India's four publicly listed real estate investment trusts have outperformed India's benchmark indices in fiscal 2025, as their distributions per unit collectively improved 12% over the previous financial year.

The distribution per unit of the listed REITs—which are Brookfield India Real Estate Trust, Embassy Office Parks REIT, Mindspace Business Parks REIT and Nexus Select Trust—was much higher than the 5.1% returns given by BSE Sensex and the 5.3% advance of NSE Nifty 50 in fiscal 2025.

The Nifty Realty, which reflects the performance of real estate companies engaged in construction of residential and commercial properties, also saw a 5.5% decline over the financial year.

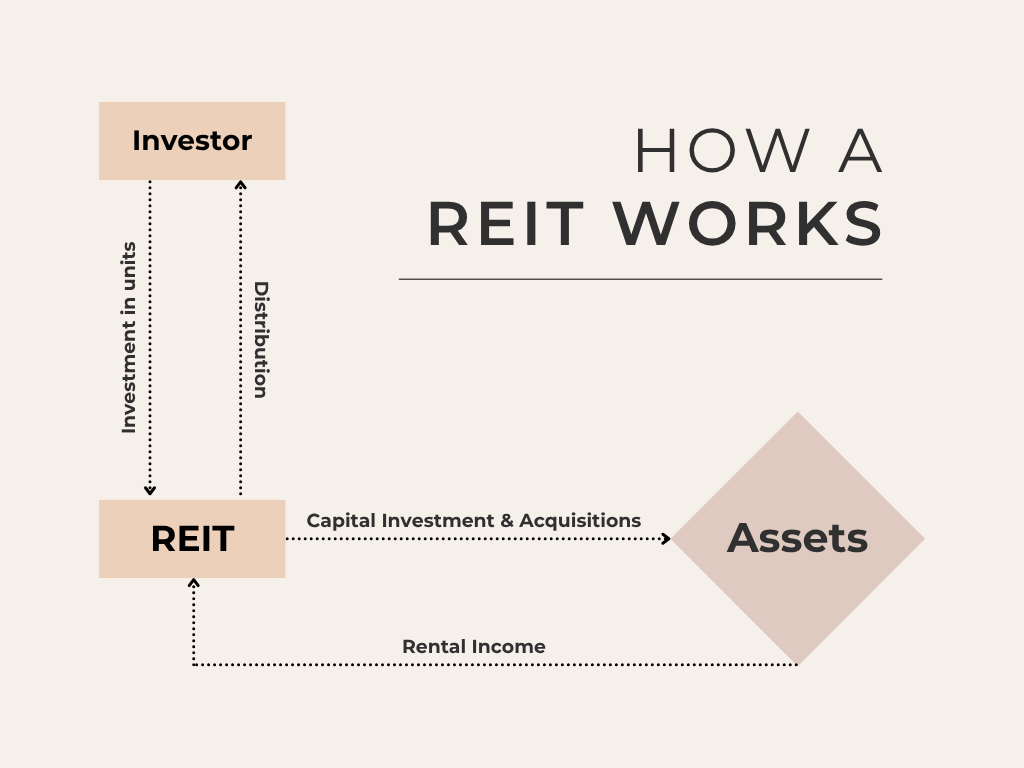

Distribution per unit refers to the amount of cash payment a REIT distributes to each unit holder, typically on a per-unit basis. REITs are required to distribute at least 90% of their net distributable cash flows to unitholders semi-annually. This distribution is the main source of returns for investors in REITs.

How a REIT works. (Photo source: NDTV Profit)

Nexus saw its distribution increase to Rs 8.35 from Rs 7.08 per unit on a year-on-year basis, which represented nearly an 18% growth—the highest among its listed peers.

Next in line was Mindspace, whose distribution per unit jumped over 14% on the year to Rs 21.95. Brookfield and Embassy also saw a yearly growth of around 8% each in their distributions per unit.

Of the four listed trusts, Embassy and Nexus have also guided for improved distribution in the next fiscal. While Embassy eyes up to a 13% year-on-year improvement at Rs 24.5 to Rs 26 per unit, Nexus sees its distribution rising up to 10% at Rs 9.1 to Rs 9.2 per unit.

India's four publicly listed real estate investment trusts have collectively distributed over Rs 1,553 crore to its unitholders for the fourth quarter of fiscal 2025.

The REITS have seen a 13% year-on-year increase in their quarterly distribution, which was disbursed to 2.64 lakh unitholders, the Indian REITs Association said in a release in May.

Individually, for the March quarter, the net distributable cash flows of Embassy and Mindspace stood at Rs 496 crore and Rs 284 crore, respectively. Nexus Select's distribution came up to Rs 303 crore on a trust level, while Brookfield's was at Rs 204 crore on a standalone basis.

In March, Knowledge Realty Trust, a joint venture of private equity firm Blackstone and Sattva Developers Pvt., also filed draft papers for an initial public offering worth Rs 6,200 crore.

Upon listing, Knowledge Realty will be the largest office REIT in the country based on gross asset value of Rs 59,445 crore as of the September quarter, according to a company's draft offer document. Knowledge Realty will be the fifth REIT to be launched in India and the fourth to be backed by the buyout firm.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.