.jpg?downsize=773:435)

Shares of PN Gadgil Jewellers Ltd. are on an upward spree as analysts at Motilal Oswal initiated coverage with a 'buy' rating and a price target of Rs 950, implying a 17% upside from the current market price of Rs 814.70.

PN Gadgil, the second-largest jewellery retailer in Maharashtra, is aggressively expanding its retail footprint, said the firm. The company, which operated 36 stores in this fiscal, aims to reach 80 stores in the next two years, as per the report.

The proceeds from its recent Rs 850 crore IPO will fund the addition of new stores, debt reduction, and other corporate initiatives.

Motilal Oswal believes this strategy will drive a 23% revenue compound annual growth rate between fiscal 2024 and fiscal 2027, supported by the rising trend of formalisation in the jewelry sector and increased penetration of organised retail in Maharashtra.

The brokerage expects PN Gadgil Jewellers to deliver a 36% profit CAGR through fiscal 2027, with the profit before tax margin improving to 4.6%. Analysts value the stock at 35 times its fiscal 2026 earnings.

Focus On Premium Products

PN Gadgil has improved its product mix, particularly in the high-margin studded jewelry category, which rose by 250 basis points to 7% of sales in the past three years, said the brokerage. The company is targeting double-digit contributions from studded jewelry in the near term, they added.

Furthermore, the company's personalised "make-to-order" services have enhanced customer loyalty, leading to a 27% footfall CAGR between fiscal 2021 and 2024. Customer conversion rates at stores are now at 90%, stated the note.

Maharashtra, one of India's largest jewelry markets, offers immense growth potential for PN Gadgil, believes Motilal Oswal. While the company holds an 8% market share in the state, its plans to double store presence in key cities are expected to unlock further opportunities.

Compared to peers like Titan and Kalyan Jewellers, PN Gadgil has demonstrated superior operational efficiency, said Motilal Oswal, with 5x inventory turnover and strong profitability metrics, including a 34% return on equity and 24% return on invested capital in fiscal 2024.

Potential Risks

The brokerage has warned of potential risks, including:

Volatility in gold prices, as their hedging is not yet comprehensive.

Execution challenges in new store rollouts.

Rising competition in the organised space, which could pressure margins.

PN Gadgil Jewellers Share Price Today

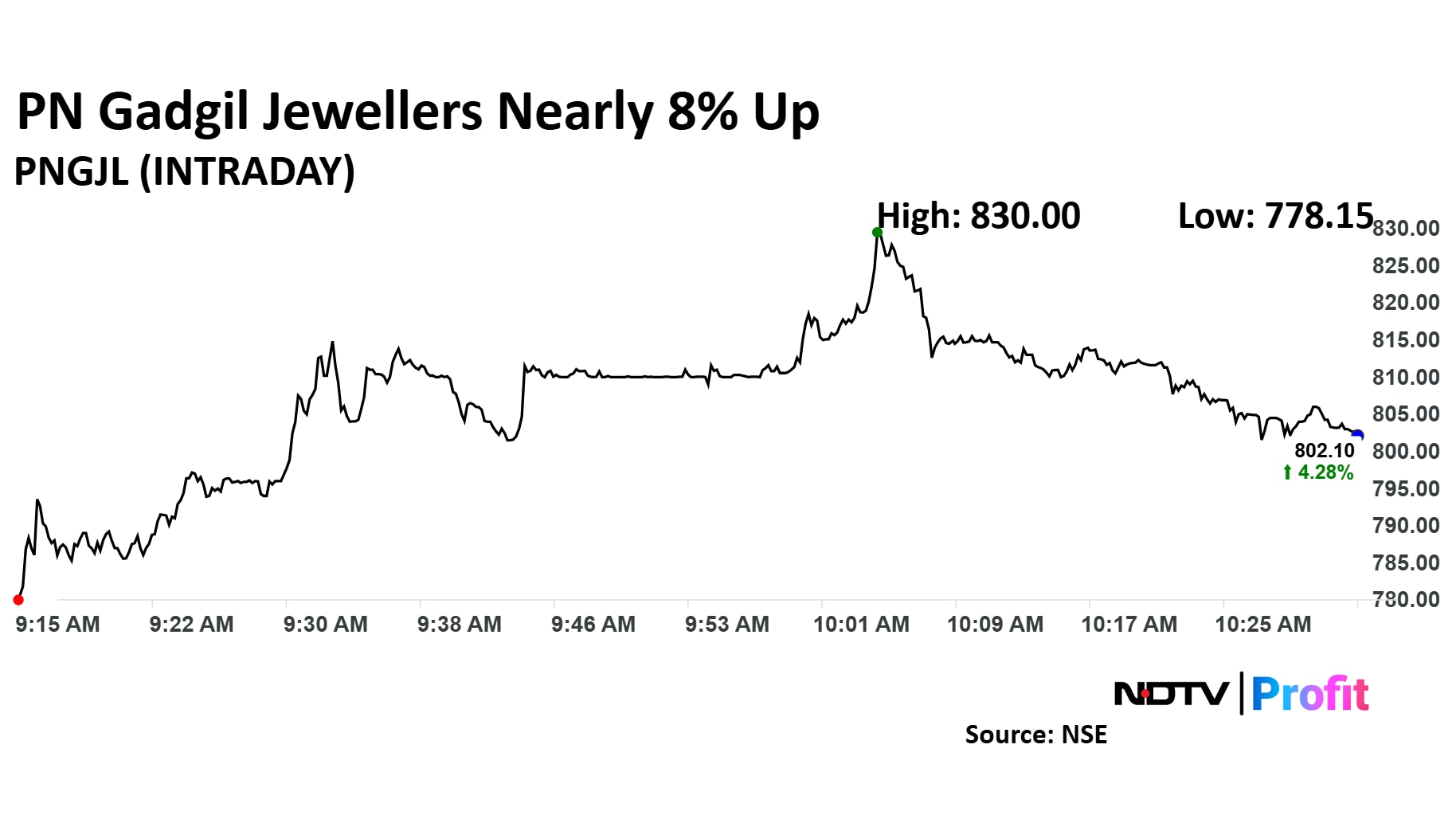

PN Gadgil Jewellers share price rose as much as 7.90% to Rs 830 apiece, the highest level since Sep. 24, 2024. It pared gains to trade 5.92% higher at Rs 814.70 apiece, as of 10:28 a.m. This compares to a 0.25% decline in the NSE Nifty 50 Index.

It has risen 39.33% on a year-to-date basis. The relative strength index was at 67.34.

Motilal Oswal is the only brokerage tracking the stock, as per Bloomberg data. The average 12-month consensus price target implies an upside of 17.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.