Shares of Persistent Systems Ltd. fell sharply on Wednesday, declining 7.41% after the company reported its first-quarter results for FY26. Despite a year-on-year rise in net profit and revenue, the numbers failed to meet market expectations.

The Pune-based IT services firm posted a consolidated net profit of Rs 425 crore for the April–June quarter, up 7.4% from Rs 396 crore in the previous quarter. Revenue from operations rose 2.8% sequentially to Rs 3,334 crore, but came in below analyst estimates of Rs 3,357 crore. Operating profit increased 2.5% to Rs 518 crore, also missing the projected Rs 526 crore. Margins remained flat at 15.5%, slightly below the expected 15.6%.

While the company showed steady growth in profitability, the modest pace of revenue expansion and margin stagnation appeared to disappoint investors. The stock, which had been trading which has been volatile in the previous sessions, faced pressure softer-than-expected topline and operating metrics. Persistent Systems operates in digital engineering and cloud-based solutions.

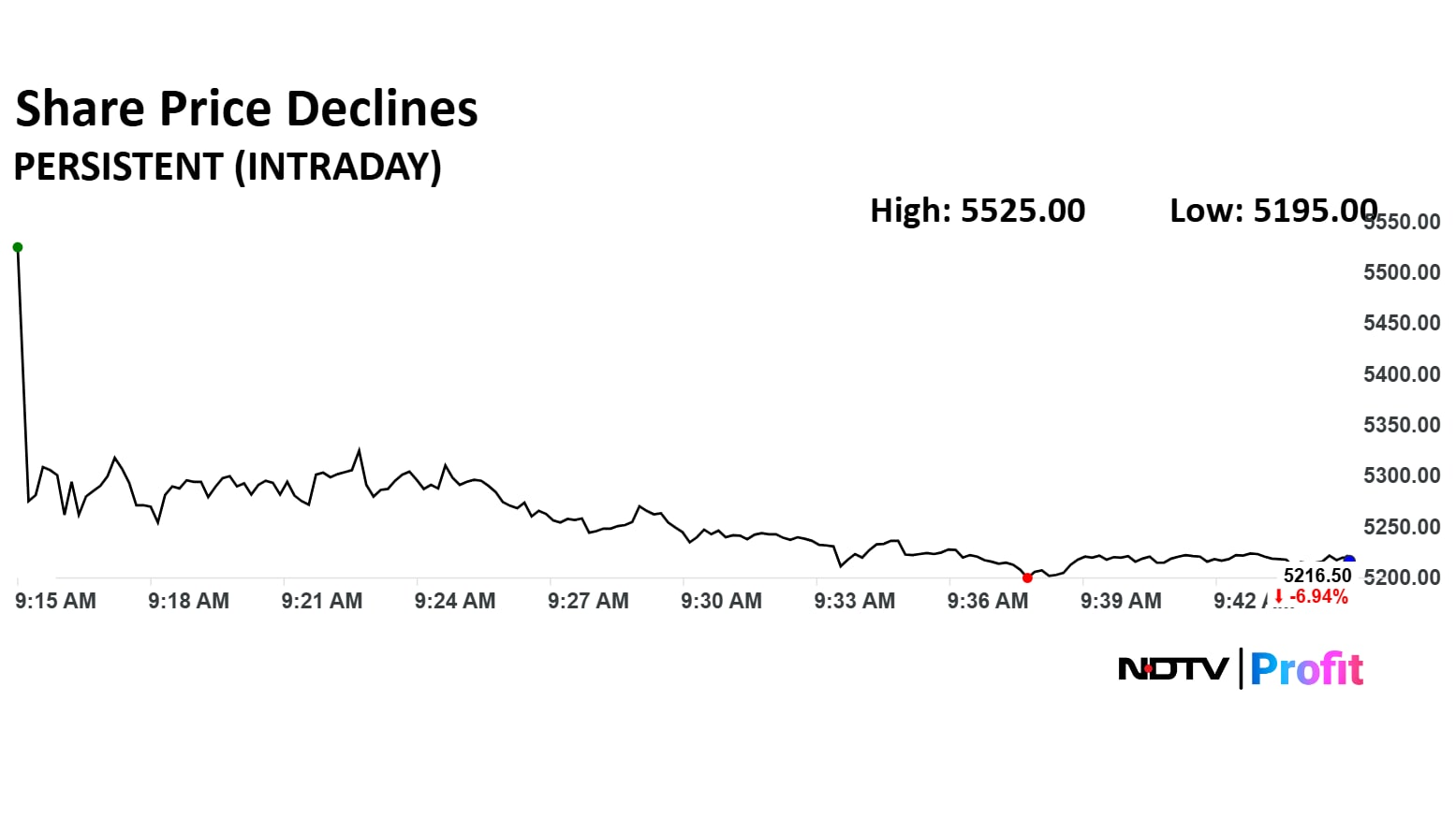

The scrip fell as much as 7.41% to Rs 5,190 apiece. It pared losses to trade 6.86% lower at Rs 5,221 apiece, as of 09:41 a.m. This compares to a 0.13% decline in the NSE Nifty 50 Index.

It has risen 8.53% in the last 12 months. Total traded volume so far in the day stood at 17 times its 30-day average. The relative strength index was at 30.

Out of 42 analysts tracking the company, 19 maintain a 'buy' rating, 10 recommend a 'hold,' and 13 suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.3%

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.