Shares of Raymond Ltd. adjusted on Wednesday, as shares turn ex-date for demerger of the real estate business — Raymond Realty.

The demerger ratio was set at 1:1. As per the scheme, one fully paid-up share of face value of Rs 10 of Raymond Realty will be given for every share held in the parent firm Raymond.

The record date, which was set at May 14, will determine the eligible shareholders for the spin-off. The ex-date, which coincides with the record date, marks when the share price adjusts to reflect the split leading to the decline.

Raymond announced the demerger of the real estate division in July 2024. The National Company Law Tribunal approved the plan in March, and the demerger came into effect on May 1.

Raymond Realty shares will be listed on both the NSE and the BSE and will trade as a completely standalone entity. The date of listing will be intimated by Raymond later.

The demerger plan aims to exploit the growth potential of the real estate business and attract a fresh set of investors and strategic partners to participate in the real estate business, according to Gautam Singhania-led Raymond.

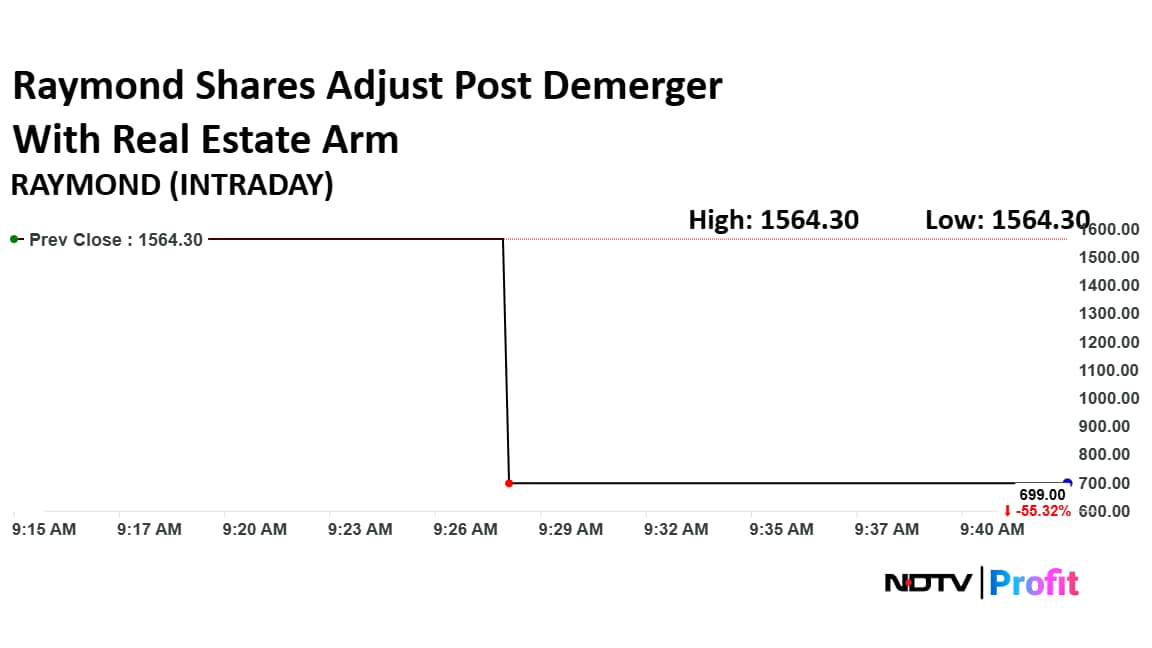

Raymond Share Price Adjusts

Shares of Raymond fell as much as 55.32% to Rs 699 apiece as the shares adjust post demerger as of 9:41 a.m. This compares to a 0.62% advance in the NSE Nifty 50.

The stock has fallen 67.22% in the last 12 months and 58.31% year-to-date. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 55.93.

Out of five analysts tracking the company, four maintain a 'buy' rating and one recommends a 'hold', according to Bloomberg data.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.