Shares of One97 Communication Ltd. fell nearly 6% on Tuesday as several brokerages maintained cautious stance on the company's outlook.

The parent company of Paytm reported a loss of Rs 208.3 crore for the third quarter of fiscal 2025, however, it was still better than analysts' expectations, with Bloomberg consensus estimates predicting a loss of Rs 332 crore.

The bottom-line marked an improvement over the corresponding period last year, when Paytm reported a loss of Rs 221.7 crore. The company's revenue showed positive growth, increasing by 10.1% to Rs 1,828 crore for the quarter, surpassing the expected Rs 1,660 crore.

Brokerages like BofA, Macquarie, CLSA and Jefferies have maintained 'hold' rating.

However, BofA cautioned that achieving net income break-even remains distant, with risks of slower uptake in lending revenues continue to pose challenges. The firm also highlighted that Paytm is looking to expand its distribution model, which could impact its future growth trajectory.

Macquarie also pointed out upside risks to distribution revenues, given higher take rates. While the firm expects adjusted Ebitda break-even by the fourth quarter, Jefferies cautioned that the new lending model may temporarily impact near-term margins.

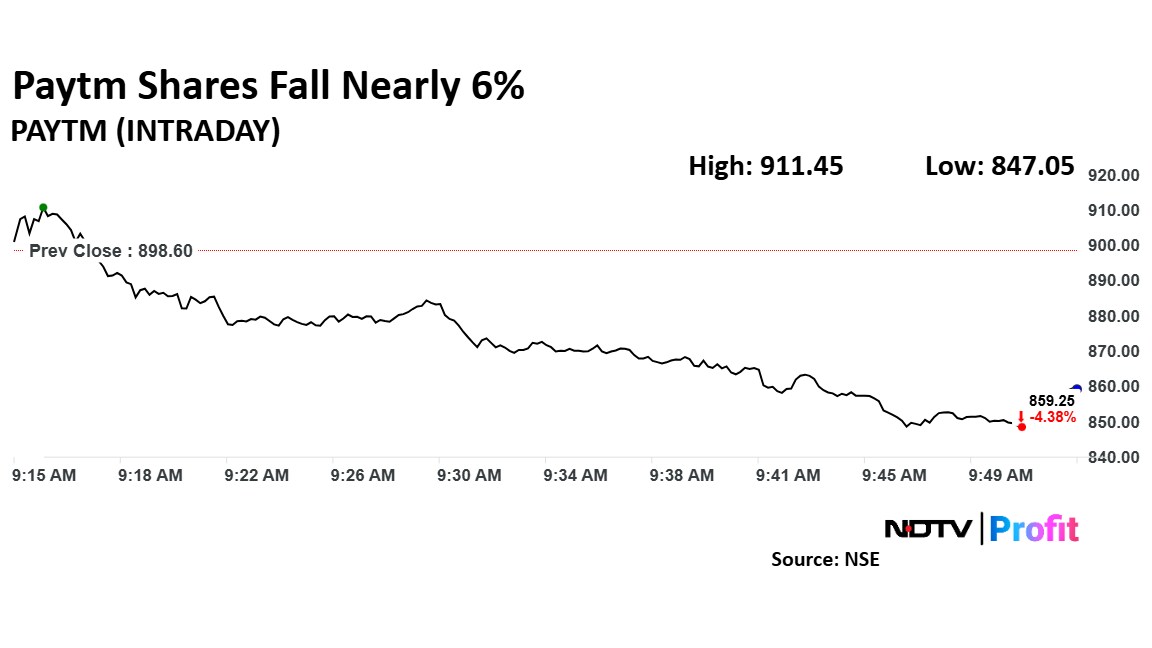

Paytm Shares Fall Nearly 6%

Paytm shares fell as much as 5.65% to 847.80 apiece. It pared losses to trade 5.46% lower at Rs 849.50 apiece, as of 9:47 a.m. This compares to a 0.05% decline in the NSE Nifty 50 Index.

It has risen 12.38% in the last 12 months. Total traded volume so far in the day stood at 1.6 times its 30-day average. The relative strength index was at 41.

Out of 19 analysts tracking the company, nine maintain a 'buy' rating, six recommend a 'hold,' and four suggest 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.6%.

Essential Business Intelligence, Continuous LIVE TV, Sharp Market Insights, Practical Personal Finance Advice and Latest Stories — On NDTV Profit.