.webp?downsize=773:435)

Shares of Premier Energies Ltd surged in trade on Tuesday as US-based GEF Capital Partners' affiliate, South Asia Growth Fund II Holdings, reduced its stake through open market transactions, as reported by Bloomberg News.

The company offloaded stakes at a floor price of Rs 1,051.5 per share. The block deal is valued at approximately Rs 2,630 crore.

As of March, South Asia Growth Fund II held an 11.1% equity stake in Premier Energies Ltd, according to BSE shareholding data. Following the block deal, the fund will be subject to a 150-day lock-in period during which it cannot sell additional shares in the company.

IIFL Capital Services Ltd. is managing the Premier Energies block deal.

South Asia Growth Fund II is a private equity fund focusing on investments in renewable energy, energy efficiency, waste recovery, climate tech, digital solutions, and software and tech services within India. GEF Capital Partners also holds investments in companies like Hero Motors Ltd. and Electra EV.

This stake sale comes amid Premier Energies' strong financial performance, with the company reporting a 43.9% revenue increase in the March quarter and a 167% rise in profit after tax compared to the previous year. For the full fiscal 2025, revenue more than doubled to Rs 6,518.7 crore, and net profit surged 307% to Rs 937 crore.

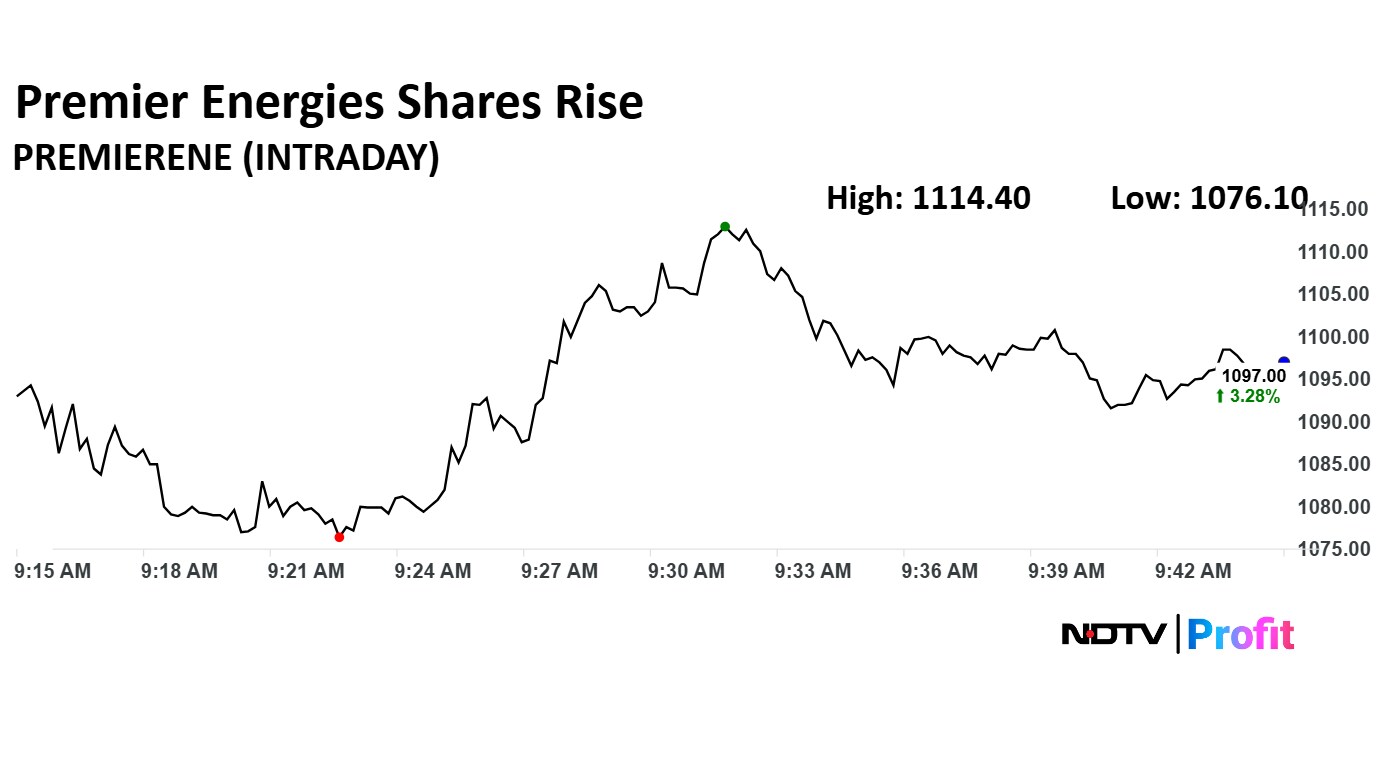

Premier Energies Share Price Today

The scrip rose as much as 4.21% to Rs 1,106.90 apiece, the highest level since May 19. It pared gains to trade 3.89% higher at Rs 1,103.50 apiece, as of 09:46 a.m. This compares to a 0.05% advance in the NSE Nifty 50 Index.

It has fallen 19.10% on a year-to-date basis but has risen 30.15% since listing. The relative strength index was at 41.08.

Out of four analysts tracking the company, one maintains a 'buy' rating, one recommends a 'hold', and two suggest 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 9.3%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.