- Revenue up 7.5% at Rs 1,940 crore versus Rs 1,805 crore.

- EBITDA up 17.1% at Rs 119 crore versus Rs 102 crore.

- EBITDA margin at 6.1% versus 5.6%.

- Net profit down 11.5% at Rs 29.6 crore versus Rs 33.5 crore.

Around 184 companies reported their October–December performance. We will be back with more earnings tomorrow. Till then, this is Khushi signing out! Goodnight.

Here are the earnings in focus for Tuesday: Afcons Infrastructure, Apollo Hospitals Enterprise, Arvind SmartSpaces, Ashiana Housing, Balrampur Chini Mills, Britannia Industries, Chambal Fertilisers & Chemicals, Dilip Buildcon, DCW, Edelweiss Financial Services, Eicher Motors, EIH, Esab India, Escorts Kubota, Finolex Cables, Gujarat Narmada Valley Fertilizers & Chemicals, Gujarat Pipavav Port, Grasim Industries, HEG, Hinduja Global Solutions, HLE Glascoat, Hindustan Foods, Huhtamaki India, IIFL Capital Services, India Glycols, Indiqube Spaces, Jubilant FoodWorks, Jyoti CNC Automation, Kirloskar Ferrous Industries, Kewal Kiran Clothing, Karnataka Bank, Landmark Cars, Lumax Industries, Morepen Laboratories, Samvardhana Motherson International, Motisons Jewellers, NLC India, Nucleus Software Exports, Oil India, PDS, Power Mech Projects, Prince Pipes and Fittings, R Systems International, Safari Industries India, Som Distilleries & Breweries, Techno Electric & Engineering Company, Titan Company, Torrent Power, TVS Supply Chain Solutions, United Breweries, Wockhardt, ZF Commercial Vehicle Control Systems India.

The live blog has ended. Anas and I will be back tomorrow with more updates.

Happiest Minds Q3FY26 (cons)

Dynamatic Technologies Q3FY26 (cons)

To pay interim dividend of Rs 5 per share

All Time Plastics Q3FY26 (Cons, YoY)

To start commercial production of bamboo products

Muthoot Microfin Q3FY26

Gulf Oil Q3FY26 (Cons, YoY)

To pay interim dividend of Rs 21 per share

NRB Bearings Q3FY26 (cons)

To pay interim dividend of Rs 3.2 per share

Bata India Q3FY26 (Cons, YoY)

Pfizer Q3FY26

One-time cost of Rs 58.2 crore in Q3

Aurobindo Pharma Q3FY26 (cons)

One-time cost of Rs 65.3 crore due to new labour codes

Vadilal Industries Q3FY26 (cons)

Ramco Cements Q3 (Cons, YoY)

BSE Q3FY26 (Cons, QoQ)

Gujarat State Fertilizers - Q3 (cons)

Genus Power Q3FY26 (cons)

Isgec Heavy Q3 (cons)

Re-appoints Aditya Puri as MD for 5 years from May 1

Re-appoints Kishore Chatnani as Joint MD for 5 years

Rolex Rings Q3

Navin Fluorine - Q3FY26 (cons)

Texmaco Rail - Q3 (cons)

PNC Infratech - Q3 (cons)

Neuland Labs Q3FY26 (Cons, YoY)

Apollo Micro Q3 Highlights (YoY)

Hello lovely people! Khushi here. I'll be satiating your earnings related curiosity, stay tuned for all the latest updates.

This is Anas signing off. My colleague Khushi is set to take over and give you all the earnings updates post-market hours.

Mold-Tek Packaging Q3 Highlights (YoY)

GSK Pharma Q3 Highlights (Consolidated, YoY)

Trident Q3 Highlights (Consolidated, YoY)

EIH Associated Q3 Highlights (YoY)

Happy Forgings Q3 Highlights (Consolidated, YoY)

Suprajit Engineering Q3 Highlights (Consolidated, YoY)

Sky Gold Q3 Highlights (Consolidated, YoY)

Kaveri Seed Q3 Highlights (Consolidated, YoY)

Zydus Life Q3 Highlights (Consolidated, YoY)

Graphite India Q3 Highlights (Consolidated, YoY)

KPR Mill Q3 Highlights (Consolidated, YoY)

Jyothy Labs Q3 Highlights (YoY)

Aurobindo Pharma Q3 Estimates (Consolidated, YoY)

Zydus Lifesciences Q3 Estimates (Consolidated, YoY)

Man Industries Q3 Highlights (Consolidated, YoY)

BSE Q3 Estimates (Consolidated, QoQ)

Revenue at Rs 1239 crore vs Rs 1,068 crore

Net profit at Rs 612 crore vs Rs 558 crore

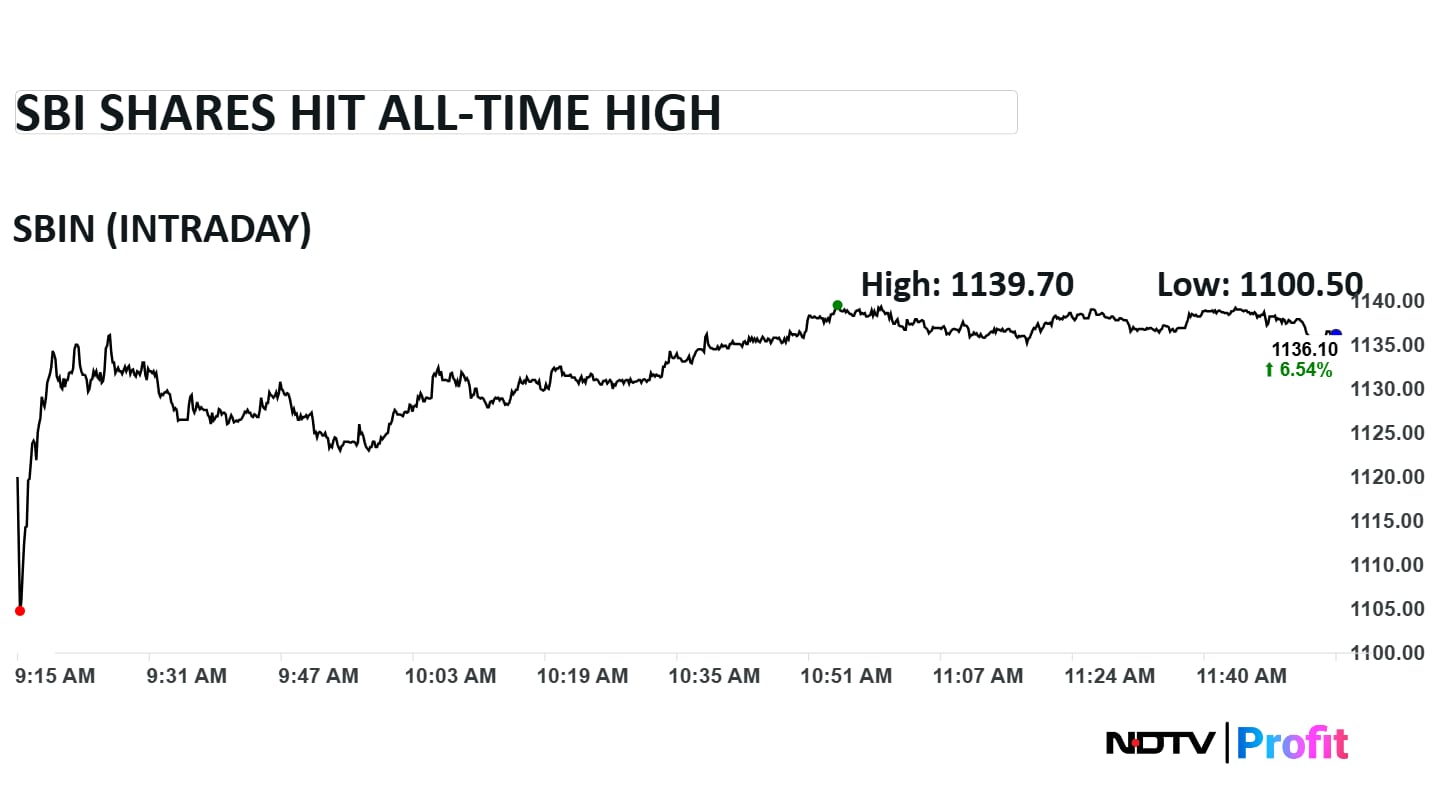

State Bank of India (SBI) shares have hit an all-time high following stellar third-quarter earnings.

Hello and welcome to our live coverage of today’s Q3 earnings action. I’m Anas, and I’ll be guiding you through all the key results, updates and management commentary as they unfold through the day.

Later in the day, my colleague Khushi will take over and give you her insights. Keep watching this space!

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.