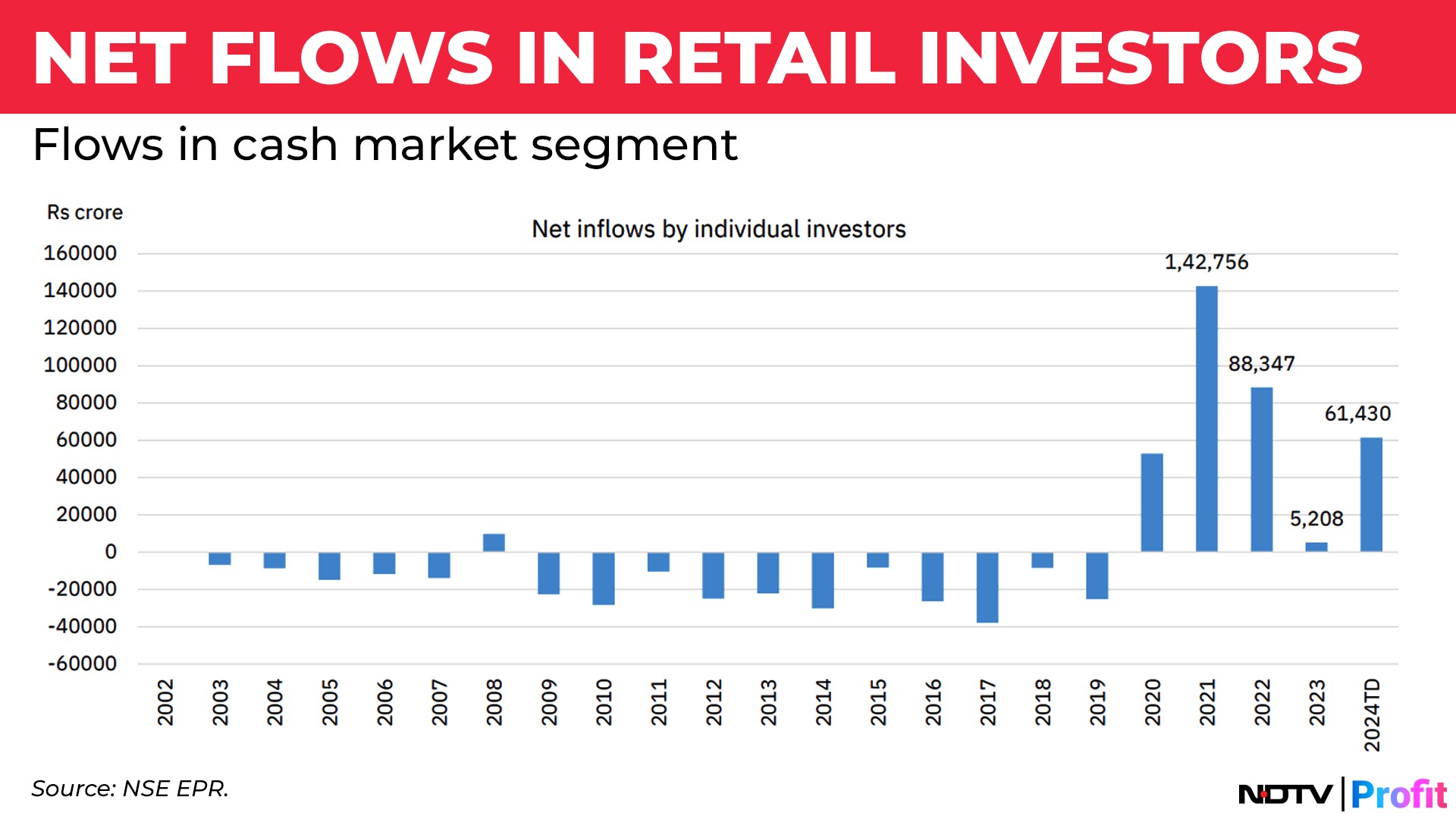

Retail investors have added Rs 61,430 crore in Indian equity markets so far this calendar year, reversing the trend of outflows in the quarter ended December and beating 2023 flows by nearly 12 times.

"While net investments started picking up between August 2023 and October 2023 by individual investors, the subsequent months witnessed large outflows by them, which largely offset the inflows witnessed in the prior months," according to the National Stock Exchange's Market Pulse report.

The quarter ended December saw an outflow of Rs 5,854 crore by retail investors, while calendar year 2023 saw inflows to the tune of Rs 5,200 crore.

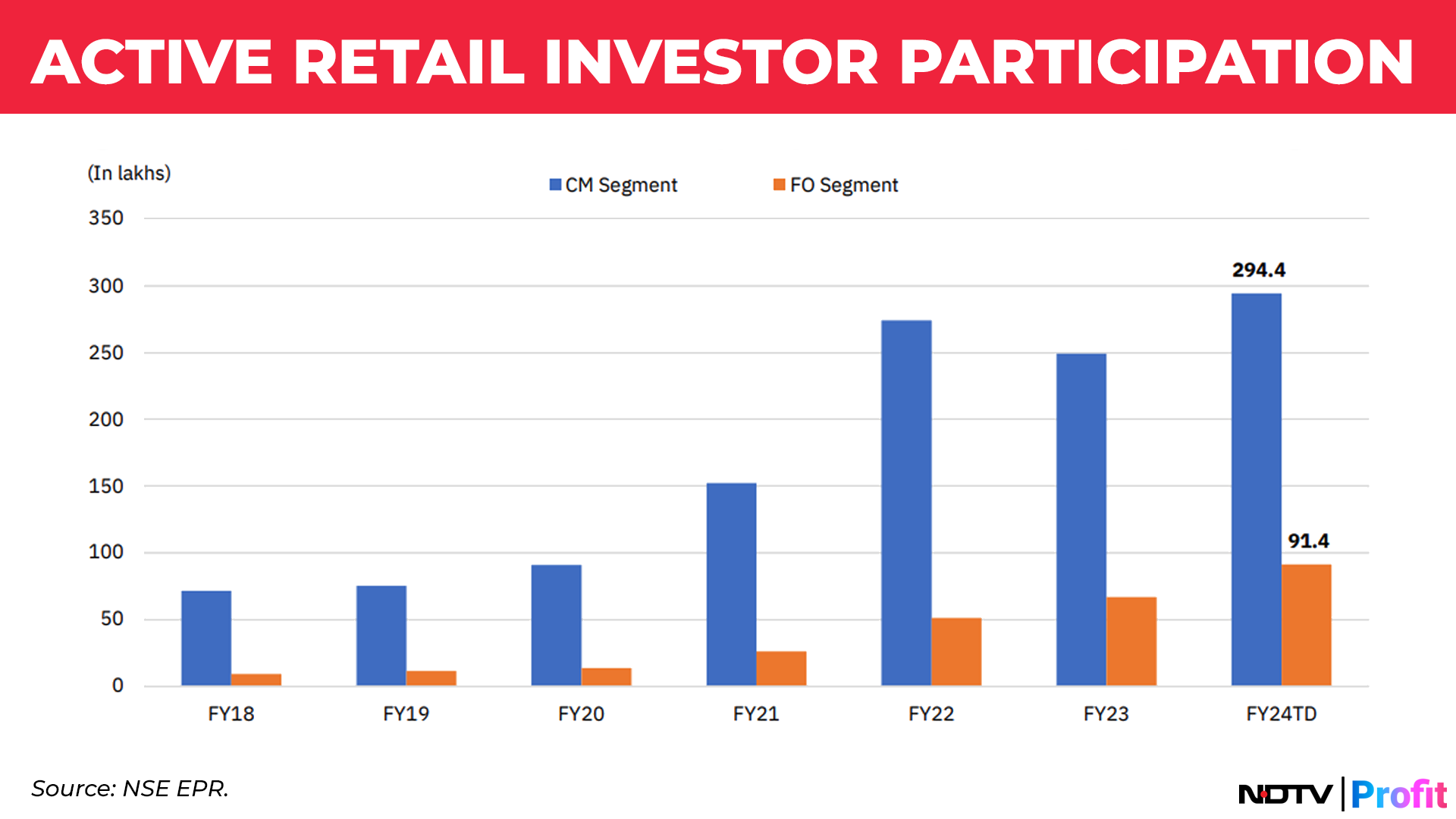

The report attributed the reversal in the last two months to strong economic fundamentals, increasing new investor registrations and growing investor participation.

Investor participation in NSE's cash segment, at 1.5 crore, rose to a record for the second month in a row in February, growing by 4.2% month-on-month. The number of unique investors in the equity derivates segment also hit a fresh high at 49.1 lakh individuals, rising 3.8% month-on-month.

Financial years 2021 and 2022 witnessed a surge in direct participation by individual investors in the Indian stock market after an 11-year hiatus.

Post-pandemic liquidity and limited investment options amid declining interest rates largely contributed to the influx of individual investors in Indian equity markets, the report said.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.