Share price of Piramal Enterprises jumped as high as nearly 6% despite a 25% drop in net profit in its quarter 4 results. The company beat Bloomberg's net income estimates and rose 28% to Rs 964 crore versus Rs 755 crore, according to Bloomberg data. Additionally, the stock was trading at high volume on Wednesday.

The company announced its Q4 results on Tuesday after market hours. While total income was up 20% to Rs 3,032.6 crore versus Rs 2,528.2 crore in the same period last year, net profit missed Bloomberg estimates of Rs 126.5 crore and fell to Rs 102.4 crore versus Rs 137 crore last year.

Total assets under management increased 36% to Rs 80,689 crore. Moreover, the firm recommended a final dividend of Rs 11 per share of a face value of Rs 2 each for the fiscal year ending March 2025, subject to approval from shareholders. It is planned to be paid on the day of the company's 78th annual general meeting.

Share Price

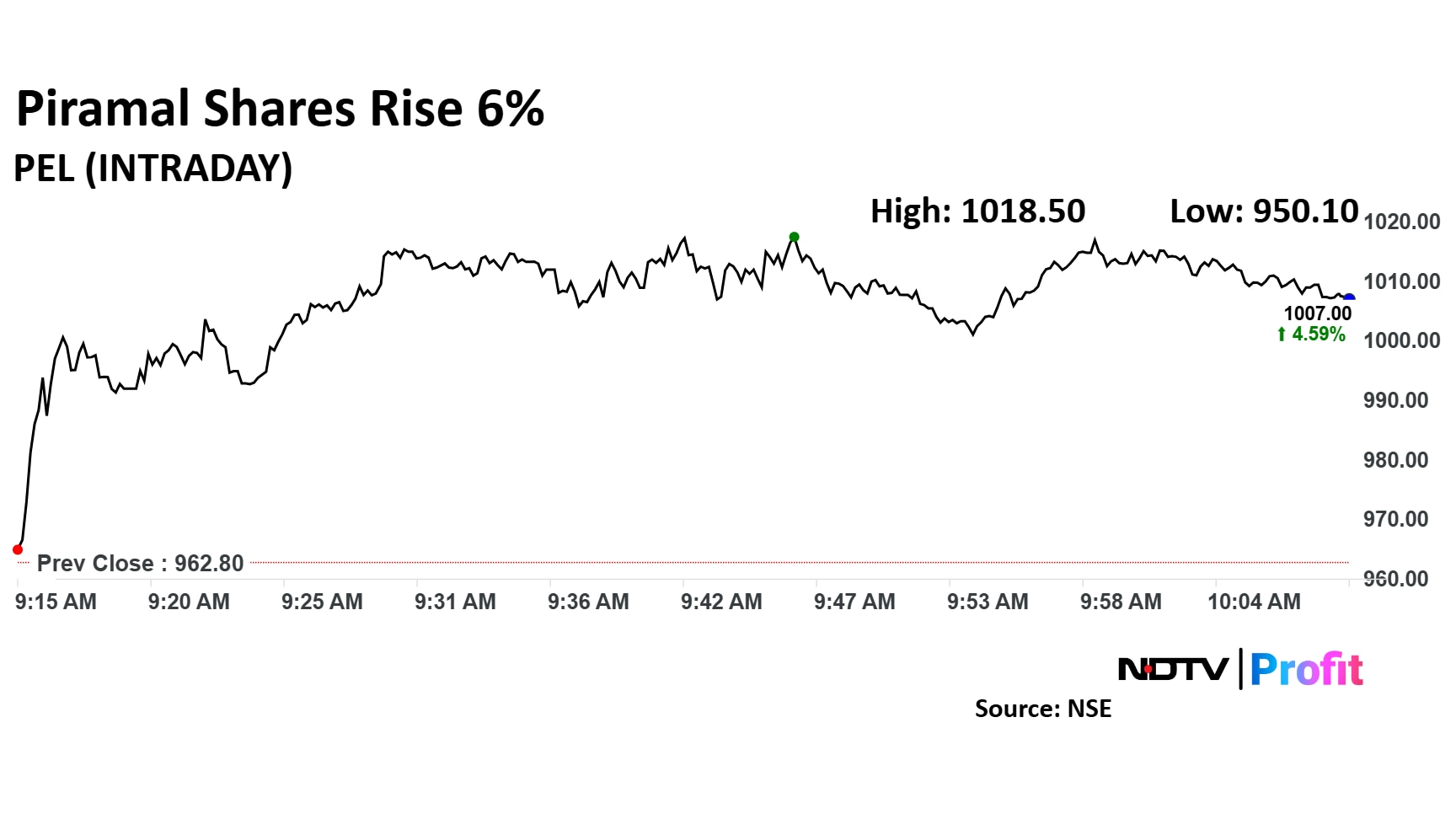

Piramal Enterprises' share price rose as much as 5.79% to Rs 1,018.50 apiece. It pared gains to trade 4.77% lower at Rs 1,009 apiece, as of 10:15 a.m. This compares to a 0.34% decline in the NSE Nifty 50 Index.

Share price has fallen 1.20% on a year-to-date basis and is up 1.28% in the last 12 months. Total traded volume so far in the day stood at 12 times its 30-day average. The relative strength index was at 33.69.

Out of eight analysts tracking the company, two maintain a 'buy' rating, three recommend a 'hold,' and three suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies a downside of 5.2%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.