Shares of Pidilite Industries rose more than 8% after the company reported its December-quarter earnings with a jump in its profit. The fevicol maker's net profit rose 8.2% to Rs 552 crore in the third quarter of the current financial year from Rs 510 crore for the same period last year.

The company's revenue rose 7.6% to Rs 3,369 crore for the October-December quarter from Rs 3,130 crore for the year-ago period. Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 7.5% to Rs 798 crore from Rs 742 crore in the same quarter of the previous fiscal 2024.

Its margin remained flat at 23.7% for the three months ended Dec. 31, 2024, compared to 23.72% for the same quarter in the last financial year.

However, Macquarie remains cautious on the company's near-term prospects due to moderating demand outlook. Macquarie has maintained an 'Underperform' rating with a target price of Rs 2,600.

While the third-quarter Ebitda performance was broadly in line with expectations, the brokerage expressed disappointment with the shift in the company's outlook commentary, which has moved from an optimistic stance to a more cautiously optimistic view on demand.

On the other hand, Goldman Sachs remains positive, maintaining a 'Buy' rating with a target price of Rs 3,560. Despite the challenging consumption environment, the company was able to achieve accelerated volume and revenue growth, the brokerage added. However, the brokerage noted that while the company was able to expand gross margins, this was somewhat offset by an increase in advertising spends.

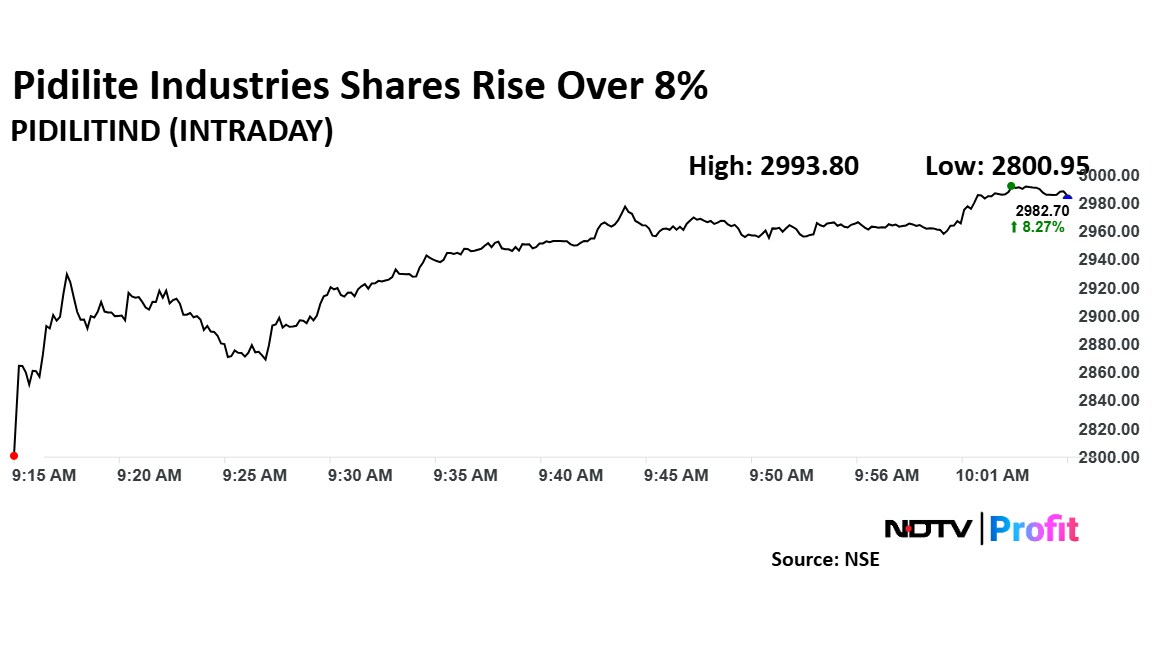

Pidilite Industries Shares Rise Over 8%

The scrip rose as much as 8.39% to Rs 2,985.75 apiece, the highest level since Dec. 24. The stock was trading 8.36% higher at Rs 2,985 apiece, as of 10:05 a.m. This compares to a 0.25% advance in the NSE Nifty 50 Index.

It has risen 18.33% in the last 12 month. Total traded volume so far in the day stood at 29 times its 30-day average. The relative strength index was at 57.

Out of 17 analysts tracking the company, nine maintain a 'buy' rating, three recommend a 'hold,' and five suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 8.3%.

Comprehensive Budget 2026 coverage, LIVE TV analysis, Stock Market and Industry reactions, Income Tax changes and Latest News on NDTV Profit.