ITC Ltd.'s profit for the three months ended March surpassed estimates even as margin slipped.

Net profit rose 19 percent year-on-year to Rs 3,481 crore in the March-ended quarter, according to the cigarette-to-fast moving consumer goods maker's exchange filing. That compares with the Rs 3,241-crore consensus estimate of analysts tracked by Bloomberg.

The company's revenue rose 13 percent on a yearly basis to Rs 11,992 crore in the January-March period. That's higher than the Rs 11,822-crore estimate. The revenue of cigarette vertical was lifted by 7-14 percent prices hikes done during March.

The company's operating income, or earnings before interest, tax, depreciation and amortisation, rose 10 percent over the last year to Rs 4,572 crore, in line with the Bloomberg estimate of Rs 4,578 crore. Its operating margin contracted 100 basis points to 38.1 percent in the March quarter. The company announced a final dividend of Rs 5.75 per share.

The fast moving consumer goods companies are seeing a slowdown due to tepid rural demand. A cash crunch triggered by loan defaults of Infrastructure Leasing & Financial Services has also spilled over to affect India's consumption engine.

The company's Managing Director Sanjiv Puri will take over as the new chairman after YC Deveshwar passed away on Saturday.

Segmental Revenue (YoY)

Cigarette Business

- Revenue up 13.2 percent to Rs 5,586 crore.

- EBIT margin at 69 percent versus 71 percent.

FMCG (Excluding Cigarettes)

- Revenue rose 7.3 percent to Rs 3,274 crore.

- EBIT margin at 4 percent versus 3 percent.

Hotels

- Revenue up 25 percent at Rs 510 crore.

- EBIT margin at 17.5 percent versus 18.4 percent.

Agriculture

- Revenue increases 16.2 percent to Rs 2,101 crore.

- EBIT margin at 7 percent versus 6.9 percent.

Paper

- Revenue rose 18.1 percent to Rs 1,537 crore.

- EBIT margin at 19.5 percent versus 18.6 percent.

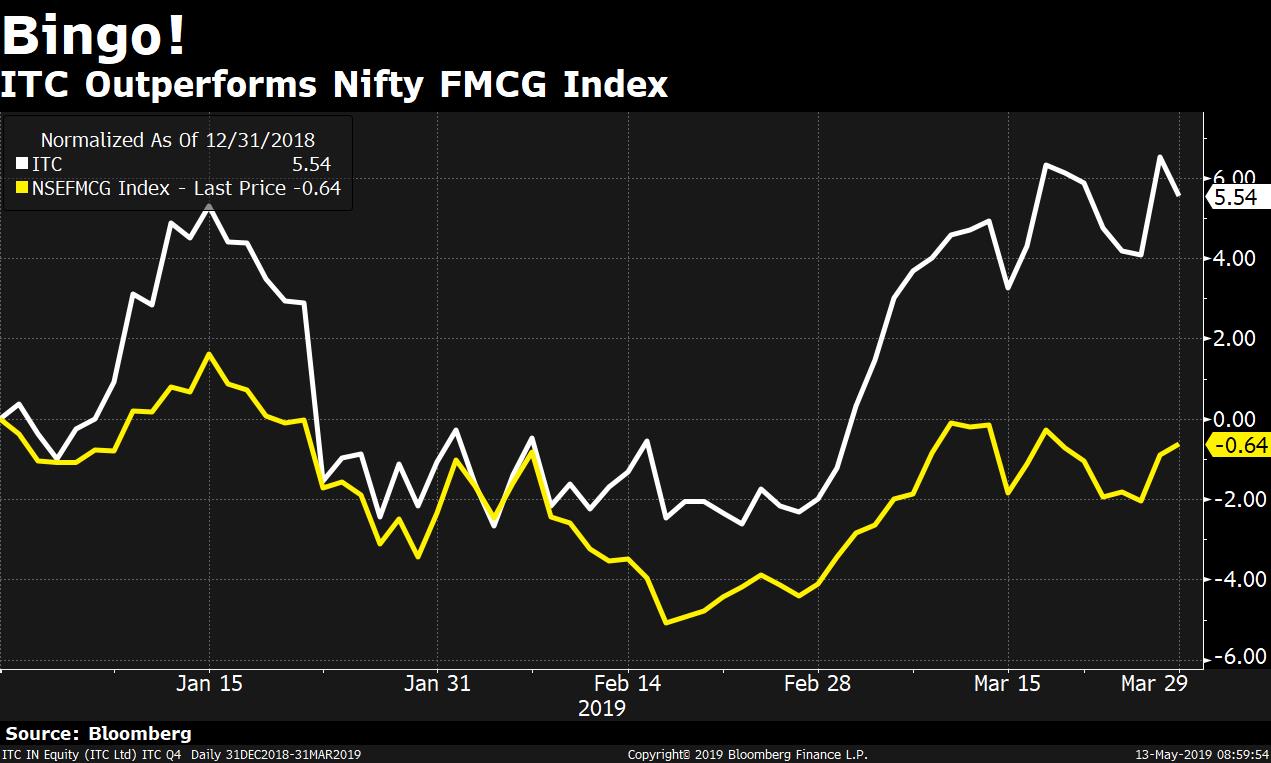

Shares of ITC fell a percent to Rs 295.10 apiece after the earnings announcement, tracking Nifty's 1.3 percent drop in today's session. The shares advanced 5 percent this year compared to a 5.2 percent gain in the Nifty.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.