Shares of Adani Ports and Special Economic Zone Ltd., Eternal Ltd., Paras Defence and Space Technologies Ltd., were in focus on Friday, after the companies announced their fourth quarter results.

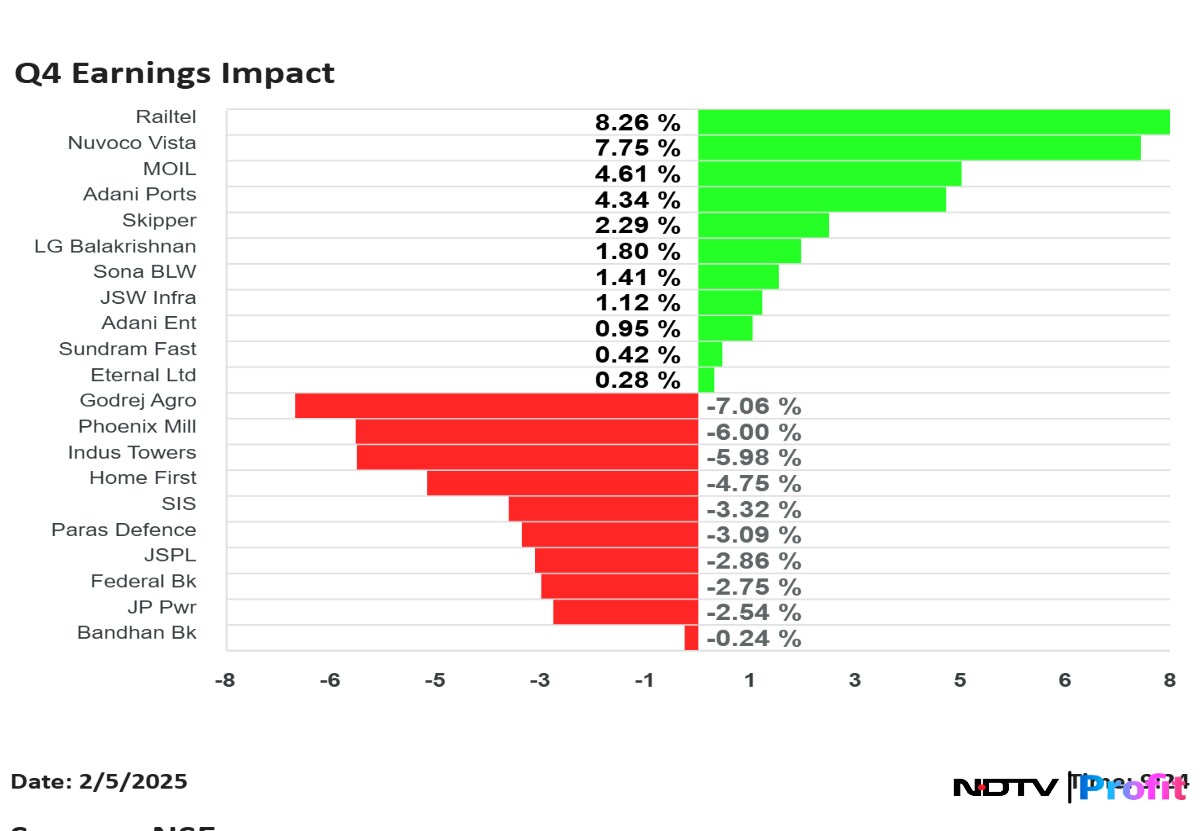

Railtel Corporation of India Ltd. shares rose the most, while Godrej Agrovet Ltd. fell the most, among the companies that announced their results for quarter ended March.

Adani Ports Q4 Results (Consolidated, YoY)

Share price rises 4.69% at Rs 1,273.60.

Revenue up 23% to Rs 8,488 crore versus Rs 6,897 crore.

Ebitda up 23.8% to Rs 5,006 crore versus Rs 4,044 crore.

Margin at 59% versus 58.6%.

Net profit up 47.8% At Rs 3,014 crore versus Rs 2,040 crore.

To pay a dividend of Rs 7 per share.

FY26 revenue/Ebitda guidance at Rs 36,000-38,000 crore/Rs 21,000-22,000 crore.

Eternal Q4 Results (Consolidated, QoQ)

Share price falls 5.36% at Rs 220.05.

Revenue up 7.9% at Rs 5,833 crore versus Rs 5,405 crore (Bloomberg estimate: Rs 5,824 crore).

Ebitda down 55.6% at Rs 72 crore versus Rs 162 crore (estimate: Rs 101.7 crore).

Margin at 1.2% versus 3% (Estimate: 1.7%).

Net profit down 34% at Rs 39 crore versus Rs 59 crore (estimate: Rs 42 crore).

The co expects profit potential in business at a steady rate of 5-6%.

Adj. EBITDA margin guidance revised upwards to 5-6% of net order value.

Growth in food delivery remains subdued due to sluggish demand, a shortage of delivery partners and competition.

Shutting down Zomato Quick.

Adani Enterprises Q4 Results (Consolidated, YoY)

Share price rises 2.72% at Rs 2,364.

Ebitda up 19% to Rs 4346 crore versus Rs 3646 crore.

Net profit up 8.5x to Rs 3845 crore versus Rs 449 crore.

One-time gain of Rs 3946 crore from 13.5% Adani Wilmar stake sale.

Adani New Industries has started further expansion of solar cell and module lines, with additional capacity of 6 GW.

Adani New Industries has completed capacity expansion of wind biz to 2.25 GW.

AdaniConnex has completed construction of the Noida data centre, with an operational capacity of 10 MW.

Nuvoco Vistas Q4 Results (Consolidated, YoY)

Share price rises 9.95% at Rs 351.

Revenue up 4% at Rs 3042 crore versus Rs 2933 crore.

Ebitda up 12.4% at Rs 552 crore versus Rs 491 crore.

Margins at 18.1% versus 16.7%.

Net profit up 65% at Rs 166 crore versus Rs 100 crore.

Godrej Agrovet Q4 Results (Consolidated, YoY)

Share price falls 7.81% at Rs 710.10.

Revenue down 0.5% to Rs 2,133.64 crore versus Rs 2,144.47 crore.

Ebitda down 7% to Rs 146.68 crore versus Rs 158.21 crore.

Margin at 6.9% versus 7.4%.

Net profit up 1% to Rs 66.10 crore versus Rs 65.48 crore.

Sona BLW Q4 Results (Consolidated, YoY)

Share price falls 2.64% at Rs 468.45.

Revenue down 2.2% to Rs 864.75 crore versus Rs 884.12 crore.

Ebitda down 6% to Rs 231.27 crore versus Rs 246.96 crore.

Margin at 26.7% versus 27.9%.

Net profit up 11% to Rs 163.68 crore versus Rs 148.08 crore.

Jindal Steel and Power Q4 Results (Consolidated, YoY)

Share price falls 5.82% at Rs 843.55.

Revenue down 2.25% at Rs 13183 crore versus Rs 13486 crore.

Ebitda down 7.11% at Rs 2271 crore versus Rs 2445 crore.

Ebitda margin down 90 bps at 17.22% versus 18.12%.

Net loss at Rs 339 crore versus profit of Rs 935 crore.

Exceptional loss of Rs 1,229 crore.

Indus Tower Q4 Results (Consolidated, QoQ)

Share price falls 7.24% at Rs 378.65.

Revenue up 2.38% at Rs 7727 crore versus Rs 7547 crore.

Ebitda down 37.17% at Rs 4396 crore versus Rs 6997 crore.

Ebitda margin down 3582 bps at 56.89% versus 92.71%.

Net profit down 3.99% at Rs 1779 crore versus Rs 1853 crore.

JSW Infrastructure Q4 Results (Consolidated, YoY)

Share price rises 3.51% at Rs 303.95.

Revenue up 17% to Rs 1,283 crore versus Rs 1,096 crore (Bloomberg estimate: Rs 1,267 crore).

Ebitda up 10% to Rs 641 crore versus Rs 582 crore (Bloomberg estimate: Rs 637 crore).

Margin expands to 50% vs 53% (Bloomberg estimate: 50.3%).

Net profit up 54% to Rs 509 crore versus Rs 330 crore (Bloomberg estimate: Rs 364 crore).

Federal Bank Q4 Results (Standalone, YoY)

Share price falls 4.27% to Rs 188.28.

Net interest income up 8% to Rs 2,377 crore versus Rs 2,195 crore.

Net profit up 13.7% to Rs 1,030 crore versus Rs 906 crore.

Net interest margin for the quarter at 3.11% versus 3.12%.

Gross NPA at 1.84% versus 1.95%.

Net NPA at 0.44% versus 0.49%.

Skipper Q4 Results (Consolidated, YoY)

Share price rises 6.20% at Rs 487.05.

Revenue up 11.6% to Rs 1,288 crore versus Rs 1,153 crore.

Ebitda up 14% to Rs 124 crore versus Rs 108 crore.

Margin at 9.6% versus 9.4%.

Net profit up 91% to Rs 48 crore versus Rs 25 crore.

Bandhan Bank Q4 Results (YoY)

Share price rises 4.72% at Rs 173.43.

Net profit up 482% to Rs 317.9 crore versus Rs 54.62 crore. (Bloomberg estimate: 467)

Net Interest Income sees a 4% slip at Rs 2,756 crore versus Rs 2,859 crore. (Estimate: 2,880)

Net Interest Margin for the quarter stood at 6.7%.

Gross NPA at 4.71% versus 4.68%.

Net NPA at 1.28% versus 1.11%.

Sundram Fasteners Q4 Results (Consolidated, YoY)

Share price rises 1.50% at Rs 930.85.

Revenue up 4.4% to Rs 1,530.59 crore versus Rs 1,466.48 crore.

Ebitda down 2% to Rs 224.71 crore versus Rs 228.33 crore.

Margin at 14.7% versus 15.6%.

Net profit down 7% to Rs 124.49 crore versus Rs 134.41 crore.

Phoenix Mills Q4 Results (Consolidated, YoY)

Share price falls 6.88% at Rs 1,550.

Revenue down 22% to Rs 1,016.3 crore vs Rs 1,305.9 crore.

Ebitda down 11% to Rs 559.7 crore vs Rs 626.7 crore.

Margin expands to 55.06% vs 47.98%.

Net profit down 11% to Rs 346.5 crore vs Rs 388.8 crore.

The board recommended a final dividend of Rs 2.5 per equity share.

Paras Defence and Space Technologies Q4 Results (Consolidated, YoY)

Share price falls 4.23% at Rs 1,302.

Revenue up 35.8% to Rs 108.23 crore versus Rs 79.69 crore.

Ebitda up 131% to Rs 28.29 crore versus Rs 12.25 crore.

Margin at 26.1% versus 15.4%.

Net profit up 117% to Rs 20.83 crore versus Rs 9.60 crore.

Approves splitting each share into two.

LG Balakrishnan Q4 Results (Consolidated, YoY)

Share price rises 3.47% at Rs 1,234.90.

Revenue up 10% at Rs 670 crore versus Rs 607 crore.

Ebitda up 1% at Rs 102 crore versus Rs 101 crore.

Margin at 15.2% vs 16.6%.

Net profit up 24% at Rs 84 crore versus Rs 68 crore.

RailTel Corp Q4 Results (Cons, YoY)

Share price rises 10.42% at Rs 326.90.

Revenue up 57% at Rs 1308 crore vs Rs 833 crore.

Ebitda up 54% at RS 180 crore vs RS 116 crore.

Margins at 13.7% vs 14%.

Net profit up 46% at Rs 113 crore vs Rs 77.5 crore.

Home First Finance Q4 Results (YoY)

Share price falls 4.97% to Rs 1,168.20.

Total income up 31% at Rs 416 crore vs Rs 318 crore.

Net profit up 25% at Rs 105 crore vs Rs 83 crore.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.