Shares of Raymond Ltd. continued their rally on Wednesday, climbing more than 6% to hit a three-month high, marking the second consecutive day of gains. The stock has gained significant momentum over the past two days.

On Tuesday, Raymond Ltd.'s stock surged nearly 14%, before it closed 11.65% higher at Rs 1,799.95, with an increase in trading volume as over 5 lakh shares changed hands.

The surge comes amid a significant restructuring at Raymond, following the demerger of its lifestyle business. The company's operations are now focused on the real estate and engineering sectors, with the lifestyle segment spun off to streamline the group's structure. The demerger has been aimed at simplifying operations, attracting new investors, and providing more funds to the newly separated business.

In September 2024, Raymond Lifestyle Limited made its public debut on the stock market, offering investors a chance to invest directly in the lifestyle business that had previously been part of Raymond's diversified portfolio.

The strong performance of Raymond shares is seen as a positive reflection of investor confidence in the company's ongoing transformation and its focus on expanding in the real estate and engineering sectors. The demerger has opened up new growth opportunities for Raymond.

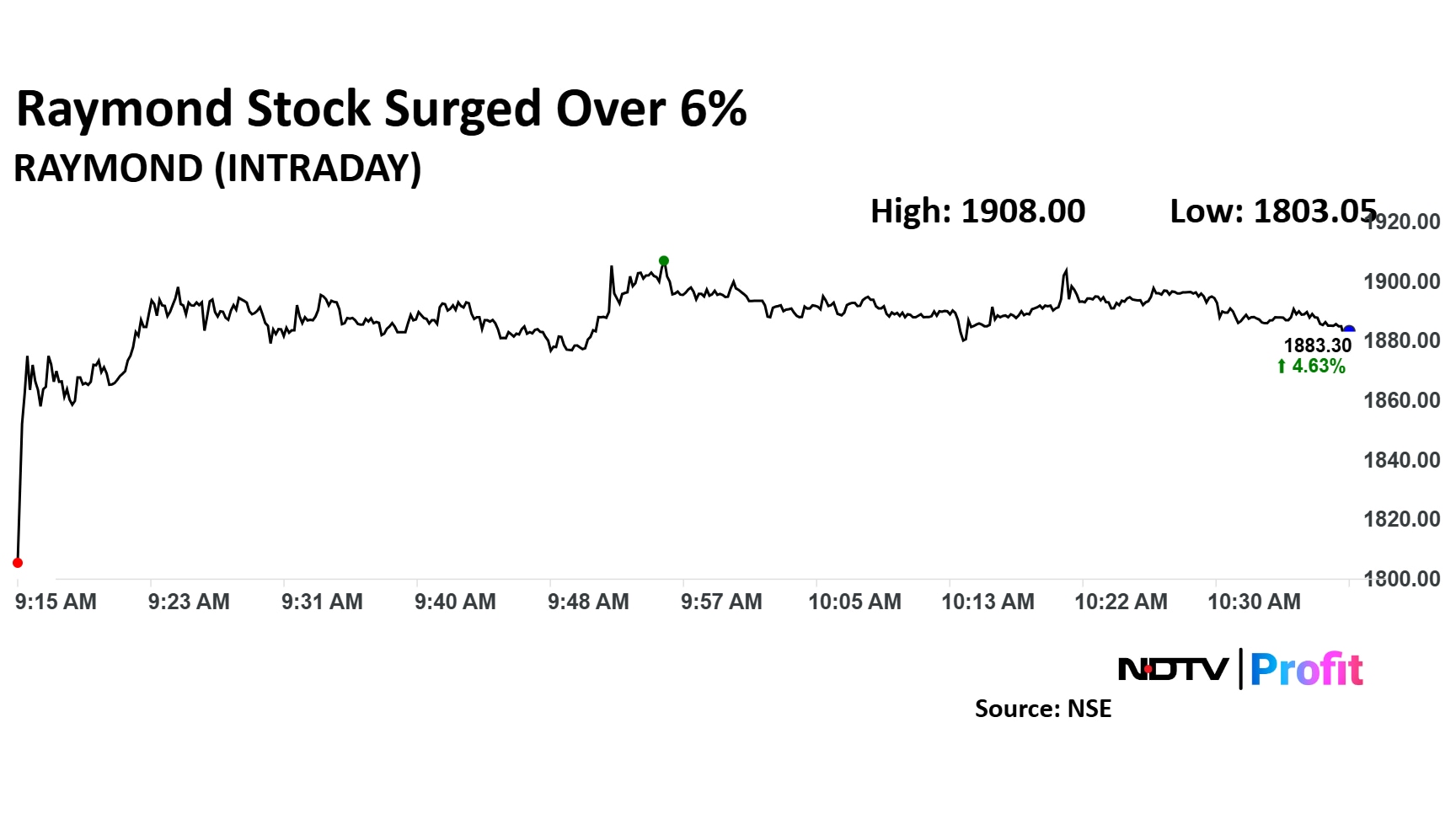

Raymond share price rose as much as 6.02% to Rs 1,908.35 apiece. It pared gains to trade 4.54% higher at Rs 1,881.60 apiece, as of 10:44 a.m. This compares to a 0.26% advance in the NSE Nifty 50 Index.

It has risen 72.78% in the last 12 months. Total traded volume so far in the day stood at 26 times its 30-day average. The relative strength index was at 70.

Out of five analysts tracking the company, four maintain a 'buy' rating, and one recommends a 'hold', according to Bloomberg data. The average 12-month consensus price target implies an upside of 29.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.