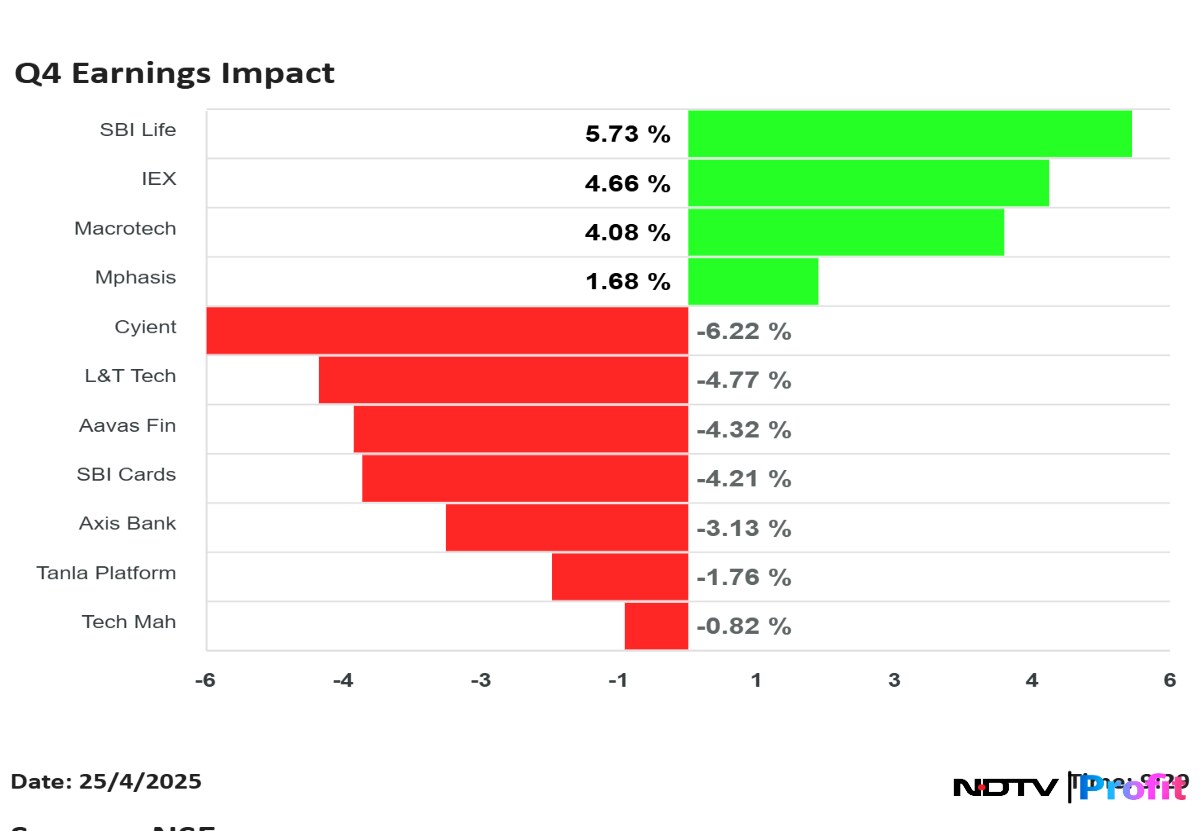

Shares of Axis Bank Ltd., Tech Mahindra Ltd., L&T Technology Services Ltd., were in focus on Friday, after the companies announced their fourth quarter results.

SBI Life Insurance Ltd. shares rose the most, while Cyient Ltd. fell the most among the companies that announced their results for quarter ended March.

Axis Bank Q4FY25 (Standalone, YoY)

Share price falls 4.02% at Rs 1,158.60.

Net profit flat at Rs 7,117.5 crore versus Rs 7,129.67 crore (Estimate: Rs 6,601.24 crore).

Net Interest Income up 6% at Rs 13,811 crore versus Rs 13,089 crore (Estimate: Rs 14,008 crore).

Net interest margin at 3.97%, up by 4 bps.

Provisions up 14.7% at Rs 1,359 crore versus Rs 1,185 crore.

Gross NPAs at 1.28% versus 1.46% (QoQ).

Net NPAs at 0.33% versus 0.35% (QoQ).

Cyient Q4 Highlights (Consolidated, QoQ)

Share price falls 9.48% at Rs 1,125.

Revenue down 0.9% to Rs 1,909 crore versus Rs 1,926 crore.

EBIT up 11.2% to Rs 235 crore versus Rs 211 crore.

Margin to 12.3% versus 11%.

Net profit up 39.3% to Rs 170 crore versus Rs 122 crore.

Recommends final dividend of Rs 14 per share.

SBI Life Insurance Q4 FY25 (Consolidated, YoY)

Share price rises 9.56% at Rs 1,762.

Net Premium Income down 5% at Rs 23,860 crore versus Rs 25,116 crore.

Net profit up 0.37% at Rs 813 crore versus Rs 810 crore.

Annualised Premium Equivalent stands at Rs 5,450 crore with growth of 2.25% (YoY).

Value of New Business stands at 1,660 crore with growth of 9.93%.

Value of New Business margin up 351 bps at 30.46% versus 26.95%.

Tech Mahindra Q4FY25 (Consolidated, QoQ)

Share price falls 4.86% at Rs 1,375.

Revenue up 0.7% at Rs 13,384 crore versus Rs 13,286 crore (Bloomberg estimate: Rs 13,460.09 crore).

Net profit up 18.7% at Rs 1,167 crore versus Rs 983 crore (Estimate: Rs 1,083.9 crore).

EBIT up 2% at Rs 1,378 crore versus Rs 1,350 crore (Estimate: Rs 1,875.14 crore).

Margin At 10.3% versus 10.2% (Estimate: 13.9%).

Other income rises to Rs 173 crore versus Rs 16.5 crore.

PAT growth on the back of rise in other income.

L&T Technology Services (Consolidated, QoQ)

Share price falls 6.99% at Rs 4,164.90.

Revenue up 12.4% to Rs 2,982 crore versus Rs 2,653 crore (Bloomberg estimate: Rs 3,036 crore).

Net profit down 3.4% to Rs 311 crore versus Rs 322 crore (Bloomberg estimate: Rs 354.95 crore).

EBIT down 6.6% at Rs 394 crore versus Rs 422 crore (Estimate: Rs 545.53 crore).

EBIT margin at 13.2% versus 15.9% (Estimate: 18%).

Indian Energy Exchange Q4FY25 (Standalone, YoY)

Share price rises 4.48% at Rs 199.39.

Revenue up 16.7% to Rs 141.2 crore versus Rs 121 crore (Bloomberg estimate: Rs 145.27 crore).

Net profit up 18% to Rs 112 crore versus Rs 95.1 crore (Estimate: Rs 109.95 crore).

Ebitda up 16% to Rs 121.87 crore versus Rs 104.61 crore (Estimate: Rs 129.6 crore).

Margin at 86.3% versus 86.5% (Estimate: 89.2%).

Tanla Platforms Q4FY25 (Consolidated, QoQ)

Share price falls 2.41% at Rs 472.35.

Revenue up 2.4% at Rs 1,024 crore versus Rs 1,000 crore.

Ebitda down 1.46% at Rs 136.43 crore versus Rs 138.46 crore.

Ebit margin down 52 bps at 13.32% versus 13.84%.

Net profit down 0.84% at Rs 117 crore versus Rs 118 crore.

Macrotech Developers Q4 FY25 Highlights (Consolidated, YoY)

Share price rises 4.29% at Rs 1,376.90.

Revenue up 5.1% at Rs 4,224 crore versus Rs 4,019 crore.

Ebitda up 16.6% at Rs 1,221 crore versus Rs 1,047 crore.

Margin expands to 28.9% versus 26%.

Net profit up 38.5% to Rs 922 crore versus Rs 666 crore.

Aavas Financiers Q4 Highlights (YoY)

Share price falls 4.20% at Rs 2,008.10.

NII up 14.34% at Rs 271 crore versus Rs 237 crore.

Net profit up 7.7% Rs 154 crore versus Rs 143 crore.

GNPA at 1.08% vs 1.14%.

NNPA at 0.73% vs 0.81%.

SBI Cards Q4 Highlights (Standalone, YoY)

Share price falls 6% at Rs 871.

NII up 14.48% at Rs 1,620 crore versus Rs 1,415 crore.

Net profit down 19% to Rs 534 crore versus Rs 662 crore (Bloomberg estimate: Rs 511.11 crore).

GNPA at 3.08% versus 3.24%.

NNPA at 1.46% versus 1.18%.

Mphasis Q4 Highlights (Consolidated, QoQ)

Share price rises 3.23% at Rs 2,547.80.

Revenue up 4.2% to Rs 3,710 crore versus Rs 3,561 crore.

EBIT up 4% to Rs 567 crore versus Rs 545 crore.

EBIT margin flat at 15.3%.

Net profit up 4.2% to Rs 446 crore versus Rs 428 crore.

Board recommends dividend of Rs 57 per share.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.